Deep Dive: Is Going Direct-to-Consumer the Way Forward for Retail?

KEY POINTS

- More and more retailers such as G-III Apparel, Nike, Adidas and VF Corporation are rebalancing their distribution in favor of a direct-to-consumer (DTC) model. Beauty companies such as L’Oréal and Procter & Gamble have also focused more on DTC channels in recent years.

- Apparel and beauty companies can now reach customers directly through multiple digital channels, and with less effort physically using new store formats such as pop-up stores.

- Going direct means retailers have more control of the retail experience, better engagement with customers, as well as improved product margins. However, going fully direct means forgoing the scalability that comes with wholesale distribution, so it is not a straightforward decision.

Executive Summary

Across markets, traditional brands are facing intensifying competition from new digitally-native concepts and international entrants, while retail landscapes are consolidating. Department stores, which represent the traditional wholesale retailers in categories such as apparel and beauty, are closing stores and turning to smaller-size stores amid falling foot traffic. Their strategy to offer discounts and promotions as a key tool to drive demand has led to eroding the value of the brands sold at their locations and prompted brand owners to seek more control.

In addition, brands no longer connect with customers solely through prime retail space in department stores and mass retailers, or advertisements on mass media. They communicate with customers directly on social media, and sell to them directly with less effort on e-commerce marketplaces or through new store formats, such as pop-up stores.

The DTC model offers apparel and beauty companies better engagement with customers, more control of their product and consumer experience, improved margins and the ability to gather consumer data first. This results in operational velocity and alignment. However, scaling DTC channels is a capital-intensive task, and opting to go DTC alone means that brands forgo the scalability offered by the wholesale channel.

Apparel and Beauty Companies Focusing More on DTC

In our 17 Retail Trends for 2017 report, we discussed that the path retailers take to consumers will be more direct in 2017, and we have started seeing more evidence of brands moving in the direct-to-consumer (DTC) direction.

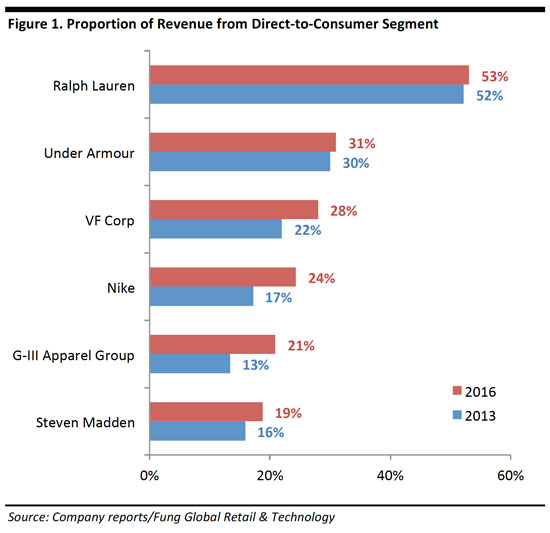

Nike: For instance, Nike’s DTC business contributed to 24% of the company’s revenue in 2016, up from 17% in 2013. Nike plans to grow its DTC business by 250% in the next five years, with revenue forecast to reach $16 billion in 2020, double the $6.6 billion generated from this channel in 2015.

Adidas: Adidas is following suit. At its 2017 investor day, management discussed plans to generate 60% of its revenues from controlled retail locations and to quadruple its revenue from e-commerce by 2020.

A number of other apparel companies such as G-III Apparel and VF Corp, as well as beauty companies such as L’Oréal and Procter & Gamble have also focused more on DTC channels in recent years.

Direct-to-Consumer Channels

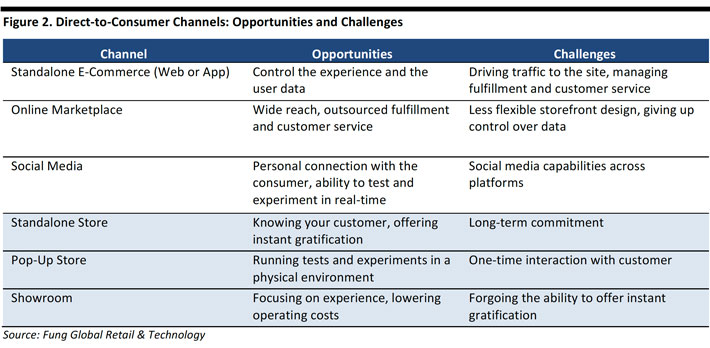

Apparel and beauty companies can sell directly to consumers via a number of offline and online channels, and the choice of channels depends on a number of factors including revenue, cost and risk.

Digital Channels

Standalone E-Commerce Websites and Apps

Selling through a dedicated website or an app means selling directly to consumers. This channel is appealing because of the lower setup and operations costs compared to opening up a brick-and-mortar store, and the wider reach to potential customers.

Standalone sites have been the go-to-launch platform for many startup consumer brands: Bonobos, Birchbox, Warby Parker, Casper and Everlane, to name a few.

However, as these businesses have scaled, they have found that going direct via a proprietary website is not enough for sustainable long-term growth. The main issue is that customer-acquisition costs online are high, while fulfillment, returns and customer service require operational knowhow and efficiencies. Driving eyeballs to a new website is increasingly difficult, given the low startup costs for new projects and the increasing competition online, while online conversion and retention is traditionally low compared to shopping at brick-and-mortar locations, where consumer touch and feel the product while they also interact with store associates.

Online Marketplaces

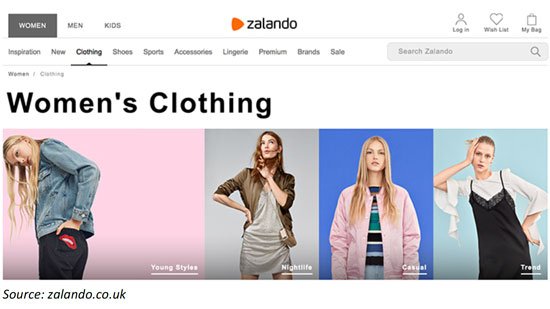

We cover digital marketplaces extensively in our research, because marketplaces have been experiencing significant growth and are one option retailers have to bypass the distribution chain. Amazon and other marketplaces such as Jet.com, eBay, Tmall (China) and Zalando (Europe) have enabled brands to sell directly to consumers across the globe. One example is Zalando’s Partner Program, a DTC platform that enables brands to make their products available on its e-commerce platform, where Zalando handles payment, customer service and fulfillment for its partnering brands.

Marketplaces offer a wide reach—for example, selling on Amazon allows brands to reach 300 million consumers—and are increasingly more seamless. Digital marketplaces have moved aggressively to create ever-more efficient ways to handle fulfillment and customer services, minimizing the friction for sellers on their platforms.

At the same time, however, marketplaces do have their limitations: 1) the storefront designs that brands can sell through are not as flexible as standalone digital assets; 2) the consumer and transaction data is housed by the marketplace; and 3) there are still some issues around brand protection and counterfeit goods sold on marketplaces globally.

Social Media

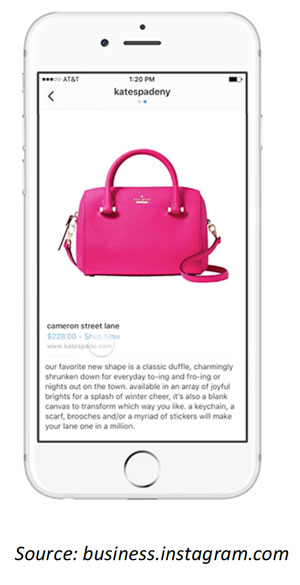

Instagram and Pinterest, for example, both now offer a commerce tool, as does WeChat in Asia. In addition to allowing users to shop via its platform, Instagram allows brands to directly share their brand story and messaging with users. Social media presents a powerful engagement tool and customer service for brands, and we see social medial platforms as an increasingly important commercial channel for retailers.

Brick-and-Mortar Channels

Offline channels remain the dominant and most-used channel for apparel and beauty product purchases: according to the Prosper Monthly US Consumer survey conducted in February 2017, over 70% of consumers purchased clothing and beauty products most often at brick-and-mortar locations. As apparel and beauty companies adopt the DTC model, their presence in offline markets has remained important in order to reach and engage with customers.

Standalone stores offer apparel companies full flexibility in operating their retail space. Larger standalone stores serve as flagship stores, which are used as a marketing tool where brands can offer enhanced shopping experiences and services.

Pop-up stores are an ideal choice for apparel and beauty companies, especially startups, as a first step to connect physically with their customers. Given the lower setup cost and shorter lease terms, it is possible to test concepts and other variables before opening a permanent brick-and-mortar shop. In the case of apparel startup Cuyana, it first tested the location and audience using a pop-up store in Venice, before opening a permanent shop there in 2015.

L’Oréal and Philips partnered in December 2016 to launch a male grooming pop-up store at Singapore Changi Airport. Professional barbers provided a range of shaving and grooming services using Philips’ shavers, as well as skincare products by the L’Oréal Paris Men Expert range, which helped to widen their customer base as they showcased their products to male travelers. The number of pop-ups and pop-up concepts, such as trucks, has seen substantial growth in recent years. According to Popup Republic, a service provider for the pop-up industry, this channel has grown to approximately $10 billion in sales in 2016.

Showrooms have emerged as a popular format for digitally-native apparel and beauty brands. Showrooms are places where consumers can touch, feel and try on a brand’s product, while they also consult with a trained store associate. After experiencing the product, the consumer can then order it online. This means showrooms operate with minimal inventory, creating operational efficiency for the brand, as all sales are still fulfilled by its e-commerce infrastructure.

Why Go DTC?

We identify five reasons why more apparel companies as well as apparel startups are adopting the DTC model: 1) better customer engagement; 2) the potential for higher operational efficiency; 3) the potential for better margins; 4) speed; and 5) alignment.

1. Better Customer Engagement

By selling directly to customers, apparel and beauty companies have full control over different touchpoints with customers, helping them to better engage with consumers.

They have higher flexibility in store design and full control over the brand presentation in directly-operated stores, and are also able to leverage such flexibility to create an immersive experience for shoppers.

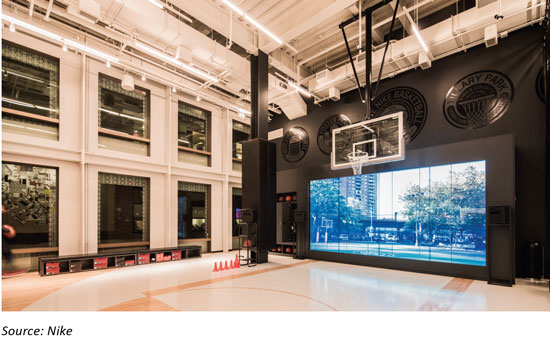

Nike: For example, Nike’s new flagship store in New York SoHo features a half court for basketball, a soccer trial zone and treadmills where customers can experience the products “in the field” before making a purchase.

Adidas: Adidas’s new SoHo flagship, which opened a month after Nike’s, similarly includes a space where fans can watch live games, a customization station and a lot of technology to aid the consumer experience.

The Art of Shaving: This high-end DTC male grooming brand under Procter & Gamble has over 100 retail locations across the US, of which, 56 feature a “Barber Spa.” These stores offers customers a total brand experience and opportunities to cross sell products.

Apparel and beauty companies can also collect customer data specifically to their needs through their own stores, gaining the necessary customer intelligence to deliver personalized experiences. According to Reuben Hendell, CEO of e-commerce technology provider BrandShop, “It’s important for brands to be able to deliver personalized experiences, not only to drive more sales, but also because 75% of consumers prefer it.

2. The Potential for Higher Operational Efficiency

In the traditional retail model involving third-party resellers, wholesalers suffer from the shortcomings and negative externality in predicting wholesale demand with accuracy. For example, resellers who buy from the wholesalers may have less sophisticated demand-planning systems that cause them to place orders based on inaccurate demand forecasts. These resellers may cancel and return orders or sell products at heavily discounted prices. Selling at a lower ASP usually leads to lower profitability.

By shifting to the DTC model, apparel and beauty companies can better predict demand with timely sales data collected directly from their own stores. Given the higher flexibility of directly-operated stores, brands can leverage in-store technology to enhance operations.

Social media also helps apparel and beauty companies to improve their demand planning. Apparel startup Genuine People has increased production quantities and pace based on real-time feedback from its Instagram account. According to the startup’s Co-Founders Sharona Cohen and Nave Avimor, when they posted fresh new pieces that were still in production on Instagram, their inbox immediately started to pile up with customers wanting to get those pieces. Such direct engagement with customers has helped startups to manage demand before mass production; similarly they might also test the water by posting their items on social media before going into mass production.

3. The Potential for Better Margins

Generally, DTC revenue earns higher margins for apparel and beauty companies compared to sales through the wholesale channel, as the companies have more control over pricing by selling through their own channels.

According to a Kurt Salmon report, VF Corporation’s DTC business has a gross margin rate 10 percentage points above its average, and a more than 20% return on invested capital.

4. Speed

Fast-fashion brands, such as Zara, H&M and Uniqlo are direct-to-consumer retailers—they do not sell to wholesale accounts. One thing that fast fashion is known for is speed and a DTC model is one of the main enablers of it. In apparel, a DTC operating model means that the time it takes to put a product up for sale is only a fraction of the time it takes to distribute through wholesale channels. Going fully DTC means brands bypass showcasing, negotiating, selling and delivering products to wholesale accounts, which is a process that can take months. On the flip side, they forgo the scalability of selling to wholesalers globally, which is why fast-fashion brands have undergone, and still are undergoing, rapid global expansion of their store footprints—essentially, they are fully replacing the need for wholesale. The other advantage of DTC when it comes to speed is that any learnings from consumer data and consumer observation can be integrated in the whole organization in almost real-time, something Zara is famous for, but selling wholesale means that wholesale store associates interact with consumers: the product owners are one step away from any consumer insights.

5. Alignment

Finally, selling wholesale and selling DTC creates a divide inside an organization because the organization is serving two very different clients.

Selling DTC means the brand is catering to the end-consumer—it can build sensitivity and alignment for the needs and wants of the end-consumer throughout its organization.

Selling wholesale means the brand is catering to the needs and wants of the wholesale buyer. Naturally, the wholesale buyer’s incentives and decision-making are likely to differ from those of the end-consumer, which leads to operational and cultural challenges inside the brand’s organization and structure.

Implications

Considering the benefits of adopting the DTC model, there are also costs and implications for apparel and beauty companies in product development, as well as possible channel conflicts.

As mentioned earlier, brands can collect customer data specifically to their needs, and this brings both challenges and opportunities in product development. Apparel companies can develop customized products for respective customer segments and regions, however, this also implies extra resources required in product development, as well as inventory management.

While more apparel and beauty companies are focusing more on DTC, retail distributors remain an important player in the US apparel and beauty market. According to the Prosper Monthly US Consumer survey conducted in February 2017, more than half of US adults purchased clothing most often at department stores or discount stores. Brands need to strike a careful balance between their directly-operated stores and retail partners, in areas such as pricing and assortment.