Quick Take: The Boom in Marketplace Platforms

KEY POINTS

In this report, we review the different types of marketplace platforms.

- Global marketplace platform provider revenues are expected to more than double from $18.7 billion in 2017 to $40.1 billion in 2022, driven by the sharing economy.

- Marketplaces are about much more than just selling products. Portals serve demand among consumers for resale and rental of products, as well as for finding and booking services.

- Service industries, especially those purchased by consumers, such as local restaurants and hair salons, have traditionally been fragmented. Marketplaces aggregate these providers, making it much easier for shoppers to find, compare and book services.

- We think the ease that these platforms bring has been one reason for strong growth in spending on discretionary services in the US in recent years: it is now as easy to buy services as it has long been to buy products.

Introduction

When one hears online marketplaces, immediately platform giants Amazon, eBay or Alibaba spring to mind. However, online marketplaces are about much more than just selling products. Globally and in the US, we have seen a boom in marketplaces serving specialized demands, focused on niche categories or providing platforms for trading services rather than products.

In one of our earlier reports, Deep Dive: Online Marketplaces Disrupting Retail, we examined the top business-to-business (B2B) and business-to-consumer (B2C) marketplaces in the world. In this quick take, we explore the different types of marketplaces and showcase examples of marketplaces primarily in the US and some emerging platforms from other regions.

Virtual Marketplaces: Offering a Wide Array of Choices

Businesses and individuals can sell online, either directly through their own e-commerce website or on a marketplace platform, such as Amazon or eBay. Products as well as services can be marketed online through either of these methods, and revenues from the marketplace model are expected to double between 2017 and 2022. Juniper Research forecasts that global marketplace platform provider revenues will grow from $18.7 billion in 2017 to $40.1 billion in 2022, driven by the sharing economy. The Americas are expected to contribute some 57.2% of that 2022 total.

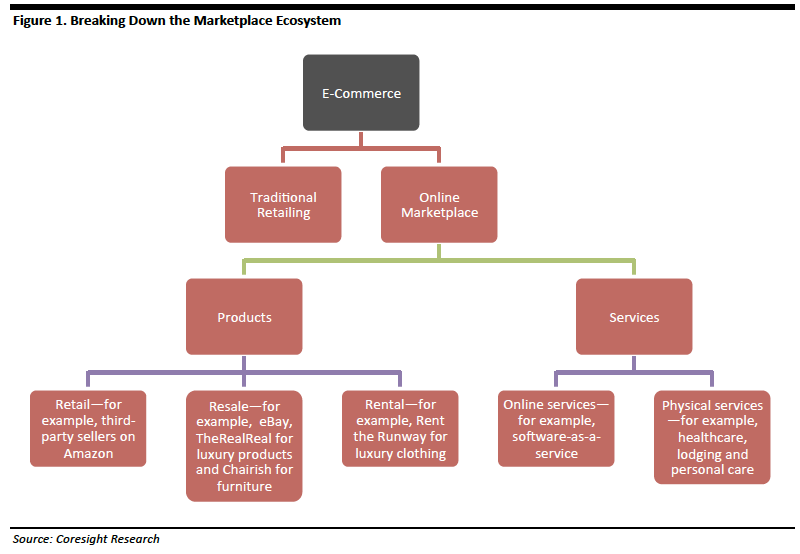

Below, we show how the marketplace ecosystem can be broken down into segments.

This is not an exhaustive list and innovators are constantly inventing new ways of product and service delivery. Marketplace platforms make money by charging sellers listing fees, membership fees or a commission on transactions. Before we examine the different types of marketplaces, we outline some of the broad trends we have seen in their evolution: vertical marketplaces, local marketplaces and providers of ancillary services.

Vertical marketplaces: Vertical platforms that present curated products and services from sellers within specific categories are seeing growth. More recently, hyper-vertical platforms, which include niche markets within niche markets, are sprouting. For example, Witchsy claims to be “a marketplace for artists created by artists.” The platform allows artists freedom to sell quirky and dark-humored merchandise which may otherwise fall outside selling guidelines of marketplaces such as Etsy or Amazon.

Local marketplaces: Marketplace leaders, such as Amazon, may have a global stronghold, but local marketplaces tend to stay in the lead in many markets, such as Flipkart in India and Alibaba in China.

The evolution of ancillary services to support existing sharing economy marketplaces: The growth in rental marketplaces, such as Airbnb, has prompted an increase in problems faced by buyers and sellers which other startups have seized as an opportunity for a viable business. For example, UK-based Guardhog provides insurance for sharing economy platform members.

Online Marketplaces for Products

Product marketplaces involve the actual exchange of a physical product for money. The product can be either delivered to the buyer or picked up by the buyer from a mutually-agreed-on location. Product marketplaces involve three key types of transactions: 1) the retail of new products; 2) the resale of used products; and 3) the rental of products for a limited time use.

1) Retail Marketplaces

Retail marketplace platforms bring together sellers of products alongside the platforms’ own brands. The platform simply functions as a virtual marketplace for third-party sellers to sell their products. Third-party sellers include large retailers and brands as well as individuals and retailers selling multiple brands through their virtual shopfronts.

Convenience in purchasing, access to a large market of buyers and sellers and the ability to compare prices online are some of the key factors driving the surge in retail marketplace platforms.

Popular Platforms

- Amazon, a pioneer in the retail marketplace segment, has facilitated trade across the globe.

- Apart from general merchandise marketplace platforms, such as Amazon and eBay, marketplaces for specialist or niche products are quickly growing. US-headquartered Etsy provides a global platform for self-employed jewelry and furniture makers, artists and designers to sell products made by them.

- Similarly, DaWanda from Germany and BeBello from Hong Kong provide platforms for craft-makers in Europe and Asia, respectively.

Emerging Platforms

- ePorta, a London-based B2B interiors marketplace, connects buyers of furniture, lighting, accessories and other décor with suppliers of these products. Buyers include interior designers, architects, property developers and retailers. ePorta was established in 2014 and has raised $8 million so far, according to Crunchbase.com.

- London-based Lyst, a global fashion search platform, offers over 4 million fashion items from 11,000 brands and stores. It was founded in 2010 and claims that nearly 65,000 shoppers use the site each year. It has raised $60.5 million in funding, according to Crunchbase.com.

2) Resale Marketplaces

Resale marketplace platforms allow sellers to distinguish their used products from conventional retail marketplaces where new and unused goods are sold. Marketplaces focused on resale, or re-commerce as it is also referred to, tend to be specific to the product segment being sold, such as apparel, which we previously covered in our report Deep Dive: Fashion Re-Commerce Evolution, and furniture, which we wrote about in our earlier report Furniture Re-Commerce: A Niche Segment with Significant Potential.

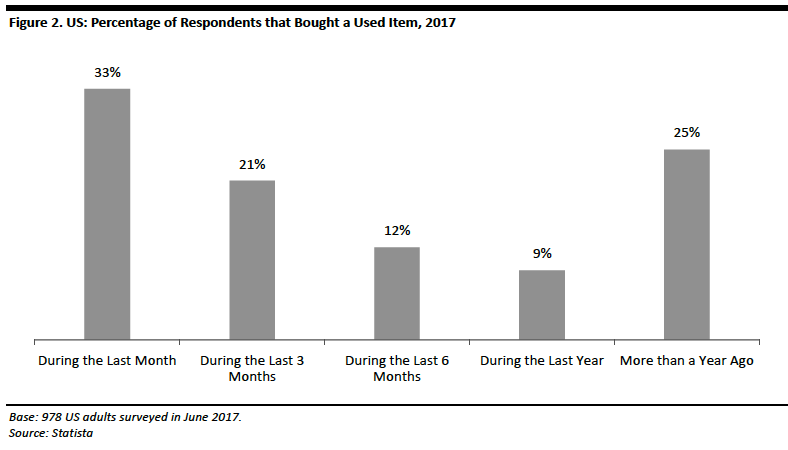

Resale marketplaces have been gaining popularity as an increasing proportion of consumers opt to buy used items to save money or save resources. A Statista survey from June 2017 indicates that around 75% of US consumers have bought a used item at least once in the last year.

PopularPlatforms

Among the various product categories, apparel resale sites have become increasingly popular.

- ThredUp is one of the biggest fashion resale websites in the US. It also claims to have been the first to enter the industry.

- Poshmark is another website for people that want to sell used fashion items. It has 25 million items from over 5,000 brands.

- ThredUp and Poshmark lead in the low-to-mid-price online resale segment in the US.

- ThredUp publishes a yearly report with estimates for the total resale market, divided by segment. In its Annual Resale Report 2018, ThredUp estimated that the online and offline resale market for apparel was worth $20 billion in 2017 and that apparel accounted for 49% of the total resale market that year.

Emerging Platforms

- Rebag was founded in 2014 and is a marketplace solely for used luxury designer bags. It is based in New York and has raised $31.8 million in funding since its launch, according to Crunchbase.com.

- New York-based Furnishare was founded in 2014 and offers a complete turnkey solution for buying and selling used furniture. Furnishare offers to pick up furniture from sellers and then clean, inspect and put it online for sale. It also offers delivery and furniture assembly services to buyers. The company has received seed funding of $2 million, according to Crunchbase.com.

3) Rental Marketplaces

Rental marketplace platforms allow people to list items they own and are willing to rent to others for temporary use. Renting allows people to recover the investment on items they expect to use only rarely, for example expensive items of clothing worn for special occasions or furniture and homewares.

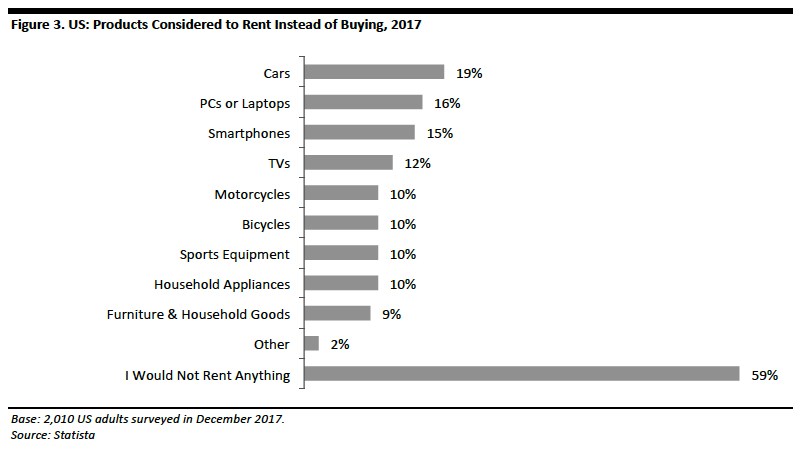

Cars are the most popular items to be rented, according to a Statista survey from December 2017. While 59% of those surveyed indicated that they would not rent anything, 10% or more said that they would consider renting gadgets, vehicles, sports equipment and household appliances. Some 9% stated that they would rent furniture and household goods.

Apart from these products, apparel has grown to be a popular category in the rental space, driven mainly by millennials. We wrote about this trend in our earlier report, Deep Dive: Millennial Lifestyles Drive Growth in Apparel Rental. Some of the key statistics from our report include the following:

- According to a survey by shopping-center operator Westfield, about 46% of millennials in the UK and 35% in the US would be willing to spend £200 (US$253) or more monthly to rent clothes.

- About 60% of millennials prefer renting goods to owning them, according to a survey conducted by the Organisation for Economic Co-Operation and Development in 2013.

Popular Platforms

- US-based Rent the Runway has been one of the most successful startups in this space. It offers designer-branded fashion rentals, including special occasion dresses and outfits. Since its launch in 2009, Rent the Runway has raised $210 million from investors. It currently employs over 1,000 staff who serve its 8 million customers.

Emerging Platforms

- London-based Fat Lama is a marketplace that offers fully insured peer-to-peer renting of spare items that people own to others nearby. The startup recently raised $10 million in Series A funding in a round led by Blossom Capital, with participation from Atomico and existing investor Y Combinator.

Online Marketplaces for Services

Service marketplace platforms allow providers to sell their services online, either for online delivery or delivery at the buyer’s office or home or the service provider’s location.

1) Online Delivery of Services

Online service marketplaces include B2B and B2C programs or software services as well as services that can be remotely delivered by specialists and freelancers.

Popular Platforms

- Amazon’s subsidiary Amazon Web Services (AWS) provides on-demand cloud-computing services to individuals and businesses on a subscription basis. The subsidiary’s AWS Marketplace provides a platform for sellers of software services, such as network infrastructure security, data analytics, backup and archiving, cloud management and many others. Businesses and individuals can browse for these services, place orders and pay through the AWS Marketplace, while the services are consumed from the provider’s website.

- Apart from the above B2B marketplace example, this category also includes platforms for several specific activities that can be delivered to consumers online. Cleartax, a platform in India, is a marketplace for accounting professionals that provide book-keeping and accounting services to individuals and small- and medium-sized businesses.

Emerging Platforms

- SmartKarma is a financial research platform that allows asset management firms and professional investors to access investment research for Asian markets. It was launched in 2014 and is based in Singapore. It has raised $21 million in funding. Subscribers pay an annual fee to access research from its 400 contributing analysts who are paid freelance fees based on the popularity of their research.

- Switzerland-based ODEM is a decentralized platform for educators to provide education and tutoring services to students. Its programs, which run on the Ethereum blockchain and artificial intelligence, aggregate student demand for specific subjects, market educators’ offerings and enable secure payments.

2) Physical Delivery of Services

Platforms that aggregate providers of physical services include food-service aggregators such as Just Eat, beauty and wellness booking platforms, and maintenance and household service platforms. This category also includes B2B platforms for services such as couriers.

In the B2C segment, in particular, online platforms have consolidated at the front end a number of fragmented industries, such as taxis, beauty services, cleaning and maintenance services, and restaurants. In doing so, marketplaces have removed the barriers that consumers traditionally faced when looking to buy such services.

Popular Platforms

- US-based TaskRabbit, founded in 2008, is an online marketplace that matches freelance labor with local demand, allowing consumers to find help with everyday tasks, including cleaning, moving, delivery and handyman services. TaskRabbit is available to consumers across the US and in London, UK. It was acquired by Swedish furniture firm IKEA in September 2017.

- US beauty and wellness services booking startup StyleSeat was founded in 2011 and has raised $40 million so far. People can browse beauty and wellness professionals in over 15,000 cities across the US and book services online or through the StyleSeat app.

Emerging Platforms

- Australian startup CanYa offers a blockchain-based services marketplace for service providers and freelancers. The built-in automation matches service providers’ skills with the needs of the client, and automatically pays the provider once the service is delivered. The startup was founded in 2015 and has raised $12 million through an initial coin offering (ICO) earlier in 2018 and $1.5 million in equity crowdfunding. It is using the fresh funds to build its cryptocurrency payment layer, and in February 2018, it announced that it had been accepted into Chinese e-commerce firm JD.com’s blockchain accelerator program.

What We Think

We expect to continue to see growth and evolution in marketplace platforms across industries. Retail marketplaces allow a larger number of buyers and sellers to engage with each other on a common platform, while resale and rental marketplaces continue to drive growth in the sharing economy.

Service industries, especially those purchased by consumers—such as local restaurants, independent beauty parlors or small cleaning firms—have traditionally been fragmented. Marketplaces aggregate these providers, making it much easier for shoppers to find, compare and book services. Indeed, we think the ease that these platforms bring has been one reason for strong growth in spending on discretionary services in the US in recent years: it is now as easy to buy services as it has long been to buy products.

Marketplaces are gaining share when shoppers buy products online, and they look set to consolidate their positions as destinations when shoppers want to buy services.