US Plus-Size Apparel: Reviewing the $46 Billion Opportunity

KEY POINTS

The women’s plus-size apparel market has been underserved historically, but recent trends show that the segment has been growing at a faster rate than the US apparel market overall. Above-average growth in plus-size fashion will continue to be propelled by increased supply, changing consumer demographics and psychographics, and higher obesity rates through 2021.

- Global access and transparency, the democratization of retail (allowing smaller startups to compete), and social media are changing the plus-size market.

- Younger plus-size shoppers are vocal, particularly on social media, about demanding fashion that fits; they do not want to be marginalized because of their body shape. Savvy retailers are beginning to address these shoppers as well as older plus-size shoppers.

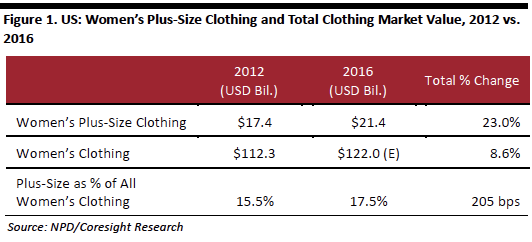

- American consumers spent $21.4 billion on women’s plus-size clothing in 2016, according to The NPD Group, equivalent to about 17.5% of total women’s apparel sales, we estimate. Yet the obesity rate among American women ages 20 and over is 38%, according to data from the US Centers for Disease Control and Prevention.

- If the 38% of American women who are classified as obese were to spend the same amount on clothing as the average American woman, the plus-size market would be valued at $46.4 billion, we estimate.

Introduction

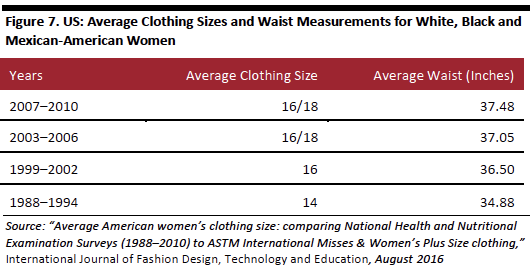

The average American woman wears a size 16–18, according to a recent study, and women’s plus-size clothing sales have been growing faster than total apparel sales in the US, according to market research firm The NPD Group (NPD). The firm forecasts that the plus-size market will grow at an average of 4% annually from 2015 to 2020. This compares with Euromonitor International’s forecast of 2.1% average annual growth for total apparel sales over the same period. The gap between these growth forecasts suggests that plus sizes present a bright area of opportunity within apparel retail and especially in fashion apparel.

To better serve this growing apparel segment, many department stores, midmarket retailers and e-commerce sites are redefining and/or expanding their plus-size ranges, offering more stylish options in more sizes. Women who wear plus sizes have been vocal in recent years, particularly on social media, about their desire to buy fashionable, trendy clothes in the same fabrics and styles as offered in so-called straight sizes. Social media influencers and the rise of the body positivity movement have contributed to shifting cultural attitudes toward those who wear plus sizes, and retailers and designers that have prioritized their plus-size offerings have seen success in recent years.

In this report, we review data on plus-size sales in the US and pull together consumer survey data from Prosper Insights & Analytics, NPD and others to gauge the percentage of American women who shop for plus-size clothing. We then examine what retailers and brands are doing to better serve this market and the opportunities it presents. We provide data on obesity levels by age and ethnicity in the final section of the report.

The Plus-Size Women’s Clothing Market in the US

Market Value

The women’s plus-size market has been growing faster than the apparel market overall in the US in recent years. According to the latest available data from NPD, US retailers sold $21.4 billion worth of women’s plus-size clothing in 2016, and we estimate that plus-size sales represented around 17.5% of all women’s clothing sales that year. Between 2012 and 2016, US sales of women’s plus-size clothing grew by a total of 23%, according to NPD data.

In 2016 alone, US sales of women’s plus-size apparel rose by 6% year over year, to $21.4 billion, according to NPD. According to the US Bureau of Economic Analysis, the total women’s and girls’ clothing market grew by just 1.3% that year.

Market Prospects

NPD forecasts that the US women’s plus-size apparel market will grow at an average of 4% annually from 2015 to 2020, from $20 billion to $24 billion. The total clothing market is forecast to grow more slowly, at an average annual rate of 2.1% over the same five-year period, according to Euromonitor International. That gap indicates that plus sizes present a bright area of opportunity within apparel retail.

Some 38% of American women are classified as obese, according to 2014 data (latest available) from the US Centers for Disease Control and Prevention (CDC). Yet the plus-size market accounted for just 17.5% of the total women’s clothing market in 2016, we estimate. If the 38% of women classified as obese were to spend the same amount on clothing as the average woman, the plus-size market would be valued at $46.4 billion (based on estimated 2016 womenswear spending of $122 billion). However, we note that obesity is an indicator of plus-size apparel demand, not a requisite.

As we discuss later, US obesity rates are forecast to climb in the coming years, suggesting a double opportunity for plus-size brands and retailers:

- Growing average apparel spend per plus-size consumer to close the gap with the typical womenswear shopper.

- Serving a consumer segment that is growing in scale as obesity rates increase.

Percentage of American Women Who Shop for Plus-Size Clothing

To get an idea of how many American women buy plus-size apparel, we reviewed consumer survey data from Prosper Insights & Analytics, NPD and others. There are two ways of estimating the plus-size market: gauging the number of shoppers who buy from clothing ranges that include larger sizes (usually defined as size 14 and above) and gauging the number who buy from ranges specifically branded as “plus size.”

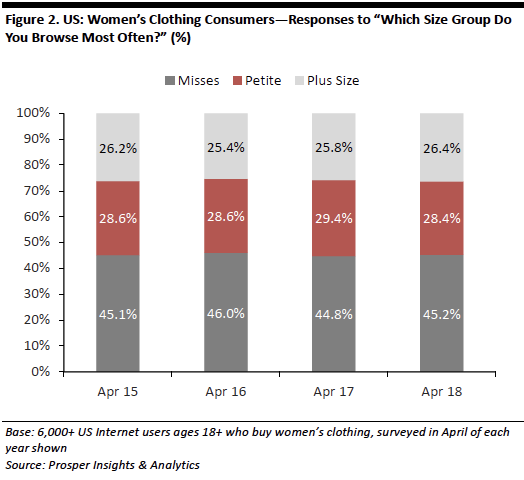

According to survey data from Prosper, about a quarter of American women have browsed plus-size clothing in each of the past four years, and that percentage has remained fairly steady year to year. The firm’s most recent survey, conducted in April 2018, solicited information from more than 6,000 US Internet users ages 18 and over who buy women’s clothing. One survey question asked respondents which size group of women’s clothing they browse most often. The question did not ask respondents if they browse dedicated plus-size brands, which means that the data should represent total plus-size shoppers, including those who browse sizes 14 and higher in regular (not specifically plus-size) clothing ranges.

While the Prosper survey found that more than 25% of American women have browsed plus-size clothing in recent years, data from the CDC indicate that the obesity rate for American women ages 20 and over is 38%. Although there is no direct relationship between clothing sizes and obesity rates, that percentage difference suggests that women who wear plus sizes underindex in apparel spending relative to their share of the US female population.

Figures from a yearlong project that HanesBrands conducted with “curvy” women (the consumers the company worked with prefer the term “curvy” to “plus-size”) provide further support to the notion that there is a gap between the percentage of American women buying plus-size clothing and plus-size women’s share of the population: the company found that 35% of women are considered plus-size by age 25 and 44% are considered plus-size by age 33.

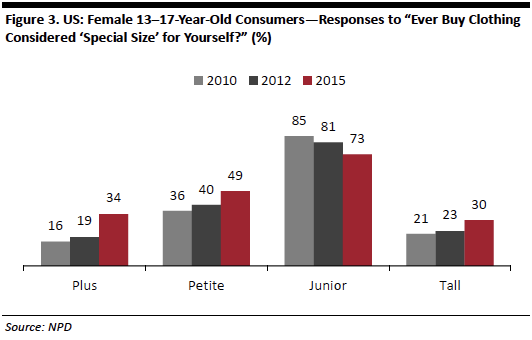

The teen plus-size market has also been growing in the US, and NPD reported that the proportion of US female teenagers buying plus-size ranges doubled from 16% to 34% between 2010 and 2015. The firm surveyed 13–17-year-olds in 2010, 2012 and 2015, asking whether they ever buy clothing considered “special size” for themselves. The phrasing of the question suggests that respondents may shop for ranges that are specifically marketed as plus-size lines.

The Opportunity

A study published in the International Journal of Fashion Design, Technology and Education in August 2016 found that the average American woman “wears between a Misses size 16–18, which corresponds to a Women’s Plus size 20W, with greater distinctions found when considering race and ethnicity.” Sizing is inconsistent among brands, so it is somewhat difficult to gauge what constitutes a typical range in plus sizes: some companies carry plus sizes in a OX–3X range, while others offer sizes up to 7X. Many others carry plus sizes in a 14–26 or 14–34 range, referring to subsets of these as either Misses, Women’s or Plus sizes. Despite the variances, most in the industry seem to refer to sizes 14 and higher as plus sizes.

In recent years, many plus-size consumers have complained to fashion reporters and on social media that the clothes offered in their size are unfashionable and too limited in range. Some have also said online that sales associates have treated them poorly in stores. In addition, department stores and other retailers have traditionally located their plus-size clothing ranges at the back of stores or on higher floors, and have devoted much less selling space to plus-size apparel than to straight-size apparel. In its July 2017 IPO filings, plus-size apparel retailer Torrid estimated that there is one dedicated plus-size store for every 30 specialty apparel stores, meaning that there is one plus-size store for every 34,000 plus-size women versus one specialty store for every 600 women. These data points underscore just how underserved the plus-size market has been.

The fashion industry, too, has long been accused of treating plus-size shoppers as an afterthought because of designers’ perceptions that clothes do not look as flattering on plus-size people and that offering plus sizes negatively affects a brand’s image. Industry perceptions that plus-size women were less willing to spend on expensive apparel have also long bubbled under the surface—the thinking was that plus-size women might lose weight, and that they would not want to spend much on clothing that would fit them only for a short time. The bottom line is that this consumer segment has been left greatly wanting in terms of fashion. E-commerce, however, has been a game changer.

Plus-size shoppers can often find a greater range of offerings in their size when shopping online. However, a recent survey conducted by Dia&Co, a clothing subscription service for women who wear sizes 14 and above, found that the majority of plus-size shoppers are still looking for better options. The January 2017 survey polled 1,500 American women ages 18 and up who reported wearing size 14 or higher and also self-identified as plus-size. The survey found that the main reason respondents believe designers do not include larger sizes in their lines is that those sizes do not fit the designers’ image. Other key findings of the survey include:

- • Some 72% of respondents do not believe that fashion designers create their designs with the average American woman in mind.

- • Approximately 78% would be willing to spend more money on clothing if more designers offered plus-size options.

- • Some 68% are interested in participating in fashion trends, but 67% feel that there are not as many fashionable clothing options available in their size as they would like.

- • About 93% believe it is important for designers to create clothing lines that are size-inclusive, and 97% would think more positively of a designer who included plus-size clothing in a line.

- • Some 97% believe it is important for designers to include plus-size models in runway shows.

- • About 80% would be likely to purchase an item from their favorite designer if that designer began to offer plus-size clothing.

Despite plus-size shoppers’ continued disappointment over the options available to them, things are beginning to shift, both culturally and in retail. Social media influencers and the rise of the body positivity movement have contributed to changing attitudes toward those who wear plus sizes, and retailers, seeking pockets of growth in an apparel market where sales growth has been slowing, are beginning to catch up and respond to these historically underserved shoppers. Today, many retailers and brands are serving plus-size shoppers more proactively, offering them more fashionable choices in stores, online and through other options such as rental services.

Plus-Size Women’s Clothing: Retailers and Brands

Lane Bryant and Avenue are well-established, leading specialized plus-size retailers in the US. Lane Bryant operates more than 800 full-line and outlet stores in 48 states, targeting women ages 30–45 who wear plus sizes. In a December 2017 online survey of more than 10,000 North American consumers conducted by customer experience firm Market Force, Lane Bryant ranked as consumers’ second-favorite retailer after Nordstrom. Avenue operates approximately 300 stores offering clothing in sizes 14–32.

Privately held Ashley Stewart returned to profitability after twice filing for bankruptcy and now operates 89 stores in the US as well as a thriving e-commerce business. Ashley Stewart opened a new flagship in Newark, New Jersey, in 2017. The store offers apparel and lifestyle merchandise, including intimates, footwear and accessories, and features a social media alcove and a dressing room with sofas and ottomans for lounging. The format testifies to the company’s strategy of offering plus-size shoppers the same dignity, service and range of merchandise as those who wear other sizes are accustomed to receiving.

Newer retailers of plus-size clothing, such as Torrid (founded in 2001) and Eloquii (founded in 2011), have emerged to serve younger and more style-conscious shoppers. Torrid is growing fast: the company grew sales by 30% year over year in the first quarter of fiscal 2017 (ended April 29, 2017), driven by comparable sales growth of 12% and a 29% increase in space. (We discuss Torrid in our Deep Dive: Reviewing 2017’s Retail IPOs report.) Eloquii, originally part of The Limited, relaunched in 2014 as an online-only retailer focused on trend-driven fashion with a fast-fashion element.

Eloquii was one of the first retailers to respond to demand for on-trend plus-size fashions, offering sequined pencil skirts and bare-midriff tops in plus sizes. The fact that these products have been among the brand’s best sellers reflects consumer demand for plus-size apparel that is stylish and fashionable. Eloquii also collaborated with Reese Witherspoon’s lifestyle brand, Draper James, on a limited-edition plus-size line in March 2018. Eloquii has expanded from an online-only operation into brick-and-mortar, and now operates four physical stores. The Eloquii brand is also available to rent at RenttheRunway.com.

A number of other retailers, such as Kohl’s, Walmart and JCPenney, are reviving or expanding their plus-size offerings. At New York Fashion Week in September 2017, Lauren Conrad launched a limited-edition runway collection for Kohl’s that was her first LC Lauren Conrad brand collection to include items in plus sizes (ranging from 0X to 3X). The brand will reportedly add plus sizes permanently to future collections. In March 2018, Walmart introduced a new plus-size line called Terra & Sky in stores and online, and the company has partnered with department store Lord & Taylor to bring premium brands—including plus-size ranges—to a “store within a store” on Walmart’s new website.

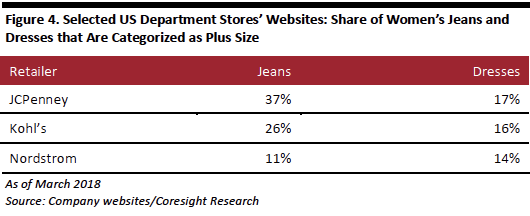

JCPenney is among the US department stores with the strongest plus-size offering, and management has stated that the company seeks to become a destination for plus-size shoppers. The retailer has established large plus-size sales sections in stores and, in March 2017, the company’s chief merchant told Glamour magazine that “in 2016, sales for the plus-size area were better than the rest of women’s apparel combined.” Our recent research on women’s jeans and dress ranges offered on various department stores’ websites found that JCPenney was the retailer that offered the highest percentage of its women’s jeans in plus sizes, with some 37% of jeans sold on its site available in plus sizes.

Nonspecialized mass-market retailers such as Forever 21 and Target are also reported to be popular destinations for plus-size shoppers. Forever 21 faced criticism for featuring “average size” models and too small a range of sizes in its Forever 21 Plus line when it first launched its plus-size offering, but the retailer appeared to address the criticisms before relaunching the brand in early 2017. Target has offered plus-size clothing under the Ava & Viv brand since 2015. Online retailer ASOS, which targets shoppers in their 20s, is among the newer e-commerce companies that are seeing significant numbers of plus-size shoppers.

In the plus-size activewear and sportswear segment, Nike launched a plus-size range in March 2017 and plus-size shoppers looking for workout wear, activewear and swimware can also now shop for those items at retailers such as Old Navy, Lane Bryant, REI, Athleta, Nordstrom, Amazon and digital native Fabletics (now with 24 stores and growing).

Amazon is addressing plus-size demand in its growing collection of apparel private labels, too. Many of its womenswear brands—such as Arabella (casualwear), Coastal Blue (swimwear), Core 10 (sportswear) and Daily Ritual (casualwear)—include plus-size products, and it offers a dedicated women’s and men’s plus-size outerwear brand called The Plus Project.

On the designer front, website 11 Honoré launched in August 2017 carrying apparel in sizes 10–20 from designers such as Prabal Gurung, Zac Posen and Monique Lhuillier. Premium-positioned department stores such as Bloomingdale’s, Neiman Marcus and Saks Fifth Avenue have added modest in-store plus-size offerings to the larger selections they already offered online.

Lingerie is one of the fastest-growing plus-size categories, according to IBISWorld research cited by Bloomberg in September 2017. HanesBrands launched two new plus-size lingerie lines in 2017, and JCPenney, Lane Bryant and PVH Corp. have also added to their plus-size intimates offerings. Cacique is a formidable plus-size intimates brand exclusively available at Lane Bryant; it accounts for approximately 40% of Lane Bryant’s sales. At an industry conference earlier this year, Ascena Retail Group CEO David Jaffe spoke of wholesale distribution as an opportunity for Cacique (Ascena is the parent company of Lane Bryant). He noted that Ascena might also offer the collection through its other apparel brands. PVH Corp. bought e-commerce lingerie startup True & Co. in 2017 and, according to Bloomberg, plus sizes account for 56% of True & Co.’s sales.

New business models such as fashion rental, led by Gwynnie Bee in the plus-size segment, and personal styling subscription services, such as Stitch Fix, are also offering fashion-conscious plus-size shoppers greater choice online. Gwynnie Bee offers women’s plus-size fashion rentals by online subscription, targeting professional women ages 28–45. Subscribers can rent items in sizes 10–32 from more than 190 brands. Since 2012, Gwynnie Bee has increased its sales by 10%–15% annually, according to an October 2016 article in Fast Company, becoming one of the largest purchasers in plus-size fashion. (We discuss apparel rental, including Gwynnie Bee, in our Deep Dive: Millennial Lifestyles Drive Growth in Apparel Rental report.) Online styling service Stitch Fix extended its offering to include plus sizes in early 2017 and now offers items in sizes 14W–24W and 1X–3X. Stitch Fix customers receive a curated selection of items to try on at home, and then keep only those they want to buy.

US Obesity Rates and Average Clothing Sizes

According to the latest available data from the CDC, the rate of obesity among American women ages 20 and over was 38% in 2014. The CDC determines obesity by using weight and height to calculate a body mass index, or BMI, number. Adults with BMIs of 30 or higher are considered obese. The CDC says that “for most people, [BMI] correlates with their amount of body fat.”

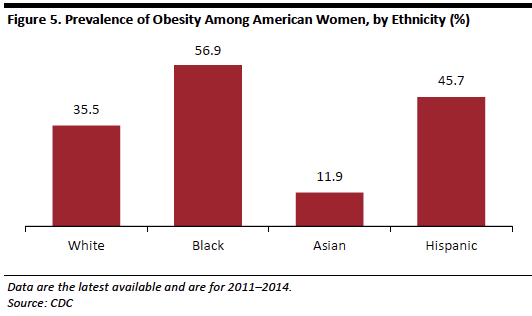

Non-Hispanic black women have the highest age-adjusted rates of obesity among American women, followed by Hispanic women, non-Hispanic white women and Asian women, according to the CDC.

Euromonitor International pegs the US obesity rate (for both men and women) even higher, at 44% in 2016 among Americans ages 15 and older, making the US the nation with the highest obesity rate in the world. Euromonitor forecasts that this rate will approach 50% by 2021.

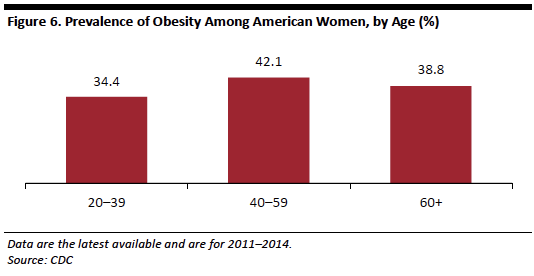

CDC data show that obesity rates in the US are higher among middle-age women and older women than among younger women.

Among American women, average clothing size and waist diameter have increased over the past few decades.

Key Takeaways

The average American woman now wears a size 16–18 and CDC data indicate that the rate of obesity among American women is 38%. These data points indicate that the plus-size apparel market is potentially worth $46.4 billion, assuming women classified as obese spend the same amount on clothing as the average woman and based on the total womenswear market size in 2016. If the US obesity rate increases to 50% by 2021, as Euromonitor forecasts, the plus-size market will represent a $61.0 billion opportunity (again, based on the 2016 total womenswear market size; at a 2021 market size, the opportunity will be greater still).

However, consumer surveys indicate that only about 25% of American women browse plus-size clothing, suggesting that women who wear plus sizes underspend on apparel relative to their proportion of the US population. This is likely due, in part, to consumers’ dissatisfaction with the range of choices provided to them, as many women who wear plus sizes feel that clothing in their size is not trendy or fashionable.

Nevertheless, plus-size apparel sales have been growing faster than apparel sales overall in recent years, and a number of retailers have revamped or expanded their plus-size offerings in order to better serve this growing market segment and take advantage of the opportunity it presents. A younger, more inclusive generation expects to find fashion and style in plus-size assortments, and retailers and brands that respond to this demand are highly likely to succeed with plus-size customers.