Analyst Opinion: The Rise of Livestreaming

KEY POINTS

In this series of short notes, we explore various aspects of consumer behavior as it relates to technology adoption and retail in the US and China. In this report, we focus on livestreaming as a way to monetize user-generated content by influencers and key opinion leaders (KOLs).

- User-generated livestreams are not new in China, nor are they in the US, but 2016 saw increasing adoption of livestreaming in China, as distinct content monetization models emerged around virtual gifts and e-commerce.

- The livestreaming economy in China has sufficient content supply and demand to ensure its growth over the medium term, with investment flowing into new content generation.

- The market characteristics and consumer behavior in the US are markedly different from those in China, but platforms in the US are experimenting with virtual-gift features that are common in China. We think these have limited potential as monetization tools in the US.

The growth of livestreaming was certainly one of the big stories in China in 2016, and the topic continues to grab headlines in 2017. To date, there are more than 200 livestreaming platforms that cater to the mobile-first Chinese consumer, some of the most popular being YY, Huajiao, Douyu, Taobao Live and Panda. The different platforms have generated a staggering amount of content, with Chinese media reporting that Taobao Live alone generated over 140 million hours of content in the past year. Because of its popularity and effectiveness, livestreaming is now widely adopted by brands and retailers as a way to market and sell in China. Beyond entertainment, gaming and e-commerce, livestreaming is now expected to find adoption in non-entertainment verticals as diverse as education and finance.

While user-generated livestreams are not new in China, nor are they in the US, 2016 saw increasing adoption of livestreaming, as distinct monetization models emerged. This led to the proliferation of Internet celebrities (wang hong) and the creation of the “cewebrity” economy, which is set to grow to $17.0 billion, according to estimates from Analysys. The scale and increasing sophistication of the livestreaming economy in China far outshines its equivalent in the West, where livestreamed content is primarily consumed through YouTube, Facebook, Instagram, Twitter, Snapchat and specialized platforms such as Twitch for gaming.

This opinion note discusses the factors that have underpinned the success of livestreaming as a content monetization vehicle in China, and how this has led popular livestreaming features in China to cross over to social media platforms in the US.

Monetization: Virtual Gifts

Beyond advertising, which is the traditional way to monetize content in the West, livestreaming platforms in China have leveraged virtual gift giving as a way to align incentives between the platform, the content creator and the viewer. Virtual gifts are purchased by viewers and presented to the broadcaster in real-time during a livestream. The broadcaster can acknowledge the gift live and perform in return, creating an engaging experience for the audience. The digital gifts are then converted to cash and the revenue is split between the platform and the broadcaster.

Because virtual gifts offer a direct relationship between the quality of the content and the revenue generated, many aspiring performers have jumped on the numerous livestreaming platforms to broadcast their talent, skills, or opinions as a way to earn part-time income. In many cases, amateur broadcasters have reported sufficient complementary earnings to incentivize them to continue generating content. This has led to two interesting outcomes: 1) there is now what seems to be a sustainable long-tail of broadcasters with niche followings for whom pursuing livestreaming is economically viable; and 2) the interactive nature of virtual gift giving has led to the creation of communities centered around broadcasters, which has spurred the development of relationships among their members in what can be considered a new form of social media. As a result, the livestreaming industry in China has sufficient supply and demand in terms of content to ensure its growth over the medium term.

Monetization Models: E-Commerce

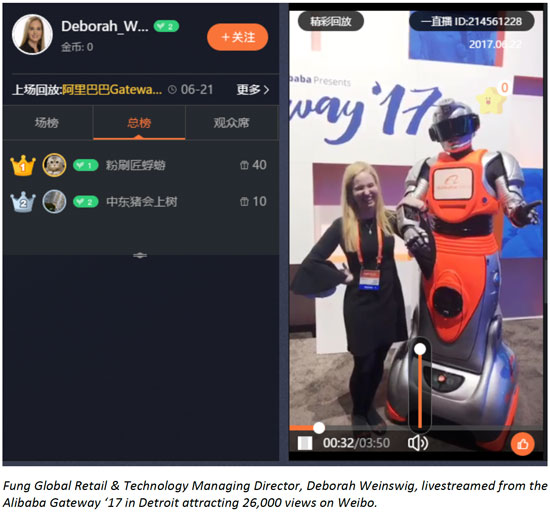

The other big monetization model for livestreamed content is e-commerce. Boosted by platforms such as Alibaba’s Tmall Live and JD Live, content creators have been able to build brands and followings that allow them to operate e-commerce stores which yield impressive sales figures. For example, one Taobao KOL, Cherie, reported that her e-commerce store generated ¥100 million (approximately $15 million) during Alibaba’s Singles’ Day in 2016.

In an e-commerce context, livestreamed content looks a lot like direct selling—similar to a home-shopping channel—where prominent Internet celebrities showcase, trial and sell products to their online followers. In some cases, influencers have started their own labels rather than marketing or curating branded products. They are entrepreneurs who run digital businesses with large enough teams to support product sourcing, distribution and after-sales services. From this perspective, the influencer economy enabled by livestreaming has become a disruptor to traditional fashion and beauty brands selling in China.

Livestreaming Trends

What is next in store for livestreaming and the cewebrity economy in China?

Last year, we saw dramatic investment from venture capital in livestreaming platforms and in talent from influencer incubators which aim to groom and represent the next batch of cewebrities.

Already in 2017, we have witnessed consolidation discussions on the platform end, as some of the 200 platforms are naturally not expected to make the cut, but there is also an increased emphasis on investing in better content and expanding the scope of verticals that are covered by livestreams. For example, the popular livestreaming platform company YY is branching out into non-entertainment categories such as food, automobile and pets. In addition, virtual reality (VR) content is viewed by some as the next big thing for livestreaming, which will enable a truly immersive user experience. And, while Huajiao Live released VR Zone, a 3D livestreaming platform, we are still a long way out before mass adoption of VR content, due to the multiple impediments of the technology which will hamper adoption in the short term.

What Does the Growth in Livestreaming Mean for Companies in the West?

Since the beginning of 2017, we have seen several US platforms starting to experiment with some of the features that have made livestreaming into an industry in China. YouTube introduced the “Super-chat,” which enables livestream viewers to pay to have their comment featured more prominently in a chat stream, and Twitter added “Super Hearts,” which are virtual gifts, to Periscope in June 2017. In addition, there have been a few entrants to the market that originated in China, namely live.me and live.ly. However, we remain skeptical about whether these features can be successfully adopted in the US.

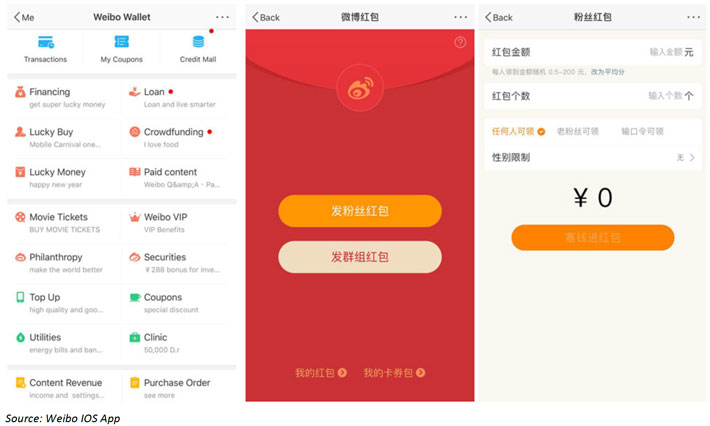

One of the reasons that digital gift giving has been so successful in China is digital tipping—the practice of sending a small amount of money to a publisher or broadcaster digitally. Tipping has been adopted by platforms that support content in text, audio or video formats, such as Weibo, China’s biggest micro-blogging platform, which added the feature in 2014, and WeChat, which followed in 2015. In essence, online tipping in China has introduced a new way to monetize content that is supported by consumer behavior in the local market. The ubiquity of digital tipping has led to an increase in the number of consumers who “tip” for content and who send money online through digital red packets as a sign of gratitude, a practice that is aligned with the tradition of red packet giving in China during the New Year, and which is made easier with the increasing penetration of mobile payments.

The market characteristics and consumer behavior in the US are markedly different from those in China. Mobile payment penetration (as measured by mobile payment users as a percentage of smartphone users) is only 43.7% in the US compared to 83.3% in China, and giving money as a sign of gratitude diverges from traditional social norms. From this perspective, the monetization potential of introducing virtual gifts to livestreaming platforms in the US seems limited; however, it will be interesting to see whether this feature leads to increased engagement and interest in livestreamed content.