Deep Dive: UK Value Clothing Market—Pure Plays Drive Market Growth

KEY POINTS

- Major value retailers account for almost one-quarter of the total UK clothing market, we estimate. The value apparel market was worth nearly £10 billion in 2016, and sales increased at a CAGR of 3.4% over the past five years.

- New entrants and higher standards have boosted the UK value clothing market. The structural “winners,” such as Primark and Boohoo.com, are those that offer a fast-fashion product to a young target customer.

- Grocery retailers are prominent in the value apparel market, and they appear to have gained sales as a result of the BHS closure in August 2016.

- Higher standards and an explosion in choice are heaping competitive pressures on long-standing value players.

Executive Summary

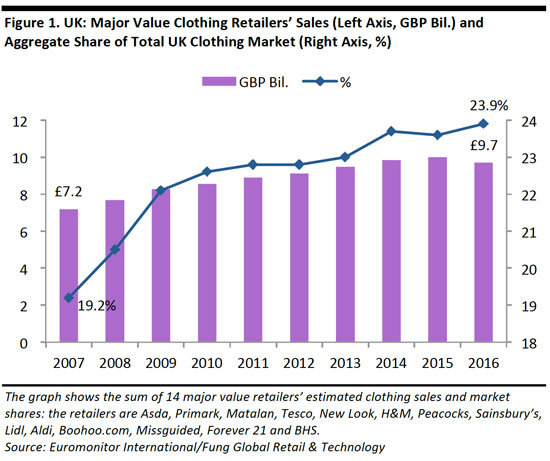

Major value retailers account for almost one-quarter of the total UK clothing market, we estimate, based on Euromonitor International data. The value apparel market was worth almost £10 billion (including VAT) in 2016, and sales increased at a CAGR of 3.4% over the past five years. Two major factors have underpinned growth in the value clothing market in recent years:

- The product offering has been vastly elevated: Value retailers are more popular because value apparel is better than ever. The selection of stylish and attractive product available at very low prices has dramatically increased, especially in merchandise ranges targeted at millennial and Gen Z consumers.

- E-commerce has injected new vigor into the value market: Sophisticated, fashionable online-only players are distinct from the somewhat tired formats of previous generations of value retailers. Boohoo.com and Missguided have been vastly outperforming their multichannel peers, even when measured only against those retailers’ online sales, as well as their brick-and-mortar peers.

Primark, with total UK revenues of £2.9 billion in fiscal 2015 (latest available data) and Asda’s George brand, with estimated clothing and footwear sales of around £2.1 billion in fiscal 2016, are the biggest players in the UK value clothing market. Grocery retailers and online-only retailers are two highly successful segments in the market, and new entrants continue to pile in.

Grocery retailers are prominent in the value apparel market. Tesco, Sainsbury’s and Morrisons appear to have gained sales as a result of the closure of the BHS chain. Each of these retailers remarked that they had seen strong apparel growth over the Christmas 2016 period. This benefit will fall away after the anniversary of BHS’s final closure, which was in August 2016.

Internet-only retailers such as Boohoo.com, PrettyLittleThing and Missguided are growing rapidly. Boohoo.com recently said that sales for fiscal year 2017 (ended February 28), were up about 50%, ahead of previous guidance of 46%–48% growth. Boohoo.com recently acquired PrettyLittleThing, which will further boost its UK revenues. Privately owned Missguided recently reported that sales were up 34% in the year ended March 2016, and that sales rose 60% in the subsequent six-month period.

New entrants are heightening competition in the market. These include Pep&Co, which is now rolling out clothing to stores in its sister chain, Poundland. Reserved, a Polish retail brand, is set to open its first UK store shortly, on London’s Oxford Street. And Amazon, which already offers low prices on branded fashion, is set to launch private-label products designed specifically for the UK market.

Higher standards and an explosion in choice are heaping competitive pressures on a number of long-standing value players such as Matalan, New Look and Blue Inc. So, growth in the overall value clothing market is not a rising tide that is lifting all boats.

Introduction

In this report, we explore value clothing retailing in the UK, including reviewing leading value players and analyzing drivers of growth. We look at the size and growth of the value clothing market and the market shares of top retailers, discuss grocery retailers and Internet-only retailers that sell value apparel, and identify likely winners and losers in 2017.

We define value clothing retailers as those that offer low price points that are generally significantly below those of midmarket rivals: in essence, the value retailers are where shoppers are likely to turn if they are strapped for cash. Almost all value retailers focus on private-label fashions rather than on third-party brands.

Retailers in this market include Primark, Boohoo.com, New Look, Matalan, H&M, Peacocks, Pep&Co, Missguided, Forever 21, Select Fashion, Blue Inc and the now-defunct BHS. We also consider the private-label apparel lines offered by grocery retailers Tesco (F&F brand), Sainsbury (Tu brand) and Asda (George brand) as part of the value market, as well as apparel offered by grocers Aldi and Lidl.

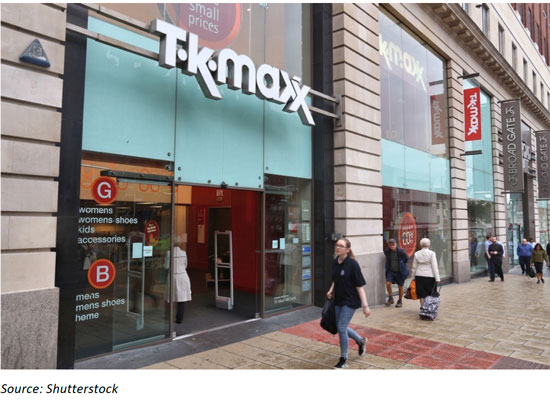

There is a case for including Sports Direct and T.K.Maxx within the value market, as they typically sell below full retail price, or at least with the appearance of a discount. However, we consider them adjacent to the value sector for two reasons. First, in many cases, they are selling at prices that are still substantial. Second, and relatedly, Sports Direct and T.K.Maxx also provide customers with substantial branded offerings, including big-name mass-market brands and, in the case of T.K.Maxx, premium labels.

Value Retailers Capture One-Quarter of the Clothing Market

Major value retailers account for almost one-quarter of the total UK clothing market, we estimate, based on Euromonitor International data on 14 major value retailers:

- The value market’s aggregate market share has increased by approximately 510 basis points in the last 10 years, as depicted in the graph below.

- The size of the UK value clothing market was almost £10 billion (including VAT) in 2016, and sales increased at a CAGR of 3.4% over the past five years.

As we discuss later, however, not all major value retailers have gained over the period.

Two major factors have underpinned growth in the value clothing market:

- The product offering has been vastly elevated: Value retailers are more popular now because value apparel is better than ever. The selection of stylish and attractive product available at very low prices has dramatically increased, especially in terms of merchandise targeted at millennials and Gen Zers.

- E-commerce has injected new energy into the value market: Sophisticated, fashionable online-only players are providing a very different shopping proposition from the occasionally tired-looking store formats and relatively basic product offering of previous generations of value retailers. As a result, Boohoo.com and Missguided have been vastly outperforming their brick-and-mortar peers, even when measured only against those companies’ online sales.

For these reasons, the value market has attracted a broader and more diverse range of consumers, including young, fashion-conscious shoppers who have turned to pure plays and middle-class consumers who are trading down for certain purchases such as basics while visiting higher-end stores for investment items.

Reflecting the higher standards in the segment, the growth in value retail has not been a rising tide that has lifted all boats. Undistinguished middle-ground retailers targeting shoppers in the family life stage or older shoppers have struggled to gain traction, just as their midmarket retail peers have. For example, Matalan has posted declining sales and BHS closed down completely in August 2016 following years of revenue declines.

Top Retailers in Value Clothing

Market Share

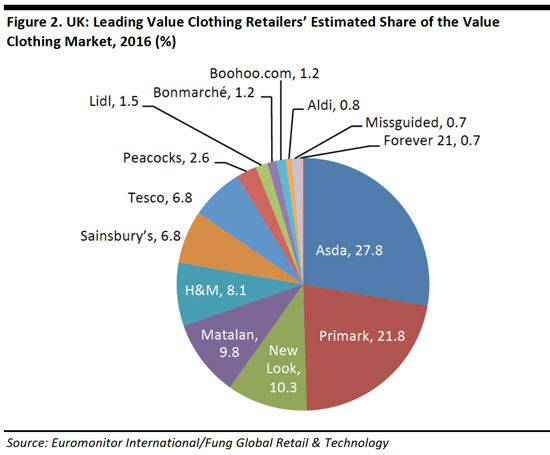

Below, we break down the value clothing market by retailer, based on Euromonitor data. Some smaller players, such as Select Fashion and Blue Inc, are not included. The still-tiny market share captured by Internet-only retailers is notable. For example, Boohoo.com and Missguided capture only small shares. We think this underlines the fact that there is substantial scope for growth at these types of retailers as more value spending migrates online.

We strip out BHS data in the graph below, due to the retailer’s closure in August 2016. Based on our own estimates, we think that Euromonitor’s figure for the George brand at Asda is improbably high relative to the Primark figure (see Figure 3 for our own estimates). Moreover, press reports suggest that both Kantar Worldpanel and Verdict Retail see Primark as taking greater share than Asda.

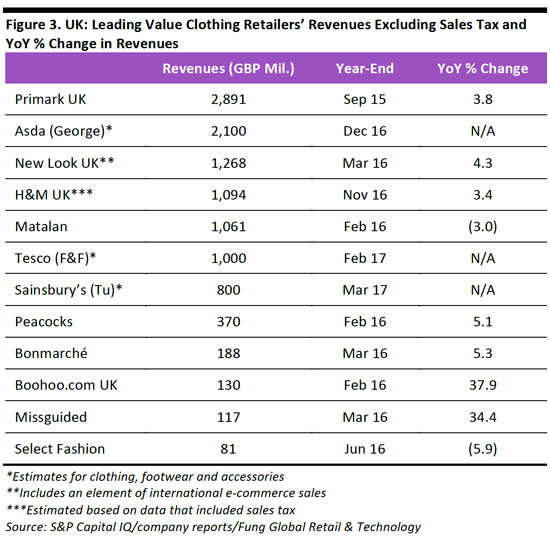

Retailers’ Revenues

Below, we rank major value retailers by their latest full-year revenues. For specialist retailers such as Primark and Matalan, this includes any non-clothing revenues. For grocery retailers Asda, Tesco and Sainsbury’s, the figures are our estimates for their net sales of clothing, footwear and accessories combined. UK-only data for some value retailers, such as Forever 21, are not available.

The closure of BHS in 2016 freed up several hundred millions of pounds of apparel sales. BHS’s last filed accounts were for the year ended August 2014, when it turned over £668 million. Its revenues were consistently declining year over year in the preceding years. The closure of the business opened up opportunities for other retailers that target customers aged 45 and older, as BHS did. We believe that the grocery retailers will take some of the remaining BHS clothing share and that Matalan, Bonmarché, Peacocks and Pep&Co also have the opportunity to gain sales.

We also note that two retailers adjacent to the private-label value market, T.K.Maxx and Sports Direct, have been outperforming the total apparel market:

- TJX UK, the parent company of T.K.Maxx and HomeSense in the UK, grew revenues by 10.9%, to £2.4 billion, in the year ended January 2016 (latest). At the time of writing, the company operates more than 350 T.K.Maxx stores and 30 HomeSense stores in the UK and Ireland.

- Sports Direct grew total sales by 14.2% in the first half of its fiscal year 2017, ended October 2016 (latest). Its core UK sports retail segment grew revenue by 7.4% in the period, and operated 454 stores at the end of the period. Group revenue stood at £2.9 billion in the year ended April 2016, with UK revenues accounting for £2.3 billion. The retailer sells a mix of third-party brands and proprietary brands with a discount positioning.

Offline-Only Retailers

As we have already noted, Internet-only retailers have helped drive growth in the value clothing market. And, as with the overall apparel market, more and more value clothing spending will migrate online in the coming years.

Among brick-and-mortar retailers, there are very few holdouts against e-commerce, but they feature disproportionately in the value market. E-commerce laggards have included Sainsbury’s, which launched its Tu brand online only in August 2015.

Primark is the only major apparel specialist that does not sell online. The company indicated that the economics do not stack up, given its ultralow price points. George Weston, CEO of parent firm Associated British Foods, underlined this position in the company’s most recent earnings call, when he confirmed that analysts could rule out a move online by Primark because “the economics of the stores are just much better than the economics of online clothing retail.” Discount fashion chain Pep&Co remains purely store-based, too.

Among the grocery retailers, Lidl remains a solely brick-and-mortar retailer. Rival Aldi launched a transactional nonfood UK website in January 2016, through which it sells its clothing ranges. Morrisons is also planning an online launch for its clothing ranges, as we discuss later in this report.

Segment Review: Grocery Retailers, Internet Pure Plays and New Entrants

In this section, we review three notable segments within the value clothing market: grocery retailers, Internet-only retailers and new entrants to the market.

Grocery Retailers are Resurgent

Supermarket retailers account for 10% of the total UK clothing and footwear market by value, according to Kantar Worldpanel. But this share is depressed by their low average unit prices; they capture almost one-quarter of the market when measured by volume.

One challenge for this segment is that consumers are changing their grocery-shopping behavior. British grocery shoppers are increasingly turning away from large out-of-town superstores in favor of smaller supermarkets, discount supermarkets, convenience stores and transactional websites. In theory, this should be hitting the clothing sales of major supermarket retailers, as supermarket fashion relies on large-store footfall to generate incremental clothing sales to customers doing their regular grocery shopping. However, the UK’s three publicly traded supermarket groups have recently noted strong growth, not declines, in their fashion sales. They have likely mopped up share from BHS following its final closure in August 2016. If that is the case, the year-over-year boost in sales enjoyed by the grocery retailers will annualize later this year.

- Sector leader Tesco said its comparable fashion sales rose by 4.3% in the six weeks ended January 7, 2017. Tesco’s fashion label is F&F.

- Second-place Sainsbury’s noted a 10% leap in its clothing and footwear sales in the third quarter of its fiscal year 2017, which covered the Christmas 2016 period. Sainsbury’s fashion label is Tu.

- Fourth-place Morrisons said its Nutmeg clothing brand “performed well” in its nine-week Christmas trading period, which ended January 1, 2017.

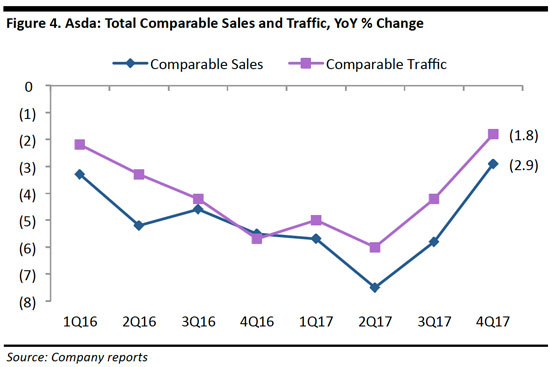

Walmart-owned Asda is the biggest retailer of apparel among the grocery chains. Its long-established clothing brand is called George. Asda has been posting negative comparable sales growth in total, but has failed to disclose performance in fashion recently. Asda’s total comps fell by 2.9% in the fourth quarter of its fiscal 2017 year. Traffic was down 1.8% in the quarter—and declining store traffic is sure to have affected clothing sales.

However, significant sequential changes in Asda’s quarterly comps and traffic suggest that these metrics could swing to positive territory in the coming year. If they do, the George fashion range should benefit, and Tesco may be negatively impacted.

![]() Sainsbury’s has likely benefited from a number of initiatives, including the launch of an e-commerce site in August 2015 and the release of an upmarket Tu Premium range in September 2016. The company recently signed retail expert Mary Portas to help make Tu a “destination brand for high-street fashion.”

Sainsbury’s has likely benefited from a number of initiatives, including the launch of an e-commerce site in August 2015 and the release of an upmarket Tu Premium range in September 2016. The company recently signed retail expert Mary Portas to help make Tu a “destination brand for high-street fashion.”

Morrisons was late to the apparel category, launching its Nutmeg brand only in 2013, and initially only in childrenswear. The retailer’s typically smaller supermarkets present ranging issues for clothing and footwear. Nevertheless, in February 2017, Morrisons announced plans to extend the brand to womenswear.

Morrisons was late to the apparel category, launching its Nutmeg brand only in 2013, and initially only in childrenswear. The retailer’s typically smaller supermarkets present ranging issues for clothing and footwear. Nevertheless, in February 2017, Morrisons announced plans to extend the brand to womenswear.

E-commerce remains an opportunity for Nutmeg, and in Morrisons’ March 2017 full-year results presentation, CEO David Potts said that the company would expand its online offering to include clothing at an unspecified time. E-commerce could provide a boost to the company’s clothing sales that is proportionately higher than what it provides to supermarket rivals, given the space challenges that Morrisons faces in many of its stores.

Seeking to tap the athleisure trend, Tesco enhanced its apparel offering with an activewear range for spring 2016.

Meanwhile, Aldi and Lidl have made moves to capture greater share in clothing, too, with special, short-lived collections launched within their rotating nonfood special buys. In 2016 and early 2017, for instance, Aldi launched on-trend fashion lines, officewear, running apparel, cycle clothing, skiwear and even riding apparel.

Pure-Play Game Changers

![]() Boohoo.com brings exceptional speed and agility to the value clothing market. Coupled with ultralow selling prices, this makes for a compelling proposition that is far more sophisticated than the mediocre shopping environments and undistinguished product ranges that characterized some previous generations of value retailers.

Boohoo.com brings exceptional speed and agility to the value clothing market. Coupled with ultralow selling prices, this makes for a compelling proposition that is far more sophisticated than the mediocre shopping environments and undistinguished product ranges that characterized some previous generations of value retailers.

Boohoo.com’s “test and repeat” model is based on stocking a limited number of units of each new style, and then buying deeper volumes if a style performs well. The company sources around 50% of its products in the UK, which, combined with the test-and-repeat strategy, enables it to cater to shoppers’ demands for fast fashion. Boohoo.com’s online-only operation brings simplicity to this model, whereas other fast-fashion retailers must deal with the complexity of stocking new products in multiple stores.

Boohoo.com can reportedly get a product from concept to sale within two weeks. The company says it offers 20,000 different styles and introduces up to 100 new styles a day, and that “the speed and agility of the group enables it to be first to market with the latest on-trend styles and fashion.”

The company acquired UK pure play PrettyLittleThing and the US pure-play brand Nasty Gal in late 2016. Boohoo.com’s sales jumped by 50% in its 2017 fiscal year.

![]() Missguided offers a similar mix of low-priced fast fashion aimed at young shoppers. The privately owned company says that it adds more than 50 new styles to its site each day.

Missguided offers a similar mix of low-priced fast fashion aimed at young shoppers. The privately owned company says that it adds more than 50 new styles to its site each day.

Missguided founder and CEO Nitin Passi told The Guardian in 2015, “[W]e’re rapid fashion….If a trend comes, we need to have it on our site in under a week.” The company says it can turn samples around in a day, and it reportedly gets products to market much quicker than fast-fashion legend Zara does. Passi has stated that his ambition is to turn the company into a £1 billion business in five years. In November 2016, the company opened its first brick-and-mortar store, at London’s Westfield Stratford City mall.

Missguided is a distinctive player, even in a crowded young-fashion pure-play segment that includes PrettyLittleThing, ASOS, Little Mistress, Bejealous, Brand Attic and Romwe. These e-commerce names span the value and midmarket segments, and we expect them to capture share from legacy store-based young-fashion retailers such as New Look and Topshop.

New Entrants Are Widening the Choice

Competition in the value clothing market will only increase with new entrants such as Reserved and Amazon UK’s private-label apparel lines.

![]() Pep&Co

Pep&Co

- Pep&Co is a new UK womenswear, menswear and childrenswear brick-and-mortar value apparel concept started by former Asda and Bain & Company executives in 2015. The company is owned by South African retail holding company Steinhoff. Pep&Co opened 50 stores across the UK in summer 2016 and plans to have 85 stores in the UK by the end of 2017.

- Following a trial period, Pep&Co will also roll out Pep&Co clothing shops within large Poundland stores. Pep&Co management stated that its goal is for Pep&Co to be to Poundland what the George brand is to Asda.

- The fashion chain is aimed at mothers on a budget. Prices start at £1 and 95% of product sales are under £10.

![]() Reserved

Reserved

- Reserved is owned by LPP, an apparel retailer based in Poland. Reserved will shortly open its first UK store, in the former BHS site on Oxford Street in London. LPP generated PLN6,021 million (£1.1 billion) in 2016. Analysts expect LPP revenues to increase by 17% year over year in 2017 and by 12.7% in 2018.

![]() Amazon

Amazon

- Amazon has launched eight own-label fashion brands on its US website. The labels are only available for Amazon Prime members. Several of these labels offer items at value price points and are created by and exclusive to Amazon, including Franklin & Freeman for men’s shoes, Franklin Tailored for men’s formalwear, James & Erin for women’s clothing and Scout + Ro for children’s clothing.

- In February 2017, Drapers reported that Amazon is planning to launch private-label clothing ranges designed for the UK market and that the company has recruited senior apparel-buying experts from Primark and Marks & Spencer.

- Separately, Amazon is planning to develop its own line of workout apparel in order to capitalize on the ongoing strength of the athleisure trend in the US and Europe.

- Amazon can leverage its vast amount of transaction and consumer browsing data to develop successful private-label fashion lines.

- Away from private label, Amazon routinely sells branded fashion below regular retail prices, with various depths of discounts, arguably making its offering similar to that of an off-price retailer.

Likely Winners and Losers

Finally, in the following three tables, we outline some notable retailers that look, respectively, likely to outperform the value market in 2017, broadly keep pace with the market or underperform versus the market.

Key Takeaways

- New entrants and higher standards have boosted the UK value clothing market. The structural “winners” look to be those with fast-fashion product and a young target customer. Market leader Primark and fast-growing Boohoo.com and Missguided share these characteristics.

- Grocery retailers are prominent in the value apparel market, and Tesco, Sainsbury’s and Morrisons appear to have gained sales as a result of the closure of BHS. This support will fall away once we lap the first year since BHS’s final closure, which was in August 2016. Sainsbury’s looks to be the most consistent outperformer in the grocery apparel segment.

- Higher standards and an explosion in choice are heaping competitive pressures on long-standing value players such as Matalan and New Look.