Latin America Consumer Overview

KEY POINTS

- Argentina is emerging from a prolonged period of political and economic instability. Consumers are beginning to return to stores, and they are shopping more online. Argentina has the fastest-growing e-commerce market in Latin America, expanding at an annual rate of 28%.

- Many Brazilian consumers seek out foreign brands as displays of wealth, and the upcoming Olympic Games in Rio de Janeiro present an opportune time for foreign brands to gain exposure in Brazil.

- Chile expects to see an increase in e-commerce, especially as smartphone sales increase in the country.

- Colombian consumers love brands, and the country’s economy is expected to continue to grow through 2017, supporting a flourishing retail market.

- In Mexico, the retail sector is expanding rapidly, and the country’s population is young, which means consumer behavior is evolving.

Executive Summary

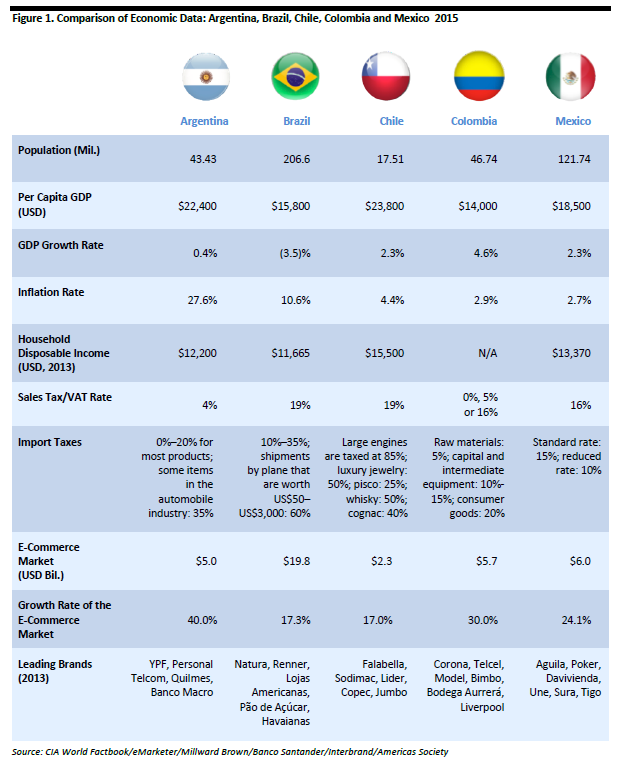

Latin America has an expanding and dynamic retail sector that relies on consumers who are anxious to spend their newly gained disposable income. In this report, we focus on Argentina, Brazil, Chile, Colombia and Mexico, countries with a booming middle class that is both affluent and aspirational. Despite macroeconomic difficulties spanning much of Latin America, consumers in the region continue to demonstrate brand loyalty. While the next few years are expected to prove economically difficult in a number of countries in Latin America, there are still many opportunities for retailers to gain consumer loyalty in the region, as it is home to some of the most attractive markets in the world.

- Argentina is emerging from a prolonged period of political and economic instability. Consumers are beginning to return to stores, and they are shopping more online. Argentina has the fastest-growing e-commerce market in Latin America, expanding at an annual rate of 28%.

- Many Brazilian consumers seek out foreign brands as displays of wealth, and the upcoming Olympic Games in Rio de Janeiro present an opportune time for foreign brands to gain exposure in Brazil.

- Chile expects to see an increase in e-commerce, especially as smartphone sales increase in the country.

- Colombian consumers love brands, and the country’s economy is expected to continue to grow through 2017, supporting a flourishing retail market.

- In Mexico, the retail sector is expanding rapidly, and the country’s population is young, which means consumer behavior is evolving.

- Economy

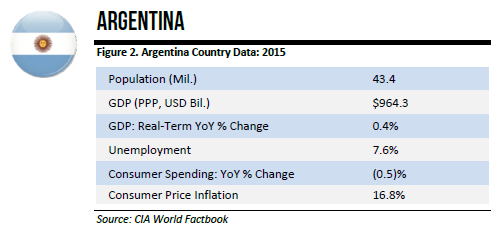

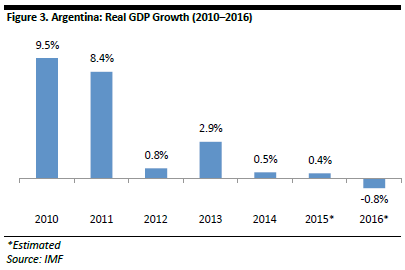

Argentina has the second-largest economy in South America (Brazil has the largest). The country has abundant natural resources and a well-educated labor force. The economy is primarily service based; services account for 72% of GDP, while industry accounts for 23% and agriculture for 5%. In 2001, Argentina faced a severe depression, growing public and external indebtedness, and a bank run. In the same year, the government declared a default. The economy continued to struggle after the Argentine peso was unpegged from the US dollar in early 2002; GDP shrank by 18% from its 1998 level, and more than 60% of Argentines were under the poverty line. Though the economy grew by an average of 8.5% until 2008, the global recession hit Argentina hard, and the nation has seen a prolonged recession and high inflation in recent years. Unemployment in March of 2016 was 7.6%.

In 2015, Argentina’s GDP grew by 0.4%, to US$964.3 billion. The country exported an estimated US$66 billion worth of goods, including soybeans and derivatives, petroleum and gas, vehicles, corn, and wheat. Imports, composed primarily of machinery, motor vehicles, petroleum and natural gas, organic chemicals, and plastics, amounted to an estimated US$61 billion.

- Demographics

In terms of population, Argentina is the third-largest country in South America, behind Colombia and Brazil. Although the country’s population of 43.4 million is still growing, it is slowing steadily as the birthrate declines. The total fertility rate was estimated to be 2.2 in 2015, according to The World Factbook, published by the CIA. The median age in Argentina is 31.4 years and approximately 40% of the population is under 24 years old. The capital, Buenos Aires, has a total of 15.8 million inhabitants, and 91.8% of the country’s population lives in urban environments.

- Consumer Summary

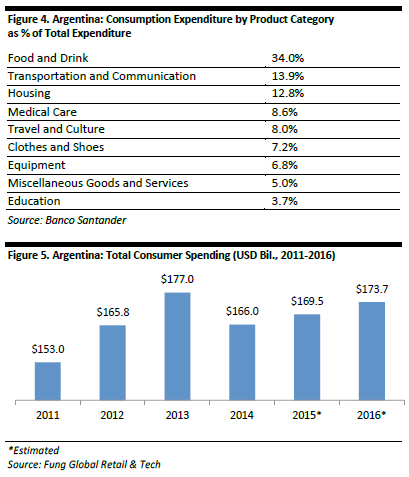

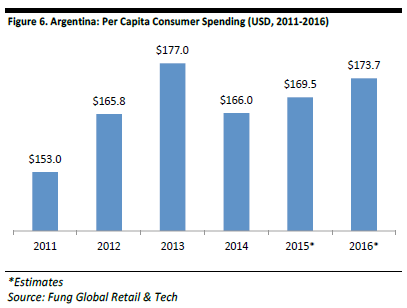

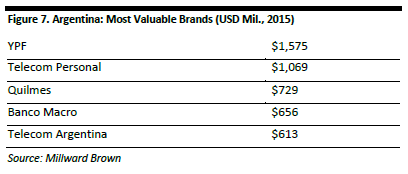

According to Banco Santander, Argentines’ consumption preferences are more similar to those of Europeans than they are to those of other Latin American consumers. Argentine consumers have particular preferences regarding services, including home-delivery and after-sales services. They also often prefer to repair old goods rather than purchase new ones. Argentina applies a large import tax, so consumers generally prefer to buy domestic products. Banco Santander describes Argentine consumers as “rational and conservative.” The macroeconomic conditions in the country have caused consumers to be wary and, thus, not particularly loyal to brands.

According to a report from BI Intelligence that was released in March 2016, Argentina is the fastest-growing e-commerce market in Latin America, expanding at an annual rate of 28%. Half of the population’s cellphone users are expected to have smartphones by 2017, according to eMarketer.

- Economy

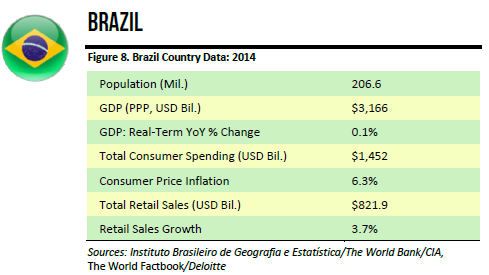

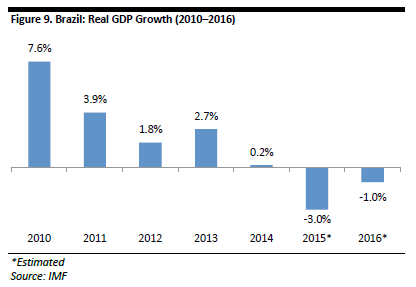

The Brazilian economy is the seventh largest in the world by nominal GDP, the second largest in the Western Hemisphere and the largest in Latin America. According to the CIA, the country’s 2015 GDP was estimated to be US$3.2 trillion. Services make up an estimated 71.9% of the economy, while industry accounts for 22.2% and agriculture for 5.9%, according to the CIA. Unemployment has been rising; it was 6.6% in 2015, up from 4.84% in 2014, and the International Monetary Fund (IMF) estimates that it will reach a peak of 8.9% by 2017.

Brazil exported an estimated US$189.1 billion worth of goods in 2015. The country’s primary export commodities are transportation equipment, iron ore, soybeans, footwear, coffee and automobiles. Brazil imported an estimated US$174.2 billion worth of goods in 2015, primarily machinery, electrical and transportation equipment, chemical products, oil, automotive parts, and electronics.

- Demographics

Brazil is the fifth-most-populous country in the world, with a population of approximately 205 million. Population growth has been slowing since 2006, when the total fertility rate fell below 2.1. The total fertility rate has been declining since then, and stood at 1.8 in 2015. The median age in Brazil is 31.1 years and almost half the population is under 24 years old. The majority of the population, 85.7%, lives in urban areas. São Paulo is the largest city, with 21 million inhabitants, while Rio de Janeiro is the second largest, with 12.9 million inhabitants.

- Consumer Summary

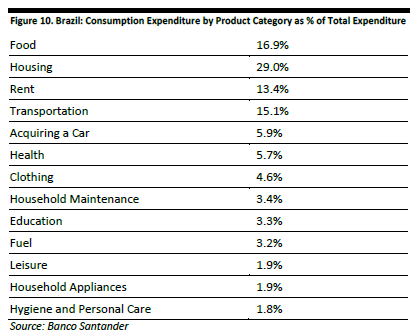

According to Banco Santander, Brazilian consumers are highly loyal to brands. Though often loyal to domestic brands, Brazilians buy foreign products as displays of wealth, including technology and American sports brands. More affluent consumers pay close attention to quality, customer service and companies’ social commitment, including protection of the environment and sanitary standards. The household consumption per capita was US$3,909 in 2014, the majority of which went toward food and housing.

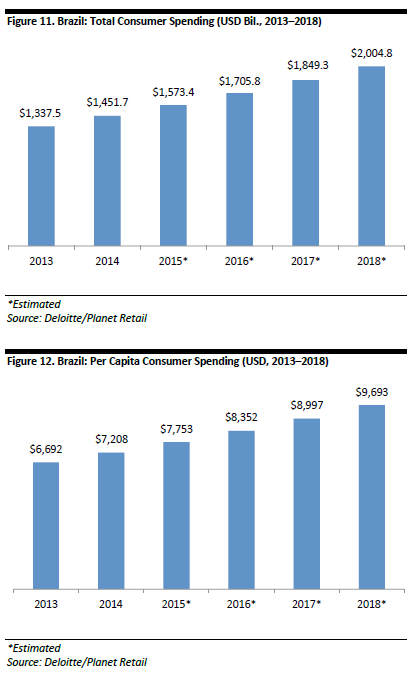

In Brazil, buying a product by paying in installments is very common. According to Banco Santander, Brazilians buy nearly everything on credit, including real estate, household appliances and brand name clothes. Stores often offer payment plans for purchases, allowing customers to spread payments out over time, sometimes without interest. But Brazilian retail sales are slowing and household real income is declining due to high inflation and unemployment. According to Deloitte, the end of tax incentives for certain purchases and the high cost of credit have both fueled the downturn in consumption.

According to the Confederação Nacional da Indústria, Brazilian consumer confidence in January 2016 measured 98.6, up from 96.3 the month before but nearly six points lower than the January 2015 reading of 104.2.

According to TNS Infratest, when Brazilians were asked what factors they considered when making purchase decisions, 28% responded that urgent need was the number one factor, although discounts and promotions were also important.

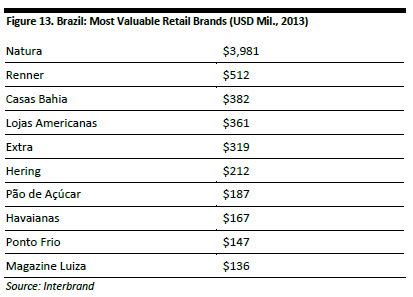

The beauty and personal care market in Brazil is one of the largest in the world, valued at US$43 billion. According to McKinsey & Company, it is also “by far” the world’s fastest-growing market; between 2010 and 2015, the market for these products and services grew at an annual rate of 14%. Brazilians spend US$230 per capita annually on beauty and personal care products, more than any other countries’ inhabitants in the world, relative to GDP.

Brazil is the world’s 10th-largest retail e-commerce market and the only Latin American country in the top 10 globally. eMarketer estimates that there were 80 million digital shoppers in Brazil in 2015, 8 million more than in 2014.

- Economy

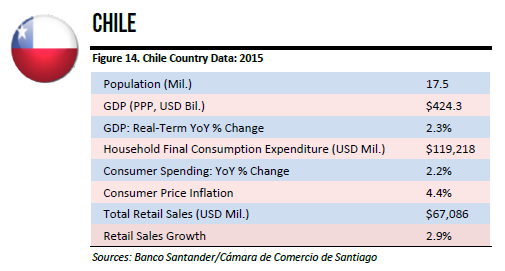

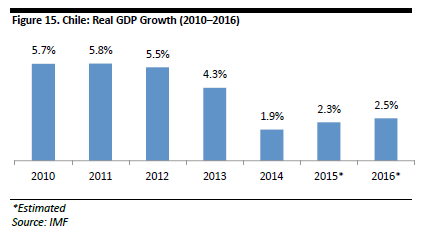

The World Bank ranks Chile as a high-income economy, and it has been one of the fastest-growing economies in Latin America over the past decade. According to Banco Santander, Chile’s 2015 GDP was US$240 billion. The market-oriented country engages in a large amount of foreign trade and has strong financial institutions and policies. Chile has the strongest sovereign bond rating in South America. Exports of goods and services account for one-third of GDP; copper alone makes up 20% of government revenue, according to the CIA. The economy is primarily driven by services, which make up an estimated 61.6% of the economy, although industry remains significant, accounting for 35% of the economy, largely due to copper extraction.

According to the CIA, Chile exported an estimated US$61.8 billion worth of goods in 2015. The country’s primary export commodities are copper, fruit, fish, paper and pulp, chemicals, and wine. Chile imported an estimated US$56 billion worth of goods in 2015, mostly petroleum and related products, chemicals, electrical and telecommunications equipment, industrial machinery, vehicles, and natural gas. According to the IMF, Chile’s inflation is expected to decline in 2016 from its 2015 peak of 4.36%.

- Demographics

Chile’s population of approximately 18 million is in the advanced stages of development and is currently aging. The total fertility rate in 2015 was estimated to be 1.82, according to the CIA. The median age in Chile in 2015 was 33.7 years. Approximately 89.5% of the population lives in urban areas, and the capital city of Santiago has 6.5 million inhabitants.

- Consumer Summary

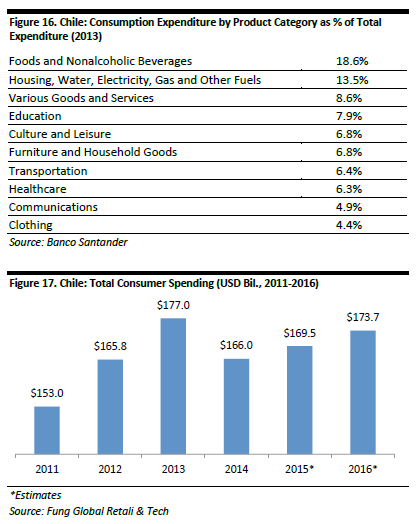

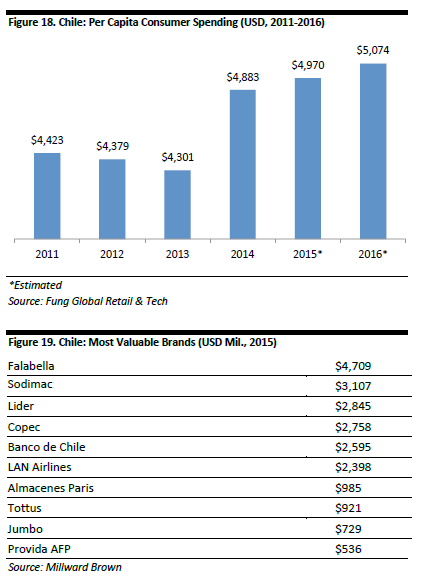

According to Banco Santander, Chilean consumers are particularly concerned with quality, durability, technology, customer support and availability of service. Currently, electronic goods and IT are growing sectors in Chile; more than 50% of Chilean consumers have bought electronic goods, including DVDs, smartphones, music equipment and computers. While Chileans are willing to pay more for quality, according to Banco Santander, 42% of them say price is the most important factor when making purchase decisions. Credit is widespread in Chile, with 68% of Chileans possessing at least one credit card. The household consumption per capita in 2014 was US$6,712.

According to a Nielsen survey, Chilean consumer confidence measured 87 in the first quarter of 2015, which was up from 81 in the previous quarter. In the same survey, 71% of Chileans polled claimed to have changed their shopping habits to accommodate to the economic climate. In times of economic crisis, 51% said they had searched for more economical brands; 43% said they had avoided entertainment outside the house; 44% said they had cut down on eating out; and 49% said they had bought fewer clothing items.

According to a report by Cámara de Comercio de Santiago, young Chileans are very loyal to brands regardless of their socioeconomic status. And as Chileans have become increasingly connected (80% of households claim to have at least one smartphone), they have been buying more goods online. On Cyber Monday in 2015, 12% of sales in Chile were made from smartphones, as opposed to only 1% the previous year.

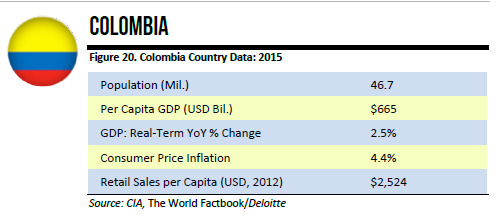

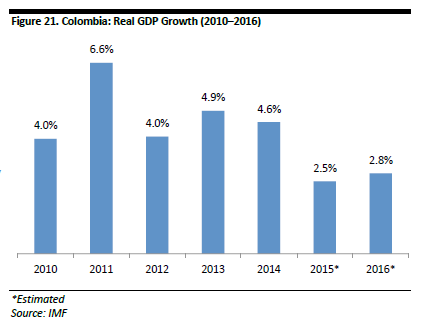

- Economy

Colombia has experienced sustained growth in recent years, with nearly a decade of strong economic performance. According to the CIA, Colombia’s estimated GDP was US$665 billion in 2015. However, the country saw high unemployment in 2015—9.4%, up from 9.1% in 2014, according to the CIA’s estimates.

Industry helps drive Colombia’s economy as the world’s fourth-largest exporter; the sector accounts for 36.9% of the country’s economy. Services and agriculture make up 56.7% and 6.4% of the economy, respectively. The CIA estimates that Colombia exported US$48.5 billion worth of goods in 2015, primarily petroleum, coal, emeralds, coffee, nickel, cut flowers, bananas and apparel. Imports are estimated to have totaled US$56.1 in 2015, mostly in the form of industrial equipment, transportation equipment, consumer goods, chemicals, paper products, fuels and electricity.

- Demographics

With a population of 46.7 million, Colombia is the second-most-populous country in South America after Brazil. The country’s population is young; 25% of residents are aged 14 or younger. The median age is 29.3 years. The total fertility rate is just under the replacement rate, at 2.0. The population is still growing, but at a slowed rate of only 1%. Just over three-fourths of Colombians live in urban areas, and 9.8 million people live in the capital city of Bogotá.

- Consumer Summary

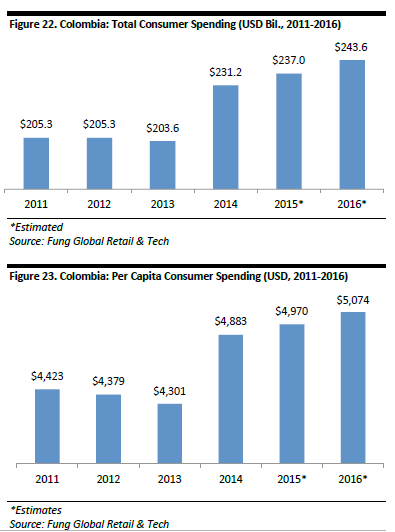

The retail sector in the capital city of Bogotá is one of the most sophisticated in Latin America. According to Kantar Worldpanel, Colombian consumers are loyal to brands, and generally have “favorite” products. According to Banco Santander more than 70% of Colombian households say they are willing to pay more for a product that offers more and better benefits, so promotions and private labels do not tend to sway consumers. Though promotions are still appreciated, they account for only 9% of purchases.

According to eMarketer, Colombians tend to purchase electronics online due to the high price of technology in Colombia. They also buy apparel, beauty products and entertainment online due to cheaper prices abroad.

In 2014, final household consumption expenditure per capita in Colombia was US$3,014. While the country’s central bank expects the economy to grow by 2.7% in 2016, that would be its slowest pace since 2009, and Bloomberg suggests that consumer confidence in the country has fallen to its lowest point in over a decade.

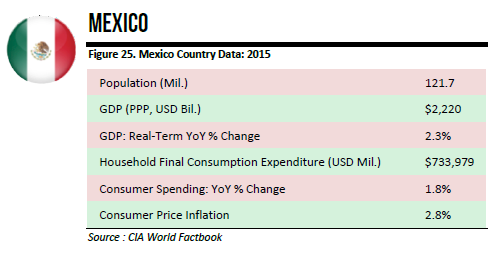

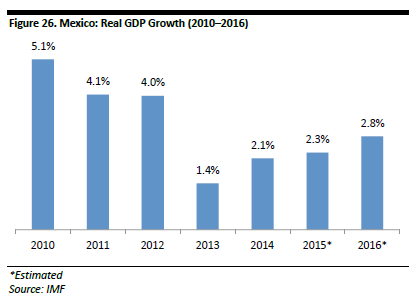

- Economy

Mexico has a US$2.2 trillion economy that is largely driven by the manufacturing sector, which has benefited from the North American Free Trade Agreement enacted in 1994. Industry and agriculture still account for significant portions of the economy, at 24.1% and 13.4%, respectively.

Mexico is the US’s second-largest export market and its third-largest source of imports, according to the CIA. Mexico exported an estimated US$430.9 billion worth of goods in 2015, primarily manufactured goods, oil and oil products, silver, fruits and vegetables, coffee, and cotton. In 2014, 80.2% of the country’s exports went to the US. Mexico imported an estimated US$434.8 billion worth of goods in 2015, primarily metalworking machines, steel mill products, agricultural machinery, electrical equipment, automobile parts for assembly and repair, and aircraft and aircraft parts.

- Demographics

According to the CIA, Mexico is the second-most-populous country in Latin America, with almost 122 million people. Population growth has been slowing since 2008, though the total fertility rate remains above the replacement rate, at 2.27. The median age is 27.6 years, and the population is young overall, with 45.49% of residents aged 24 or younger. An additional 40.55% of Mexicans are aged 25–54. The capital, Mexico City, has 21 million inhabitants and 79.2% of the country’s population lives in urban areas

- Consumer Summary

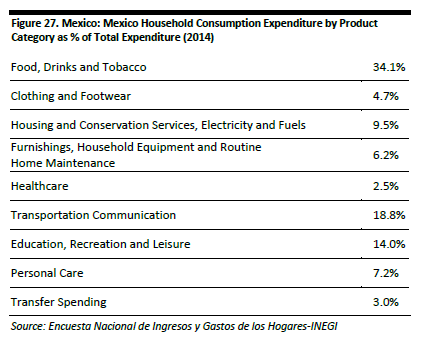

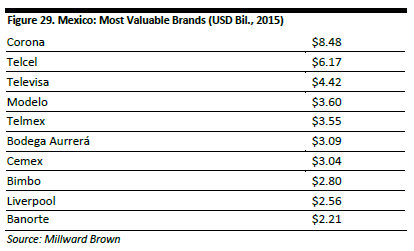

According to Banco Santander, Mexican consumers are strongly influenced by the opinions of friends and family, as purchasing decisions are often made as a household. Female heads of households are most likely to do the shopping. Promotional prices are important to Mexican consumers, though many retailers find it difficult to influence them because they are well aware of brand names and cost-benefit ratios. Mexican consumers prefer one-on-one shopping experiences that include personalized service. Household consumption per capita in 2014 was US$5,854, with nearly half of the total going toward food, nonalcoholic beverages and transportation. Mexicans also tend to save a significant portion of their money, according to Merca2.0, with 50% of consumers putting part of their paycheck aside all year round.

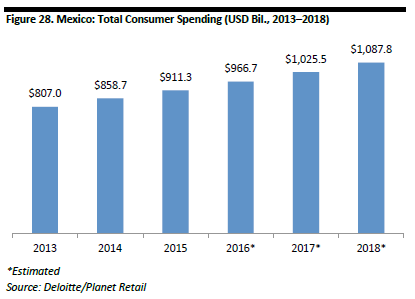

Mexico’s consumer confidence measure grew in the final months of 2015, rising to 93.0 in December 2015. Consumers are more optimistic about the economic conditions in Mexico, as unemployment and inflation remain low. According to the LatinFocus Consensus Forecast, private consumption is expected to grow by 3.1% in 2016, and by an additional 3.3% in 2017.

E-commerce sales in Mexico are expected to nearly triple between 2014 and 2019. In 2014, according to eMarketer, Mexico’s e-commerce sales totaled US$4.38 billion, and the firm estimates they will reach US$13.3 billion by 2019.

Conclusion

Latin America is still an under-retailed region that provides many opportunities for retailers, despite the macroeconomic difficulties many countries in the region face. As Latin American consumers become more aware of brand names, e-commerce and technology, the retail market is likely to become one of the most alluring in the world.