DEEP DIVE: Mobile Payments In China

KEY POINTS

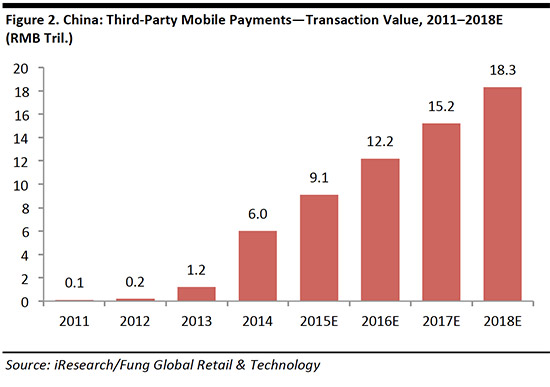

- The Chinese mobile payment market has grown rapidly and will reach ¥12.2 trillion (US$1.83 trillion) in 2016, up from ¥0.2 trillion (US$31.7 million) in 2012, according to iResearch.

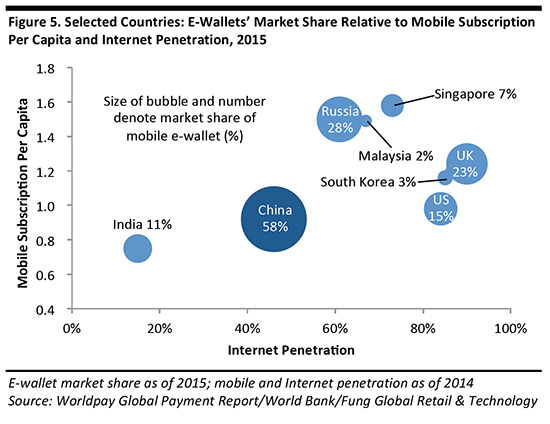

- E-wallets account for a 58% share of the mobile payment market in China—the highest percentage globally—indicating that mobile payments are an integral part of the Chinese shopping experience. In the US, the figure is just 15% and in the UK, it is 23%.

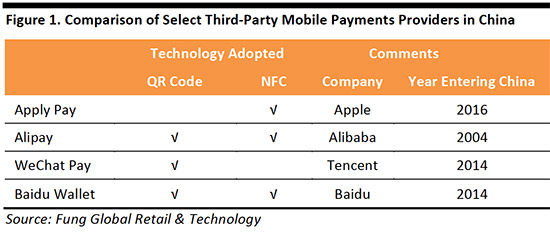

- Mobile payment systems based on NFC and QR code technologies are most common in China.

- New regulations and improved security will provide more clarity on the evolving mobile payment industry in China.

- Retailers in China need to optimize their mobile payment strategies in order to increase sales and customer retention.

EXECUTIVE SUMMARY

Mobile payments refer to payment processes performed via mobile devices. In this report, we focus our discussion on two mobile payments technologies that are most commonly used in China: near-field communication (NFC) and QR code.

Mobile payments have the highest market share in China compared to its global counterparts and the market will continue to grow in tandem with the popularity of retail e-commerce—likely even faster. China’s mobile payments transaction value is estimated to reach ¥12.2 trillion (US$1.83 trillion) in 2016, up from ¥0.2 trillion (US$31.7 million) in 2012, according to iResearch, a Chinese Internet data provider. The high adoption rate of mobile payments in China is mainly attributable to:

- The ubiquity of mobile Internet,

- Evolving consumer preferences, and

- Advanced infrastructure.

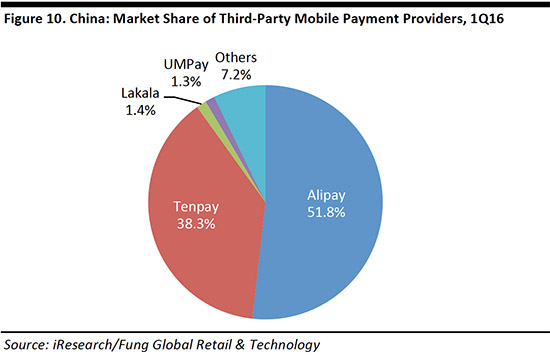

China’s third-party mobile payment industry is highly concentrated, with Alipay and Tenpay comprising 90% of the market in the first quarter of 2016. Traditional payment networks such as MasterCard and UnionPay are actively participating in mobile payments to avoid being disintermediated.

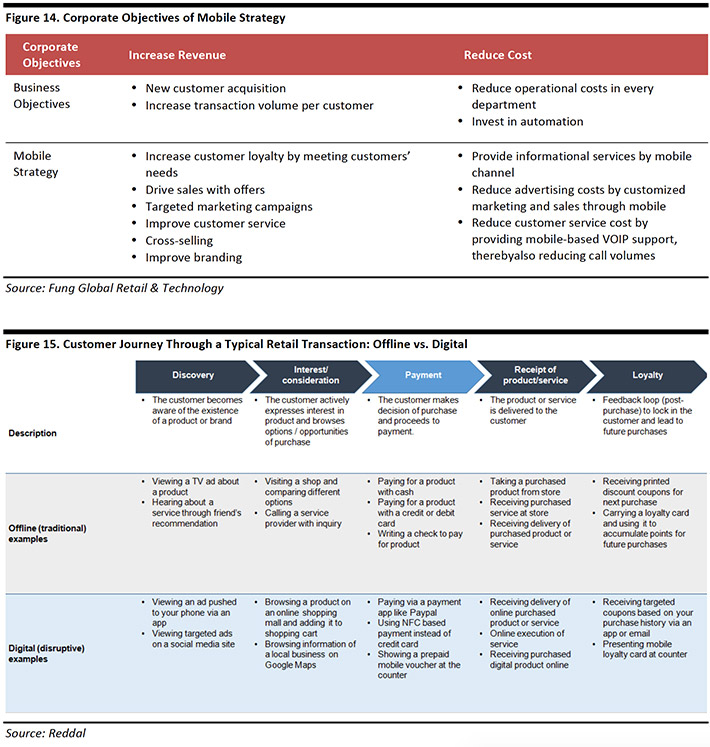

Mobile payments have become an extremely useful tool for retailers to optimize their strategy for the Chinese market. Mobile payments have evolved from being a simple transaction utility to a means of increasing sales, leveraging data, enhancing customer engagement and brand marketing.

In determining the feasibility of mobile payment alternatives, retailers should examine the different systems’ technology, fee structure and user base, among other factors.

INTRODUCING MOBILE PAYMENTS

Mobile payments are typically defined as payment processes performed via mobile devices; these payments eliminate the need for physical credit card payment infrastructure. In this report, we focus on the two mobile payment technologies that are most commonly used in China: near-field communication (NFC) and QR code. We note that there is some overlap, as certain popular payment methods use both technologies.

Popular payment services that rely on NFC technology include PayPal, Apple Pay, Huawei Pay and Samsung Pay. QR-based payment services include WeChat Pay, Alipay and Baidu Wallet, while their NFC technology is not widely adopted. To pay for an item that has a QR code, the customer scans a bar code that contains information—such as a webpage with product or order information provided by the vendor—and is then redirected to a payment page in his or her smartphone’s browser to complete the transaction.

DEFINING E-WALLETS

E-wallets (also known as mobile wallets or digital wallets) are used to initiate mobile payments, and may be supported by either NFC or QR technology. An e-wallet enables users to store their credit card information, such as number, and expiration date, in a mobile app instead of on a plastic card with a chip or magnetic stripe. Users can then make purchases through the app. E-wallets are considered more convenient, as they provide a better user interface and can store coupons and loyalty card information.

E-wallets (also known as mobile wallets or digital wallets) are used to initiate mobile payments, and may be supported by either NFC or QR technology. An e-wallet enables users to store their credit card information, such as number, and expiration date, in a mobile app instead of on a plastic card with a chip or magnetic stripe. Users can then make purchases through the app. E-wallets are considered more convenient, as they provide a better user interface and can store coupons and loyalty card information.

MOBILE PAYMENT INCREASINGLY IMPORTANT FOR RETAILERS IN CHINA

Mobile payments have become increasingly popular in many European countries, as we discussed in our July 2016 report Mobile Payments: Supporting Europe’s Move to a Cashless Society. We initially explored the Chinese mobile payment industry in our September 2015 report The Changing Face of Mobile Payments. In this report, we provide an overview of the Chinese mobile payment ecosystem, with a focus on:

- The latest industry dynamics

- Key players and business models, supplemented by case studies

- Challenges and future opportunities

- Practical advice for international retailers that are preparing to enter the Chinese mobile payments market

As mobile payments move from being merely another means of payment to a tool for increasing customer loyalty and brand marketing, those retailers that provide mobile payment options will be more relevant to customers. In China, e-wallets’ share of the mobile payment market is the highest globally, although other developed markets have higher penetration levels for both mobile subscriptions and Internet usage. In China, it is crucial for merchants to optimize the mobile payment experience in order to reach a critical mass of domestic shoppers.

CHINA’S MOBILE PAYMENT MARKET SIZE

China’s mobile payment market is the largest in the world in terms of absolute size and growth potential. According to iResearch, a Chinese Internet data provider, the Chinese mobile payment market is estimated to reach ¥12.2 trillion (US$1.83 trillion) in 2016, up from ¥0.2 trillion (US$31.7 million) in 2012.

The third-party mobile payment market in China is concentrated, with the two largest players—Alipay (owned by Alibaba) and Tenpay (owned by Tencent) accounting for a combined 90% share.

DRIVERS OF MOBILE PAYMENT ADOPTION IN CHINA

E-wallets account for 58% of the mobile payment market in China, which is the highest percentage globally. In the US, e-wallets account for just 15% of the market and in the UK, they account for 23%, according to Worldpay’s Global Payment Report. The high rate of mobile payment transactions in China is mainly due to a confluence of three factors, which will continue to drive the trend going forward:

- Ubiquity of mobile Internet

- Evolving consumer preferences

- Advanced infrastructure and widespread merchant adoption

Ubiquity of Mobile Internet

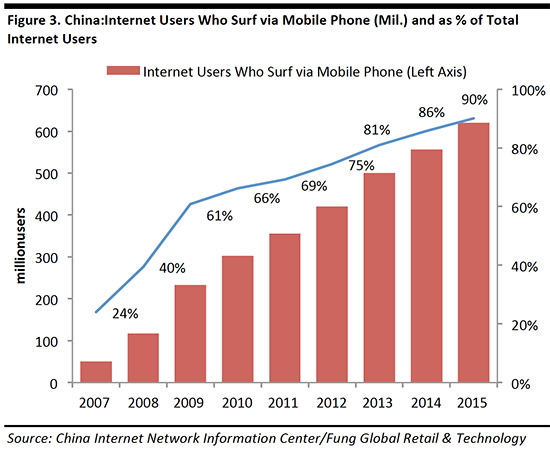

Chinese Internet users typically use their mobile phones to surf the web, which we think provides fertile ground for mobile payment adoption and explains why e-wallets account for such a high share of mobile payments in China. China’s mobile Internet users totaled 620 million in 2015, representing 90% of the country’s total Internet users and more than double the number from just five years earlier, according to China Internet Network Information Center.

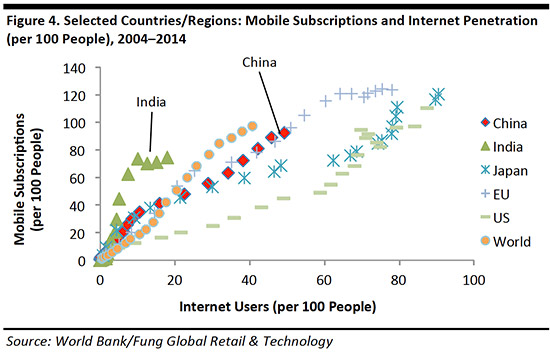

We believe that rising mobile subscription and Internet penetration in China, coupled with Chinese consumers’ propensity to shop on their mobile devices, is conducive to higher adoption of e-wallets. Mobile subscription and Internet penetration have increased rapidly in China in the last decade. Between 2004 and 2014, the mobile subscription rate in China rose from 26 per 100 people to 92 per 100 people, according to the World Bank. By comparison, the mobile-subscription-per-capita rate is 0.98 in the US and 1.25 in the UK; the world average is 0.97.

Similarly, Internet penetration in China almost doubled between 2004 and 2014: in 2004, only 25.6 out of every 100 people had access to the Internet in China, but by 2014, the figure was 49.3 out of every 100. The Internet penetration rate is 87.4% in the US and 91.6% in the UK, while the world average is 40.7%. So, despite rapid increases in mobile subscriptions and Internet penetration in China, we see further room for growth in both metrics, as the country’s rates remain below those of its global peers.

Evolving Consumer Preferences

Mobile subscriptions and Internet penetration alone do not explain e-wallets’ disproportionately high share of mobile payments in China; customer adoption of e-wallets is also critical. E-commerce is increasingly integrated into the daily lives of Chinese consumers, and online-to-offline and omni-channel retailing solutions are increasingly popular, making mobile payment the transaction method of choice for many shoppers.

China has the highest incidence of smartphone shopping as a percent of all online shopping in the world, with 68% of those surveyed by PayPal (2014) having purchased via a smartphone in the past 12 months.

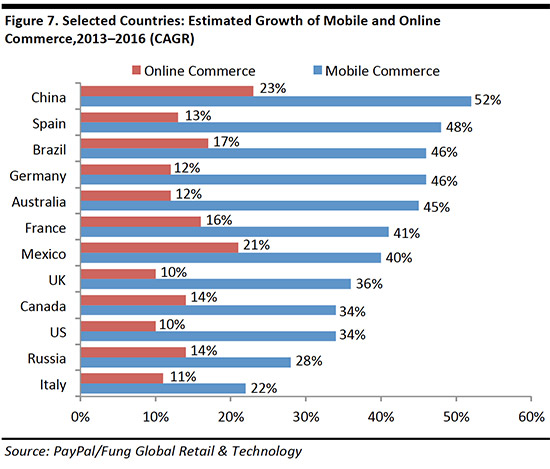

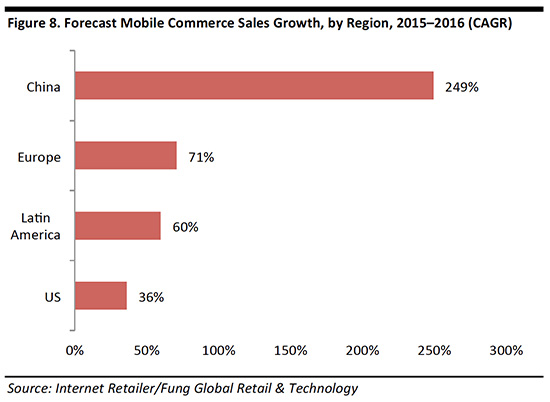

PayPal found that growth in mobile commerce and online commerce are correlated. In fact, mobile commerce growth is expected to exceed that of online commerce across the countries in PayPal’s sample.

China is expected to exhibit strong growth: between 2013 and 2016, mobile commerce is expected to grow at a 52% CAGR and online commerce at a 23% CAGR in the country, according to PayPal.

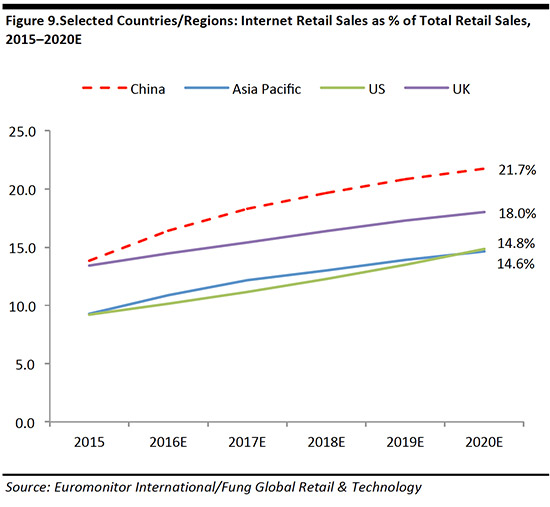

E-commerce represented 16.4% of China’s total retail sales in the first half of 2016, the highest rate globally, according to Euromonitor International. In other major markets, such as the US and the UK, e-commerce accounts for 14%–18% of all retail sales.

Euromonitor expects China’s e-commerce as percentage of all retail sales to rise to 21.7% in 2020.

Advanced Infrastructure and Widespread Merchant Adoption

Mobile payments entered the Chinese market as a more convenient alternative to credit card payments, and their rapid growth is due in part to the country’s weak credit card culture and the wide acceptance of mobile payment technologies by merchants. According to China’s central bank, credit card penetration in the country fell to 0.29 per person at the end of 2015 from 0.34 at the end of 2014.

Mastercard Mobile Payments Readiness Index

The MasterCard Mobile Payments Readiness Index, which measures markets in terms of their preparedness for and receptivity to mobile payments, ranked China 10th globally, and 4th in Asia, behind Singapore (1st), South Korea (4th) and Japan (6th). This was largely due to China’s strong mobile payment infrastructure—as the mobile phone industry and NFC terminalization in China are relatively sophisticated—and its high level of consumer readiness: Chinese consumers are familiar with and willing to use different types of mobile payments.

KEY PLAYERS IN CHINA’S MOBILE PAYMENTS INDUSTRY

The third-party mobile payment industry is concentrated in China. As of the first quarter of 2016, Alipay and Tenpay held a combined market share of 90%.

Key Third-Party Mobile Payment Providers in China

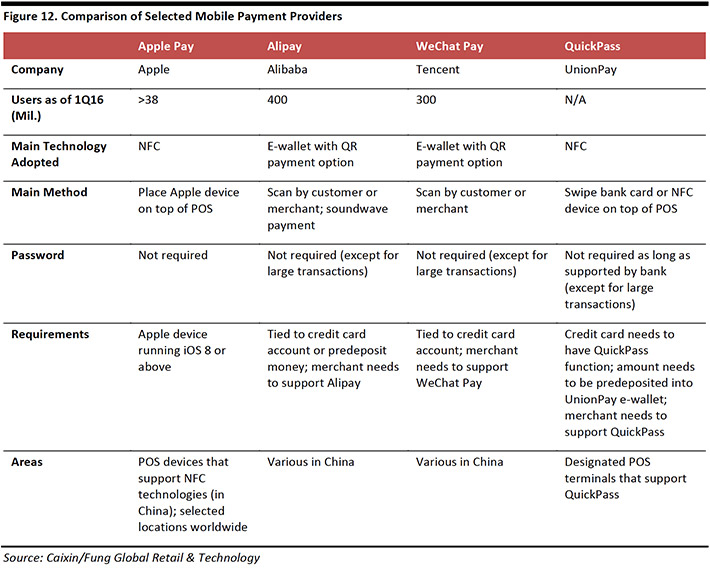

In this section, we highlight the most popular mobile payment methods in China, where the mobile payment ecosystem is dominated by Internet and e-commerce companies Alibaba and Tencent. By contrast, in the US, the key players are payment and technology companies: PayPal, Apple and Google. Major players in China’s mobile payment industry include:

- Apple Pay: an NFC-based mobile payment system developed by Apple that allows people to use their mobile devices to buy goods and services. Users’ accounts are linked to their credit and debit cards, and personal data are encrypted by tokenization technology. Apple Pay was rolled out in China in February 2016.

- Alipay: a QR code payment method that is used on the Taobao and Tmall websites, the most popular online marketplaces in China. Alipay was launched by Alibaba Group in 2004 and has the largest market share in China.

- WeChat Pay: launched by Tencent in 2014, this system relies on QR-code technology, and has been widely adopted in China. Tencent also owns the QQ Wallet and Tenpay systems, but we focus on WeChat Pay here because it has been more widely adopted than the other two services.

- Baidu Wallet: this QR code payment system launched by Baidu in 2014. The service is positioned as the wallet for users of Baidu, the most popular search engine in China. Baidu Wallet users are offered discounts for Baidu’s other services, such as music.

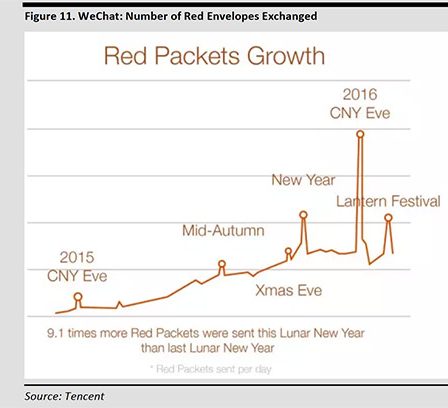

CASE STUDY: THE DIGITIZATION OF TRADITION—VIRTUAL RED ENVELOPES AS AN EFFECTIVE USER-ACQUISITION TOOL

The virtual red envelope is an example of how China’s tech companies took advantage of a cultural tradition to further entrench their presence in the mobile payment industry.

The Challenge

Tech companies often face the challenge of gaining traction with users and merchants simultaneously. They need to incentivize users to bind their payment credentials to their accounts, and at the same time, convince merchants to devote resources to building their platform.

WeChat’s Solution

WeChat launched a peer-to-peer payment feature called Red Envelopes prior to Chinese New Year in 2014. Giving out red envelopes with cash to relatives and friends is a time-honored tradition during Chinese New Year. WeChat deftly used this tradition to get users to adopt mobile payments on its messaging platform.

The results have been staggering. In 2016 (the third year since launch), WeChat delivered 8.08 billion digital red envelopes on Chinese New Year’s Eve (10.6 red envelopes per user). The number of red envelops that were shared, which has developed into a popular peer-to-peer transfer method from merely a Chinese New Year tradition, grew from 1 billion for the full year of 2015, up from 16 million in 2014. WeChat has enjoyed some significant benefits by launching its virtual red envelope feature:

- Unlocking of subsequent transaction activity across WeChat ecosystem: A prerequisite for successful expansion into mobile finance is winning over Chinese users’ digital wallets. As users top up their WeChat accounts to give away red envelopes, they bind their credit card to their accounts, and open themselves up to other payment services on WeChat’s one-stop platform.

- Gamification of Chinese New Year: WeChat users can allocate a sum of money to be distributed among a specified group of friends on a “first come, first served” basis. This feature has proven very popular, as users like to compete to get the most red envelopes; the thrill of competition leads to more and more envelopes being sent.

Reaction from Competitors

WeChat is by far the most popular platform for exchanging virtual red envelopes, but some competitors have introduced their own version of virtual red envelopes in order to increase the profile of their mobile payment platforms. In 2016, Alipay saw 324.5 billion red envelopes exchanged and Baidu Wallet saw 11.2 billion red envelops being exchanged, which contained a total of ¥300 million (about US$45.6 million) between January 28 and February 8.

Participation of Traditional Payment Networks into Mobile Payments in China

As Alipay, WeChat Pay and Apple Pay become increasingly popular in China, traditional payment networks are actively participating in mobile payments to avoid being disintermediated. For example, UnionPay has introduced QuickPass, MasterCard has introduced MasterPass and Visa has introduced Checkout. QuickPass is a contactless payment service that allows users of NFC-enabled smartphones to make payments by waving their devices at UnionPay point-of-sale (POS) terminals. The service was launched in China by state-backed UnionPay in 2015.

KEY CHALLENGES AND OPPORTUNITIES FOR MOBILE PAYMENTS IN CHINA

Will NFC or QR Technology Prevail?

China’s mobile payment industry faces two sources of potential friction as it develops: regulation and security. Given the competing technological standards of NFC and QR, the Chinese government’s regulations are critical. The NFC system is gaining prominence, as Apple, Huawei and Samsung have partnered with UnionPay in China. At the same time, e-wallets such as Alipay and WeChat Wallet utilize QR code payment technology, which many consumers are already familiar with and which is well suited to the current infrastructure in China. We do not expect either system to dominate, but instead to coexist.

CASE STUDY: APPLE PAY FOR NFC

Since its official launch in China in February 2016, Apple Pay has become the new face of NFC payments in the country. The initial response was remarkable: more than 3 million cards were activated on Apple Pay in the first two days it was available.

China’s regulators hold great power in deciding the fate of international technology companies, as was evidenced by Uber’s experience in the country. Uber faced regulatory challenges and eventually sold its Chinese operations to Didi Chuxing. Google and Facebook have both faced censorship in China. However, Apple Pay has partnered with state-backed UnionPay, so we do not expect the service to experience any regulatory difficulties.

Regulation: What Does the Future Hold for Third-Party QR Mobile

Payments in China?

QR code payments have raised security concerns in China, and the government’s policy stance on the technology standard is still unclear. Payment by QR code can expose users to fraud because it takes place in an unsecure environment on the Internet. Viruses embedded in the code can capture personal information and hackers may be able to break into mobile devices to steal account information. Transactions made through QR code systems are also difficult to track because there is inadequate verification of a user’s identity to guard against fraud.

Considering the inherent security risks, China’s regulators banned the use of QR code technology for third-party mobile payments in 2014, stalling the release of virtual credit cards (originally scheduled for the second quarter of 2014) and the use of QR code payments by Alibaba and Tencent.

Though banned officially by the government, QR code payment has nonetheless been widely adopted by consumers and merchants. QR code payment standards, which are drafted by the Payment & Clearing Association of China and authorized by the People’s Bank of China, show the government’s determination in standardizing such payments.

We expect that the draft guidelines will likely offer more clarity on QR code payments, and set the scene for further growth of the technology.

Where Are We Headed? Identifying Future Growth Opportunity in the Chinese Mobile Payment Market

iResearch data indicate that China’s third-party mobile payment transaction value reached ¥6.2 trillion (US$942 million) in the first quarter of 2016 and that it will reach ¥18.3 trillion (around US$2.8 trillion) by 2018. China’s mobile payment transactions in the first quarter grew by 33% quarter over quarter and by 202% year over year.

China’s demographic shift to a two-speed economy—characterized by an increase in the number of affluent households, a new generation of sophisticated consumers and increased e-commerce—will likely drive incremental consumption growth and, hence, mobile payment growth.

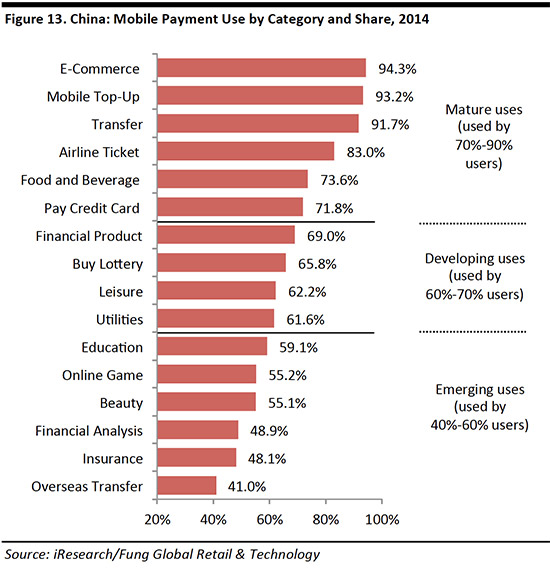

According to iResearch, Chinese consumers choose to pay by mobile payments most frequently for:

- Online shopping (mobile payments are used for 94% of all transactions)

- Recharging prepaid cards (93%)

- Payment transfer (92%)

- Travel (83%)

We see the most scope for growth in transaction categories that currently account for the lowest share of mobile payments:

- Cross-border transfer (mobile payments are used for only 41% of all transactions)

- Insurance purchase (48%)

- Financial analysis (49%)

IMPLICATIONS: WHAT DOES THIS MEAN FOR RETAILERS TARGETING CHINESE CONSUMERS?

Mobile payments have become an extremely useful tool for retailers to optimize their strategy for the Chinese market. But as technology advances, how customers interact with and pay merchants will continue to evolve. Merchants have long regarded mobile payments as a simple transaction utility. Their attitude has now changed, and they are seeing mobile payments as a means of increasing sales, leveraging data and enhancing customer engagement.

A 2015 survey on digital commerce by PwC found that mobile payment providers need to focus on four extra factors in order to capture the opportunities:

- Improving customer engagement and loyalty: use marketing, such as customer loyalty programs and personalized offers, to drive higher sales

- Developing better understanding of customer data: use data analysis to gain better insight into customer spending behavior, which can then be used to optimize inventory management

- Integrating data among channels more effectively

- Ensuring high levels of security

These four factors are increasingly intertwined with online-to-offline models. Sesame Credit and Yu’eBao, both from Alibaba’s Ant Financial division, are examples of value-added services developed by payment providers to enhance the customer experience. Sesame Credit leverages big data technology to calculate individuals’ credit scores based on factors such as past financial information. The system is expected to simplify the loan extension procedure and will be mandatory beginning in 2020. Yu’eBao offers money market funds to its investors with substantially higher interest rates than banks. The funds are mostly short-term loans from the highest-rated institutions, to minimize risk.

Which Mobile Payment Solution Should Retailers Choose?

NFC-based and QR code payment methods are the most viable options for retailers and will likely be embraced by consumers. In our view, retailers should consider the following factors when deciding which mobile payment method to adopt:

- Is the method platform dependent? China’s smartphone sales are increasingly skewed toward Android, which may imply bias for platform-agnostic mobile payment methods over Apple Pay. According to Kantar WorldpanelComTech, iPhone sales accounted for only 18% of total smartphone sales in China during the second quarter of 2016.

- What are the fees levied by different mobile payment methods? Third-party mobile payments typically bypass settlement by the acquiring bank. Consequently, retailers are likely to enjoy lower transaction fees with these methods.

- Does the method have a vast user base? Alipay and WeChat Pay, as affiliates of China’s e-commerce giants, have inherited a large number of users from the cross-selling of services, which is a positive for retailers. Alipay is the payment method for Alibaba’s Tmall and Taobao websites and, so, has gained significant customer traction. Similarly, users of WeChat, China’s most popular social app, have been encouraged to bind their credit cards to their accounts.

The security of e-wallets is improving as technologies advance and as regulations are put in place, thus reducing the threat for retailers.

CONLCUSION

In China, mobile payments have a higher market share than they do in any other country, and the market will continue to grow in tandem with the popularity of retail e-commerce—likely even faster.

NFC-based and QR code mobile payments are most commonly used by Chinese consumers, and we expect new government regulations will offer more clarity to the outlook of the mobile payment environment in China.

Retailers in China will need to optimize their mobile payment strategy and leverage mobile payments to increase sales and customer loyalty. In determining the feasibility of mobile payment alternatives, retailers should examine the different systems’ technology, fee structure and user base, among other factors.