Deep Dive: US Consumer Survey—Amazon Yet to Become the Go-To Place for Womenswear

KEY POINTS

- The majority of womenswear consumers are omnichannel shoppers, with 73.0% of surveyed women purchasing apparel from both online and offline channels in April 2017.

- Amazon womenswear customers have almost doubled over the past four years. Some 23.2% of women surveyed bought womenswear from Amazon, but only 1.9% purchased womenswear most often from the online retailer.

- While Amazon is competitive in terms of price and selection, according to consumers, Kohl’s promotions remain appealing, while Macy’s has an edge on quality and style.

Executive Summary

This is our sixth monthly report based on Prosper Insights and Analytics’ Amazon Shopper Intelligence service. This month, we focus on the womenswear category.

Key Findings

- The majority of womenswear consumers are now shopping omnichannel: 73.0% of surveyed women purchased womenswear from both online and offline channels in April 2017. Brick-and-mortar remained the main channel for womenswear purchases, with 80.5% of women buying most or all of their apparel offline, and 87.2% of surveyed women buying womenswear most often at physical stores.

- The number of Amazon womenswear customers has increased over the past four years: 23.2% of those surveyed bought womenswear at the online retailer in the three months prior to April 2017, up from 14.5% in April 2013. However, those who shop womenswear most often at Amazon remain a niche segment, only 1.9% of those surveyed said they shopped most often on Amazon for womenswear.

- Kohl’s, Walmart and Macy’s remain the top-three retailers at which surveyed women purchase womenswear most often. While Amazon is competitive in terms of price and selection, Kohl’s promotions remain appealing to customers, while Macy’s has an edge on quality and style.

About Amazon Shopper Intelligence Service

The Amazon Shopper Intelligence Service provides members with monthly data on consumer shopping patterns and preferences, drawing on more than 10 years of data on Amazon shoppers as well as on shoppers at other leading retailers. The data are instructive in helping users make informed business decisions.

US Womenswear Market Overview

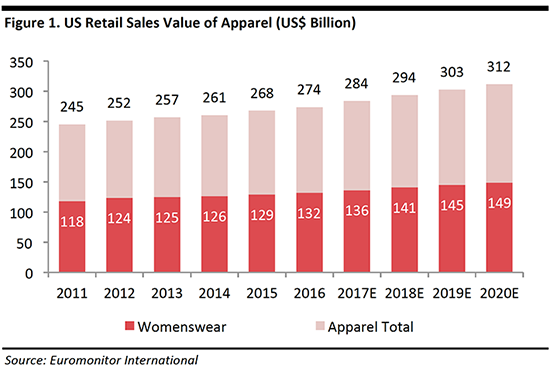

The US apparel market grew at a modest compound annual growth rate (CAGR) of 2.2% from 2011 to 2016, and was valued at US$274 billion in 2016. The share of womenswear relative to the total market size has remained stable over the past five years, within the range of 48%–49% and was valued at US$132 billion in 2016. This category is expected to grow at a CAGR of 3.1% on average through to 2020 to reach US$149 billion, according to data from Euromonitor.

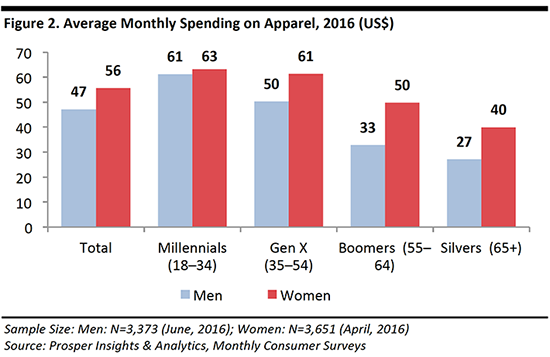

Prosper’s data shows that on average, women in the US spend US$56 on apparel each month, more than men’s monthly spending on menswear of US$47. Younger males and females, however, spend close to the same amount, with millennial women spending an average of US$63 each month, while their male counterparts spend US$61. Gen X females come very close to the millennial female shopper at US$61 each month. Boomers and silvers spend less, at an average of US$50 and US$40 each month, respectively.

1. The Majority of Womenswear Consumers Are Shopping Omnichannel

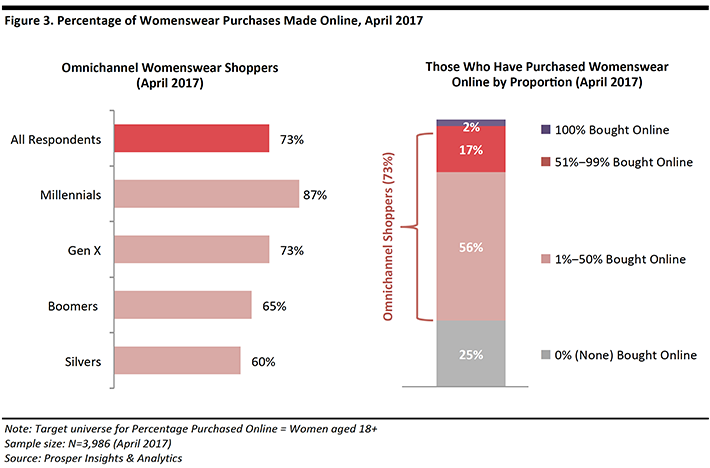

The most recent consumer survey done in April 2017 shows that the vast majority of women are buying womenswear from both online and offline channels. Across the four demographic groups, 87.1% of surveyed millennials are omnichannel womenswear shoppers, followed by Gen X at 73.0% and boomers at 64.8%.

Brick-and-mortar remained the main channel for womenswear purchases, as 80.5% of surveyed female consumers have bought most or all of their apparel offline. Among all female consumers, 55.7% have bought no more than half of their womenswear online and 24.8% have bought entirely offline.

Those who have bought their apparel entirely online remain a niche segment, representing 2.3% of female consumers surveyed, while 17.0% have bought more than half (but not all) of their womenswear online.

2. Consumers Purchase Womenswear Most Often at Brick-and-Mortar Locations

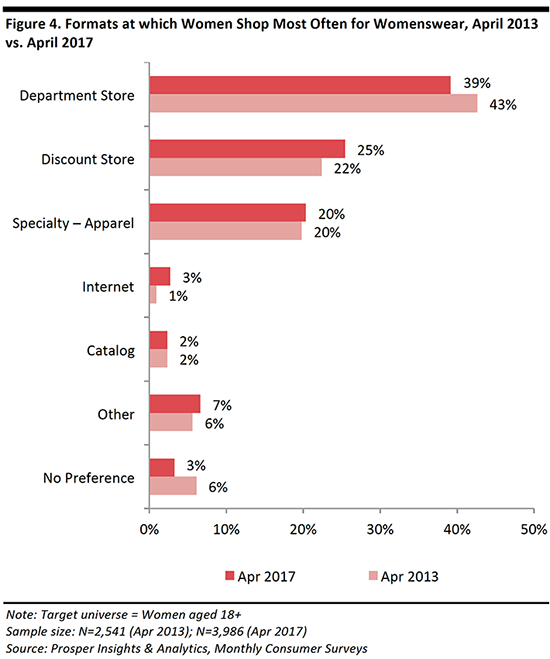

According to the Prosper monthly consumer survey conducted in April 2017, brick-and-mortar is the main channel for womenswear purchases: 87.2% of surveyed women buy womenswear most often at physical stores, however, that number is down 2.3% compared to five years ago.

Department stores, discount stores and specialty stores remain the top-three store formats at which women buy womenswear most often. Department stores remained the top store format; however, its mind share has decreased from 42.6% in April 2013, to 39.2% in April 2017. In contrast, discount stores saw an increase in mind share, from 22.4% in April 2013, to 25.4% in April 2017. Specialty stores saw their mind share remain the same compared with four years ago, at 20.3%, a slight increase from 19.8% in April 2012, although the change is not statistically significant.

Those who purchased womenswear online most often increased significantly, from 0.6% in April 2012 to 2.7% in April 2017. However, these consumers remain a niche segment when compared with other channels.

3. Female Consumers Shopping at Fewer Retailers, While Amazon is Gaining More Customers

Womenswear customers are shopping at fewer retailers compared with four years ago. Those who purchased womenswear in the 90 days prior to April 2017 did so from 4.2 retailers on average, down from 4.5 retailers on average in 2013.

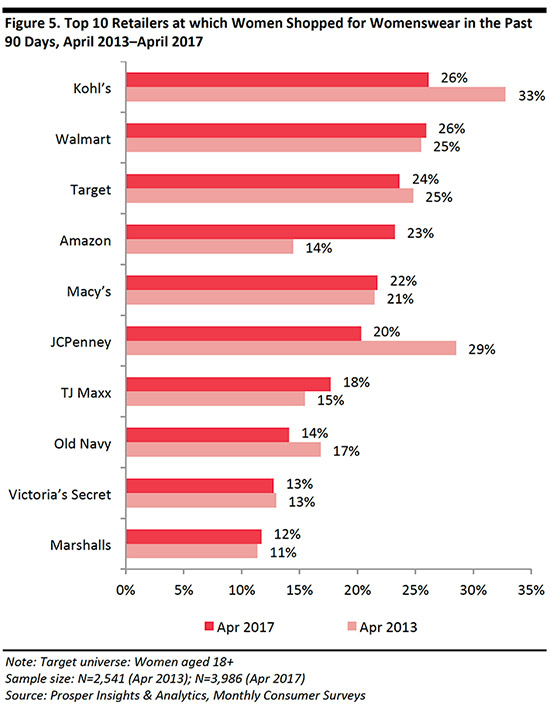

Kohl’s remained the top destination for womenswear shopping, with 26.1% of those surveyed making a purchase at the retailer in the three months prior to April 2017. However, Kohl’s dropped by 6.7 ppt when compared to four years ago. Target and JCPenney also saw a decline in shoppers in the same period, with decreases of 1.2 ppt and 8.2 ppt, respectively.

Amazon saw the largest increase in the number of female womenswear customers in April 2017 compared with April 2013. It had the highest growth of 14.0% to reach 23.4% in April 2017. Macy’s saw modest growth of 0.3 ppt to reach 21.7% in April 2017.

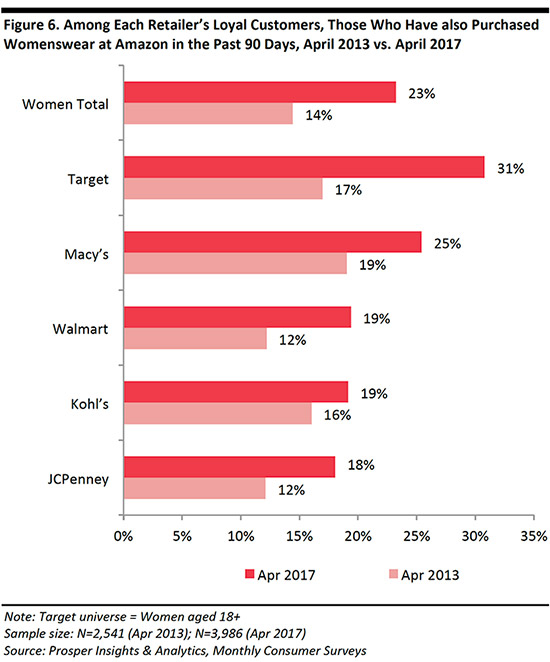

In terms of preferences, we see that loyal customers of all major US department stores have become more inclined to go on Amazon for womenswear purchases over the past four years.

Target has seen the biggest climb in this measurement: 31% of its loyal customers have also purchased womenswear on Amazon in the three months prior to April 2017, up from 17% in April 2013.

Walmart, Kohl’s and JCPenney also saw an increase in their loyal customers shopping for womenswear at Amazon, but the proportion is still lower than the average among all female consumers of 23%.

4. Amazon Is Yet to Become the Go-To Place for Womenswear

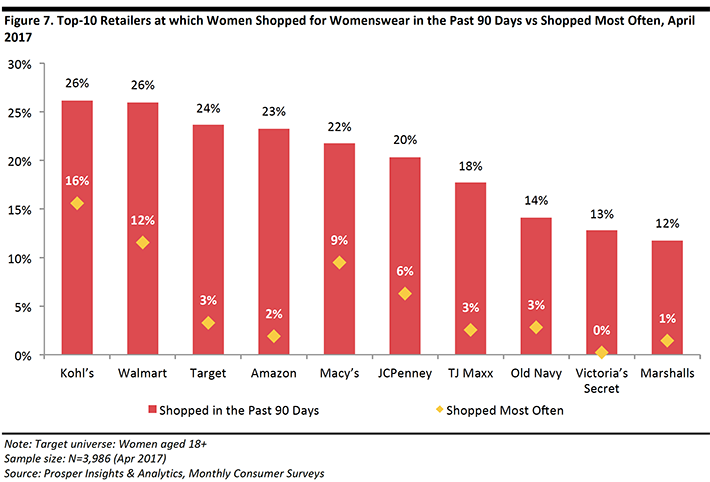

The top-three retailers at which surveyed women shopped most often for womenswear were either discount stores or department stores, including Kohl’s (15.6%), Walmart (11.5%) and Macy’s (9.5%). .

Among those who have shopped at Kohl’s in the 90 days prior to April 2017, over half of them were its loyal customers. As for Walmart and Macy’s, loyal customers made up of nearly half of those who shopped there in the past 90 days as well.

Despite Amazon’s efforts to increase its womenswear assortment, it has only managed to increase the number of shoppers, and still has some ways to go before becoming the go-to place for womenswear. As of April 2017, only 1.9% of surveyed females shopped at Amazon most often for womenswear.

5. Amazon Is Competitive on Price and Selection, Kohl’s Promotions Remain Effective, while Macy’s Has an Edge on Quality and Style

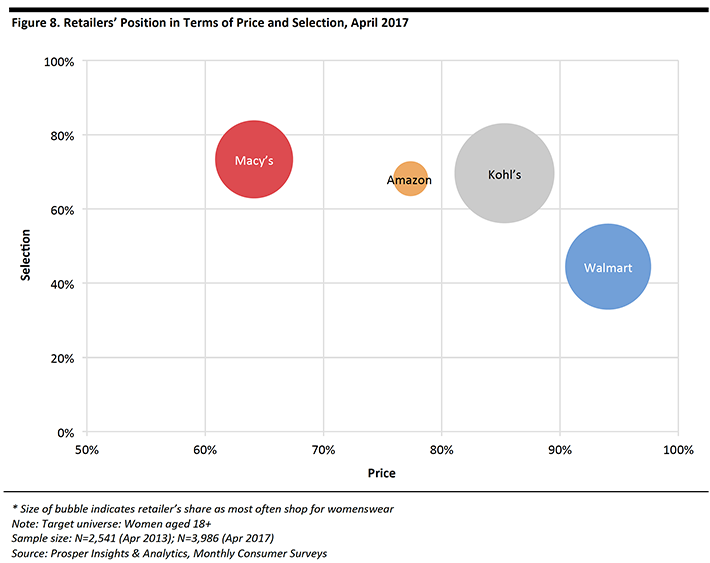

We looked at the reasons cited for shopping for womenswear most often at the respective retailers. In particular, we compared Amazon with the other three leading retailers in the category—Walmart, Kohl’s and Macy’s—based on price and selection, which are the two-most-mentioned reasons across all retailer customers.

Apart from price and selection, we compared Amazon with each of the top-three retailers, and identified the relative strength and positioning of the respective retailer compared with Amazon. This provides a better understanding as to why more customers from these retailers are buying womenswear on Amazon, but still shop most often at their favorite retailer.

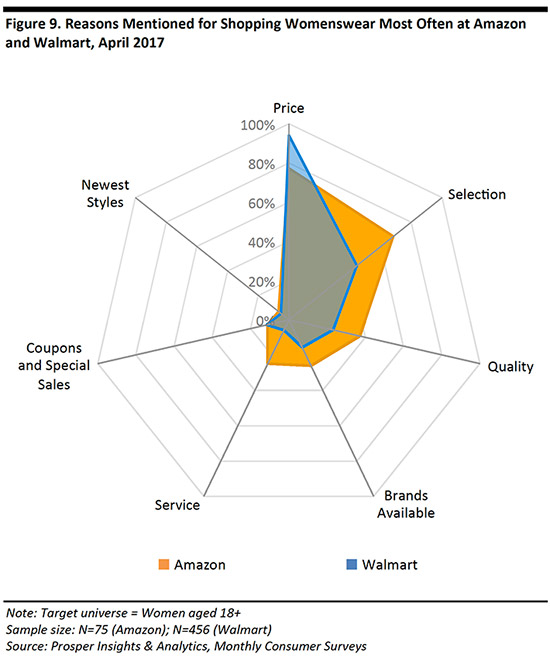

![]() Walmart: Price Is Everything

Walmart: Price Is Everything

Amazon and Walmart both capture price-sensitive consumers, with price being the most-mentioned reason for the two retailers’ loyal customers, at 77.4% and 94.1%, respectively.

In early June 2017, Amazon took another move to capture low-income consumers by offering a 45% discount on its Prime membership to customers receiving government assistance. With this offer from Amazon, more low-income Walmart customers might increase their womenswear spending at Amazon, especially those who have already experienced buying womenswear from Amazon, which represents 19% of Walmart’s womenswear customers.

In addition, Amazon also has an edge over Walmart on a number of attributes including selection, quality, brands available and service.

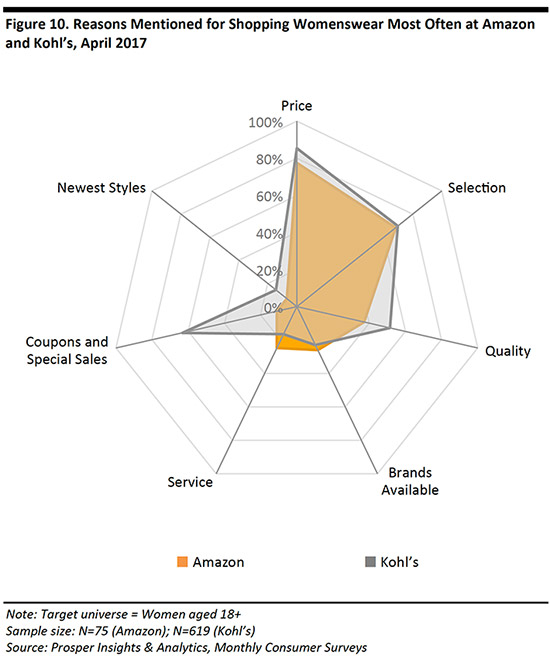

![]() Kohl’s: Promotions Are the Key

Kohl’s: Promotions Are the Key

Price, mentioned by 85.3% of its customers, is also the top reason to shop womenswear at Kohl’s, and is higher than that of Amazon at 77.4%

Kohl’s is comparable to Amazon in terms of curation, in which selection and brands available were mentioned by 69.6% and 22.9% of Kohl’s customers, as well as 68.2% and 69.6% of Amazon’s customers, respectively.

Compared with other womenswear retailers, promotions such as coupons and special sales play an important role in capturing Kohl’s loyal customers, which, at 63.2%, was the third-most-mentioned reason among Kohl’s customers and was the highest figure among all top retailers.

Similar to at Kohl’s menswear section, the conventional pricing strategy of using special sales and coupons remains an important and effective tool for the retailer.

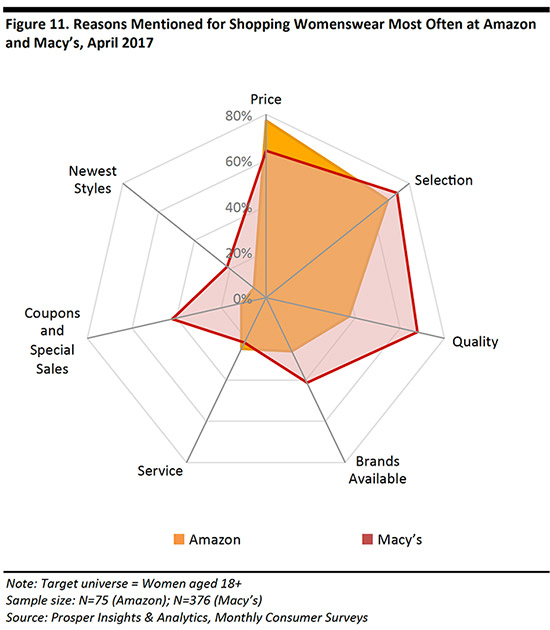

Macy’s: Differentiates with Quality and Style

Macy’s: Differentiates with Quality and Style

Selection is a key strength for both Macy’s and Amazon: mentioned by 73.4% of Macy’s customers as a reason to shop for womenswear there and by 68.2% of Amazon’s customers.

What differentiates Macy’s from Amazon could be attributed to the quality of their selection. More Macy’s customers mentioned reasons for choosing to shop there such as quality, brands available and latest style, at 67.9%, 41.3% and 21.7%, respectively, than did Amazon’s customers, at 37.1%, 26.0% and 6.8%, respectively.

While Amazon has expanded its selection with competitive pricing, Macy’s still differentiates from Amazon in terms of the quality and style in their womenswear section.

About the Amazon Shopper Intelligence Service

The Amazon Shopper Intelligence Service combines Fung Global Retail & Technology analysis and commentary with input on thousands of US shoppers from Prosper. It includes:

- Over 10 years of data on Amazon shoppers as well as on leading retailers’ shoppers

- Prosper Shopper Preference Share (indicates how Amazon is growing as a preferred retailer for 11 different merchandise categories, and the reasons why)

- Retail positioning maps (plot retailers and their competitors based on the percentage of their shoppers who shop there for particular reasons)

- Net promoter scores

- Key demographics