10 Top Takeaways from Day 2 of Magic 2017

KEY POINTS

The FGRT team is in Las Vegas this week attending the Magic conference, which covers the men’s, women’s and children’s apparel, accessories and footwear markets. Here, we share our 10 top takeaways from day two of the event.

- The Magic show is truly magical, offering something for everyone.

- Fit is critical in apparel sales, even more important than fashion or style.

- Retailers can reimagine retail by becoming the “go-to” vendor in their segment and by reimagining their spaces to offer mixed-use experiences.

- There are several simple, straightforward tools that retailers can employ to ensure that they belong in the successful camp.

- Fashion continually offers escapism by borrowing from the future and the past, and liberally mixing and matching styles.

- The overall economic environment is positive; the top-performing retail industries are beauty and toys.

- Footwear is seeing no growth, and for the first time, e-commerce is seeing declining growth.

- Fashion Snoops highlights the top trends for fall/winter.

- Two growing and emerging retail categories: travel and staying at home.

- The go-to sourcing destination: Vietnam continues to lure US firms.

1. The Magic Show Is Truly Magical, Offering Something for Everyone

Kicking off the show, Mercedes Gonzalez, Director of Global Publishing Companies, gave a talk titled, “Know Your Show Floor ABCs: A Seminar for New Stores,” which was a short introduction for first-time visitors. She also gave the history of Magic (from the Men’s Association Guild in California), which started 70 years ago as a trade show. She provided a brief outline of the Magic show and the venue, and provided tips for navigating the segment of the show held at the Las Vegas Convention Center. She characterized Magic as truly magical, offering products at every price point. Visitors can buy goods at the show for immediate delivery or for delivery at two other points in time.

She described the motivation for opening a store: how to work as little as possible for as much income as possible—the answer is to be the boss. This role also involves budgeting and hiring staff. The job of the retailer is to know the customer so intimately in order to provide them with what they did not know they wanted.

Gonzalez discussed the tracks of young contemporary apparel, activewear, childrenswear, footwear (labeled FN Platform). The WSA Magic track covers fast fashion and low-priced apparel. Footwear Sourcing covers several countries, and with Sourcing at Magic, Gonzalez mentioned a private-label brand that graduated to opening its own retail stores.

Finally, Gonzalez urged attendees to have a budget prepared and that walking the entire show floor would be highly beneficial.

2. Fit Is Critical in Apparel Sales, Even More Important than Fashion or Style

This seminar took place as a panel discussion titled, “Foundations of Fit for Fashion.” Fit is critical in apparel sales, even more important than fashion or style. Ed Gribbin, President of retail, apparel and fashion consulting firm Alvanon, discussed aesthetic versus technical fit. He learned about fit from his stint in the uniform industry, which must fit everyone, versus in retail, which can only offer six to eight sizes. Even today, retailers are constantly struggling with fit.

In apparel design, there is a constant conflict between the creative and technical teams due to an inherent lack of trust, and there is no clear ownership of fit. Moreover, there are different definitions of fit: aesthetic, commercial, technical and personal. Product developers have to know who they are selling to and who they want to sell to. Developers need a focused, target demographic, a single core body and implement the right tools. Yet, designers and merchants differ on the idea of “fit intent.” It is critical that the roles and responsibilities be assigned and accepted within the organization.

Crystal Button, SVP Global Sourcing and Tech Design of Fullbeauty Brands, a catalog-driven web business dedicated to the plus-size customer—both men and women—in a broad range of categories. The company produces 5,000 private-label items per year. Her remarks centered on the communication of fit and 3D fitting. The company created an internal tool to work with its product lifecycle management (PLM) system to manage the intent of a garment and fit, ultimately leading to catalog and web pages. For example, the company has six silhouettes for tops, such as shaped, straight, relaxed, A-line, trapeze and fit & flare. There are also options for sleeve lengths and sleeve shapes. This tool has reduced return rates and conversion rates, as the customer has a more consistent and reliable fit. Button then turned to 3D fitting. Virtual fitting speeds up the overall process, reduces the number of samples, provides the opportunity to view the garment on an avatar and strengthens partnerships with the factories.

Mark Charlton, VP of Technical Services at Calvin Klein, offered a presentation titled, “Unpacking Fit.” His remarks began with fit being a function of body type, comfort boundaries, ease preferences and personal taste. Success is when a consumer tries on a garment and comments, “yes, it fits.” The industry manages expectations by having the consumer try on the garments and decide whether they fit. One portion of fit is science—body types vary. One portion is art—is a garment bespoke or meant to fit a range of people? Other factors affecting fit include globalization, homogenization, obesity and e-commerce. There is an interesting comparison between returning food in a restaurant and returning apparel—somehow the restaurant does a better job of managing expectations. In summary, fit is art x science x communication (this is the most important part.)

3. Retailers Can Reimagine Retail by Becoming the “Go-To” Vendor in their Segment and by Reimagining their Spaces to Offer Mixed-Use Experiences

The presentation by Syama Meagher, CEO of retail strategy and consulting firm Scaling Retail, was titled, “Re-Imagining Retail.” Her firm works with emerging designers, contemporary brands and enterprises (including the United Nations). Her presentation centered on retail trends and who is doing well and how we can move away from being product-based to focused on media and communication. The first part, titled, “What’s Happening with Retail?” covered a pullback from cultural homogenization and a shift toward stronger brand communication and differentiation. Despite the success of e-commerce, 115 million people are not considered online shoppers. Retail is evolving into becoming a “holistic environment” (i.e., omnichannel.) Therefore, retailers need to think like media companies and publish content on a regular basis. This is less work than previously, due to all the tools for posting to social media. Retailers should take a “campaign first” approach, which means thinking about social media publishing, even when buying product.

Meagher emphasized that retailers need to become the “go-to” vendor in their specific market by focusing on the customer with a 360-degree perspective, improving logistics, storytelling, practicing access and accountability, offering private-label products, using augmented reality (AR) and virtual reality (VR), offering brand exclusives, participating in the IRL (in real life) experience economy and participating in partnerships.

Retailers who are fortunate to have a physical space have the opportunity to reimagine it, for example, by bringing in pop-up stores. Brands are paying for shelf space, which can help create communities and experiences. Successful brands are less transactional; rather, they appeal to the consumer’s lifestyle. According to Meagher, “niche retailers are crushing it.” She envisioned a future in which retailers work with their customers, rather than marketing to them. Conversely, Warby Parker launched on the Internet, but subsequently branched out to have a presence in physical stores. Finally, Meagher urged the need for experimentation in a constantly-changing industry.

4. There Are Several Simple, Straightforward Tools that Retailers Can Employ to Ensure They Belong in the Successful Camp

The speaker, Dan Jablons of Retail Smart Guys, Management One, offered a presentation titled, “In 2007: Your Store Has to Be Different.” Jablons, a retail consultant, focusing on inventory planning and control, addressed the topic of “retail Armageddon” by commenting that the non-innovative stores are the ones that are closing, not the ones becoming powerful and cash rich. In his consulting work, he works with a variety of retailers, both successful and unsuccessful ones.

Successful stores have the following: more compelling offerings (i.e., the right merchandise) based on a tight focus on the customer, including case level, size assortment and price range, with unique and compelling offerings. Retailers also need people to offer advice on fit and fashion. Successful retailers also offer events or amenities such as phone-charging stations near the register (which prevents customers from walking through the store staring at their phone). The layout/design of the store is also important—millennials, in particular, value open, clean spaces.

Retailers can also offer a better selling experience. Millennials, for example, arrive at the store having done more extensive research than other customers, and demand respect during the selling process. Behind the millennials are Gen Zers, which strongly prefer shopping at physical stores. Online sales are primarily need-based items, such as dog food, paper towels and office supplies, where fashion is primarily want-based, and customers want advice.

Regarding social media, every minute, there are 4.3 million people watching videos online, so retailers should first create a YouTube channel and then post those videos onto Facebook. Videos do not have to be polished; rather, they should be raw and unpolished, so as to appear authentic. One retailer regularly posts a video of opening a freshly delivered box of merchandise, which generates much customer interest. Despite this, Jablons commented, the number-one driver of sales today is still e-mail marketing, and e-mail is a measure of mind share—reminding the customer that the retailer is still there. He says a 2% unsubscribe rate is considered very good.

5. Fashion Continually Offers Escapism by Borrowing from the Future and the Past, and Liberally Mixing and Matching Styles

David Wolfe, Creative Director at the Doneger Group, gave a presentation titled, “Fashion Future: Positive.” He commented that fashion, while always positive, is always changing, and coping with that change is a challenge. He mentioned the concept of Disney’s Tomorrowland regarding how we dress as well as in terms of architecture, and futuristic concepts like drones, which are now in use today. Perhaps architects should be fashion designers—for example, the late architect Zaha Hadid designed a line of handbags. There is currently a Balenciaga exhibition taking place in London. There are many unwearable haute couture designs that are more art than fashion. New kinds of clothing also require new kinds of accessories such as jewelry and shoes. Examples of modern designs include solar backpacks, parkas with visual optical illusions and 3D-printed handbags. Shoes, especially athleticwear, have been groundbreaking for the past 20–30 years. New sneaker designs are comfortable as well as futuristic. He showed a pair of earbuds that perform simultaneous translation.

Wolfe then turned to the question of why we are all scared. Bad news seems rampant and affects how we feel about life and fashion. This leads us to “zen out” or go crazy. Concerns include environmental catastrophes, as predicted by Stephen Hawking, skyscraper disasters, the breaking up of glacial icebergs, etc., however, there are items such as panic rings, which are able to summon help, and stress detectors. Casualization continues, with scruffy jeans, including fake mud and unconstructed garments. Sometimes fear leads to a need for comic relief, and fashion delivers. Moreover, people are customizing themselves, particularly with regards to fluid gender, which will greatly affect fashion. Robots are increasingly adopting human characteristics.

Solutions to combat these fears include embracing nature—cities are adopting urban greenery, such as incorporating trees into buildings, and plants can also be integrated into apparel. Other examples include robotic fish, which are released into rivers to monitor water quality, and drone bees which cross-pollinate plants just as real bees do. Stella McCartney has made sneakers from reconstituted plastic bottles. Sports technology has also inspired new fabrics and ultra-modern designs, and some apparel now features serenely simple styles and a no-style statement, which lends itself to knits.

Trends are no longer working, so newness is defined as mixing trends, with five to six trends being worn at the same time. Heavy-handed decoration is another escape mechanism. Pizazz prints can be mixed together, in a color collision. Other trends include Japanese and Afro-punk influences. Influences are being taken from TV and movies, such as from Game of Thrones or Star Wars. Many designers are developing innovative new shapes for use in apparel. Finally, Wolfe predicts the return of color, including “millennial pink.”

6. The Overall Economic Environment Is Positive; Top-Performing Retail Industries Are Beauty and Toys

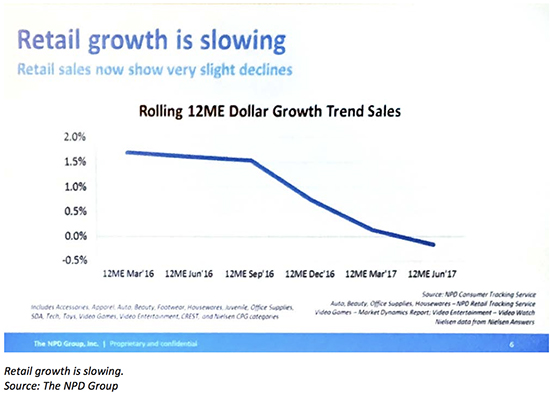

Beth Goldstein, Executive Director and Industry Analyst at the NPD Group, presented a macro view of the current economic environment, and also provided specific analysis of the footwear and apparel segments. Overall, the economic environment is positive; unemployment rates are low, housing starts are up and consumer confidence is up. Consumers have a little more discretionary income, and retail sales are showing slight declines since March 2016, as shown in the figure below.

The top-performing industries are beauty and toys, with a lot of innovation in both spaces. Parents are increasing spending on educational toys, and the beauty space continues to be disrupted. Housewares is also showing growth, as consumers are spending more on home improvements. Consumers are also making investments in their cars to make them run longer. Apparel has been flat, but within apparel, active apparel is still growing, although it has slowed. Footwear, consumer electronics and accessories are three segments that are challenged. Accessories, which includes jewelry and handbags, has been very challenged with department stores retooling their space, and the handbag is no longer the aspirational purchase that it once was.

7. Footwear Is Seeing No Growth, and for the First Time, E-Commerce Is Seeing Declining Growth

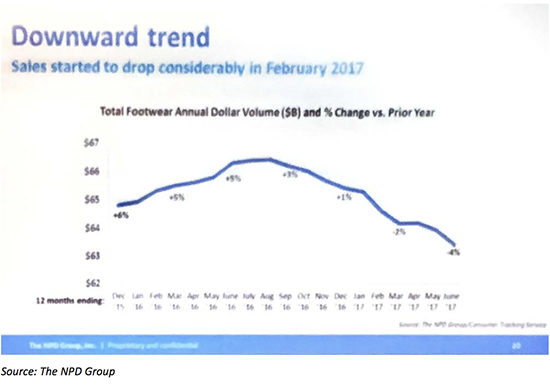

As the title for the NPD presentation suggests “Finding Opportunities in a Slow-Growth Market: The US Footwear Industry Mid-Year Review and Look Ahead,” the footwear industry is experiencing slow growth. Specifically, footwear peaked in August at $66 billion, and is now at $63 billion. Footwear started to decline dramatically in February, due to delays to income tax refunds. This was expected to pick up, but the trend has continued. Performance footwear is struggling, fashion shoes are down more, kids are down, and even e-commerce growth is slowing for the first time, as shown in the figure below.

8. Fashion Snoops Highlights Top Trends for Fall/Winter

Melissa Moylan, Creative Director for fashion trend forecaster Fashion Snoops, presented on the trends and color stories for fall/winter 2018/2019. Fashion Snoops presented four collections with inspirations. The “Space Between” collection revealed a blurring of lines between masculine and feminine, balancing hard and soft lines. The color stories include “samurai” red, a neutral palette of blue “fog”, “temple” brown and “monk,” which is a mustard yellow. The materials include brushed canvas and pleating. The women inspired by this collection are fearless, strong leaders, who seeks refuge away from the workplace at a Japanese guesthouse. She loves layering, kimono sleeves and volume. Design details include asymmetry, obi belts, draping and embroidery for holiday. Volume is a key driver in the silhouette for the bottoms, with wide leg pants and a paper-bag waist. The reworked shirt, which is a go-to piece in this collection, included an off-the-shoulder top, robe and even a power blazer. Accessories include micro frames, a hairpin and slicked back hair.

9. Two Growing and Emerging Retail Categories: Travel and Staying at Home

According to NPD, airline travel passenger counts are at an all-time high, and this category is growing. According to an NPD survey, nearly half of consumers plan to spend less on all categories in the next year, except on travel. Luggage is a category that is being disrupted with technology. Consumers can now plug portable electronics into their luggage to charge them and, according to NPD data, which it just started tracking this segment again, this category is growing.

When people are not traveling, they are staying in—staying at home is the new going out. Enhancing the in-home experience is a new growth category. For example, home fragrance, is one of the top-selling fragrances, according to NPD data, and 77% of adults use a home-scent product. Connected devices for the home and providing technology for consumers to enjoy content are another area of opportunity for retailers. For example, in 2016, home automation sales were up 57%, according to NPD data, and over 58 million US homes have at least one connected TV or attached content device. Consumers are also trying meal kits and food-delivery services, and convenience, variety and time savings are expected to be the drivers for future growth.

10. The Go-To Sourcing Destination: Vietnam Continues to Lure US Firms

The panelists included Dr. Sheng Lu, Assistant Professor from the Department of Fashion and Apparel Studies at the University of Delaware; Avedis Seferian, President and CEO of Worldwide Responsible Accredited Production (WRAP); Steven DiBlasi, VP of Global Sourcing for Lanier Clothes; and Chris Walker, Apparel Production Advisor/Author and Vietnam Garment Insider.

- Vietnam is the second-most-used sourcing base, behind China. However, Vietnam has become increasingly important over the past 10 years. Retailers continue to focus on a diversified sourcing base model in order to diversify risk.

- The “new” sourcing model is one where retailers use China for the majority of their sourcing portfolio, typically 30%–50%, Vietnam for 10%–20%, and “many countries” for the rest, with each country at under 10% each.

- Vietnam is very balanced and one of the most competitive Asian countries in terms of: i) speed to market; ii) sourcing costs; and iii) compliance.

- Vietnam remains a rising star, but US fashion companies are more cautious about the country’s growth potential. This is due to two primary factors: growing labor costs and the defeat of the Trans-Pacific Partnership agreement (TPP).

Factories in China will continue to hold the No.1 spot, due to: i) speed to market; ii) capacity; and iii) their vertical nature.

Reasons to be in Vietnam

- Compliance

- Machinery investment

- English-speaking management

- Pro-business culture

- Experience in global logistics

- Very easy to get started in Vietnam through agents

- Vietnam has made a commitment to the textile industry; it is easy to get in and out

- Environmental controls

- Factories are moving from cities to rural areas to reduce wages and turnover

- Increasingly vertically integrated

Reasons Not to Be in Vietnam

- Competition for workers from Samsung, LG, Panasonic

- Minimum wage increases of approximately 8%–10% (6.5% in 2018); the potential to increase social welfare payments (this is at 24%)

- Raw materials still imported from China, although more available in the country

- Lack of mills and dyeing houses

- No free-trade agreement with the US

- The free-trade agreement with the EU reduces the need to supply the US