Deep Dive—US Consumer Survey: Amazon is Winning the Battle in the Toy Segment

KEY POINTS

- While brick-and-mortar stores remain the main channel where consumers go to buy toys, online retailing has doubled its mind share compared with five years ago: 14.7% of consumers say they go online to purchase toys versus 7.3% five years ago.

- Amazon has capitalized on the rising popularity of shopping for toys online: over 14% of parents shop most often at Amazon for toys. The retailer has gained share at the expense of Walmart and Target, while Toys“R”Us has managed to remain differentiated.

- Both Amazon and Walmart appeal to price-sensitive customers, however, according to consumers, Amazon offers better selection and service, which is how the retailer is winning the battle in the toy segment.

Executive Summary

This is our third monthly report based on Prosper Insights and Analytics’ Amazon Shopper Intelligence service. This month, we are focusing on the children’s toys category.

Key Findings

- Brick-and-mortar stores—discount stores, specialty stores and department stores—remained the main channel where surveyed parents go most often to purchase children’s toys, contributing to a combined share of 69.7% as of December 2016.

- Amazon has capitalized on the rising populating of e-commerce shopping for toys, with over 14% of parents shopping most often at Amazon for toys, double the figure of five years ago.

- Some 87.8% of parents have experience purchasing children’s toys online. However, 59% of surveyed parents only purchase less than half of their children’s toys online. In terms of value share, Internet retailing accounted for 18% of toy purchases in 2016.

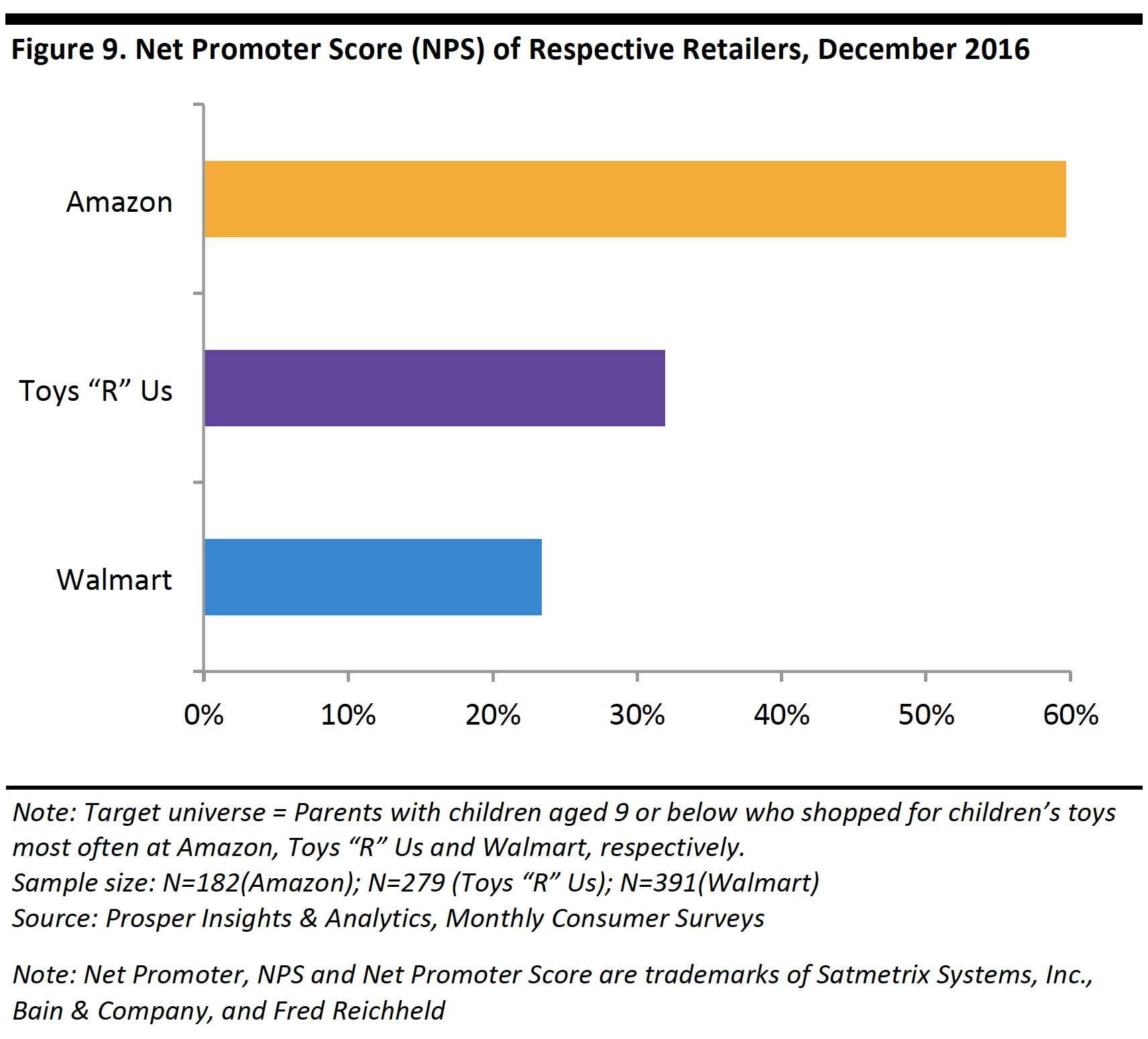

- Both Amazon and Walmart appeal to price-sensitive customers, as over 80% of their customers cite price as the reason they shop there. However, according to consumers, Amazon offers better selection and service, with a net promoter score (NPS) of 59.6, higher than Walmart’s 23.4, which is how the retailer is winning the battle in the children’s toy segment.

About Amazon Shopper Intelligence Service

The Amazon Shopper Intelligence service provides members with monthly data on consumer shopping patterns and preferences, drawing on more than 10 years of data on Amazon shoppers as well as on shoppers at other leading retailers. The data are instructive in helping users make informed business decisions.

US Toy Market Overview

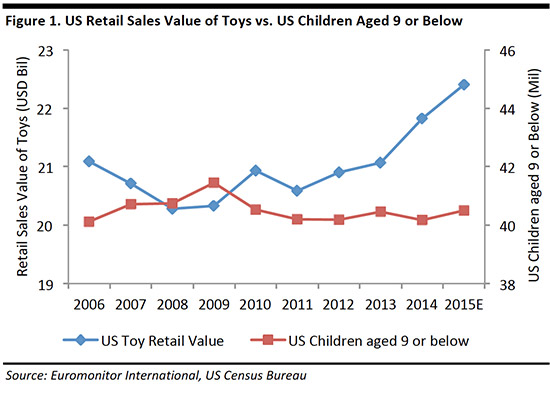

Retail sales in the US toy market reached US$22.4 billion in 2015. After a drop in 2011, the US toy market has rebounded and recorded growth for five consecutive years, with a CAGR of 2.1% from 2011 to 2015, according to Euromonitor.

The market has grown despite significant pickup in size of the children demographic. The population of children aged 9 or below has been stable over the past 10 years, within the range of 40–42 million, according to the American Community Survey by the US Census Bureau, which means parents have been spending more on toys over the past five years as the US economy has continued to recover

This is also validated by the fact that parents with children up to the age of 9, who are the core consumers of this category, generally exhibit higher consumer confidence. Some 59.9% of these parents indicated that they are confident with the economy in December 2016, which is higher than the percentage of the general population at 54.5%, according to Prosper’s monthly consumer survey.

1. The Majority of Surveyed Parents Purchase Children’s Toys Most Often at Brick-and-Mortar Locations, Yet are also Familiar with Purchasing Children’s Toys Online

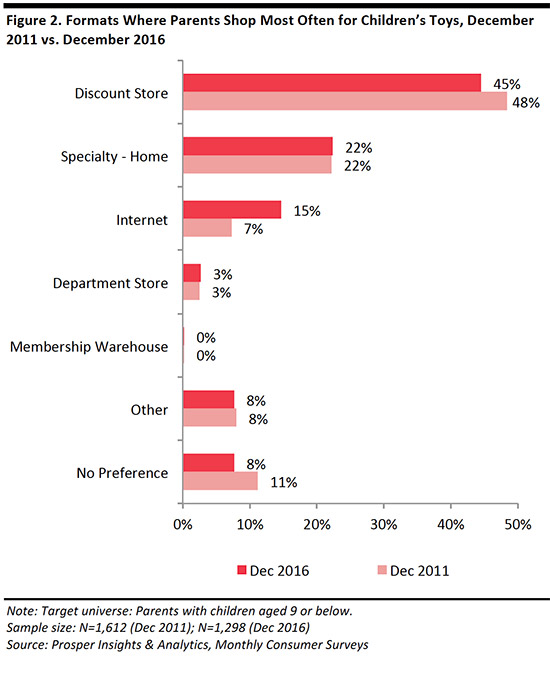

According to the Prosper monthly consumer survey conducted in December 2016, the majority of surveyed parents purchase children’s toys most at brick-and-mortar locations, with a combined share of 69.7%, down 3.6 percentage points compared with five years ago.

Discount stores, specialty store and the Internet have remained the top-three store formats where surveyed parents buy children’s toys. However, the share of the respective store formats has seen significant changes. Discount store remained the top store format, but its share has dropped from 48.4% in December 2011, to 44.5% in December 2016. Specialty stores have seen little change, with a 22.4% share in December 2016, down 0.2 percentage points compared with five years ago. In contrast, the share of online purchases has nearly doubled, up from 7.3% in December 2011, to 14.7% in December 2016.

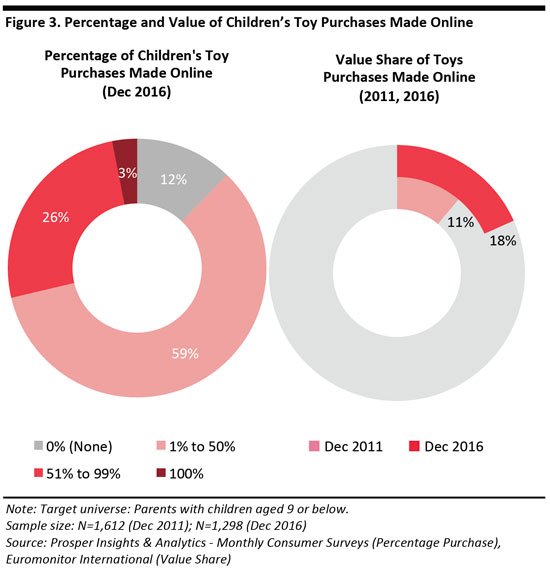

Most surveyed parents have purchased some to all of their children’s toys online, with 87.8% having done so in December 2016. This is not surprising, as most of the children’s toys consumers are millennial parents, who are already familiar with online purchasing.

Close to one-third of parents make more than half of their children’s toy purchases online, and among all parents, 3% make all of their children’s toy purchases online. However, the majority of parents only buy less than half of their children’s toys online, which also explains why the majority of parents are buying children’s toys the most at brick-and-mortar locations.

The value share of toy purchases made online is growing steadily as well, according to Euromonitor. Internet retailing accounted for 18% of toy purchases in December 2016, up 7 percentage points from December 2011.

We expect online children’s toys sales to continue to expand over the medium term. However, brick-and-mortar will remain the primary channel for buying children’s toys in the foreseeable future, in our view.

2. The Majority of Amazon Children’s Toy Customers Previously Shopped Most Often at Walmart and Target

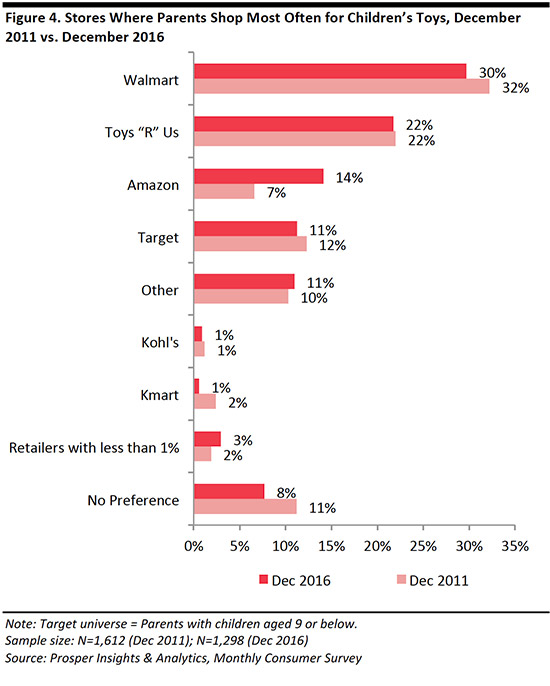

The top four retailers where surveyed parents shopped most often for children’s toys were Walmart (29.7%), Toys “R” Us (21.8%), Amazon (14.1%) and Target (11.3%). The combined share of the top-four retailer brands was 76.8%.

Discount stores such as Walmart, Target and Kmart have seen their share in the children’s toy category decrease over the past five years. In particular, Walmart’s share decreased from 32.2% in December 2011, to 29.7% in December 2016, while Target’s share dropped from 12.3% to 11.3% in the same period.

Specialty store Toys “R” Us has maintained its second place in this product category. Its share fell slightly to 21.8% in December 2016 from 22.0% in December 2011; however, this decline is not yet statistically significant. Indeed, the specialty toy retailer has seen a 0.1% increase in its domestic same-store sales in 1Q 2016.

Amazon overtook Target as the third-ranked retailer where parents shop most often for children’s toys in December 2016. The number of surveyed parents who indicated they shop most often on Amazon has increased by 7.5 percentage points over the past five years, rising from 6.6% in December 2011, to 14.1% in December 2016.

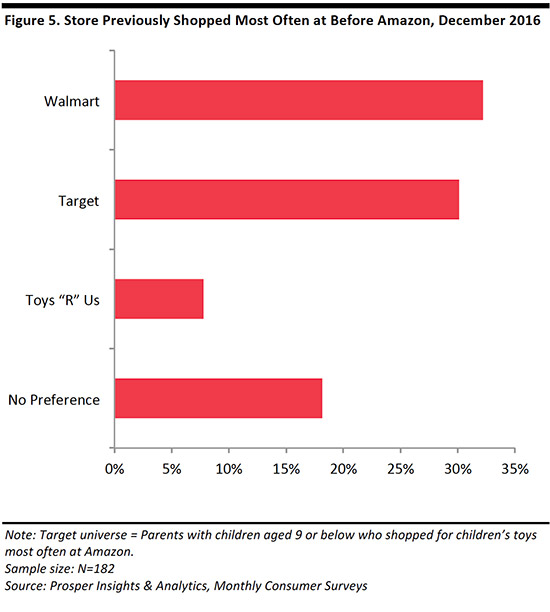

Looking closer into these Amazon customers, over half of them previously shopped the most for children’s toys at discount stores, with 32.2% shopping at Walmart and 30.1% at Target. In contrast, only 7.8% had previously shopped most often at Toys “R” Us.

3. Amazon and Walmart Both Appeal to Price-Sensitive Customers, but Amazon Edges on Selection and Service

We looked at factors for shopping most often for children’s toys at respective retailers, and compared Amazon with the two other leading retailers, Walmart and Toys “R” Us.

Walmart

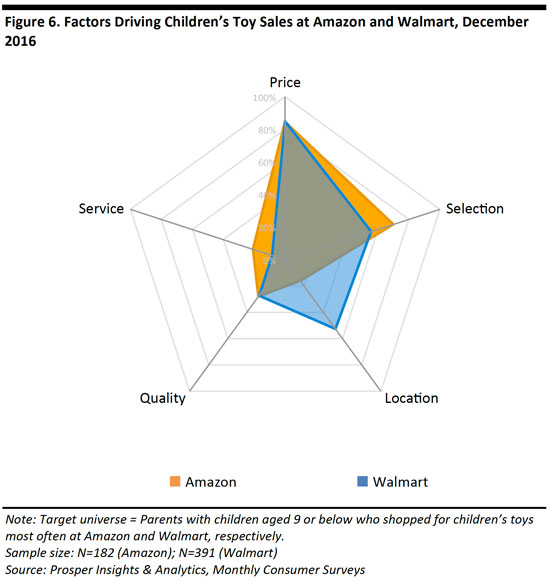

Amazon and Walmart both capture price-sensitive consumers, as price was the most mentioned reason for the two retailers’ loyal customers, at 84.7% and 84.8%, respectively. The two retail giants have been offering the most competitive pricing among US retailers. According to research conducted by e-commerce analytics firm Profitero in November 2016, the average toy prices of Amazon and Walmart were a respective 3% and 7% lower than other US retailers.

Location is a key strength that Walmart possesses, which was mentioned by 52.6% of its customers. However, when compared with Amazon on other attributes, more Amazon customers mentioned selection and service as the reason to shop most often there.

Toys “R” Us

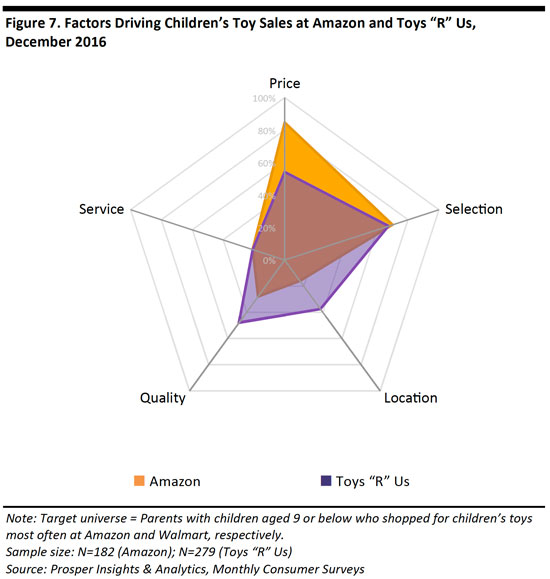

Price is the second-most-popular reason to shop at Toys “R” Us, mentioned by 54.1% of its customers, although this figure is much lower than that of Amazon and Walmart. However, in all other key aspects, Toys “R” Us is on par or even stronger than Amazon, this indicates the different positioning of the specialty toy retailer, which is revealed by the following figures.

More Toys “R” Us customers mentioned reasons such as quality and location, which were at 47.9% and 37.5%, respectively, than did Amazon’s customers at 28.0% and 16.0%. Although not a top mentioned reason, those who cited service as the reason they shop most often at Toys “R” Us (20.8%) is on par with Amazon (20.7%), and much higher than that of Walmart’s 8.9%.

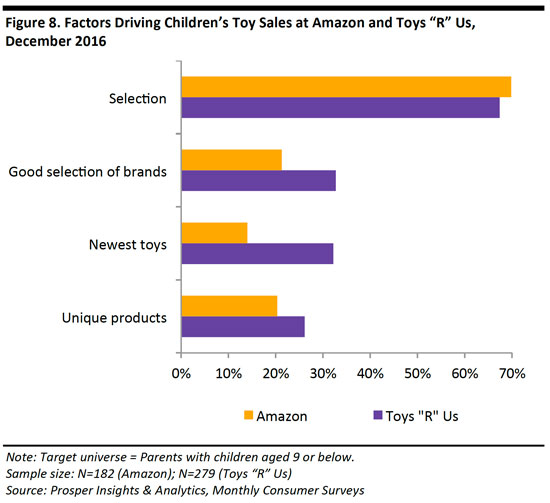

Selection is a key strength possessed by both Toys “R” Us and Amazon, mentioned by 67.3% and 69.9% of the respective retailer’s customers. However, when looking into other selection-related attributes, it reveals the quality and depth of selection possessed by Toys “R” Us. Among the specialty toy retailer’s customers, 32.7% mentioned “Good selection of brands”, 32.2% mentioned “Newest toys”, and 26.1% mentioned “Unique Products”. This is higher than that of Amazon at 21.3%, 14.0% and 20.4%, respectively.

Selection is a key strength possessed by both Toys “R” Us and Amazon, mentioned by 67.3% and 69.9% of the respective retailer’s customers. However, when looking into other selection-related attributes, it reveals the quality and depth of selection possessed by Toys “R” Us. Among the specialty toy retailer’s customers, 32.7% mentioned “Good selection of brands”, 32.2% mentioned “Newest toys”, and 26.1% mentioned “Unique Products”. This is higher than that of Amazon at 21.3%, 14.0% and 20.4%, respectively.

When looking into the NPS of the three retailer brands in December 2016, Amazon’s score of 59.6 is higher than both Toys “R” Us at 31.9 and Walmart at 23.4.

When looking into the NPS of the three retailer brands in December 2016, Amazon’s score of 59.6 is higher than both Toys “R” Us at 31.9 and Walmart at 23.4.

While both Amazon and Walmart appeal to price-sensitive consumers, Amazon’s customers are more satisfied than those of Walmart’s, which is reflected by Amazon’s higher NPS. This also helps to explain why nearly one-third of Amazon’s new customers had previously shopped most often at Walmart.

As for Toys “R” Us, the specialist toy retailer has differentiated itself from Amazon and Walmart with its depth and quality of selection. According to an article on TheStreet in July 2016, Toys “R” Us has boosted the number of private-label offerings and secured product exclusives by working closely with its suppliers.

About the Amazon Shopper Intelligence service

The Amazon Shopper Intelligence service combines Fung Global Retail & Technology analysis and commentary with input on thousands of US shoppers from Prosper. It includes:

- Over 10 years of data on Amazon shoppers as well as on leading retailers’ shoppers

- Prosper Shopper Preference Share (indicates how Amazon is growing as a preferred retailer for 11 different merchandise categories, and the reasons why)

- Retail positioning maps (plot retailers and their competitors based on the percentage of their shoppers who shop there for particular reasons)

- Net promoter scores

- Key demographics