Where Have Macy’s Shoppers Gone?

KEY POINTS

Macy’s is the US department store market leader, but the company has experienced falling sales and consequent loss of market share in recent years. To find out where those shopper dollars have gone, we surveyed US consumers and asked those respondents who said that they shop less for apparel at Macy’s than they used to which retailers they have switched their apparel spending to.

- Amazon is frequently cited as the cause of sales declines at department stores, but much less than half of the consumers we surveyed who had switched some or all of their apparel spending away from Macy’s redirected that spending to Amazon.

- T.J.Maxx/Marshalls, Target, Kohl’s and Walmart have gained meaningfully as consumers have transferred their apparel spending away from Macy’s, according to our survey.

- The prominence of value retailers as switching destinations indicates that shoppers have downgraded apparel as a spending priority. Fully 37.5% of US consumers we surveyed agreed that clothing is now less of a spending priority for them than it was about three years ago.

- Amazon Prime membership represents a big divide in terms of what retailers shoppers transfer apparel spending to when they switch from Macy’s. Among respondents who spend less on apparel at Macy’s than they used to, 53% of Prime members said they have switched spending to Amazon versus just 22% of those who are not Prime members.

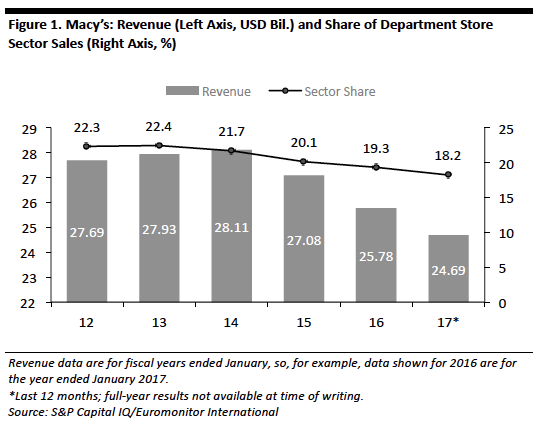

Macy’s Has Lost $3 Billion in Revenue over Five Years

Macy’s leads among US department stores, and it is America’s second-biggest retailer of apparel. But it has underperformed over recent years, even when benchmarked against a sector hit hard by declining sales. The company saw a 410-basis-point decline in sector share as annual revenues declined by $3 billion between 2012 and 2017. Only struggling Sears has seen a comparable decline in sector share, according to data from Euromonitor International.

So, where have Macy’s shoppers taken their apparel spending? The obvious answer is Amazon, but does that retailer account for all of the declines at Macy’s?

To find out, we surveyed US apparel shoppers, asking if they now spend less of their clothing and footwear budget at Macy’s than they did about three years ago (including if they stopped shopping for apparel at Macy’s altogether during the period). Our survey found that:

- Some 26% of respondents spend less of their apparel budget at Macy’s than they used to or have stopped shopping there altogether.

- Approximately 24% spend the same at Macy’s as they used to.

- Just 5.5% said they now spend more at Macy’s or have started shopping there.

- The remainder indicated that they did not shop for apparel at Macy’s in the past and that they do not shop there now.

We then asked the 26% of shoppers who had cut their apparel spending at Macy’s which retailers they had switched some or all of their apparel spending to. We summarize the findings in the following sections.

This report forms part of our How the US Shops series, in which we share insights into Americans’ shopping behavior based on the findings of our original consumer research.

Which Retailers Have Macy’s Apparel Shoppers Switched Spending To?

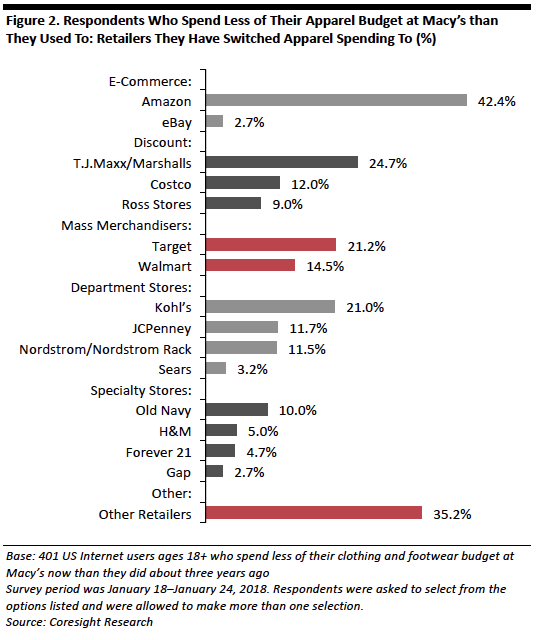

It’s likely unsurprising to readers that Amazon has been the overall biggest gainer when consumers have redirected some or all of their apparel spending away from Macy’s. Yet Amazon is far from dominant: much less than half of those surveyed who spend less of their apparel budget at Macy’s than they used to said that they had switched that spending to Amazon.

So, the full picture is more complex, as these shoppers have splintered their apparel spending among a variety of retailers, including off-pricers, mass merchandisers and other department stores, as we chart below. In terms of gaining share of apparel spending when shoppers switch from Macy’s, T.J.Maxx/Marshalls is in second place after Amazon, while Target is in third place and Kohl’s in fourth.

A natural churn between retailers likely accounts for some of these shifts—and that churn means that Macy’s, too, may have gained shoppers from some of the retailers shown below over recent years.

- Discount formats—notably off-price retailers—are big winners in terms of apparel spending that shoppers have redirected away from Macy’s. We have split out mass merchandisers as a separate segment above, but Walmart and Target have similar value positioning.

- The strength of Kohl’s partly reflects the retailer’s off-mall locations: as shoppers have migrated away from regional malls, many appear to have turned to department stores that are situated in alternative sites such as open-air shopping centers.

- The data suggest that eBay is now largely irrelevant in terms of midmarket apparel shoppers.

- Value-positioned Old Navy is the only specialty store named in our survey that has captured a meaningful share of respondents’ switched apparel spending.

The preponderance of value retailers in the ranking above reflects an apparent downgrading of apparel as a spending priority among shoppers. Fully 37.5% of the US consumers we surveyed said that they agreed with the statement “Compared to around three years ago, clothing is now less of a spending priority for me.” We think this deprioritization of apparel partly explains why so many consumers have switched away from shopping at midmarket department stores.

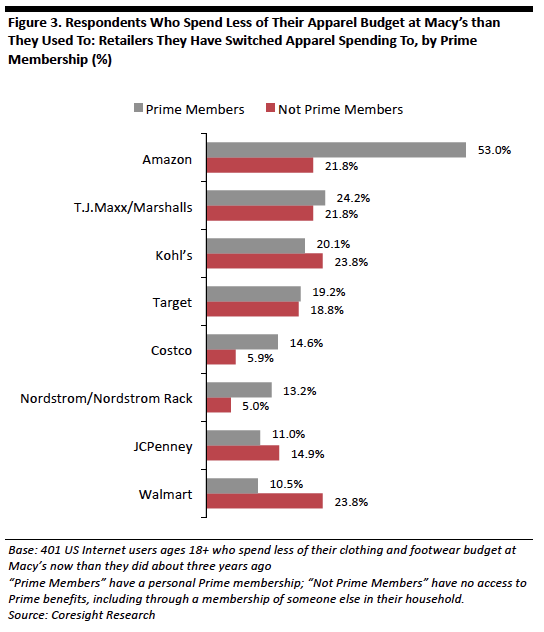

Retailers Shoppers Have Switched to, by Prime Membership: Walmart Gains Among Those Without Prime

Migration of apparel spending to Amazon is not uniform. In particular, our survey found very different trends between those shoppers who have an Amazon Prime membership and those who do not. Among all respondents who said that they spend less of their apparel budget at Macy’s than they used to:

- More than half with an Amazon Prime membership said that they have switched some or all of their apparel spending to Amazon.

- Only about 22% of those with no access to Prime have switched some or all of their apparel spending to Amazon.

- Those without a Prime membership have redirected their apparel spending to Walmart, Kohl’s and T.J.Maxx at either the same rate or a higher rate than they have switched that spending to Amazon.

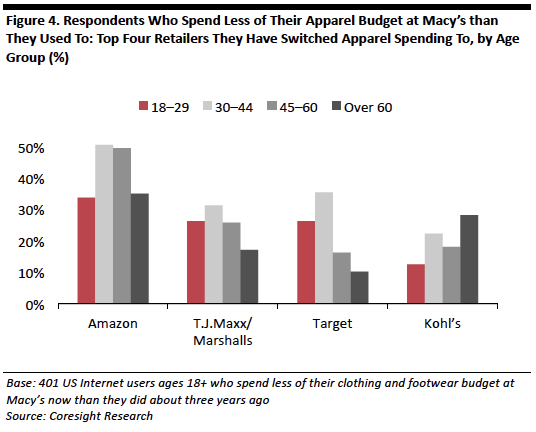

Young consumers are not leading the charge to Amazon: those ages 18–29 show a below-average rate of switching their apparel spending from Macy’s to Amazon. Instead, it is consumers ages 30–60 who switch most to Amazon.

Meanwhile, the 18–29 age group showed an above-average rate of switching to value retailers such as T.J.Maxx, Target and (not charted below) Old Navy.

Key Takeaways

Amazon is only partly responsible for declining sales at department stores such as Macy’s. Among survey respondents who said that they spend less of their apparel budget at Macy’s than they used to, much less than half said they had switched that spending to Amazon.

Amazon Prime membership is a big differentiator in terms of apparel spending being redirected from Macy’s: Prime members are much more likely to have moved some or all of their apparel spending to Amazon than are those with no Prime membership.

Value retailers such as off-price stores and mass merchandisers are popular options for switching, reflecting the deprioritization of apparel spending among some consumers in recent years.

- Readers may also be interested in another of our recent reports, Deep Dive: Amazon Apparel—US Survey Reveals What Shoppers Buy, Which Retailers They Have Switched from and Their Attitudes Toward Amazon as a Fashion Retailer. In that report, we show how Prime membership is a key differentiator when it comes to buying apparel on Amazon.