THE DIGITALIZATION OF FOOD: GROCERY RETAIL AND FOOD SERVICE

KEY POINTS

- With the growth of food retail expected to remain low in the next few years, retailers must consider the potential that digitalization offers for engaging with customers and opening new revenue streams. However, digitalization presents new challenges for retailers, as the logistics costs of e-commerce threaten to erode profit margins.

- To increase grocery e-commerce penetration, companies such as Amazon and Walmart are adopting strategies that capitalize on their competitive advantages. Meanwhile, other retailers are partnering up with digital startups to outsource the fulfilment of grocery shopping, mimicking solutions adopted by the food service industry.

- In the fragmented food service industry, tech startups serve to consolidate the front end. In grocery retail, which is already consolidated in mature markets, tech startups introduce cost-effective solutions for food delivery that can be used by retailers to compete more aggressively online.

EXECUTIVE SUMMARY

- Digitalization offers a path forward in a low-growth business. The food retail and food service industries are challenging and competitive in mature economies. With the growth of food retail expected to remain low in the next few years, players that want to expand must consider the potential that digitalization offers for engaging with customers and opening new revenue streams. However, digitalization presents new challenges for retailers, as the logistics costs of e-commerce threaten to erode profit margins.

- Retailers are developing solutions to increase grocery e-commerce penetration, using their respective competitive advantages. US-based e-commerce retailer Amazon, for example, is encouraging customers to set up home inventory systems such as Amazon Dash to increase e-grocery shopping frequency, while Walmart is capitalizing on its extensive store network to offer free pickup services for e-grocery orders.

- The potential of new business solutions that are emerging from the startup environment is so significant that Germany’s Metro Group is cultivating a portfolio of food service startups as part of its business growth strategy. Food service startups that put restaurants and customers in touch give grocery retailers additional examples of solutions that can be replicated to grow e-grocery sales. Following these companies’ lead, a number of US retailers, including Whole Foods Market, Target and Walmart, have joined forces with Internet-based delivery services for the fullfillment of online grocery orders.

INTRODUCTION

Digitalization has been revolutionizing service industries. In recent years, Airbnb and Uber have changed the dynamics of the hospitality and transportation sectors, respectively, by providing consumers with greater convenience and choice when booking accommodations and car rides within a city. Now, the food industry—restaurants, delivery services, grocery retailers and food-related niche retailers—is feeling the impact of digitalization, as digital technologies, including e-commerce and service-related apps, have started to flourish in many mature markets.

In grocery retailing, however, e-commerce penetration has been limited in a number of geographies, as grocers confront difficulties not faced by retailers that sell nonperishable, higher-price-point items. Nevertheless, digitalization is here, and is already an inescapable trend in the food industry.

In this report, we explain why e-commerce penetration within grocery has been slow, offer an overview of how the food service sector is leading the way in digitalization within the industry and acting as a “solutions pot” for grocery e-commerce, and summarize how retailers are overcoming obstacles to e-grocery expansion. We also discuss technology’s role in facilitating consumers’ interaction with food service providers and grocery retailers.

For example, apps such as EAT24 in the US and Deliveroo in the UK enable customers to order online and have food delivered from restaurants that might not have their own Internet presence and delivery capabilities. Meanwhile, apps such as Instacart in the US tell consumers if retailers have what they are looking for in stock. If so, staffers will go and get the items for customers, meaning the app effectively acts as an alternative transactional portal and as a delivery arm for the retailer.

Our Personalization in Retailing: A Digital Solution for Each Shopper report, published in 2015, discusses another aspect of the digitalization of grocery retailing—the use of in-store technology.

DIGITALIZATION: AN OPPORTUNITY FOR GROWTH

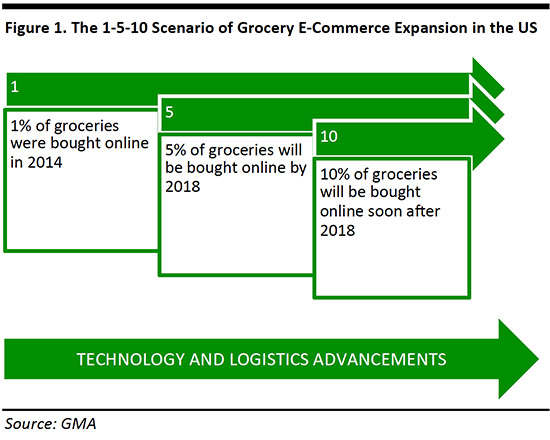

E-commerce is a significant growth opportunity for grocery retailers and food manufacturers—but from a still-small base. In 2014, the Grocery Manufacturers Association (GMA) introduced the concept of the “1-5-10” scenario, which suggests that the 1% share of groceries that were bought online in the US in 2014 is likely to turn into 5% by 2018, and then to quickly accelerate to 10%. New technologies and logistics methods are expected to make delivery more straightforward, clearing the hurdles to grocery e-commerce expansion and enabling rapid growth.

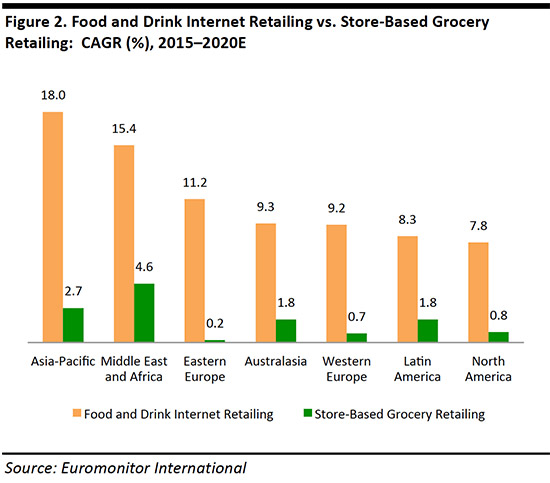

Euromonitor International predicts that food and drink Internet retailing in every region of the world will grow much faster than store-based grocery retailing through 2020.

In the UK, the online channel will be the fastest-growing grocery channel over the next few years, according to research organization IGD. The firm expects e-commerce’s share of total grocery retail to almost double, from 4.4% in 2014 to 8.3% in 2019.

In the US, online consumer packaged goods (CPG) sales are expected to contribute more than half of total industry sales growth between 2013 and 2018. During this period, total online sales of CPGs are expected to increase by $28 billion, while total CPG revenue is expected to increase by $52 billion, according to data from IRI and Wells Fargo.

Despite this growth potential, only a small portion of grocery e-commerce sales will be new business for the grocery industry. Additional sales could be generated by busy shoppers who do not have time to visit stores often and who now have the option to shop more frequently via the Internet, or by shoppers who could buy products online that are hard to find where they live—for instance, because supermarkets with large product ranges are located far away. We believe, however, that the vast majority of e-commerce sales will be diverted from the traditional brick-and-mortar channel, cannibalizing revenue.

Still, the growing importance of grocery e-commerce in food retailing is inescapable, and companies that do not adapt to online retailing are likely to lose market share and miss the long-term opportunities that digitalization presents.

E-GROCERY: STILL AN UNDERDEVELOPED CHANNEL

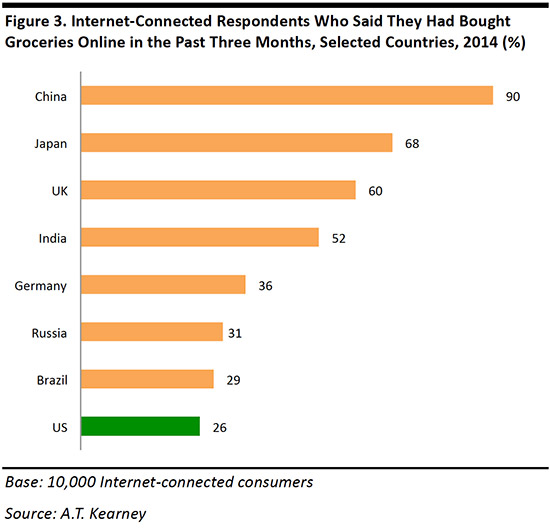

E-grocery penetration is still very low in many countries, even the ones with the most advanced grocery retail sectors. The US sees particularly low e-commerce penetration levels for a Western grocery market. According to a 2014 survey by A.T. Kearney, 26% of Internet-connected consumers surveyed in the US said that they had bought grocery products online in the last three months, compared to 60% of those surveyed in the UK and fully 90% of those surveyed in China.

Specific characteristics of the US grocery retail sector may explain why the US lags in online grocery shopping. The sector is relatively fragmented and regionalized in the US, which may inhibit digital innovation by giving retailers offline avenues for growth, such as expansion and acquisitions. But a bigger barrier is likely the cost of delivering in areas with relatively low population density.

Countries where grocery e-commerce is more popular, such as the UK, France and Japan, tend to have smaller and more densely populated areas, which makes e-commerce logistics more cost-effective.

Other markets in which consumers buy groceries online more frequently, such as China and India, are characterized by a scarcity of grocery outlets in more remote areas and traffic congestion in large cities—factors that make it harder for shoppers to get to stores and that encourage online shopping. In China, consumers like to buy imported products that are often difficult to find in local stores but that can be found through online retailers such as JD.com, Tmall and Taobao—which has helped e-grocery gain traction in the country.

Aside from specific local factors, however, the challenging economics of e-grocery retailing are responsible for its slow expansion, not only in the US, but also in other countries, including the UK, where grocery e-commerce is more advanced but untapped potential still exists.

FULFILLMENT COSTS WEIGH ON E-GROCERY EXPANSION

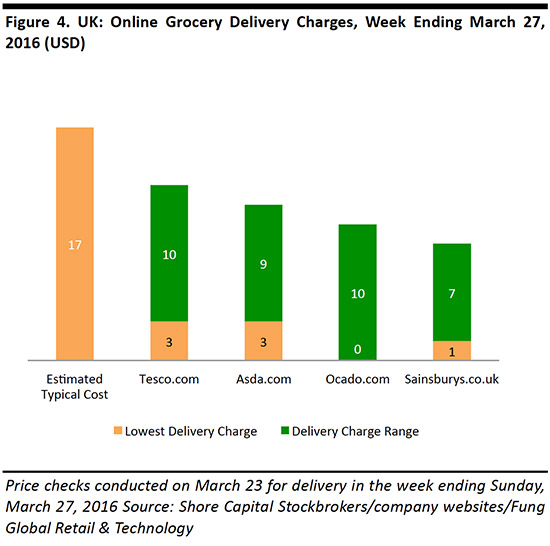

E-commerce adds significant costs to a retailer’s operations. It costs UK grocery retailers $17, on average, to pick, pack and deliver an online order to a customer, according to Shore Capital Stockbrokers. However, when we checked a number of the largest UK grocers’ delivery fees in March 2016, they ranged from $0–$10, which implies a cost burden for the retailer in the range of $7–$17 for each order.

High fulfillment costs appear to have made grocery retailers in some markets reluctant to sell online, and that has slowed the expansion of e-grocery retailing in countries such as the US.

Online grocery retailers need economies of scale in order to reach profitability, and those occur when there is an increasing number of orders per hour or per square mile. Picking costs, which in a nonautomated environment function like fixed costs, ease with scale, according to the GMA. Therefore, grocery e-commerce is more economically feasible in highly populated urban areas that generate high volumes of orders than it is in large, sparsely populated territories.

RETAILERS’ STRATEGIES TO INCREASE E-COMMERCE PROFITABILITY

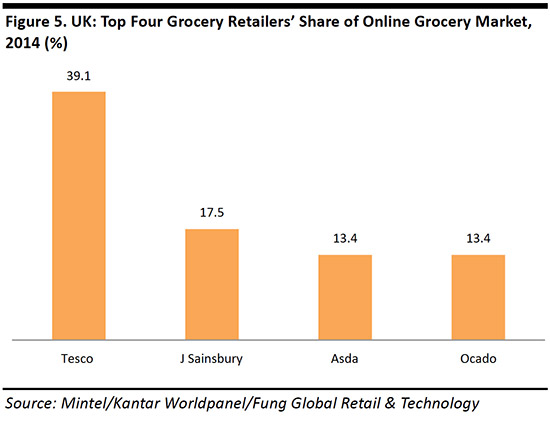

Many brick-and-mortar grocery retailers are working to make their e-commerce operations more economically viable and, in turn, helping to grow their share of grocery e-commerce. In a number of countries, leading grocery retailers that operate physical stores already hold sizable shares of the e-commerce market. For example, in 2015, French supermarket operator Casino was the second-largest Internet retailer in France after Amazon, according to Euromonitor International. In the UK, the three biggest online grocers are all brick-and-mortar retailers.

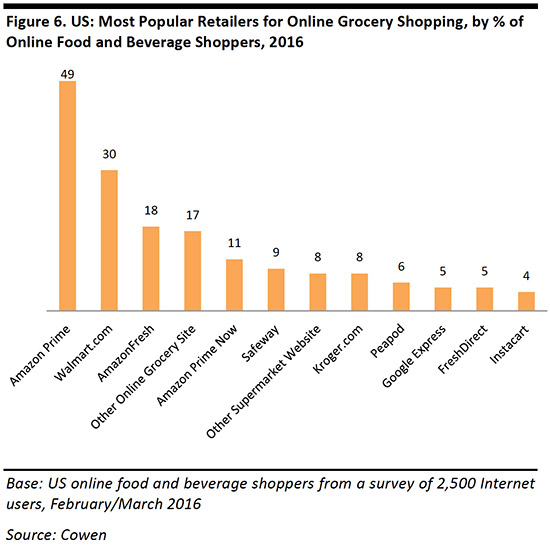

In the US, Walmart.com is the second-most-popular online grocery retailer after Amazon Prime, according to a recent survey by financial services company Cowen.

The solutions that various retailers have relied on to make e-grocery retailing more economically viable are largely based on their individual competitive advantages. Amazon has used its logistics and technology to facilitate grocery e-commerce, while Walmart has adopted a very different solution that relies on its strong store network.

Amazon Sends You a Box of Home Essentials

Amazon is becoming a grocery shopping destination for US consumers, thanks to the firm’s astute deployment of innovative strategies and technology. By making grocery e-commerce more profitable, these enable the company to gain market share in grocery retail.

Amazon addresses the problem of shipping low-price-point SKUs with solutions such as Amazon Prime Pantry, a service that allows Amazon Prime customers to buy a 45-pound box filled with packaged groceries and household goods. The service helps Amazon reduce fulfillment costs by:

- Bundling low-price-point items to increase the value of the order and help yield a margin that covers or exceeds fulfillment costs.

- Partially passing delivery costs along to the customer, in two ways: through a fixed, $5.99 fee per box and through the annual Prime membership fee.

Amazon Wants You to Set Up a Home Inventory System

Amazon has introduced other solutions, too, notably Amazon Dash and the Dash Button, to encourage repeated purchases and grow the size and value of the average basket. Amazon Dash is a scanner that enables the customer to scan the barcode of the product they want to reorder. That item is then automatically added to their cart on AmazonFresh, Amazon’s full-range grocery e-commerce service. The user can even speak the order through a microphone embedded in the device. The solution was launched in April 2014 and it is currently available in selected US urban areas where AmazonFresh operates, including New York, Los Angeles and Seattle.

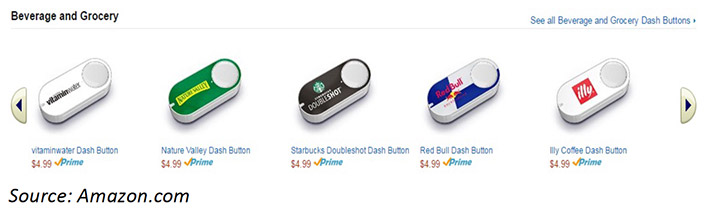

In 2015, Amazon launched the Amazon Dash Button, a physical device that looks like a key ring with a button and the logo of a product on it. When the customer presses the button, the related product is automatically ordered on Amazon. Users can conveniently store the device close to where they keep the product, such as in a cupboard.

Dash Buttons can be bought by customers via Amazon, but can also be embedded by manufacturers in the hardware of electronic appliances, thanks to collaborations between the individual appliance makers and Amazon. When the technology is embedded in the appliance, the user can reorder supplies manually via the Amazon Dash Button, but the reorder can also be triggered automatically through a service called Amazon Dash Replenishment, as the technology tracks how much product has been used.

By cutting the time between the customer’s need occurring and an order being placed, Amazon Dash and Dash Buttons minimize the possibility that the customer will shop elsewhere, procrastinate or forget about needing to make the purchase.

Assuming that Amazon Prime customers are frequent buyers at Amazon and that the company groups multiple orders processed in a short period of time into one single shipment—which is, in fact, the default option—Amazon Dash and Dash Buttons should encourage larger baskets per order, which reduce the impact of fulfillment costs on e-commerce operations.

Walmart Loads E-Grocery Shoppers’ Trunks

Walmart offers another example of how retailers can reduce the impact of fulfillment costs in grocery e-commerce. In the US, the company uses its massive brick-and-mortar footprint (75% of the US population lives within five miles of a Walmart store) to bring down delivery costs and expand online grocery services by focusing on local pickup as an alternative to delivery.

Walmart gives customers the option of collecting groceries they have bought online from one of its stores, free of charge. In-store collection helps the company saves on fulfillment costs, because:

- Part of picking and packing can be carried out by existing staff, limiting the number of extra people the company needs to employ for fulfillment.

- Walmart does not incur in delivery costs, as customers drive to the store to collect their own groceries.

Walmart successfully tested its pickup service in 2014 in its hometown of Bentonville, Arkansas. In September 2015, it announced a significant expansion of the service into a number of US cities. By April 2016, the service was available at Walmart stores in more than 20 US cities.

The DIGITALIZATION of Food SERVICE

Digitalization is also visible in food service, where numerous startups are unleashing the potential for restaurants to increase their sales. Many of these startups run apps that customers can use to order meals online from restaurants for home delivery. Local restaurants that are featured in search results run through the apps can win new business. According to food-ordering service Deliveroo, restaurants that appear in searches on its app can generate an increase in sales of up to 30%. Moreover, some of these intermediaries act as delivery agents for the restaurants, offering a new channel of distribution for them.

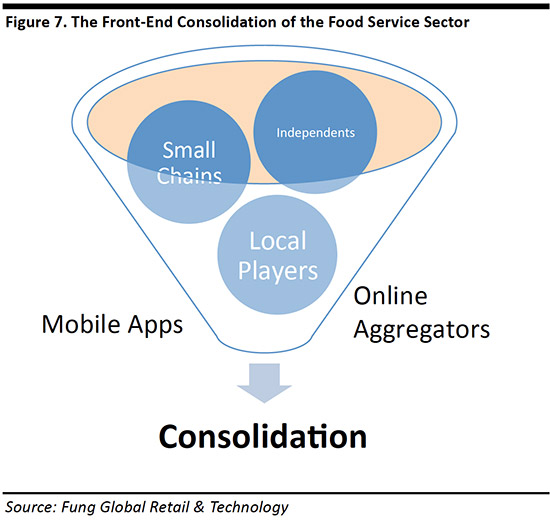

The business model of these mobile apps and online aggregators is effectively to consolidate the consumer-facing element of the food service sector. The restaurant sector—like many service sectors—remains relatively fragmented, and small, independent firms are prominent. By consolidating the front end, firms such as EAT24, Just Eat and CaterCow make finding, choosing and booking food service providers much simpler amid a fragmented landscape.

There are four main types of services that digital startups offer to the food service industry: home delivery and reservation services, subscription services, events and office catering, and experiential service agents.

Home Delivery and Reservation Services

Delivery and reservation services are intermediary booking services that connect consumers with local food service firms. These companies provide a portal that aggregates independent food service providers, and major names include EAT24 (US), Delivery.com (US), GrubHub-Seamless (US), Just Eat (Denmark, UK) and Deliveroo (UK). Uber also runs a food service delivery app, UberEATS, which was launched in March 2016 in the US and in June 2016 in London. The app enables users to order meals from nearby participating restaurants and have them delivered in as little as 12 minutes.

Subscription Services

Subscription services provide scheduled deliveries of meals, usually with a focus on healthy eating and nutrition. Major names in the category include Freshology, Fresh Diet and Power Supply in the US, and The Detox Kitchen in the UK. The companies operate online portals through which customers select their menu according to their specific dietary requirements; the meals are then delivered daily for a specified period of time.

Events and Office Catering

Startups operating in the catering space provide intermediary booking services that connect clients with local, often independent, food service firms that cater events such as business meetings, weddings and parties. Big names in this space include CaterCow (US), City Pantry (UK) and EAT Club (US). Fooda (US) offers a more distinctive spin on at-work catering: it brings pop-up restaurants into larger offices.

Experiential Service Agents

Experience-focused firms tend to go beyond simply acting as booking agents or delivery firms, offering premium or novel experiences. Innovators include Gormei (Hong Kong), a platform that enables restaurants to offer diners a unique experience that may include experimenting with a new menu or a special event. Other companies focused on experiences include EatWith (Israel), which allows guests to book dinner in a chef’s house.

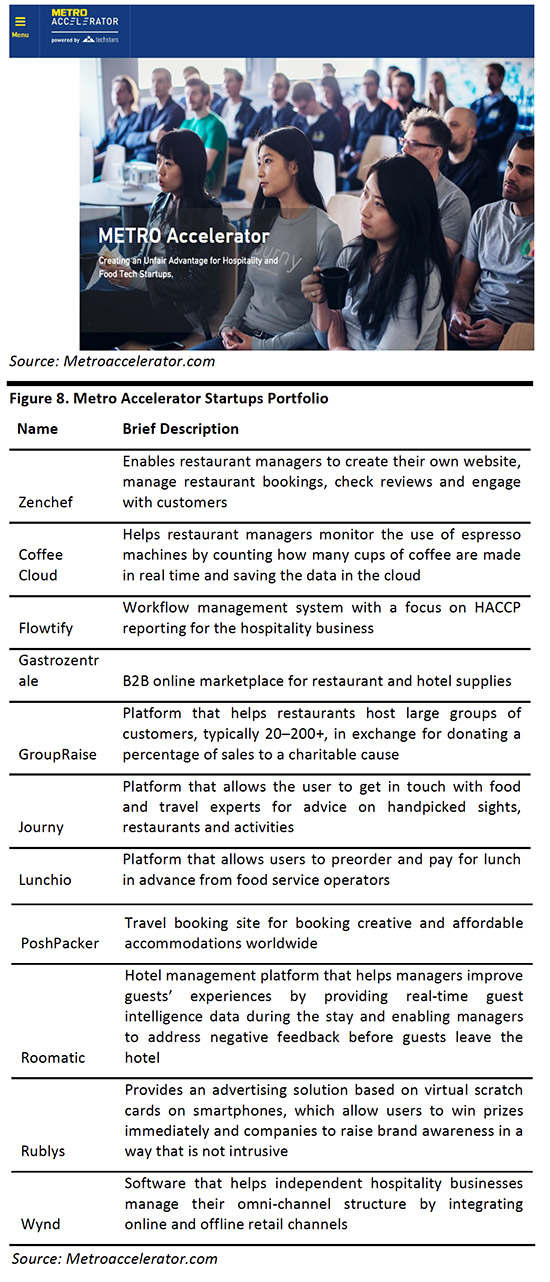

Metro GROUP: CULTIVATING Startups is a Strategy FOR GROWTH

The potential of new business solutions emerging from startups is so significant that German retailer and wholesaler Metro Group is actually cultivating a portfolio of food service startups. The initiative aims to find innovative ways to help Metro Group clients—independent restaurants and hotels, in particular—gain a competitive edge in the hospitality industry.

Metro Group started investing in startups by acquiring a 15% stake in Emmas Enkel in December 2014. Similar to Instacart, Emmas Enkel is a B2C delivery business that shops for groceries, household goods and restaurant meals in local outlets and then delivers them to customers.

In October 2015, Metro Group launched the Techstars Metro Accelerator program in partnership with US startup accelerator Techstars. Metro Group describes the initiative as the world’s first hospitality and food tech accelerator. Its goal is to create “an unfair advantage for hospitality and food tech startups.”

While the accelerator is part of Metro Group’s strategy to find innovative ways to help its clients run their businesses more efficiently, we think the company could also draw on the participating startups as a source of solutions for its retailing operations (which include consumer electronics retailer Saturn and the Real hypermarket chain). In particular, we think the startups might help Metro Group find innovative ways to gain competitive edge in the fulfillment of online orders.

IS Food Retailing LEARNING FROM FOOD SERVICE?

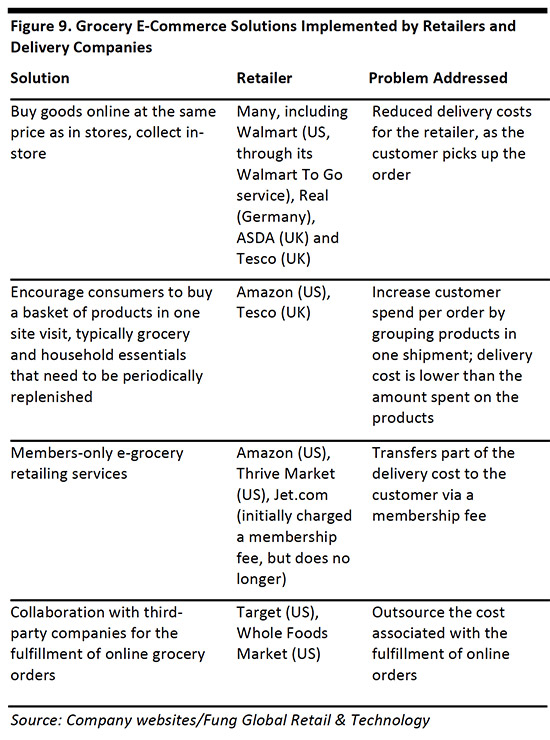

Some grocery retailers have similarly cooperated with third-party service startups. But while food service companies often use intermediaries to consolidate the front end, grocery retailers often collaborate with digital grocery order and delivery startups to reduce fulfillment costs and give customers more options when shopping online.

Internet-based delivery service Instacart works with a number of grocery retailers in the US to provide same-day delivery of grocery orders processed online. Instacart was founded in 2012 in San Francisco, and initially was a C2C platform that enabled private service providers to pick up groceries from stores for customers for an added markup. As the business developed, Instacart set up relationships with retailers directly. The retailers share their existing markups with the deliverer, enabling Instacart users to pay the same prices that they would find in a store.

Large retailers that Instacart works with include Whole Foods Market and Target. Instacart started to provide delivery services to Whole Foods customers in September 2014. By March 2016, the service was offered in 17 metropolitan areas across the US, and the two companies are planning to extend it to other areas. Target announced its collaboration with Instacart in September 2015. At the time of writing, the service is available only to customers in Minneapolis, Target’s hometown, but the company has plans to expand it to other geographies.

Other order and delivery app providers have collaborated with retailers to fulfill online grocery orders, too. In June 2016, Walmart announced that it will begin testing grocery delivery with ridesharing companies Uber and Lyft, after having tested delivery for Sam’s Club orders using Deliv—a delivery tech startup—beginning in March 2016. Through this service, Walmart’s customers place their order online and select a delivery window. Walmart associates prepare the order and call an Uber or Lyft driver to make the delivery. The customer pays Walmart the regular delivery charge online, and makes no payment to the driver. In a press release, Walmart stated that the collaboration with Uber and Lyft is part of its effort to make online grocery shopping easier for its customers.

KEY TAKEAWAYS

Much remains to be done to confront the economic challenges of e-grocery retailing and encourage the rapid growth of grocery e-commerce. The research retailers are undertaking will likely spur progress in logistics and digital technology, transforming the industry according to the 1-5-10 scenario. The key transforming factors for retailers will be lowering the cost of delivery as a proportion of sales revenue, increasing speed of delivery and providing a seamless e-grocery shopping experience.

The dynamism of the digital startup world is helping companies in food service and grocery retail expand their businesses. Uber-style intermediary solutions are promising, and likely to bring further developments in the near future. Cooperating with third-party startups will likely reduce fulfillment costs for grocery retailers and bring greater convenience to customers.

However, it is important to acknowledge that there is a major difference between the food service and grocery retail sectors: namely, the former tends to be much more fragmented than the latter. Independent companies continue to be strongly represented in food service, while food retail has been consolidated by major chains building scale, especially in mature markets. This inevitably means the value that Uber-style startups can bring to retail differs from the value they can bring to food service. The consolidating effect that these startups have on the front end of food service cannot be transferred to grocery retail: it is these innovators’ more cost-effective approach to offering services that will be most valuable to retailers as they attempt to compete more aggressively online.