US Holiday 2016 Review: Disappointing Results to Drive Retail Reorganization in 2017

KEY POINTS

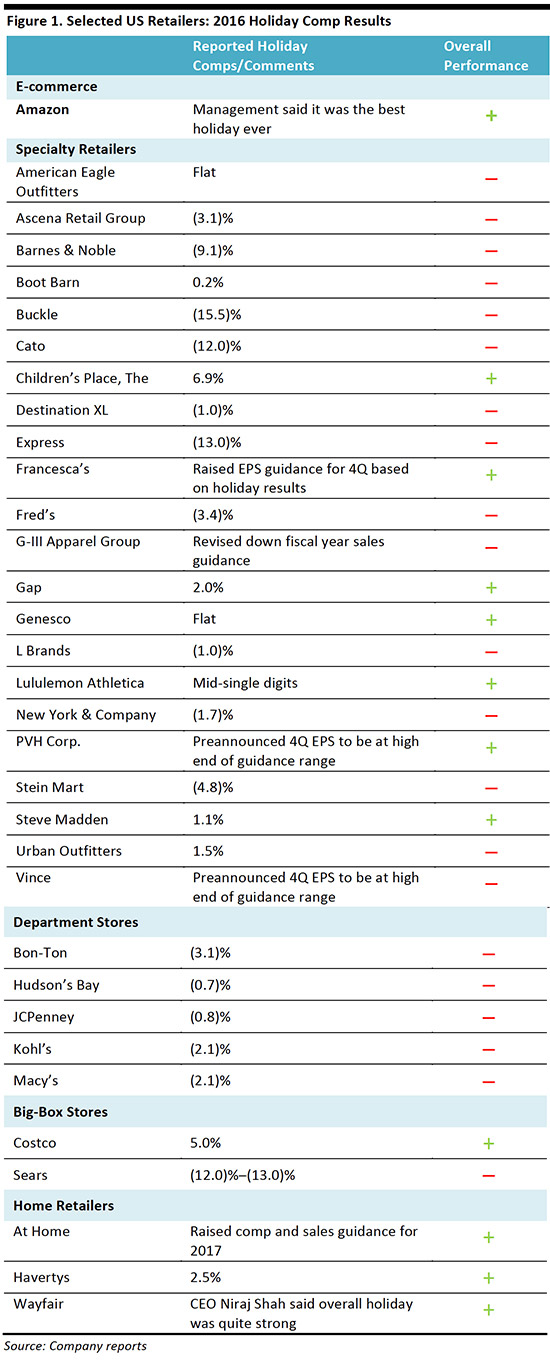

- The majority (66%) of the 32 companies we tracked that have provided holiday updates have either reported declines in holiday comps or noted that they had a worse-than-expected holiday season in 2016.

- Weak store traffic, heavy promotions across categories and sales volatility throughout the season were the common challenges mentioned by retailers.

- A few retailers had a positive holiday, including Amazon, The Children’s Place, Francesca’s, Gap, Lululemon Athletica, PVH and Steve Madden. Many of these companies updated their outlook based on positive holiday results. In addition, Costco’s December results were better than expected, and the company saw positive traffic trends.

- While the results reported so far do not paint an optimistic picture for 2017, it is important to note that many big retailers have yet to release their holiday figures. Some of them could post positive results, which would somewhat alter the current outlook for 2017.

- That said, disappointing holiday results for many department stores and specialty retailers—against a favorable macro backdrop and positive weather trends—point to structural challenges in retail, which suggests a difficult 2017.

US Holiday 2016 Results Recap

The majority (66%) of the 32 companies we tracked that have provided holiday results have either reported declines in holiday comps or noted that they had a worse-than-expected holiday season in 2016. Weak store traffic, heavy promotions across categories and sales volatility throughout the season were the common challenges mentioned by retailers.

A few retailers had a positive holiday, including Amazon, The Children’s Place, Francesca’s, Gap, Lululemon Athletica, PVH and Steve Madden. Many of these companies updated their outlook based on positive holiday results. In addition, Costco’s December results were better than expected, and the company saw positive traffic trends.

While the reported results do not paint an optimistic picture for 2017, it is important to note that many big retailers have yet to release their holiday figures. Some of them could post positive results, which would somewhat alter the current outlook for 2017. That said, disappointing holiday results for many department stores and specialty retailers—against a favorable macro backdrop and positive weather trends—point to structural challenges in retail, which suggests a difficult 2017.

Department Stores and Teen Retailers Led the Sales Declines

All five of the department stores we tracked—Bon-Ton, Hudson’s Bay, JCPenney, Kohl’s and Macy’s—reported disappointing holiday results. Macy’s made headlines with a 2.1% comp decline and its announcement of a major restructuring plan. JCPenney reported a 0.8% comp decline for November and December, missing analysts’ expectations of 3.0% growth. Teen retailer American Eagle Outfitters reported flat comps to date for 4Q. The figure was at the lower end of its guidance range and missed analysts’ expectations. The company’s management described the holiday season as “choppy and promotional.” Buckle reported a 16.2% decline in November comps and a 15.5% decline in December comps.

Weak Store Traffic Led to More Unplanned Promotions

The majority of retailers that reported disappointing holiday results identified weak store traffic as one of the primary reasons for their performance. The weaker-than-expected traffic forced some retailers to increase promotions in order to boost demand. New York & Company noted that soft traffic caused it to increase markdowns, but that this will ensure the company has a better inventory position in the spring. Urban Outfitters also said that weaker traffic, and the resultant weaker sales, required it to offer more promotions to boost demand. Ascena Retail Group noted that soft store traffic forced it to move into a more promotional stance in order to move through holiday inventory and G-III Apparel Group said its margin was adversely impacted by higher-than planned promotional activities. Mall-based retailers such as American Eagle Outfitters, Bon-Ton and Express pointed out that mall traffic was also weak.

Positive Store Traffic Consistent with Positive Sales Results

Retailers that reported positive traffic trends also reported strong holiday results. Costco’s US store traffic was up 3%, which contributed to a 5% year-over-year comp increase that beat the consensus estimate. Lululemon Athletica also reported a strong holiday season in-store, consistent with its positive traffic trends.

Retailers Experienced Sales Volatility Throughout the Holiday Season

Retailers saw sales volatility throughout the season, with strong sales during Thanksgiving weekend followed by softer demand in certain other parts of the holiday period. Kohl’s experienced strong sales on Black Friday and during the week before Christmas, but saw soft demand in early November and December. Vince and American Eagle Outfitters experienced a solid Thanksgiving weekend, but the strength was not enough to offset weaker sales throughout the rest of the season. Bon-Ton reported an improved Thanksgiving–December period after seeing challenging sales in the first three weeks of November. Boot Barn experienced a soft November, but saw a 2.3% comp increase in December, which helped the company achieve positive comps for the holiday season overall.

E-Commerce Was a Bright Spot for Retailers Across the Board

A majority of retailers highlighted strong performance in the digital channel regardless of their overall results. Urban Outfitters noted a “larger-than-expected” shift in channel demand, with double-digit sales growth from its retail e-commerce sites offset by lower-than-expected store comps. Express and Boot Barn both noted that they were pleased with their growth momentum in the digital channel.

Despite weak overall performance, department stores, too, experienced strong e-commerce growth. Macy’s, Bon-Ton and JCPenney all recorded double-digit e-commerce growth. JCPenney attributed its strong e-commerce sales to its successful omnichannel strategy, which includes offering flexible shipping options, improving site functionality and expanding its e-commerce assortment. Hudson’s Bay posted a 14.7% increase in e-commerce sales and a 21.7% increase excluding Gilt, while its overall comp store sales were down 0.7%.

The Brightest of the Bright Was Amazon

Amazon was the biggest winner of the holiday season. Management noted that 2016 was “the best ever” holiday for the company. In particular, Amazon sold millions of Alexa devices, and Alexa category sales were nine times higher than in the 2015 holiday season. The Alexa-powered Echo and Echo Dot were the best-selling products across Amazon this year.

Home and Beauty Outperform

Many home retailers posted positive results. Wayfair CEO Niraj Shah said the holiday was “quite strong” for the company. Home décor retailer At Home raised its fiscal-fourth-quarter comp guidance to 4.5%–5.5% from 3.0%–4.7% previously. Furniture company Harvertys reported 2.5% growth for the fourth quarter and noted particularly strong performance during the Thanksgiving weekend.

Home categories were strong at the department stores and big-box retailers, as well. Macy’s mentioned that furniture and bedding sales were strong, while Kohl’s highlighted home as one of its strongest-performing categories. JCPenney saw strength in appliances over Thanksgiving weekend and the rest of the holiday period, and Sears saw continued improvement in its home services business.

Beauty was another strong category over the holiday season, and a number of retailers named beauty as among their better-performing categories. JCPenney mentioned strong performance at its Sephora stores. L Brands reported that its beauty business, Bath & Body Works, saw 3% comp growth in December, outperforming the overall business, which saw a 1% comp decline.

Winter Categories Were Strong Despite Overall Weakness in Apparel

Macy’s saw particular strength in active and cold-weather merchandise over the holiday sales period. Kohl’s and JCPenney both noted that outerwear performed strongly, and Boot Barn achieved positive comps for the holiday.

More Store Closures Expected in 2017 After a Disappointing Holiday

Following disappointing holiday sales results, many retailers announced major store closure plans. Macy’s announced a new restructuring plan that includes closing 68 stores. Sears announced the closure of 150 unprofitable stores and said that it expects sales to be down 12%–13%. At an event following the announcement of JCPenney’s holiday results, the company’s CEO said that JCPenney’s fleet of 1,014 stores is too large. We think that 2017 will bring more store closures than in recent years as retailers work to address the structural challenges the sector faces.