Deep Dive: Wellness as a Luxury: Part 1—Living Well

KEY POINTS

Our Wellness as a Luxury series looks at wellness as the new status symbol: “wellthness” is fast replacing other signifiers of affluence as a luxury to be enjoyed and flaunted. In this report, we look closely at three aspects of wellthness related to living well:

- Fitness classes: Young consumers in particular are seeking aspirational, social experiences in their fitness regimes. This is prompting a premiumization of workouts and classes at fitness centers, growth of collegiate workout clubs (many of which take the form of park-based boot camps), and the development of the fitness events industry.

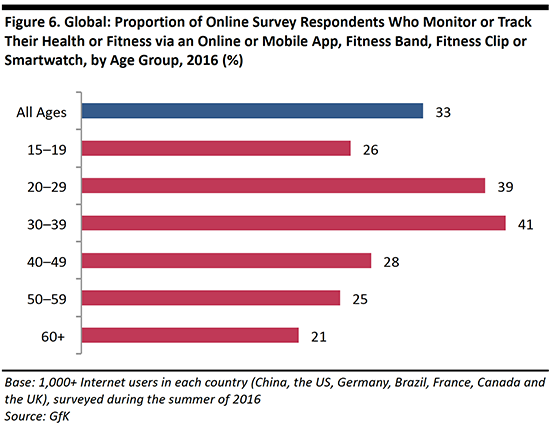

- Wearables: Consumers in the 20–29 and 30–39 age groups are the most likely to use wearable technology to track their fitness.

- Athleisure: More and more young consumers are flaunting their focus on well-being in all parts of their everyday lives. They may not be on the way to the gym, but their yoga pants or sports top signals others that fitness is a core part of their lives.

Executive Summary

In this Wellness as a Luxury series of reports, we examine wellness as the new status symbol: this “wellthness” is fast replacing more traditional signifiers of affluence as a luxury to be enjoyed and flaunted.

Young people in particular are flocking to social fitness, signing up in droves for aspirational fitness classes, using technology to measure and share their fitness progress, and bringing fitness into everyday life visibly by wearing more athleisure apparel.

Three Visible Effects of the Wellthness Trend

We note three major manifestations of the living well trend:

- Fitness classes: Young consumers are seeking aspirational, social experiences as part of their fitness regimes. This is resulting in a premiumization of workouts and classes at fitness centers, growth in the number of collegiate workout clubs (many of which take the form of park-based boot camps), and the development of the fitness events industry.

- Wearables: Consumers in the 20–29 and 30–39 age groups are the most likely to use technology such as fitness wearables to track their fitness.

- Athleisure: More and more young consumers are flaunting their focus on well-being in their everyday lives: they may not be on the way to the gym, but they signal that fitness is a core part of their lives by wearing their yoga pants or a sports top throughout the day and for activities other than working out.

Three Enabling Factors

We see three factors underpinning the emergence of the wellthness trend:

- Millennials are willing to spend more on bespoke classes and athleisure: More than 80% of 18–34-year-olds are spending a quarter of their disposable income on health products and services, according to the Cassandra Report, an ongoing study of emerging trends.

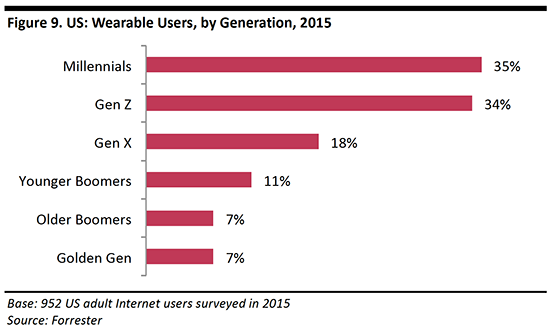

- Millennials are the largest group of wearables users: In combination, millennials and Gen Zers make up 69% of all US wearables users, according to research firm Forrester.

- Social media drives demand for wellthness: As of June 1, 2017, on Instagram alone, there were more than 196 million posts with the #fitness hashtag, more than 57 million posts tagged with #health and more than 11 million posts tagged with #wellness.

We note that factors driving the living well trend overlap with trends in the consumer and retail markets more widely. These include the shift by consumers to spending on services, social media prompting changing habits and the empowerment offered to consumers by technology. The structural nature of such factors leads us to expect sustained demand for well-being offerings.

Introduction: Wellness as a Luxury

It seems that, for many younger consumers in particular, a workout is only complete once they have posted a selfie to social media that features their workout buddies, the protein smoothie that powered their routine and the outfit they wore during the workout, which could well be from a celebrity’s athleisure line. Such selfies are one visible sign that wellness is the new luxury—one to be both enjoyed and flaunted.

The days of exhibiting wealth via expensive apparel and products may soon be behind us, as more and more consumers are indulging in aspirational fitness classes and social fitness events; enjoying healthy, organic and natural food; and using devices to measure health metrics and track their progress. Consumers are also flaunting their healthy lifestyles on social media, through the fashions they wear and through other visible choices they make in everyday life.

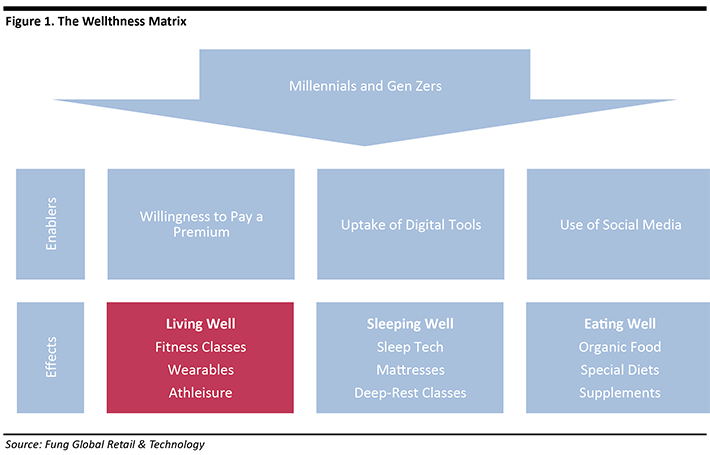

In this series of reports, we examine wellness as a status symbol, which we refer to as wellthness. We identify three specific ways that consumers are enjoying and displaying wellthness, and each of our three reports in the series will focus on a different theme:

- Living well—more consumers are participating in fitness classes and activities that improve well-being.

- Sleeping well—more consumers are using products, devices and apps that aid sleep and, so, enhance overall well-being.

- Eating well—there is growing demand for organic food, natural food, health supplements and special diets such as the Paleo Diet.

This first report in our Wellness as a Luxury series focuses on living well, notably, through fitness, which is a major, growing industry. Between 2009 and 2016, US health club membership numbers jumped by 26%, to 57.3 million, according to the International Health, Racquet and Sportsclub Association, a trade association for the global health and fitness industry. Worldwide health club industry revenue totaled $83.1 billion in 2016, and some 162 million consumers were members of a health club, according to the same trade association.

We begin by outlining our wellthness matrix, which shows the enabling factors and the effects behind the drive toward healthier living.

Millennials and Gen Zers Drive the Wellthness Trend

In this report, we consider how millennials (those born between 1980 and 1999) and Gen Zers (those born in 2000 and later) are leading the charge toward living well. Young people are flocking to social fitness events such as The Color Run (a paint run focused on health and happiness rather than competition) and park-based boot camps, and they are signing up in droves for aspirational fitness classes such as SoulCycle. They are also using technology to measure and share their fitness progress, and bringing fitness into everyday life visibly by wearing athleisure apparel for all kinds of activities other than working out.

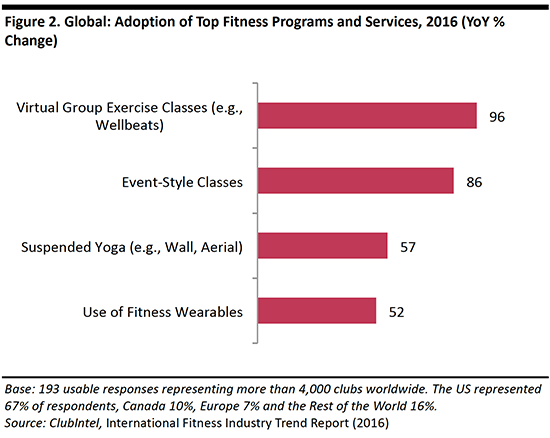

As a result of these shifts, the fitness industry is reporting increased adoption of technology, event-style classes and innovative class offerings. For example, brand insight firm ClubIntel conducted a survey in 2016 that found that technology and boutique, studio-focused classes dominated the ranking of fast-growing fitness trends.

Fitness Classes: Young Consumers Seek Aspirational, Social Experiences

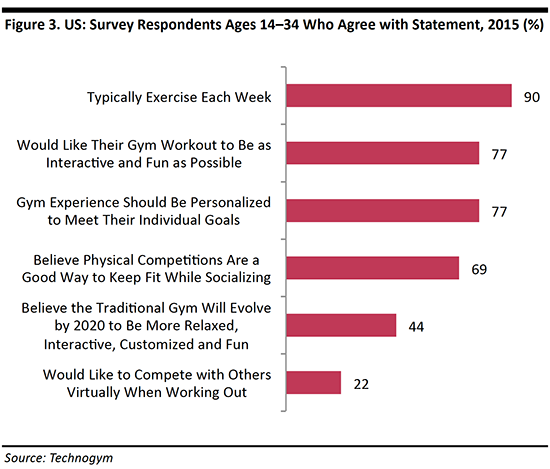

As we have covered extensively before, millennials are prioritizing quality experiences while spending more frugally on categories such as grocery and beauty. We see the group’s willingness to spend on experiences impacting the fitness industry, too. In particular, many millennials seek a social element in their fitness regimes, as confirmed by a 2015 survey of US consumers ages 14–34 commissioned by fitness equipment maker Technogym. For example, nearly 70% of survey respondents said that they believe competitions are a good way to keep fit while socializing.

Research from Missouri-based advertising agency Barkley found that 60% of American millennials regularly participate in fitness activities and that these activities are more social in nature than conventional gym workouts. We see this demand for aspirational, social fitness experiences underpinning several shifts in the industry:

- A premiumization in workouts and classes at fitness centers, epitomized by offerings such as SoulCycle and Barry’s Bootcamp.

- Growth of collegiate workout clubs, notably park-based boot camps.

- The development of the fitness events industry, led by major event names such as The Color Run and Tough Mudder.

At the same time, there has been growth in the budget gym segment, reflecting the polarization of the market, with consumers looking for either functional value or premium experiences.

The table below lists emerging and mature trends in the fitness industry according to a ClubIntel survey of 4,000 fitness clubs worldwide that was conducted in the third quarter of 2016. Reflecting the drift toward premium, differentiated experiences, the emerging trends include offerings such as barre classes (which combine Pilates and ballet), event-style classes, smaller classes and nutritional coaching.

Wearables and Other Technology: Making Results Measurable

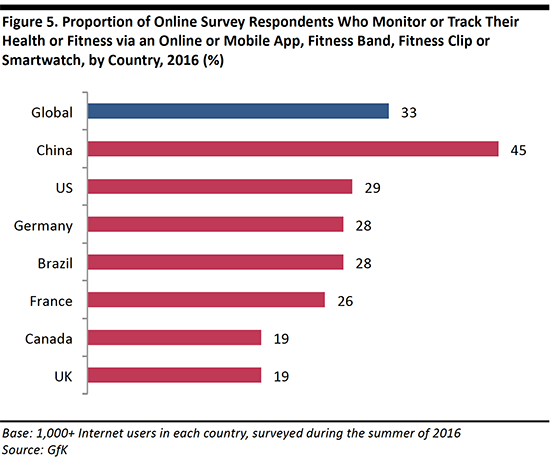

Wearable devices and other technologies are giving consumers new ways to measure, track and share their fitness performance. In countries surveyed by market research firm GfK, around one in three people are making use of these new technologies, with China leading the way.

Consumers in the 20–29 and 30–39 age groups are the most likely to use technology to track their fitness. This may reflect the fact that the very youngest consumers do not have the disposable income to invest in such technology or that they are opting to spend on leisure services rather than on goods, as we noted above.

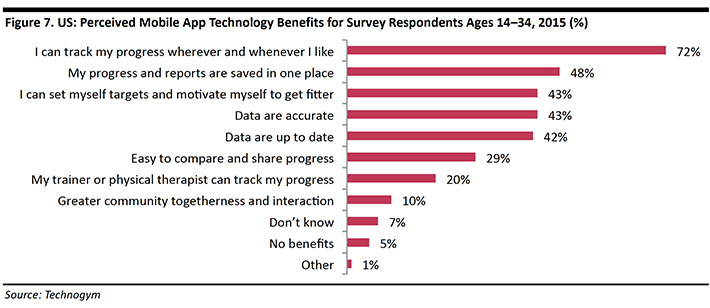

Health technology and mobile apps enable greater control over fitness regimes, and younger consumers perceive benefits to using them. About 72% of the US consumers ages 14–34 surveyed by Technogym agreed that mobile apps help them track their progress “wherever and whenever” they like, while 48% agreed that a benefit of using mobile technology is that all their progress and reports are saved in one place.

Athleisure: Flaunting the Fitness Lifestyle

The athleisure apparel trend is a visible display of wellthness beyond the gym or workout studio. More and more young consumers are flaunting their focus on well-being in all aspects of their everyday lives: they may not be on the way to the gym, but by wearing yoga pants or a sports top, they signal that fitness is a core part of their lives.

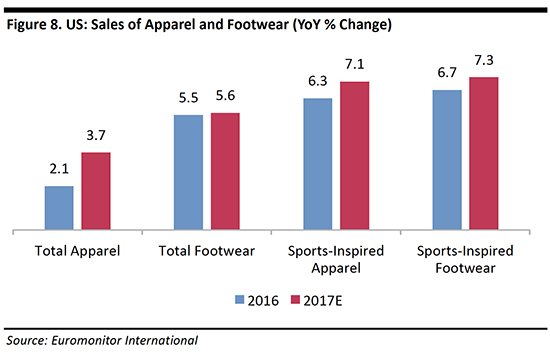

As a result, the athleisure category is outperforming in the somewhat moribund US apparel market. The “sports inspired” apparel and footwear categories (i.e., athleisure and adjacent casual-sports categories) grew considerably faster than the overall clothing and footwear markets did in 2016, according to Euromonitor International, and the research firm expects this trend to continue through 2017.

Activewear is typically priced at a premium to conventional clothing and designed specifically for an active lifestyle. More than 51% of American millennial activewear shoppers surveyed by e-commerce marketing firm Connexity said that they are willing to spend more than they can afford to get the clothes they want. Connexity also found that these shoppers view themselves as “fashion influencers,” noting that they are “31% more likely to say that people copy the clothes they wear and things they do, and 50% more likely to say that people come to them for advice on purchases.”

The Enabling Forces Reshaping the Fitness Industry

In this section, we dive more deeply into the three enablers of fitness industry growth and change that we outlined in our wellthness matrix: younger consumers’ willingness to pay a premium, their adoption of digital technology and their use of social media.

Enabler 1: Millennials Are Willing to Spend More on Bespoke Classes and Athleisure

Going the extra mile to look good is more than just putting in the additional hours of exercise—it also includes paying a premium to participate in the activities that help one get and stay in shape. Creative agency Deep Focus surveyed more than 1,700 American 18–34-year-olds in 2015 for its Spring/Summer 2015 Cassandra Report: Body, Mind, Soul. The health and wellness report revealed several insights regarding millennials’ spending on the category:

- More than 80% of this age group said they spend one-quarter of their disposable income on health products and services.

- More than 35% of those surveyed said they had reduced their spending in other areas to make more health-related purchases, which include food, activities and apparel.

- Some 41% said they would splurge on “classes that improve their body” compared with about 23% that would spend more on fitness clothing and footwear and 36% that would spend more on healthy foods and drinks.

Enabler 2: Millennials Are the Largest Group of Wearables Users

Millennials take the lead in owning wearable devices, according to a number of sources:

- This demographic is the largest user group for wearables, according to a 2017 study by research and advisory firm Gartner.

- Forrester’s 2015 survey of US wearable users found that fully 35% of them were millennials and 34% were Gen Zers.

Enabler 3: Social Media Drives Demand for Wellthness

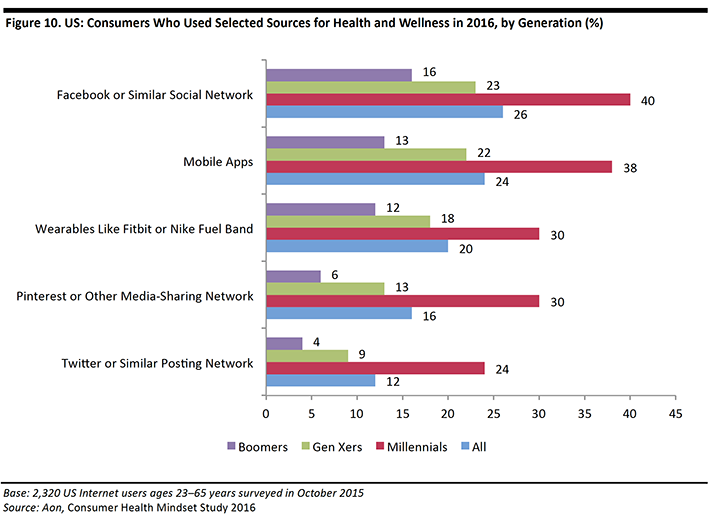

Social media is proving to be a source of information and inspiration for healthy living as well as a means of flaunting wellthness. According to Aon’s Consumer Health Mindset Study 2016, millennials outpace other age groups and the average consumer in their use of social and digital media for health and wellness efforts, activities, tracking or information.

The rise of social media platforms such as Twitter, Instagram and Facebook has spawned new ways for people to share various aspects of their lives, including their fitness and wellness regimens, and to interact with others around the world.

As of June 1, 2017, on Instagram alone, there were more than 196 million posts tagged with the #fitness hashtag, more than 57 million posts tagged with #health and more than 11 million posts tagged with #wellness. These hashtags linked to multiple images of users’ training activities, food, fitness progress, suggestions, tips and motivation.

Social media not only allows people to share their experiences, but also adds pressure on them to look good and be seen as living fulfilling lives, providing further support to the fitness industry:

- A 2016 survey sponsored by UK advertising think tank Credos found that more than half of young male respondents ranked social media as a source of pressure to look good.

- Nearly one-third of US teen girls feel bad when comparing themselves with others they see on social media, according to a 2013 survey by the American Psychological Association.

- A 2015 report from Canada’s Centre for Addiction and Mental Health similarly found meaningful associations between time spent on social media and negative mental health indicators: heavy social media users were more likely to report low self-esteem.

We explored these trends in a previous report, Deep Dive: Gen Z and Beauty—the Social Media Symbiosis, and we think their impacts are as evident in the fitness industry as in the beauty market. Young consumers who are active on social media face greater pressures to look good.

As social exercise activities grow in popularity, millennials are also building virtual communities around those they follow on social media. For example, body and image coach Kayla Itsines has amassed a huge fan following by sharing workouts, client before and after photos, advice and diets on Instagram. Itsines has encouraged her followers to share their own workouts using hashtags such as #kaylasarmy and #thekaylamovement, and to offer each other help, support and advice through comments on Instagram.

The ability to share details of workouts—such as the route taken, number of miles run or number of calories burned—on social media is, to a large extent, being driven by wearables and apps that have a sharing function built into them. Sports clothing brand Under Armour offers an app called MapMyFitness that allows users to map, log and share their workouts and connect with other users who are taking similar routes or participating in similar exercises. After completing a workout, users can share it on their social media pages.

Similarly, fitness-tracking app Fitocracy, which gamifies workouts by allowing users to earn points for completing exercises at various degrees of intensity, has seen its number of young users grow. Fitocracy users can connect with like-minded fitness enthusiasts to form a fitness tribe and take part in exercise “quests” and group challenges. The users can also share all of their activities via the app’s communities and social media channels. Fitocracy Cofounder Brian Wang told a reporter for the MarketWatch website that most of the app’s more than 2 million users are between the ages of 18 and 35.

Generational Difference: The Structural Enabler

We have emphasized throughout this report that younger consumers are driving the changes in the fitness industry, and we have outlined three direct enablers of those changes. The structural enabler, however, looks to be a generational difference, and in this section, we explore that in further detail.

Millennials are currently the largest demographic in the US, according to the US Census Bureau. As of 2015, they numbered almost 92 million and comprised about 28% of the US population. By comparison, Gen Xers (those born between 1965 and 1979) numbered 61 million in 2015 and baby boomers (those b orn between 1945 and 1964) numbered 77 million.

Totaling 53.5 million workers, millennials also now form more than one-third of the total US workforce, according to the US Bureau of Labor Statistics, and that number is expected to increase to 75% within a decade as younger millennials flow into the workforce.

Gen Zers and Millennials Are the Most Physically Active

In 2016, more than 42% of US consumers aged six and over participated in a high-calorie-burning physical activity at least once a week, according to a study by the Physical Activity Council (a group of eight leading physical fitness and sports organizations in the industry). The council has split physical activities into five levels of intensity, based on calories burned and frequency of participation:

- Inactive: These activities include archery, birdwatching and fishing, which require minimal physical movement.

- Low/medium calorie: These activities involve burning calories at a low or medium rate. Some of the low-calorie-burning activities are stretching, walking for fitness, sledding and bowling. Medium-calorie-burning activities include barre, yoga, golf, cheerleading and skiing.

- Casual and low/medium calorie: These are the above activities performed at a “casual” frequency, i.e., one to 50 times a year.

- Active and high calorie: High-calorie-burning activities include kickboxing, football, bodyweight training and Pilates. An “active” state indicates undertaking high-calorie-burning workouts 51 to 150 times a year.

- Active to a healthy level: This level indicates undertaking high-calorie-burning activities more than 150 times a year.

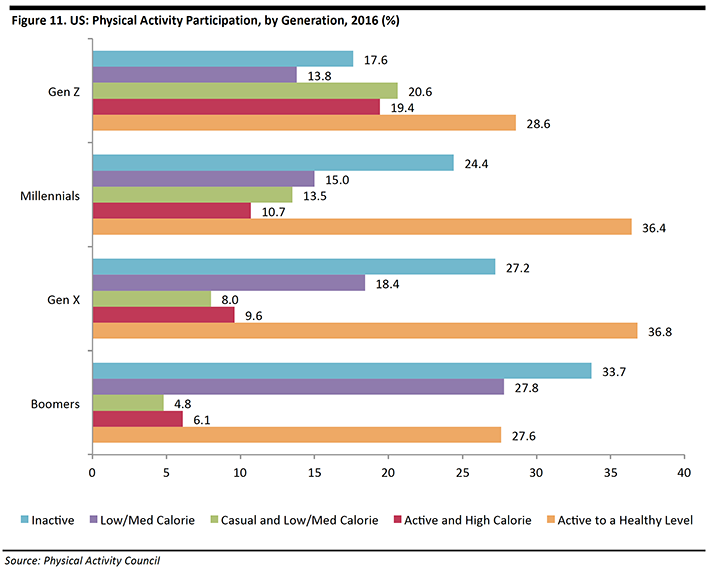

In terms of key generational differences, the Physical Activity Council found that:

- Gen Zers are the most active generation, although they exhibit varying activity levels. Only 17.6% of Gen Zers were inactive in 2016, while nearly 50% said they participated in high-calorie-burning activities 51 to more than 150 times a year.

- Millennials participated in activity more frequently, with 36.4% active to a healthy level and nearly half active at a high level at least 51 times throughout the year. But about a quarter of millennials said they were inactive.

- Gen Xers exhibited all-or-nothing behavior. Some 37% reported participating in intense activity, while approximately 27% said they were inactive. Together, those two subgroups accounted for nearly two-thirds of the Gen X population.

- Baby boomers were the least active, as more than a third reported being inactive. Those who participated in physical activities tended to choose low-intensity ones.

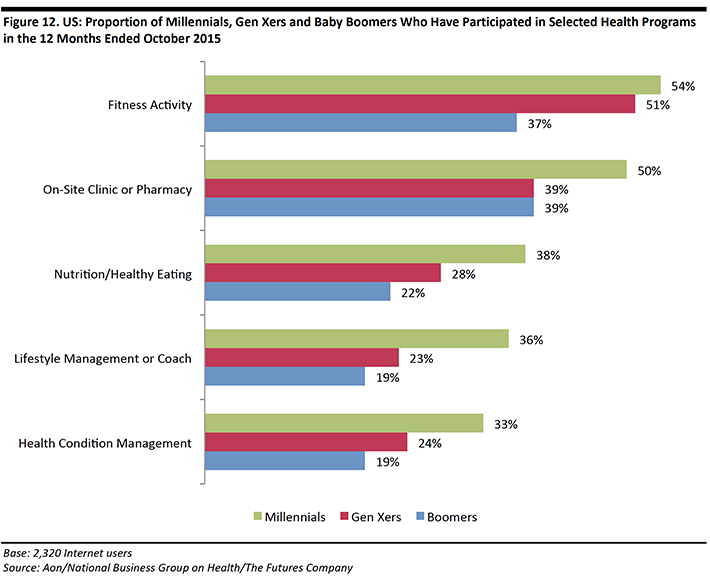

Millennials Are More Proactive in Managing Their Health than Older Consumers Are

Millennials are taking a more proactive approach toward health and wellness management compared with older cohorts. As shown below, a higher proportion of millennials participate in health programs of various kinds than do either baby boomers or Gen Xers.

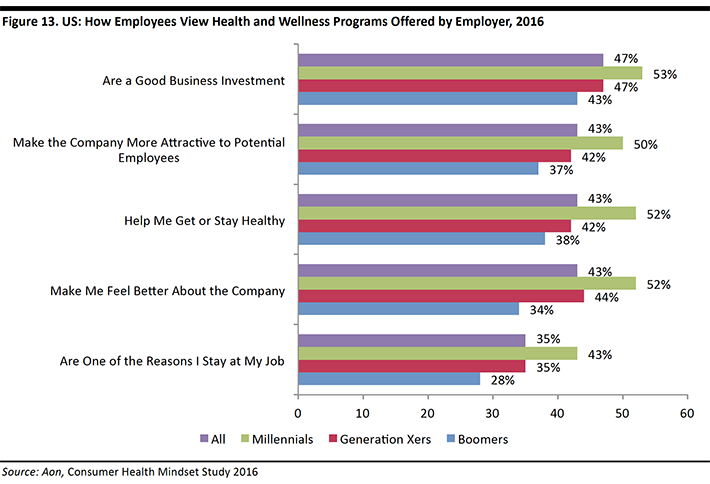

Millennials Expect Wellness at Work, Too

Millennials also value wellness programs in the workplace more highly than older generations do. According to Aon’s Consumer Health Mindset Study 2016, 53% of millennials believe that workplace wellness programs are a good business investment compared with about 47% of Gen Xers and 43% of baby boomers. And, according to the same study, 52% of millennials believe that workplace wellness programs help them get or stay healthy, compared with 42% of Gen Xers and 38% of baby boomers.

What We Think

Factors driving the living well trend overlap with trends in the consumer and retail markets more widely:

- Many young consumers are opting to spend on leisure services over products: this is visible in the growth in premium fitness class brands and fitness events.

- Social media is both a source of fitness and wellness information and a source of pressure to look good. The fitness industry looks to be one of a number of industries benefiting from this pressure.

- Technology is empowering consumers.

In other words, some key factors underpinning the growth of wellthness are structural—leading us to expect sustained demand for well-being offerings.

Keep an eye out for our subsequent reports in our Wellness as a Luxury series.