The UK Organic and Fairtrade Markets: Strong Demand Reflects Buoyant Consumer Spending

KEY POINTS

UK organic food sales are growing fast. Meanwhile, the Fairtrade category—which guarantees a fair price and extra community funds to farmers—has returned to positive growth.

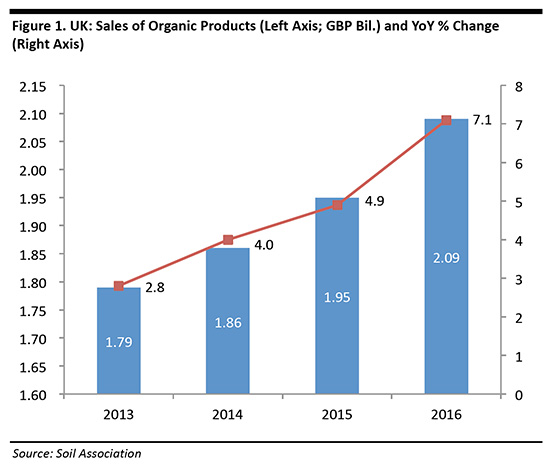

- In February, the UK’s biggest grocery retailer, Tesco, said that its organic sales had grown by a striking 15% over the past 12 months. And according to the Soil Association, in 2016, total UK organic sales rose by 7.1%, to £2.0 billion, representing an acceleration of the sales growth seen in the preceding two years.

- According to the Fairtrade Foundation, UK sales of certified Fairtrade products grew by 2%, to £1.64 billion, in 2016, following two years of declines.

- Wider availability, consumer interest in wellness and lower food prices overall appear to have driven the recent growth in organics.

- The growing demand for organic and Fairtrade products reflects the consumer miniboom seen in 2016, when shoppers continued to spend in spite of many economists’ warnings about the impact of the Brexit vote.

- The organic and Fairtrade markets may see growth rates soften in 2017 as rising inflation eats into consumers’ discretionary budgets. However, younger consumers’ interest in wellness and healthy eating are likely to support the organic market over the medium term.

Explaining the Organic Boom

Sales of organic products are booming in the UK and sales of certified Fairtrade products have returned to growth. This is despite pessimistic forecasts from numerous economists who had predicted a sharp retrenchment in consumer spending as a result of the country’s decision to leave the EU.

In this report, we wrap up some key metrics on the organic and Fairtrade markets, discuss what the demand for these products tells us about the state of the British consumer, and offer some thoughts on the outlook for both categories.

Tesco Leads the Organic Charge

In February, Tesco said that its organic sales had grown by 15% over the past 12 months. Demand grew not only for the traditional organic fruit and vegetables category, but also for organic fish, dairy and general grocery items. The 15% increase was far ahead of Tesco’s overall UK sales growth of 0.7% in the first half of its current fiscal year and its 1.4% growth in its third quarter (latest).

Tesco reported the following:

- Sales of organic fruit and vegetables—including apples, bananas, carrots, salads and root vegetables—were up nearly 17%.

- Sales of organic grocery items such as olive oil, pasta and cooking sauces climbed almost 16%.

- Organic fresh meat sales, including eggs, were up 13%.

- Sales of organic chilled foods, such as milk, hummus and cooked meats, rose by nearly 13%.

Following Tesco’s announcement, upscale supermarket chain Waitrose said that its own organic sales are growing at around 5% year over year. We note that Waitrose is likely starting from a stronger base of organic sales than Tesco is, given its positioning.

The market has been growing solidly: according to the Soil Association, a UK charity that certifies organic producers, total UK sales of organics rose by a strong 7.1% in 2016, bringing the market for organic food and nonfood products to £2.09 billion. Growth in 2016 marked an acceleration from previous years, as we chart below.

UK marketing body the Organic Trade Board says that global organic sales total $81 billion annually (£60 billion at 2016 exchange rates), meaning the UK represents around 3.5% of global sales. Some 49% of certified UK organic suppliers export products, and those exports are estimated to be worth £250 million.

Fair-Trade Sales Grow Strongly, Too

Meanwhile, UK sales of certified Fairtrade products grew by 2% in value, to £1.64 billion, in 2016, according to new data from the Fairtrade Foundation. Unlike the trend of constant growth seen in the organics market over the past several years, this marked a return to growth for the Fairtrade market following two years of declines. Fair-trade certification guarantees that those producing foods receive a minimum price and additional payments for use on community projects.

- Fair-trade coffee sales in the UK rose by 8% in 2016, helped by discounter Lidl, which reintroduced Fairtrade coffee and tea products to its range.

- The volume of Fairtrade bananas sold in the UK climbed by 6% in 2016, boosted by Tesco offering them for the first time.

More recently, grocery retailer The Co-op announced that all the cocoa used in its own-brand products would be Fairtrade certified; the company said this will impact 200 product lines and add £7 million in annual sales to the Fairtrade market. The Co-op has used 100% Fairtrade ingredients in its chocolate bars since 2002, and a number of other retailers, including Sainsbury’s and Waitrose, have switched to 100% fair trade-certified bananas.

Organic and Fair-Trade Categories Capture Approximately 4% of Food Sales

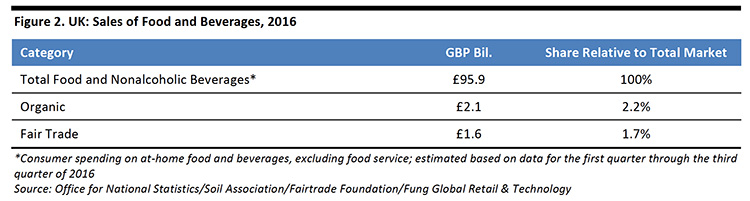

Below, we place the figures for organic and Fairtrade sales in the context of total UK consumer spending on at-home food and beverages. Sales of organic and Fairtrade products equated to just under 4% of the at-home food market in 2016, we estimate.

Note that the above data for organic sales includes a small element (approximately 3%) of beauty product sales and also includes sales to food-service providers, so organics’ share of at-home food spending is slightly overstated. The category’s share of all food and drink sales was 1.5% in 2015, according to the Soil Association.

Organics More Affordable in a Deflationary Grocery Market

We see three factors conspiring to drive up sales of organic foods: wider availability, greater consumer interest in wellness and food quality, and falling grocery prices.

1. Wider Availability

A wider range of organics are now available from mass-market grocery retailers, and supermarkets account for fully 69% of total UK organic sales, according to the Organic Trade Board. Tesco is working with that organization to make organics more visible in its stores and to help communicate the benefits of organic products through various campaigns. The discount grocers have contributed, too. Aldi launched a new organic produce range in 2014, and it now offers products such as organic baby foods.

Increased availability is not just about more stores offering organics, however. It also involves greater offerings in nontraditional, processed, “center-store” grocery categories ranging from baby foods to chocolate to protein supplements. Away from retail, McDonald’s is among the mass-market food-service names that are using more organic ingredients.

2. Greater Consumer Interest in Wellness and Food Quality

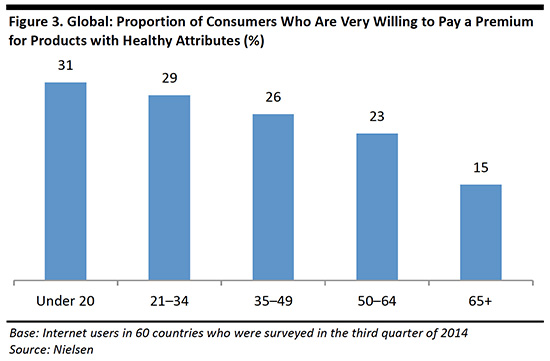

Consumers, especially younger ones, appear to be more concerned than ever before with wellness and eating well. Millennials—broadly those born between 1980 and 2000—are entering their peak spending years, and so will have growing influence on grocery sales in the years ahead, including bolstering demand for organics.

This consumer interest has been manifested in multiple food trends, such as superfoods and wheat-free diets, and it benefits the organic market, too. According to a number of studies aggregated in a 2016 research paper by the French National Institute of Agronomic Research, health concerns were the top reason consumers cited for buying organic foods.

The importance consumers attach to wellness perhaps explains why organic sales have grown consistently, while sales of Fairtrade products—where there is no wellness claim—have been patchy.

- For more on millennials’ food preferences, see our report How Millennials Disrupt Industries: Millennials and Grocery.

3. Falling Grocery Prices

British shoppers have enjoyed a run of deflation in food prices that has left them with some extra cash with which to trade up on quality. Deflation has been driven by price competition arising from the growth of discounters Aldi and Lidl. But the discounters’ popularity does not mean that shoppers have been trading down in quality: these retailers have grown in part because they have introduced more premium lines, including organics, in their stores.

British Consumer Resilience

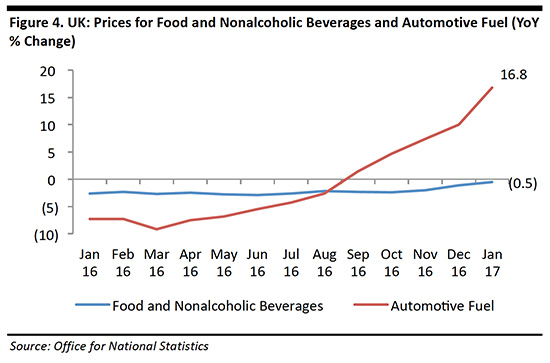

A robust UK consumer economy provides the backdrop for the abovementioned trends. British shoppers have benefited from deflation in automotive fuel prices as well as in grocery prices. Meanwhile, wages have been rising solidly, helped by a strong job market, and record-low interest rates have encouraged many Brits to borrow in order to spend.

Despite widespread warnings from economists that consumer demand would falter as a result of the UK’s June 2016 vote to leave the EU, spending on retail and service categories has been strong. British consumers proved the economists wrong, which was entirely logical, as it was highly unlikely that consumers would choose to leave the EU and then suddenly realize they must cut their spending. As a result, we saw a consumer miniboom in 2016, culminating in the strongest Christmas retail sales in more than a quarter of a century, according to data from the Office for National Statistics.

This year, we expect total consumer spending growth to soften a little, principally because rising oil costs are driving up automotive fuel prices. The depreciation of the British pound is also contributing to rising fuel prices.

The effects of the weaker pound can also be seen in the easing of food-price deflation illustrated in the graph above. Nevertheless, we expect very strong price competition to keep a cap on inflation in key retail categories this year: we estimate that food and beverage price inflation will average around 1%–2% across 2017, and that it will be weighted toward the second half of the year, when price increases could peak at approximately 2.0%–2.5%.

The higher penetration of discounters Aldi and Lidl is a main factor underpinning our expectations of low inflation. These retailers have more than tripled their aggregate UK market share over the last decade and UK shoppers have become accustomed to low (and falling) grocery prices. Nondiscount retailers such as Tesco, Sainsbury’s and Asda have been forced to lower their prices in order to stem their loss of share to the discounters, and we think these retailers will be very reluctant to risk their nascent top-line recoveries by performing pricing U-turns.

- For more on the prospects for retail sectors in 2017, please see our report UK Consumer Outlook 2017—Will the Perpetually Deferred Downturn Materialize?

Outlook

Higher inflation, especially in fuel, could well soften growth rates for the organic and Fairtrade markets this year. But both markets will also gain from more widespread retailer adoption, including at discounters, and from initiatives such as the The Co-op’s move to 100% Fairtrade cocoa.

More importantly, we see underlying trends benefiting the organic market: a wealth of indicators suggest that consumers are attaching greater importance to wellness and the quality of the food they eat. Younger age groups are driving these trends, and these groups’ spending power is increasing. While these preferences are likely to provide little boost to the Fairtrade category, they are apt to strengthen organic sales in the medium term.