Alipay—Transactions Via Alipay Reach Another Record High

KEY POINTS

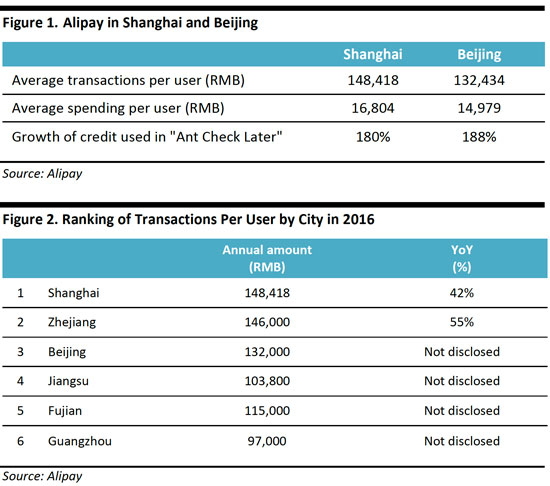

- Solid momentum: Of total transactions of the 450 million active users of Alipay in 2016, consumers in Shanghai spent the most, reaching an average spend of RMB148,000 per user, up 42% year over year. Users in Zhejiang came in second, at RMB146,000 per user on average, up 55% year over year. Overall, cosmetics saw the fastest growth, up 37% year over year, followed by outdoor sports, up 18.6%.

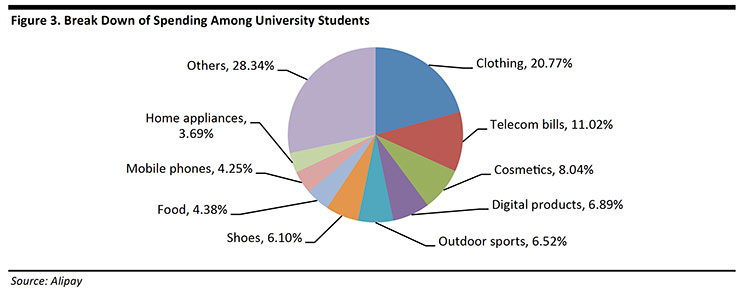

- Millennials a key driver: Millennials on average spent RMB120,000 through Alipay. Spending by university students breaks down as 21% clothing, 11% telecom bills, 8% cosmetics and 7% digital products.

- Credit spending: The number of payments through Ant Check Later, a consumer credit portal, was 3.2 billion, up 344% year over year. The number of payments by millennials grew 443% year over year, while payments by consumers born in the 1960s were up 217% year over year.

- Disruptive force: We expect Alipay to continue to disrupt the traditional payment market as well as stimulate spending among millennials through micro credit.

Solid Momentum in Tier-1 Cities

On January 4, Alipay released an annual report on mobile transaction trends in 2016. Each user received a tailor-made spending report that included data on the total amount of money spent, the type of products and ranking among cities, etc.

We highlight the key statistics below:

Spending through Alipay in tier-1 cities remains strong, as shown in Figures 1 and 2. The rapid growth of micro credit in both cities showed early signs of a shift in consumer spending from debit to credit.

Millennials a Key Driver

Alipay also stated that millennials on average spent RMB120,000 through Alipay. Spending among university students breaks down as 21% on clothing, 11% on telecom bills, 8% on cosmetics and 7% on digital products (as shown in Figure 3).

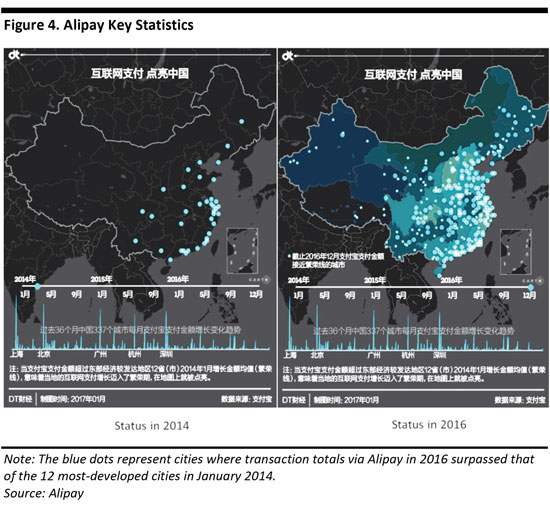

Tier-3 and Lower Cities Join the Party

According to data from Alipay, total transaction amounts in tier-3 and lower cities in January 2016 started to surpass that of transactions in tier-1 cities in January 2014. Contrary to what most may think, consumers in rural areas are not lagging behind in terms of technology usage.

Our View

It is clear that Alipay continues its solid momentum in penetrating mobile payments, regardless of age or income. Although overall consumer demand in China showed signs of slowing down in 2016, it remains to be seen whether innovative e-payment can stimulate sluggish consumer demand in China going forward. We believe there are two swing factors that could eventually drive demand growth: micro credit and purchasing power in low-tier cities.

- Micro credit: Low interest-rate loans could boost consumer spending, as is the case in the US. A switch from debit spending to credit spending could potentially unlock greater purchasing power, albeit at the expense of higher personal debt.

- Purchasing power in low-tier cities: As consumers continue to reside in rural areas, those of lower income could finally contribute and benefit from China’s economic growth. Alipay could leverage rural Taobao, a project to connect farmers to city consumers, and expand its presence in low-tier cities.