US 2017 Holiday Homestretch: Retail Recap and Predictions for the Season’s Biggest Week

KEY POINTS

In this report, we take stock of the US 2017 holiday season thus far, providing an update on macroeconomic conditions, Black Friday weekend retail sales, holiday traffic, promotions and the weather. We also share our retail predictions for the rest of the holiday season’s biggest week.

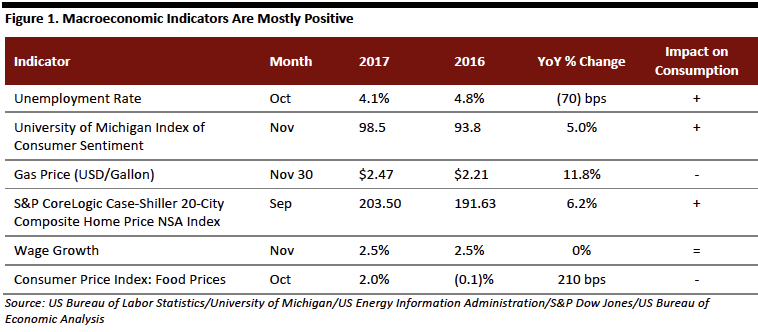

- The US macroeconomic environment is mostly positive, favoring consumer spending.

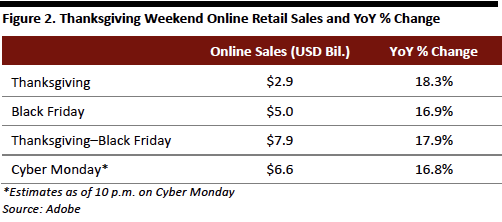

- Total retail spending over the Black Friday–Cyber Monday weekend was strong and online sales over the weekend grew by 17.9% year over year.

- Consumers are shopping more on mobile devices and mobile sales hit record highs on Black Friday, representing 46% of retail revenues that day.

- Consumers are researching online before shopping in stores. Some 60% of shoppers surveyed said they are motivated by promotions, and holiday promotions have been in line with those offered last year.

- For the holiday homestretch, we predict that retail sales growth will hit our earlier forecast of 3%–4%, that the biggest in-store sales and traffic days will be December 23 and 24, that retailers will have multiple opportunities to connect online with consumers and that shipping will be a wild card.

Introduction

There is less than one week left in the official 2017 holiday shopping season. In this report, we take stock of the season so far in the US and predict how the rest of the pre-Christmas week will shape up. We look at macroeconomic conditions, Black Friday holiday weekend spending, promotional levels, store traffic, the holiday calendar, weather and shipping days in the sections below. Overall, US retail has seen a positive progression over the holiday season this year, which bodes well for the rest of this week.

Favorable Macro Backdrop for Spending

The US macroeconomic environment is generally positive. The unemployment rate is the lowest that it has been in 17 years, at 4.1%. Consumer sentiment is positive, wage growth has remained healthy and gas prices are moderate, at $2.47 per gallon at the end of November, compared with $3.50 per gallon three years ago. In addition, consumers’ homes are more valuable, creating a “wealth effect” that makes consumers more comfortable spending on other things. Taken together, US macro indicators are much more positive than negative with regard to consumer spending.

Black Friday Weekend Kicked Off the Season with Strong Retail Sales; We Remain Optimistic that Holiday Sales Growth Will Hit 3%–4%

Black Friday Weekend Kicked Off the Season with Strong Retail Sales; We Remain Optimistic that Holiday Sales Growth Will Hit 3%–4%

In the US, Black Friday weekend is the unofficial start to the holiday season, and consumers showed confidence with their wallets over that weekend, setting spending records and exceeding industry expectations from Thanksgiving Day through Cyber Monday, particularly online. According to Adobe, shoppers spent $2.9 billion online on Thanksgiving Day versus an expected $2.8 billion; online sales that day were up 18.3% from 2016. On Black Friday, consumers spent $5.0 billion online, up 16.9% year over year, and on Cyber Monday, online sales totaled $6.59 billion, up 16.8% from 2016, according to Adobe.

Given the strong Black Friday weekend and the favorable macroeconomic backdrop, we are optimistic that retail sales will hit our previous growth forecast of 3%–4% over the holiday season. That would equate to retail sales of $679–$681 billion for November and December. Holiday sales’ five-year growth average has been 3.5%, according to the US Census Bureau.

Mobile Commerce Drove Spending on Black Friday, Representing 46% of Revenue

Consumers are spending more via their mobile devices than ever before. According to Adobe, mobile sales hit record highs over the Black Friday weekend, with mobile driving 46% of revenue on Black Friday alone, up 36% from 2016.

Adobe stated that mobile devices accounted for 61.1% of visits to online retail sites on Black Friday in 2017 versus 56% in 2016. Apparel and accessories accounted for the most sales that day, followed by electronics. Mobile also set a new record on Cyber Monday, representing 47.4% of visits to retail sites (split out as 39.9% from smartphones and 7.6% from tablets) and 33.1% of retail revenue (24.1% from smartphones and 9.0% from tablets). On Cyber Monday, sales made via smartphones accounted for $1.59 billion in revenue.

Traffic Has Been Higher than Expected and Many Shoppers Are Researching First, Then Shopping in Stores

Traffic Has Been Higher than Expected and Many Shoppers Are Researching First, Then Shopping in Stores

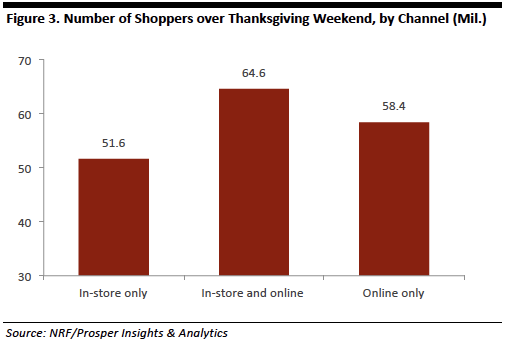

Consumers are choosing to shop both in-store and online this holiday season. Nearly three out of four Americans shopped either online or in stores over the Thanksgiving–Cyber Monday holiday weekend. According to the National Retail Federation (NRF), nearly 174 million consumers shopped over the weekend, exceeding the NRF’s original estimate of 164 million. According to ShopperTrak’s official data, store traffic on Black Friday declined by 1% year over year, while the two-day Thanksgiving–Black Friday period saw a 1.6% decline in traffic.

According to the NRF, department stores were the top retail destination over the Black Friday weekend. In a survey conducted by Prosper Insights & Analytics on behalf of the NRF, 43% of respondents indicated that they planned to shop at a department store over the long weekend. Online retailers were the next-most-popular destination, cited by 42% of survey respondents, followed by electronics stores (cited by 32%), and clothing and accessories stores (cited by 31%). Some 60% of holiday shoppers surveyed said that their purchases were driven by sales.

According to the NRF, department stores were the top retail destination over the Black Friday weekend. In a survey conducted by Prosper Insights & Analytics on behalf of the NRF, 43% of respondents indicated that they planned to shop at a department store over the long weekend. Online retailers were the next-most-popular destination, cited by 42% of survey respondents, followed by electronics stores (cited by 32%), and clothing and accessories stores (cited by 31%). Some 60% of holiday shoppers surveyed said that their purchases were driven by sales.

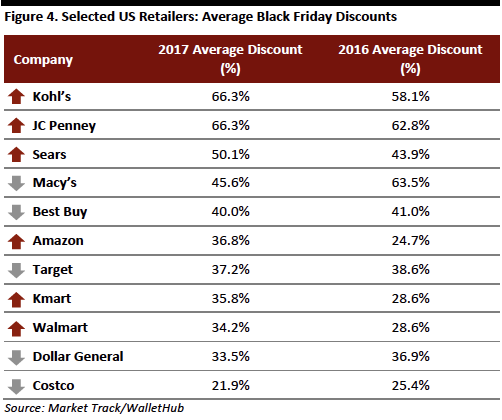

Promotional Activity Comparable to Last Year, While Inventory Levels Have Improved

Over the Black Friday weekend, promotions and prices were generally comparable to those offered over the same weekend in 2016. According to research firm Market Track, the average discount offered by brick-and-mortar retailers in their Black Friday circulars was 44%, down from 45% in 2016. The average discount at Best Buy was 40%, compared with 41% last year. JCPenney’s average discount was 66%, up from 63% last year. Macy’s, Target and Costco all offered lower average Black Friday discounts than they did last year.

The FGRT team visited 33 stores on Black Friday throughout the US and the UK, and assessed those retailers’ overall store activity, including promotions and inventory levels. Although discounting is generally prevalent and aggressive during the holiday season, we found that promotions were mostly in alignment with the same period last year, which we attribute to better inventory control and increased consumer spending. We noticed that inventory levels had improved year over year at many of the stores we visited. Most stores we checked, including Walmart, Best Buy, Target, Costco, American Eagle Outfitters and Nike, were well prepared for holiday shoppers and had stacks of items available for purchase.

The FGRT team visited 33 stores on Black Friday throughout the US and the UK, and assessed those retailers’ overall store activity, including promotions and inventory levels. Although discounting is generally prevalent and aggressive during the holiday season, we found that promotions were mostly in alignment with the same period last year, which we attribute to better inventory control and increased consumer spending. We noticed that inventory levels had improved year over year at many of the stores we visited. Most stores we checked, including Walmart, Best Buy, Target, Costco, American Eagle Outfitters and Nike, were well prepared for holiday shoppers and had stacks of items available for purchase.

Biggest Holiday Shopping Days and Shipping Days: What to Expect the Rest of the Week

Analytics firm RetailNext predicts that Friday, December 22, will be the busiest shopping day of the season in terms of both sales and in-store traffic. The table below shows RetailNext’s forecast of the five biggest shopping days of the holiday season, and we note that three of them are yet to come this week: Friday, December 22; Saturday, December 23; and Thursday, December 21.

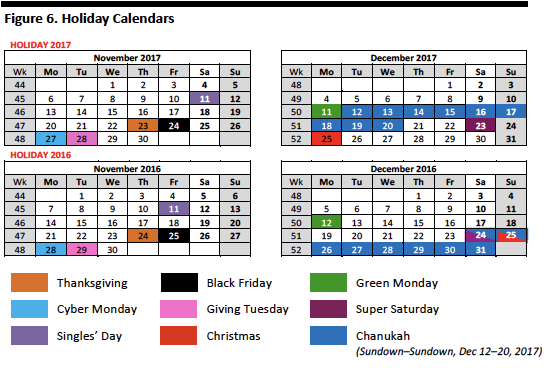

With Christmas Day falling on a Monday this year, we expect to see even more in-store shoppers than usual over the final weekend before Christmas. Also, there is one more shopping day between Thanksgiving and Christmas this year, with 31 days between the two holidays versus 30 days last year.

With Christmas Day falling on a Monday this year, we expect to see even more in-store shoppers than usual over the final weekend before Christmas. Also, there is one more shopping day between Thanksgiving and Christmas this year, with 31 days between the two holidays versus 30 days last year.

Friday, December 15, was designated as “Free Shipping Day” by retailers, and thousands of online stores participated in the event, guaranteeing that packages ordered by that day would be delivered for free by Christmas Eve. Consumers and retailers are now working with major shipping providers to get packages to their destinations on time with priority, two-day or same-day shipping. Some major retailers and shipping providers are offering shipping up to Christmas Day.

Friday, December 15, was designated as “Free Shipping Day” by retailers, and thousands of online stores participated in the event, guaranteeing that packages ordered by that day would be delivered for free by Christmas Eve. Consumers and retailers are now working with major shipping providers to get packages to their destinations on time with priority, two-day or same-day shipping. Some major retailers and shipping providers are offering shipping up to Christmas Day.

According to UPS, deliveries between Black Friday and New Year’s Eve are projected to increase by 5% from 2016. The company reported that it plans to deliver more than 750 million packages globally in the 25 days between Thanksgiving and New Year’s Eve. UPS hired 95,000 temporary seasonal workers, including drivers, delivery helpers, package sorters and loaders, who will assist with delivery during the holidays. Due to the high volume of Cyber Monday orders, UPS reported that it may experience delivery delays.

FedEx Express will be delivering packages on Saturday, December 22, and FedEx SameDay provides service 24 hours a day, 7 days a week, 365 days a year—including on Christmas Day.

The US Postal Service is delivering on Sundays through the holiday season and estimates that it will deliver 6 million packages a day through December.

Cold and Dry Weather Has Helped Retail Sales

According to Planalytics, a research firm that tracks the weather’s impact on retail, cold and dry weather in many US regions has had a positive impact on holiday sales, and recent light snow in unexpected places has helped lift seasonal purchases such as gloves and hats. Evan Gold, EVP of Global Services at Planalytics, said that it is simply a myth that consumers will shop regardless of weather. He said that December has been the driest in 50 years, and that cold and dry weather conditions in the East have positively influenced retail sales. Gold said that if this weather trend continues into January, home centers and department stores can expect to see positive impacts of $183 million and $153 million, respectively.

Retail Recap and Predictions for the Holiday Homestretch

What does all this mean for retailers as we head into the holiday homestretch? We predict the following:

- Retail sales growth will meet our previous forecast of 3%–4%. Given the positive macroeconomic backdrop, including low unemployment and high consumer confidence, the strong kickoff to the holiday season over the Black Friday weekend, and favorable weather, we have reaffirmed our estimate of 3%–4% holiday retail sales growth this year.

- Brick-and-mortar retailers will see their busiest days in terms of traffic on Saturday and Sunday, December 23 and 24, providing opportunities for customer service differentiation. Christmas falls on a Monday this year, which will heavily favor in-store shopping over the preceding weekend. In-store customer service will be a distinct differentiator, so the retailers that go the extra mile will see dividends. Stores that provide perks to customers—such as a free bottle of water, a raffle or game to play while waiting in the checkout line and free gift-wrapping services—are likely to reap the benefits well past December, particularly if their customers share their “retail joy” stories with friends and family over the holidays.

- Consumers will be shopping and researching on their mobile devices during the homestretch, and there are opportunities for retailers to connect with consumers on all social media channels with an integrated, consistent message. The holiday homestretch is the time to connect with consumers through an integrated social media strategy that encompasses multiple touchpoints on mobile devices. Consumers will be busily researching last-minute gifts, looking up store locations and hours, checking product specifications, and looking at Instagram for inspiration this week, so retailers must ensure that technology is working, chatbots are in place and customer service can answer questions quickly and efficiently. Retailers should check that pop-up ads are in place and that promotions are on Instagram and Facebook. Customers should be able to reach customer support easily and store associates should be empowered to provide efficient, helpful service.

- Shipping is a wild card due to holiday timing and the high volume of Cyber Monday orders. Retailers can help minimize shipping issues by offering customers incentives to shop in-store or use buy-online, pick-up-in-store services and by working with local delivery services for regional deliveries. Shipping companies have reported stress on capabilities due to high volumes of Cyber Monday orders. This may or may not impact holiday shipping orders. As a precaution, retailers could offer consumers heavy incentives to shop in stores or use buy-online, pick-up-in-store services and also collaborate with local on-demand shipping companies to deliver regionally where possible. Retailers that offer backup plans for shipping and plan B incentives may help prevent some shipping bottlenecks.