Travel Retail: A $60 Billion Business

KEY POINTS

- The global travel retail market was valued at $63.5 billion in 2014 and is estimated to reach $85 billion in 2020.

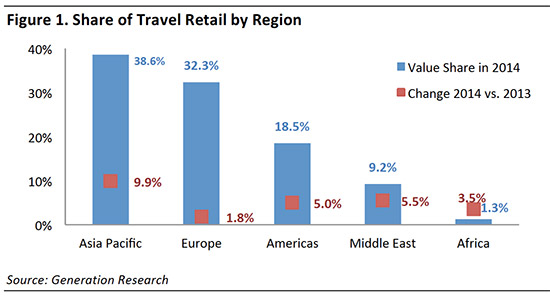

- The Asia-Pacific region is the largest travel retail market, with a 38.6% market share, followed by Europe, with 32.2%. Chinese travelers spend the most when traveling.

- More affordable travel options and an emerging middle class in developing markets are fueling growth in spending.

- The changing profile of the travel shopper may transform the travel retail market from one centered on luxury to one that caters to broader set of needs.

OVERVIEW

Over the past three decades, there has been rapid growth in international tourist arrivals, from only 277 million in 1980 to over 1 billion in 2013, according to statistics from the United Nations’ World Tourism Organization. The travel retail market has grown concurrently, increasing in size by an aggregate 8.4% a year in the past 10 years.

Looking ahead, the market shows great potential. Generation Research, a travel retail market research specialist, estimated the market’s value at $63.5 billion in 2014, and the company forecasts that it will grow to $85 billion in 2020.

THE BOOM IN THE ASIA-PACIFIC TRAVEL RETAIL MARKET

The democratization of traveling and the budget airline boom have contributed to the growing number of travelers, especially in the Asia-Pacific region. According to statistics from Airports Council International, the region accounted for 2.3 billion travelers in 2014, a 7.1% increase over 2013, representing a growth rate that was significantly higher than the world average of 5.7%.

Naturally, the Asia-Pacific region holds the highest share of the travel retail market, with 38.6% of the market’s value concentrated in the region. The market in the region grew by 9.9% in 2014, year over year, which was the fastest growth rate in the world. Europe is the second-largest travel retail market, with a 32.3% share. However, it had the weakest year-over-year growth of all regions in 2014—only 1.8%.

THE EMERGING MIDDLE CLASS IN THE NEW MARKETS

The major factor underlying the expanding number of travelers in the Asia-Pacific region is the emerging middle class in many of the countries in the region. With travel becoming more accessible, Asian consumers have shown they have a great appetite for it, and are filling the seats of airlines. Most notably, China is the largest source of outbound tourists, who represented 30% of total tax-free spending globally in 2014, followed by Russia at 14%, according to statistics from Global Blue.

WHERE DO TRAVELERS SHOP?

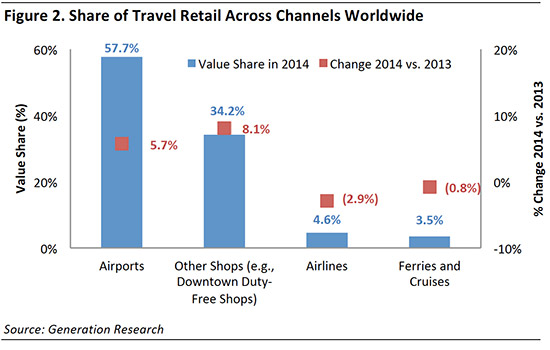

In terms of shopping locations, travelers overwhelmingly make purchases at airports, which accounted for almost 58%, or $36.6 billion, of the market value in 2014.

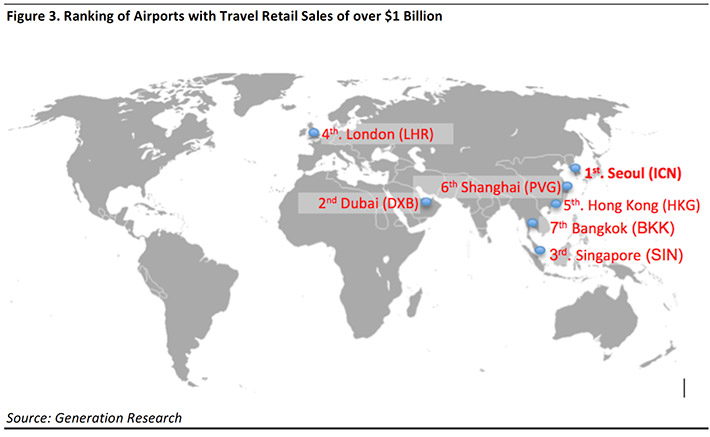

Airports have transcended their function as transportation hubs and now represent prime commercial real estate, with seven airports boasting retail sales of over $1 billion. Five of those seven are located in the Asia-Pacific region. Despite the high passenger flow, it has become more difficult for retailers to operate within airports due to soaring rental rates. For instance, the five-year retail concession fee at Incheon International Airport in South Korea was recently increased by 15%, to US$121,809 per pyeong (roughly 3.3 square meters).

Downtown duty-free shops account for the second-highest total travel retail sales, representing 34% of the market and the highest growth rate, at 8.1%. These shops represent an emerging trend, especially in Japan and China. For instance, at least four downtown duty-free retail stores are due to open in Japan in the next four years. Retailers benefit from the lower rents (compared to airports) that are available in many downtown areas, and customers are likely to spend more time in these shops than they would at airport shops.

WHAT DO TRAVELING SHOPPERS BUY?

Beauty Products Have the Largest Share

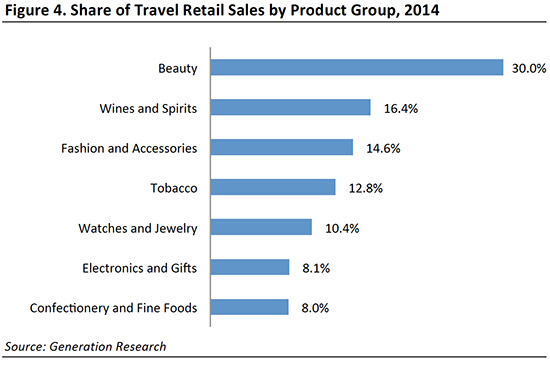

The main product groups in travel retail beauty, wines and spirits, fashion and accessories, tobacco, watches and jewelry, electronics and gifts, and confectionery and fine foods, according to Generation Research. The beauty group represents the largest segment, accounting for 30%, or $19 billion worth, of all sales in 2014.

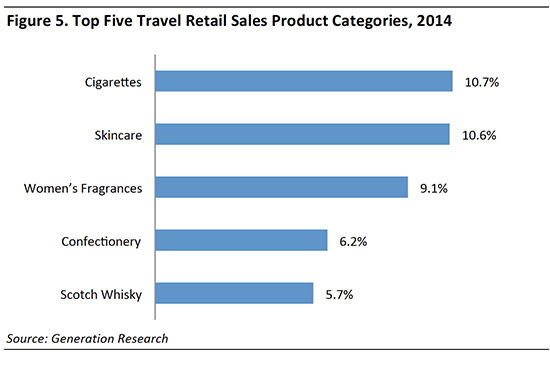

A look at the individual product categories shows that cigarettes were the top-selling product in 2014, accounting for 10.7% of total travel retail sales. Skincare and women’s fragrances, categorized under the beauty product group, took the second and third places, which explains their strong presence in travel retail distribution channels.

A look at the individual product categories shows that cigarettes were the top-selling product in 2014, accounting for 10.7% of total travel retail sales. Skincare and women’s fragrances, categorized under the beauty product group, took the second and third places, which explains their strong presence in travel retail distribution channels.

BEAUTY AND FASHION BRANDS ARE EVOLVING IN THE TRAVEL RETAIL BUSINESS

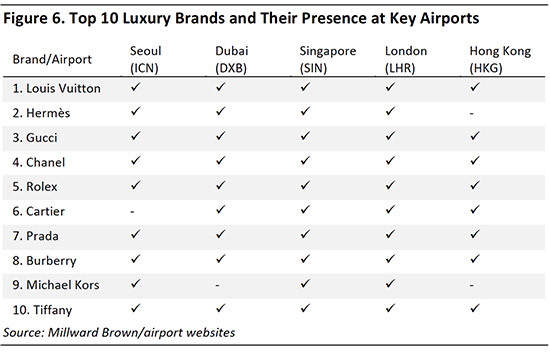

According to Exane BNP Paribas, travel retail is worth about 15% of the broader personal luxury goods market, which is why it has become a significant sales channel for beauty and fashion brands that aim to capture the luxury consumer. As illustrated in the table below, top luxury brands have established themselves in many key airports. Having a presence in this important channel not only helps luxury retailers capture existing and new customers, but increases their brands’ exposure.

L’Oréal is a key player in the market, and enjoyed a 21.3% market share in the beauty category in 2013. The French cosmetics and beauty giant created a dedicated worldwide Group Travel Retail division in late 2013 that covers a number of brands serving the needs of international travelers who have different beauty rituals and purchasing power. L’Oréal’s holistic approach to market growth means the company is able to target niche consumer groups that have only recently become part of the travel retail marketplace. The strategy bodes well for the company, given the increasing number of middle class travelers from developing countries.

Another big player in the travel retail business is LVMH. Aside from its spirits, fashion, beauty and jewelry businesses, it has a selective retailing division, which includes DFS (originally known as “Duty Free Shoppers”) and Starboard Cruise Services (a cruise ship onboard retail fascia). According to a company report, this division contributed 30% of revenue to LVMH in 2014, second only to the Fashion and Leather Goods division. DFS is investing in new retail projects in Italy and Cambodia, as well as at the Singapore Changi Airport, which will be the chain’s biggest single investment.

SUMMARY

Retail locations at travel hubs have become a significant distribution channel, boosted by a rapid increase in the number of international travelers from emerging markets such as China, Russia and Brazil. Beauty, wine and spirits, and fashion brands are in the dominant positions in the marketplace. These brands continue to invest in growth by increasing their retail footprints and strategically reorganizing their businesses to cater to this new wave of consumers. Most notably, they provide a more differentiated product offering that is supported by increasingly diverse brand portfolios.