The Millennials Series: Millennials And Beauty

KEY POINTS

- This is the second report in our Millennials Series. In this report, we explore how millennials are reshaping the beauty sector.

- Currently, millennials in the US and the UK spend less on beauty than older generations do, largely because they have lower incomes.

- A majority of millennials prefer to buy beauty products in-store, and they expect to have the same experience in-store as they do online. The generation is more likely than older generations to research beauty products online and they use social media more actively as part of the shopping experience.

- As the “selfie generation,” millennials have made makeup the fastest-growing cosmetics category globally, according to L’Oréal. In the coming years, millennials will be more likely than older generations to buy all-natural beauty products.

- Price is a key purchase driver for millennials shopping for beauty products, and they are more likely than older shoppers to both visit different stores in order to get the best deals and use coupon codes when buying beauty products.

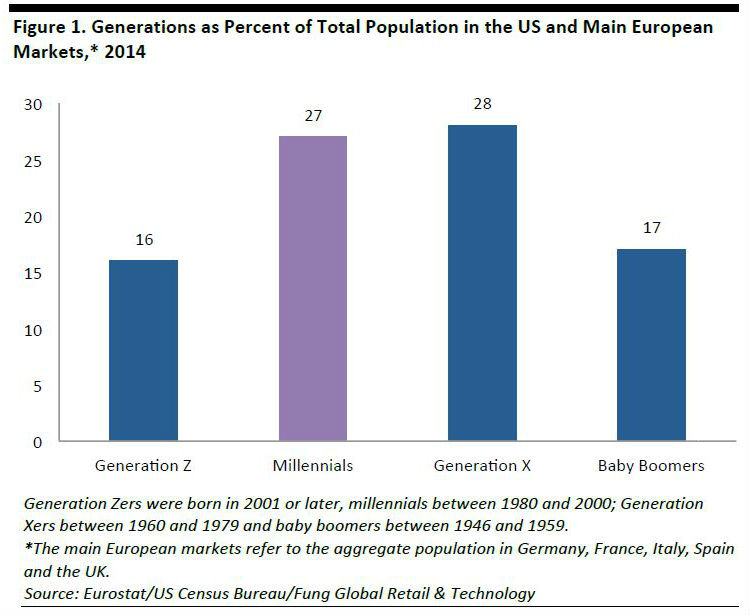

Millennials are typically defined as those born between 1980 and 2000. Given the generation’s 20-year age span, millennials make up a sizeable chunk of the population. Fung Global Retail & Technology estimates that, in 2014, millennials represented 27% of the total population in the combined US and major European markets, making the group the second-largest age segment in these markets, after Generation X.

Because millennials range in age from 16 to 36, they constitute a consumer segment that is of growing value in most markets. While many millennials have less money and financial security than older generations do, they are typically in a high-growth phase in terms of their earnings. Millennials are in a life stage where they are, or soon will be, developing their careers, moving up the professional ladder and settling down into double-income households. So, year over year, their spending power will be increasing.

This demographic is significant not only due to its size and growing spending power, but also because its consumer demands tend to differ notably from those of previous generations. While such a large group is inevitably diverse and complex, there are nevertheless some identifiable millennial trends:

- They are highly adept at using technology and are very active social media users.

- They tend to be more socially conscious than older age groups, and are influenced by product offerings marketed as ethical, sustainable or environmentally friendly.

- They are more likely than older age groups to focus on health and well-being in areas such as food and physical activity.

- They are more concerned with value and bargain hunting, in part out of necessity, as their economic opportunities have decreased.

- There is evidence that millennials are more interested in spending on experiences than on possessions.

- Similarly, there are indications that some millennials are shifting toward renting instead of owning belongings, from cars to clothes, although this may be influenced by the group’s relative economic insecurity.

- Because they are often pressed for time, millennials are likely to be looking for convenience, especially when shopping.

These preferences and behaviors are substantially affecting product and service markets worldwide, not least because millennials’ spending power is increasing. Major brands and retailers need to adapt to cater to the demands of this increasingly valuable consumer segment.

At the same time, established brands and retailers are likely to face competition from newer companies that target millennials’ demands more sharply. From ASOS to Zipcar, nimbler, tech-enabled younger companies are often focused on serving this group, which means that they can chip away at legacy brands’ current and future customer bases.

The first report in our Millennials Series covered the grocery category. In this second report, we turn to beauty.

MILLENNIALS AND BEAUTY

- This is the second report in our Millennials Series. In this report, we explore how millennials are reshaping the beauty sector.

- Currently, millennials in the US and the UK spend less on beauty than older generations do, largely because they have lower incomes.

- A majority of millennials prefer to buy beauty products in-store, and they expect to have the same experience in-store as they do online. The generation is more likely than older generations to research beauty products online and they use social media more actively as part of the shopping experience.

- As the “selfie generation,” millennials have made makeup the fastest-growing cosmetics category globally, according to L’Oréal. In the coming years, millennials will be more likely than older generations to buy all-natural beauty products.

- Price is a key purchase driver for millennials shopping for beauty products, and they are more likely than older shoppers to both visit different stores in order to get the best deals and use coupon codes when buying beauty products.

MILLENNIALS AND BEAUTY

In the first report in our Millennials Series, we discussed how this generation, typically defined as those born between 1980 and 2000, is changing the nature of grocery. In this second report of the series, we focus on the beauty category. Much of the published data on millennials’ beauty shopping habits focuses on the US. However, we incorporate notable regional and global data where appropriate. The main emphasis of this report is on the retailing of beauty products, but we cover millennials’ impact on the beauty industry as a whole, too. Specifically, this report examines:

- Millennials’ growing importance to the global beauty market: Globally, the beauty product market has the potential to double in value in the coming 10–15 years, a period during which millennials’ spending power will increase.

- Millennials’ cross-channel approach to beauty shopping: The millennial generation expects to have the same shopping experience in different sales channels and is driving the convergence of new channels of communication, commerce and service.

- Changing beauty trends: Millennials’ beauty perceptions differ from those of older generations—younger shoppers prefer living in the moment and not worrying about the future, and they are more likely to buy all-natural cosmetics than older generations are.

GLOBAL BEAUTY PRODUCT SALES GROWING STRONGLY

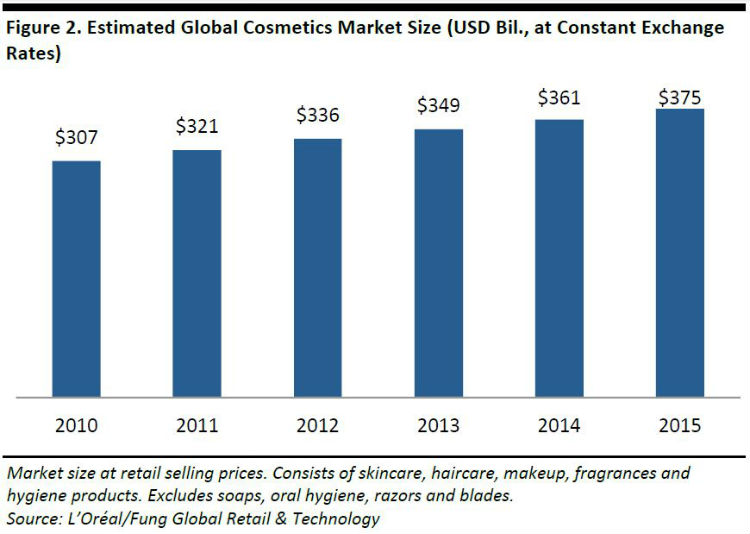

First, we offer some context on the scale of the global beauty market. Despite being a huge, mature category, beauty is still showing strong growth. According to L’Oréal, the global cosmetics market increased in value by 3.9% in 2015, at constant exchange rates. This was up from 3.6% growth in 2014. Based on L’Oréal’s estimated value of the global market at wholesale prices, we estimate that category sales reached $375 billion at retail prices in 2015.

MILLENNIALS SPEND LESS THAN OTHER AGE GROUPS ON BEAUTY

It would be reasonable to assume that younger consumers spend the most on beauty products. But, in fact, data for the US and the UK show that millennials tend to spend less than other age groups do, except for the oldest group (those aged 75 and over).

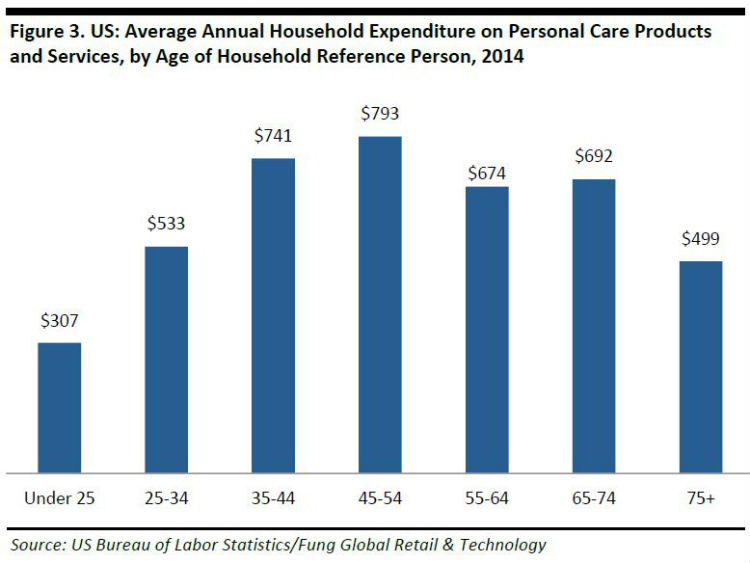

US Per-Household Spending on Personal Care

Below, we show data from the US Bureau of Labor Statistics’ 2014 Consumer Expenditure Survey (latest available), which shows average household expenditure on personal care products and services by age of the head of household. This survey indicates that younger households spend less on personal care products and services than do almost all older households.

It is worth noting that relatively few households are headed by someone younger than 25, as many very young adults are likely to live in households headed by a parent. The general trend is nevertheless indicative.

The average annual expenditure figures above do not make any distinction by gender, but women generally spend more on beauty and personal care products than men do. According Nielsen, in 2014, women accounted for 81% of the dollars spent on branded haircare in the US, and women’s share of category sales in many beauty categories was between 79% and 90%.

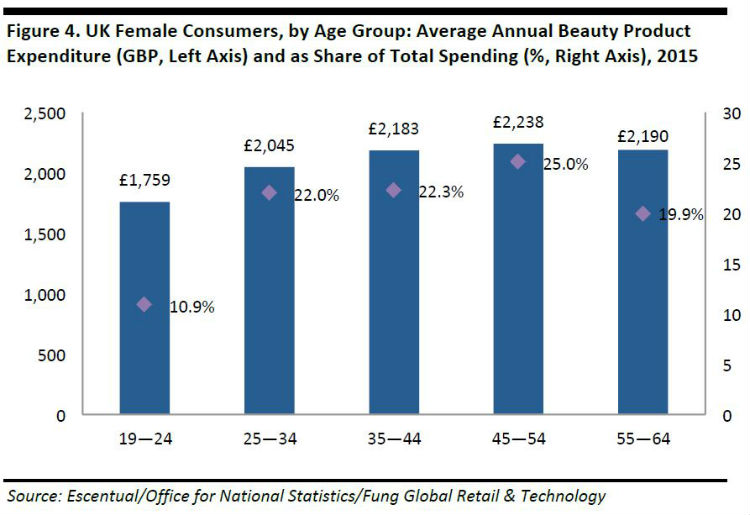

UK Per-Person Spending on Beauty

The pattern of millennials spending less than other age groups is also borne out by data from the UK. According to British online beauty retailer Escentual, in 2015, British women ages 19–24 spent £1,759 (US$2,689) on beauty products, on average, and women ages 25–34 spent £2,045 (US$3,126) on average. Both groups spent less, on average, than did other age groups. Women ages 45–54 spent the most on beauty products, £2,238 (US$3,421).

In total, women ages 19–34 (which broadly matches our definition of millennials) accounted for 32.9% of total UK beauty spending by women ages 19–64. Escentual’s figures exclude women under the age of 19 and over the age of 64, so the spending by age group does not reflect the actual share of spending of the total population. However, we estimate that millennials accounted for approximately one-third of beauty product sales in the UK in 2015.

Why Do Millennials Underspend on Beauty?

One reason millennials tend to underspend other age groups is because younger consumers tend to earn less. Millennials are at the stage of life during which their income is growing at the fastest rate they will experience in their lifetime. Average gross lifetime income peaks between the ages of 55 and 59, according to Euromonitor International. Yet, while millennials’ income may not be as high as of that of older generations, it will climb as they move up the professional ladder.

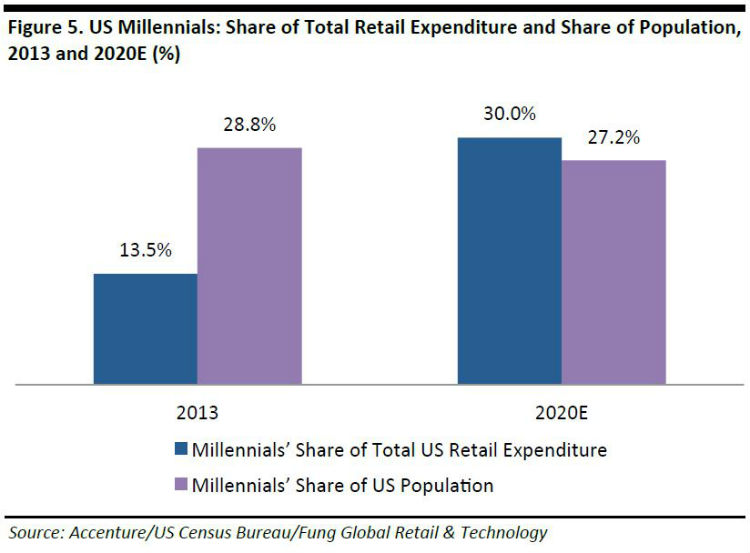

Currently, millennials underindex on retail spending (in all categories, not just in beauty) relative to their share of population, according to data from Accenture and the US Census Bureau. However, by 2020, they will overindex on retail spending and account for 30% of total retail sales in the US, according to Accenture, while accounting for just 27.2% of the population.

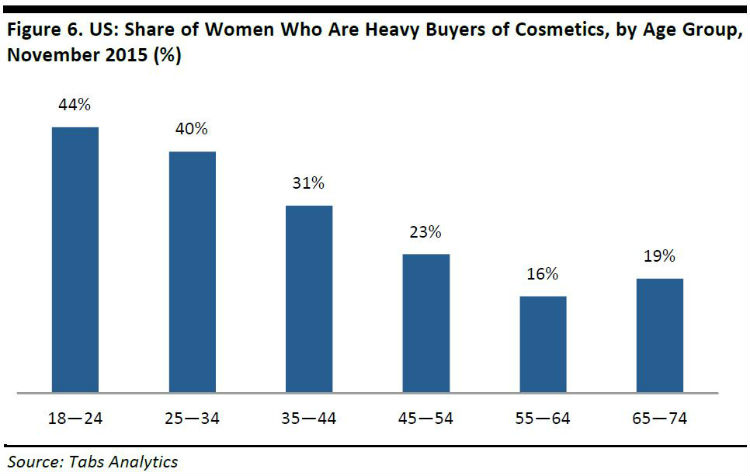

Millennials’ share of total beauty sales may not be as high as older generations’ in dollar terms, but they are more likely to buy more units of beauty products. According to research on US women’s cosmetics buying behavior from Tabs Analytics, in November 2015, consumers ages 18–34 accounted for 47% of all heavy buyers. The survey looked at 19 types of cosmetic products, and classified heavy buyers as those who purchased 10 or more types.

Millennials’ importance to the beauty industry is driven in large part by their spending potential. As they enter their peak earning years, their spending on the category is expected to accelerate. And, in the year ahead, just as millennials are forecast to overindex on retail categories in total, so, too, are they expected to overindex on beauty.

PRICE IS A PURCHASE DRIVER FOR MILLENNIALS

Millennials are more likely to stick to a tighter budget than are older generations. According to a 2015 survey of American women by media and marketing company Meredith, 60% of millennials polled said that price is a purchase driver when buying beauty products, compared to 38% of baby boomers.

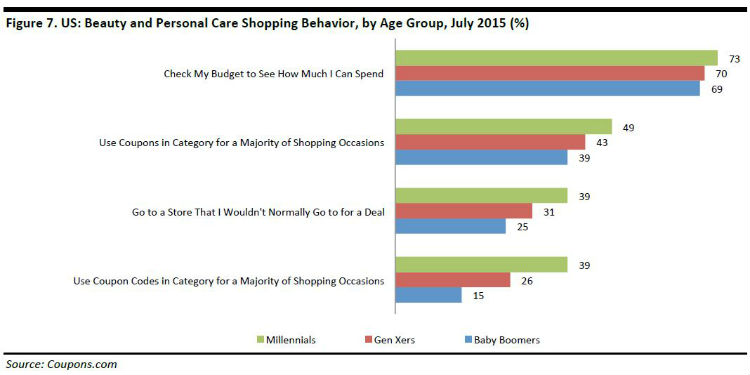

A US survey by Coupons.com similarly showed that millennials are much more likely than Gen Xers and baby boomers to take a frugal attitude to beauty shopping. For instance, some 39% of US millennials say they use coupon codes when buying beauty and personal care products, compared to 26% of Gen Xers and 15% of baby boomers.

In order to redeem coupons and make their relationship with a retailer more personal, millennials are willing to share private information, whereas older generations are more protective of their personal information. Mintel reports that 60% of millennials are willing to provide details about their habits and preferences to marketers so the marketers can understand their customers better.

MILLENNIALS’ CROSS-CHANNEL APPROACH TO BEAUTY SHOPPING

Shopping Behaviors: Millennials Versus Older Generations

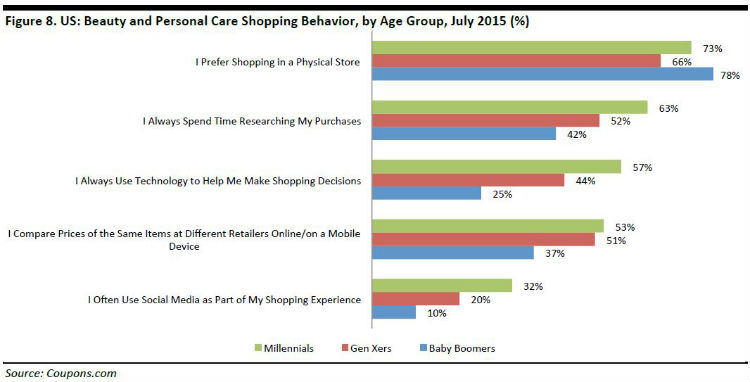

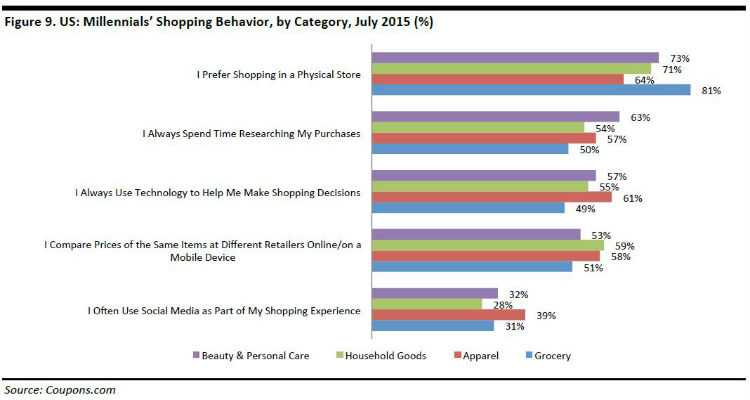

Millennials generally like to use technology when making purchase decisions, and they actively take a cross-channel approach to beauty shopping. Survey data show that millennials are much more likely than older age groups to research their purchases, use technology to help them make shopping decisions and use social media as part of the purchase process. At the same time, a majority of shoppers of all generations say they prefer shopping in stores to shopping online.

Shopping Behaviors: Beauty Versus Other Categories

Another way to view this data is to compare millennials’ behavior when shopping for beauty products to their behavior when shopping for other items. These consumers are more likely to research purchases in the beauty category than in the other categories shown in the graph below—but on measures of digital adoption, such as use of technology or social media, beauty lags apparel.

This could be because more apparel brands than beauty brands have a strong social media presence. According to a 2015 study by Yes Lifecycle Marketing, 98% of apparel brands in the US had a presence on two or more social media channels, while 91% of beauty brands did.

CHANGING BEAUTY TRENDS

According to L’Oréal, in 2015, makeup was the fastest-growing cosmetics category globally for the third year running. The growth was largely influenced by millennials’ interest in taking selfies and sharing them on social media.

The NPD Group notes that the growing trend of focusing on living in the moment comes at the cost of anti-aging skincare. The segment was the fastest-growing cosmetics category in the last decade, but its sales growth is slowing down.

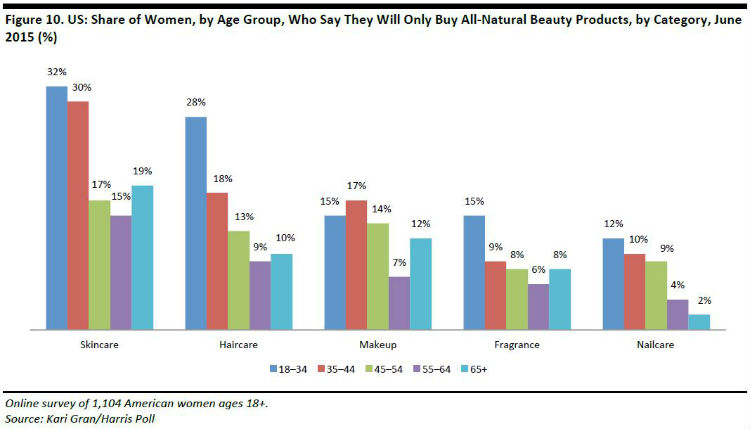

As discussed in our report Millennials and Grocery, millennials are health conscious and often prefer buying organic and natural products when they are available. This demand for natural products is also seen in the beauty category. According to a 2015 survey by natural skincare brand Kari Gran, women ages 18–34 are the most active buyers of all-natural beauty products overall. Makeup was the only category in which the 35–44 age group showed higher interest in buying all-natural products than millennials did.

Kari Gran’s survey also highlighted that millennial women are more likely than older women to purchase more all-natural beauty products in the next two years. Half of the women ages 18–34 who were surveyed said they intend to buy all-natural products in the coming years, a higher share than in other age groups:

- Ages 35–44: 44%

- Ages 45–54: 31%

- Ages 55–64: 34%

- Ages 65+: 30%

According to L’Oréal, millennials value simplicity, and they look at aging in a different way than older consumers do. Perceptions of beauty are changing, and younger generations may not be as concerned about signs of aging on their skin as preceding generations have been.

BEAUTY COMPANIES AND MILLENNIALS

Some of the largest beauty retailers and brands have identified how the industry is being impacted by millennials and, to successfully remain in the game, they are investing in satisfying the needs of this age group.

L’Oréal is the world’s largest beauty company, and its brands include Lancôme, Maybelline New York, NYX Professional MakeUp and Urban Decay. NYX Professional MakeUp, with its 100%-digital communications, has been one of the best-performing brands in the marketplace, with 78% year-over-year growth in 2015. The company says it is one of the most popular cosmetics brands in the US among 15–24-year-olds.

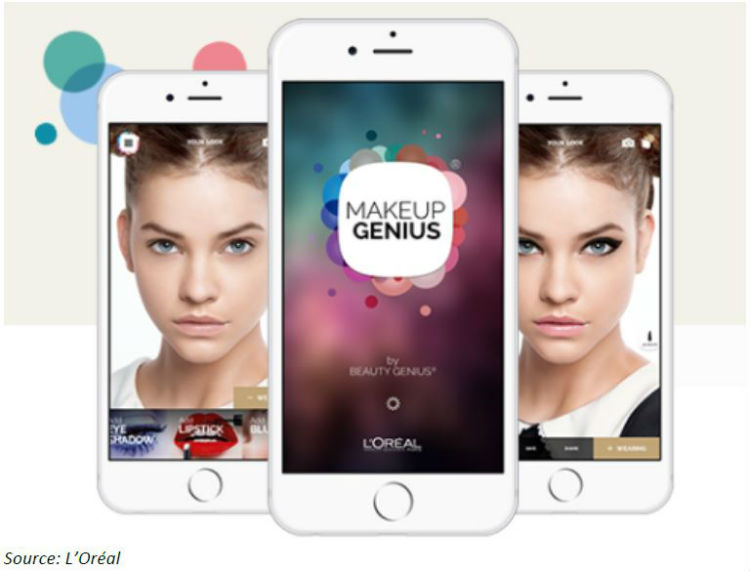

On L’Oréal’s Makeup Genius, a free virtual makeup app that uses face recognition technology, users can virtually try on L’Oréal’s cosmetics using their smart devices. The company says that the app has been downloaded more than 15 million times in 62 countries since it was launched in 2014.

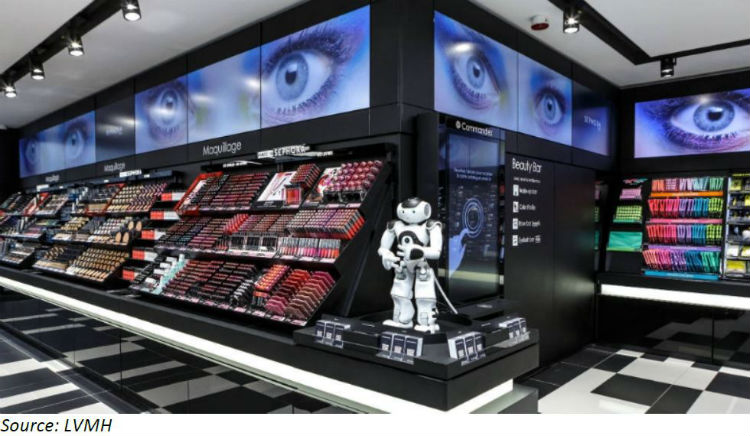

According to an August 2015 study on brand engagement by research company Brand Keys, 94.5% of US 18–34-year-olds found LVMH-owned cosmetics retailer Sephora to be engaging well with millennials. Sephora was the highest-ranked beauty brand/retailer in the study.

To keep up with fast-changing retail and e-commerce trends, the beauty retailer opened its first digital store in Paris in October 2015. The store brings online-style information and experiences into physical retail. It is filled with technology, such as NFC-tagged perfume testers, touch screens and selfie mirrors.

Online, users can exchange beauty tips in Sephora’s Beautytalk peer-to-peer online community. Lithium Technologies, the company that provided the software for Beautytalk, says that members of the community spend twice as much on Sephora products as the average customer does, and so-called superfans spend up to 10 times more than the average customer.

American beauty company Estée Lauder, which is the fourth-largest beauty company in the world, says millennials are one of the largest and most significant forces transforming the beauty industry. Estée Lauder’s brands include Clinique, MAC and Origins. The 70-year-old beauty company has partnered with popular YouTube vloggers such as Chriselle Lim and models such as Kendall Jenner to attract a younger audience.

Ulta Beauty, which is the largest specialty beauty retailer in the US, has seen its net sales grow by double-digits in recent years. E-commerce has been the company’s fastest-growing sales channel in the last five quarters, but represents less than 6% of total sales.

Ulta has merged traditional retail with value-added services and technology. Each of the company’s stores has an in-store salon featuring hair, skin and brow services. Ulta’s iPad and smartphone apps lets users exchange beauty tips and, if they sign up for the Ultamate Rewards loyalty program, they can earn free gifts and vouchers.

HOW BEAUTY RETAILERS CAN WIN WITH MILLENNIALS

Several industry bodies forecast that the beauty sector will continue to flourish in the next decades. Millennials currently spend less than older shoppers do on beauty categories, but as their purchasing power rises, they will overindex on retail spending, including, we expect, on beauty categories. As a result, it is increasingly vital for companies and brands to target their products and marketing to this demographic in the medium term.

When targeting beauty products to millennials, it is important to remember several things: they like doing research online, but still prefer to buy beauty products in-store; they value experiential retail environments; they like natural and ethical cosmetics; and price is often a key purchase driver for them when buying beauty products.

Sephora and Ulta are good examples of beauty retailers that have successfully attracted millennials by introducing the kinds of value-added services, in-store and online, that millennials appreciate.

The beauty industry could witness its most significant transformation in the coming decade, largely influenced by millennials, who will be the demographic spending the most on beauty. The generation wants the same beauty shopping experience in-store and online, the chance to try and discover new products, personalized services, and alternative product options that match their lifestyle.