Fintech Series, Part 3: Common Patterns in Fintech and Retail Tech Disruption

KEY POINTS

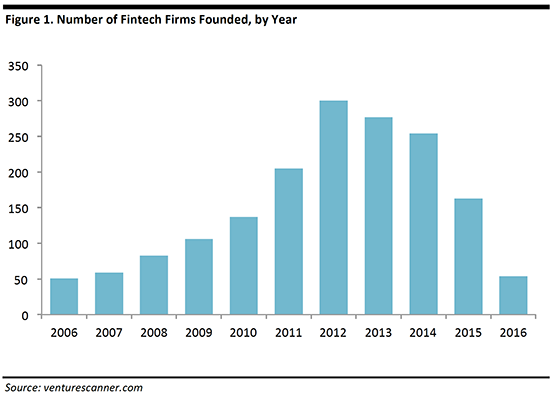

- In the wake of the global financial crisis, there was a surge in the formation of technology-focused financial services startups (fintech startups), and the number of new companies founded peaked in 2012 and 2013. Today, there are more than 1,000 fintech firms and, as of late 2016, they had raised more than $105 billion in total funding and were valued at more than $870 billion, according to VB Profiles.

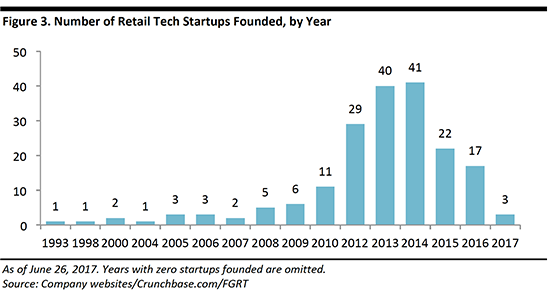

- We are seeing a similar phenomenon among retail technology startups. Creation of such firms peaked in 2013 and 2014, although their long-term impact on the changing retail industry remains unknown.

- A number of disruptive factors have affected both the fintech and retail tech industries; these include smartphones, omnichannel commerce, open platforms and data.

- Retailers are still finding their path in an unclear and dynamic retail environment. The survivors that emerge from this period of change will have become adept at navigating this new, ever-changing context.

- To understand the similarities between fintech and retail tech, Fung Global Retail & Technology met with Anil Aggarwal, an expert in both fintech and retail who founded the Money20/20 conference, and founded and serves as CEO of the Shoptalk conference.

Executive Summary

The global financial crisis opened the door for the development and growth of an array of fintech firms that aimed to fill niches that the big banks had not previously addressed. These niches represent use cases that unbundle the consolidated offerings of banks and other established players. Traditional financial services historically provided by firms that benefited from a highly regulated environment have become increasingly open to innovation by third parties whose primary focus is improving those services for consumers. Interestingly, many fintech companies were actually formed prior to the financial crisis. The case is similar for the retail tech industry, where startup formation peaked in 2013 and 2014, prior to the beginning of the turmoil currently affecting the retail industry.

As industries are disrupted, there is an initial phase of disorientation, during which, some participants assess new technologies and changes in consumer behavior. That phase is followed by a shakeout, which culminates in a brave new world in which participants have adapted to an ever-changing environment.

The Evolution of Fintech

The global financial services industry was relatively stable for many decades through the early 2000s. However, starting around 2011, an army of fintech startups began rapidly disrupting the industry, particularly during a 36-month period ranging from 2012 to 2014.

The reasons behind fintech’s disruption include:

- A material reduction in confidence in the traditional financial services industry due to the global financial crisis.

- Financial services companies had historically benefited from high barriers to entry for innovators as well as from high profitability, which mitigated pressure for the industry to innovate.

- The impact of the convergence of groundbreaking technologies ranging from the ubiquitous connectivity provided by smartphones to blockchain, which emerged from outside the traditional payments industry.

The disruption of fintech included both a proliferation of startups that provided solutions directly to consumers as well as partnerships between the large financial services institutions and startups. The technological advances that accelerated the rise of fintech startups and the digitization of payments include:

- Smartphones, which enabled the “connected consumer.”

- Omnichannel commerce.

- Open platforms that increased the rate of innovation by distributing development.

- New marketing services that reflected the direct-to-consumer nature of digital payments.

- New uses and sources of data.

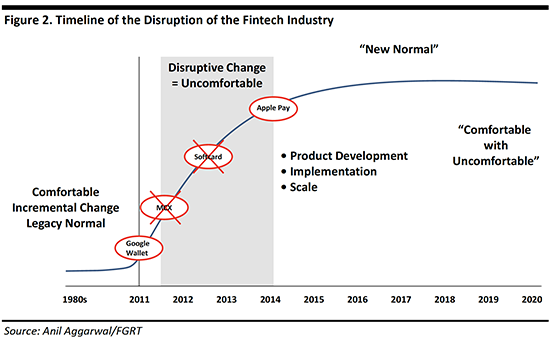

Now, the fintech industry has transitioned from a comfortable, legacy “normal” to a “new normal,” where companies have become accustomed to adapting to rapid change. For example, in 2013, a blockchain partnership with a bank was considered cutting-edge; today, however, such deals are commonplace.

The Rapid Rise of Fintech Firms

In the graph below, which shows the number of fintech firms founded by year, we see that there were some firms founded before and during the global financial crisis (which was defined by high default rates in the subprime mortgage market and the bankruptcy filing by Lehman Brothers in 2008).

In the graph, we see a time lag between the global financial crisis in 2007 and 2008 and the years when the number of fintech companies founded peaked, which were 2012 and 2013.

Although the total revenue of fintech companies is difficult to quantify, given the emerging status of many of them, VB Profiles calculated that more than 1,000 fintech companies had raised more than $105 billion in total funding and had a combined value of more than $870 billion, as of late 2016.

Based on estimates from the Organisation for Economic Co-operation and Development (OECD), the McKinsey Global Institute and the World Bank, the global financial services market will be worth about $15.6 trillion this year and account for about 20% of global GDP. The consumer segment (retail banking, life insurance, and property and casual insurance) accounts for about 60% of the global financial services market, putting its 2017 value at approximately $9.4 trillion.

Anil Aggarwal on Industry Disruption

To develop this report, we met with Anil Aggarwal, who founded the Money20/20 conference in 2011. Money20/20 became the largest fintech event globally and helped serve as a catalyst for the growth and development of the fintech ecosystem. Aggarwal subsequently founded the Shoptalk conference in 2015. Shoptalk is devoted to retail and e-commerce innovation and is also serving to help the industry during a period of dramatic change. Aggarwal was previously the founder of two tech companies, the latter of which was acquired by Google in 2012 in order to develop Google Wallet.

The graphic below illustrates the changes in the fintech industry and highlights a 36-month period of disruptive innovation over 2012–2014.

The early part of the 36-month period of significant disruption is characterized by the emergence of digital wallets such as Google Wallet (now Android Pay) and the end is marked by the market entry of Apple with its Apple Pay service. The timeline also shows payment systems MCX and Softcard, which entered the market, but failed to gain traction with consumers.

The Rise of Retail Tech Startups

Similar to how many fintech firms were founded prior to the global financial crisis, many retail tech startups actually predate the current period of challenge in the retail industry. Fung Global Retail & Technology maintains a database of retail tech startups, and the graph below shows how many were founded, by year, beginning in 1993.

As the graph shows, 2013 and 2014 were the peak years for the founding of retail tech startups. Except for the longer tail at the left, the graph has a shape similar to the earlier graph that shows the number of fintech firms founded each year.

What Lies Ahead for Retail?

Several events tend to occur during periods of dramatic industry disruption. First, basic psychology leads many companies to remain in a state of denial about what is happening around them, which results in some players losing market share or eventually dropping out of the market altogether. As customers continue to change, industries have to catch up and leaders need to receive a mandate to fix the issues.

Next, marketplaces that were previously two-sided (e.g., retailers and vendors) become multisided ecosystems, with new types of partnerships enabling progress. Finally, some companies choose to face disruption early, while others lag and respond to changes much later.

To survive disruption, companies need to evaluate:

- Trends

- New business models

- Technologies

Notwithstanding the current difficulties in the retail industry (which include declining traffic and same-store sales), the true disruption of retail is likely yet to come. At this point, most retailers are still seeking to determine what the relevant questions are; they are not yet at the stage where they might come up with the right answers. Some retailers will have to drop out of the market, and the survivors will have to become comfortable with the new, changing environment.

The graphic below maps the disruption of fintech and retail, showing that innovation in retail lags innovation in fintech by four to five years. We note that the curve for the retail industry is steeper than that for the fintech industry, meaning that retail will likely face a more turbulent transition. This transition will likely last much longer than the 36-month period of significant change that was seen in fintech. It may exceed 60 months, given that retail is complex by nature, encompassing physical assets and complicated supply chains.

Conclusion

In many ways, the timeline of startup formation in the retail tech industry parallels that seen in fintech, which has already undergone an industry disruption. Retail tech startup formation peaked in 2013 and 2014, and these new entrants are likely to add to the disruption that the retail industry is undergoing. Once the smoke clears, the emergent companies will be adept at dealing with a dynamic environment that is the new normal.