Deep Dive: The Rise of Social Media Influencers and Their Brands

KEY POINTS

- Over the past few years, we have witnessed the rise of bloggers and social media influencers, and influencer marketing is rapidly becoming commonplace in categories spanning beauty to fashion.

- Reflecting the decline in TV and print, companies are harnessing the growth in social media consumption and increasingly utilizing Internet personalities to reach consumers.

- Influencers have become a driver of consumer purchases, especially among young consumers. Brands are working with celebrity and social media influencers to attract Gen Zers, a demographic group that is the most influenced by social media endorsements.

- Numerous social media influencers are launching their own product lines, from beauty to fashion to homeware categories. As a result, the influencer brand space is crowded, especially in the beauty category.

- Given the cutthroat level of competition and market oversaturation in both beauty and fashion retail, we believe it will be very difficult for the majority of influencer brands to gain meaningful scale in either the beauty or apparel categories.

Introduction

In this report, we analyze the rise of social media influencers, the rationale behind influencer marketing strategies and the trend of prominent influencers launching their own products and brands. We also touch on some of the opportunities for, and challenges associated with, influencer collaboration, and outline some of our thoughts on future trends.

Over the past few years, we have witnessed the rise of bloggers and social media influencers, and influencer marketing is rapidly becoming commonplace in categories spanning beauty to fashion.

- Social media influencers are usually fashion stylists, bloggers, street-style stars, models and makeup artists that typically accrue a following of loyal fans by displaying their personal style and purchases, as well as making product recommendations.

- Social media personalities range from super-influencers having millions of followers to micro-influencers with fan bases of less than 100,000.

- Some influencers provide creative and educational content, especially in the beauty category, through instructional videos.

- Certain influencers publish a blend of sponsored and organic social-media posts. Some influencers promote brands that they genuinely like, and others derive meaningful compensation from affiliate links or partnerships with retailers and brands.

The Scale of Influencers

Reflecting the decline in TV and print media, companies are increasingly reaching out to Internet personalities to reach consumers. Influencer marketing is still new to many brands, but marketers continue to allocate a greater share of marketing funds for strategies that use influencers, according to Activate by Bloglovin’, an influencer-marketing platform.

- Activate by Bloglovin’ surveyed 100 marketers in February 2017 to understand their attitudes toward influencer marketing. Nearly one-third of surveyed marketers considered influencer campaigns an essential part of their marketing strategy, and 41% had seen more success with an influencer-marketing campaign than traditional ones. Approximately 63% of surveyed brands increased their influencer-marketing budgets in 2017 and 44% planned to do so by up to 24%.

Influencers raise brand awareness and drive sales to e-commerce destinations through content on platforms such as blogs, Instagram and YouTube channels where they interact with followers.

- In summer 2017, Amazon expanded its Amazon affiliate marketing program to include YouTube social media influencers.

- According to marketing insights company SimilarWeb, individual influencers appear in the top 20, and some in the top five, online-referral sources for leading retailers.

- Additional statistics provided by SimilarWeb show that approximately 13%–18% of all US desktop online traffic for Nordstrom.com, Revolve.com, Net-a-porter.com, Shopbop.com and Sephora.com is derived from influencer referrals.

Rationale for Using Influencers

1. Increases Consumer Engagement

Marketers are placing increased emphasis on influencer campaigns to raise awareness and reach new audiences. Some brands work with super-influencers, even if the partnership does not contribute to greater sales generation but increases consumer engagement.

- According to a marketer study by Activate by Bloglovin’, 76% of marketers seek to increase brand awareness through influencer-marketing campaigns and 71% to reach new types of audiences.

2. To Attract Gen Zers

Influencers have become a key factor in influencing consumer purchases, especially young consumers. Brands are working with celebrity and social media influencers to attract Gen Zers—generally defined as those born after the late 1990s or after 2000—a demographic group that is highly influenced by social media endorsements versus brand names. These young shoppers are strongly inclined to use social media for style inspiration and product research, as well as trust the opinions of popular bloggers.

- According to L2, companies from Adidas to L’Oréal are targeting younger consumers through growing investment in influencer social media campaigns, mainly on Instagram.

- Gen Z consumers are 59% more likely than the general population to connect with brands through social networking sites, according to Nielsen.

- According to Nielsen, 29% of Gen Z survey participants stated that celebrity endorsement might influence their purchase decisions, compared to 21% for the general population.

3. Credibility

Finally, influencers have a lot of credibility that brands may not have.

- Influencer referrals are powerful; consumers trust influencer product recommendations and bloggers often use the products themselves in YouTube videos. Influencers claim that they are connected to their audiences and give honest opinions and reviews about product traits, which, in turn, demonstrates authenticity and drives conversion rates.

Influencers Versus Celebrities

There has been a shift towards using influencers with smaller or mid-sized fan bases, and away from brands’ traditional focus on marketing endorsements by celebrities. Partnering with an influencer can, in some cases, generate large sales volumes at a fraction of the cost of hiring a celebrity ambassador. For example, a beauty super-influencer can be hired as a brand ambassador for $500,000 compared to millions of dollars for a top-tier celebrity. In fact, the role of micro-influencers continues to increase as brands swap celebrities for social media personalities that have a smaller number of followers but show greater customer engagement.

- According to Tribe Dynamics, approximately 80% of the top 15 beauty brand collaborations for the first half of 2017 were with influencers and only 20% were collaborations with celebrities. Furthermore, the overwhelming majority of online beauty influencers are micro-influencers with less than 100,000 followers.

- Influencers who are not generally famous can sometimes be more effective because they often appeal to a specific niche.

- Influencers are gaining more and more recognition with followings as large as, or larger than, celebrities.

- Some celebrity endorsements have not worked out as well as hoped, particularly in the past couple of years, according to Tribe Dynamics.

- Influencers have a closer relationship with consumers than celebrities, as influencers drive authenticity and relevance.

- There is a growing mix between traditional celebrity and social media star influencers such as model Gigi Hadid. Hadid has co-designed apparel collections with Tommy Hilfiger and a limited-edition boot with Stuart Weitzman. Hadid has 37 million followers on Instagram and her ambassadorship has contributed to double-digit sales growth across the Tommy Hilfiger women’s category.

Beauty Dominates Influencer Brands

Influencer collaborations are most prevalent in the beauty space, and the influencer business continues to play a growing role in the sales and marketing of beauty products, especially on YouTube and Instagram.

According to market research firm The NPD Group, numerous beauty brands have been keen to work with influencers, as some influencer collaborations have generated higher sales than traditional celebrity partnerships. Influencers, including beauty vloggers, are often specialized in particular product niches, such as makeup or skincare, and often provide consumer educational information and application tutorials. Product mentions can be sponsored or organic through products featured in tutorials or tagged in posts, as well as suggested as alternatives to prestige products. Awards ceremonies for beauty influencers have even been established across product categories such as makeup, nails and hair.

- Laura Mercier: Aimee Song, whose Instagram page attracts 3.6 million followers, was reported to be paid $500,000 in a partnership with beauty brand Laura Mercier.

- Becca Cosmetics: In 2016, a face palette collection launched by influencer and makeup tutor Jaclyn Hill for the Becca Cosmetics brand resulted in $1 million in sales in 90 minutes, according to Women’s Wear Daily. Hill also won a celebrity makeup artist of the year award.

- BareMinerals: BareMinerals partnered with beauty influencer Ingrid Nilsen, who reportedly received over $500,000 to promote a makeup launch in 2017.

- Frederic Fekkai: Haircare and hair salon brand Frederic Fekkai has partnered with influencer Teni Panosian to promote its salons and products.

- Maybelline: The L’Oréal-owned Maybelline brand has partnered with one of YouTube’s most-watched beauty influencers, Nikkie de Jager, to host a 10-episode YouTube series for Maybelline’s channel.

Traditionally, high-end designer brands were less keen on being associated with beauty influencers than mass-market brands were, but some are now embracing the marketing strategy.

- Dior: Some Dior product sales have benefited from the support of beauty influencers Manny Gutierrez and Jaclyn Hill, and Dior management acknowledged that there is a highly engaged, highly visible customer audience for influencers.

Fashion Also Embracing Influencers

Fashion has been slower than the beauty space to embrace the use of influencers to promote products, but that is rapidly changing.

- OVS: Italian mass-market retail chain OVS will launch an apparel and accessories capsule collection in partnership with social media influencers, models and designers Kendall and Kylie Jenner. The first delivery will hit stores in Italy, Switzerland and Austria, as well as online shops in March 2018.

- Nordstrom: Four out of every five mobile web visits to Nordstrom.com coming from referral traffic are driven by influencer network RewardStyle, which works with 20,000 influencers, according to digital intelligence platform SimilarWeb.

- According to SimilarWeb, RewardStyle’s influencers drive 34% of Revolve.com’s referral traffic, 31% at Net-a-porter, 22% at Sephora.com and 24% at Amazon-owned Shopbop.com.

- Forever 21: Forever 21 partners with small and micro-influencers, and almost 90% of the company’s Instagram posts feature influencers that have follower numbers in the thousands, according to L2.

- Adidas: According to SimilarWeb, Adidas has made a conscious decision to shift away from sponsoring big sporting events towards a digital marketing strategy that includes partnering with influencers and celebrities.

- H&M: H&M is expanding into the Indian market through a social media and influencer-led marketing strategy. The retailer has worked with a variety of key influencers and asked online shoppers to post pictures of their personal fashion styles.

- Others: Bloglovin’ partners with many brands on influencer campaigns including Burberry, Gucci and H&M. Online fashion retailers ASOS, Revolve and Luisa Via Roma, as well as Urban Outfitters, also drive revenue through strategic influencer marketing.

Influencers Are Influencing Holiday Purchases

The influencer space continues to expand as more brands recognize the effectiveness of influencers to drive traffic and sales for specific events or by posting holiday or promotion shopping-related content or tailoring content on blogs. Influencers feature sale codes and promotion deadlines as well as helpful, usable insights. For Black Friday 2017, more and more followers turned to Instagram for purchase recommendations.

- According to RewardStyle, influencers included 51% more products in their posts during the seven days leading up to Black Friday this year than during an average week. Furthermore, Black Friday 2017 saw three times as many clicks from influencer content to retailers’ sites compared to a regular day.

- Nordstrom is lauded for its affiliate sales generated by content creators, especially for its prominent annual anniversary sale.

Drawbacks of Influencers as a Marketing Channel

Despite the clear commercial imperatives, the insufficient transparency over the endorsement of influencers is threatening the credibility of this new marketing channel among consumers. Compensating influencers to post promotional photos or posts without disclosing brand sponsorships can be a damaging practice. However, some influencers provide educational content and genuine recommendations instead of just obtaining commissions.

- Authenticity: Authenticity is paramount to the way influencer campaigns are received by consumers, and the idea that an influencer is using products of their own volition forms part of their appeal to followers. Anything that detracts from this perception could turn customers off and result in negative publicity and even possible legal complications.

- Scrutiny around paid sponsorships: There is growing legal scrutiny around disclosure of brands’ influencer partnerships and commissions to promote companies and products. The FTC has been increasing regulation and cracking down on influencers that do not clearly disclose when an Instagram post is actually a paid advertisement. Influencers need to clearly and conspicuously disclose all business partnerships and paid sponsorships on all social media platforms.

Influencers Launching Own Brands

Influencer commerce is likely to grow in the future, as influencers can leverage follower data to create products that already have built-in audiences. We are already witnessing numerous social media influencers launching their own product lines in the beauty and fashion categories.

- Huda Kattan: Huda Kattan has become the first social media beauty influencer to attract private equity investment for her four-year-old beauty brand Huda Beauty. Private equity firm TSG Consumer Partners has also backed beauty brands Smashbox and It Cosmetics. The investment deal will support further product expansion, retail distribution and international expansion. Kattan started her brand with a line of false eyelashes and has since expanded into highlighter palettes, foundation and primer distributed in 40 US Sephora stores. Huda Beauty is sold at Harrods, Selfridges, Cult Beauty and ShopHudaBeauty.com, although the majority of sales are derived from retail distribution. Kattan has a global fan base, with 22 million Instagram followers, 4 million YouTube subscribers and 1.5 million blog visitors.

- Arielle Charnas: One of the most popular social media influencers, Arielle Charnas, co-designed the Something Navy x Treasure & Bond line with Nordstrom. The collaboration reportedly generated over $1 million in sales in less than 24 hours on Nordstrom.com, where the collection was sold exclusively. Charnas has also co-created successful lines for Koral and Monrow that were sold exclusively at activewear retailer Bandier, and partners with Amazon and First Aid Beauty.

- Jen Atkin: Hairstylist to the celebrity Kardashian-Jenner family, Jen Atkin, launched Ouai, a haircare product line that is expected to generate sales of $15 million in 2017. The products are distributed in US Sephora stores. Social media continues to play an important role in the company’s strategy, with Instagram accounts used frequently to maintain a relationship with customers and obtain feedback regarding existing and future products. Atkin’s Instagram account has about 2 million followers and Ouai’s about 250,000.

- Liah Yoo: YouTube skin care vlogger (video blogger) Liah Yoo launched a new skin care brand called “Krave” and products are sold through Kravebeauty.com. Yoo’s YouTube channel audience allows her to operate a direct-to-consumer (D2C) e-commerce model without a distribution partnership with other retailers. She has also previously consulted for L’Oréal’s Asia-Pacific arm on social media marketing and partnered with Unilever Asia on the Ponds brand, as well as with several South Korean AmorePacific brands.

- Marianna Hewitt: Beauty super-influencer Marianna Hewitt and business partner Lauren Gores will launch a D2C skin-care line called Summer Fridays in January 2018. The brand will be sold exclusively at Summerfridays.com. Hewitt will also release her second beauty box with Revolve, following a first box that sold out twice in summer 2017. Hewitt also stated that she will enable followers to participate in the development of future products. Following the release of four skin care masks in 2018, crowdsourcing will be used to determine what products to expand into in the future.

- Chiara Ferragni: High-end influencer Chiara Ferragni started the blog The Blonde Salad, which has 379,000 followers, and her own Instagram account has 10.5 million followers. Ferragni opened a Chiara Ferragni Collection store in Milan and plans to open 40 Chiara Ferragni stores in 2018–2019, mainly in Asia.

- Farah Merhi: Influencer Farah Merhi launched her first home goods collection on television shopping service QVC. According to QVC, Merhi has a very large following on social media, including over 4 million followers on Instagram, and is one of the most influential names in home décor.

Opportunities and Challenges for Influencer Brands

The US apparel and beauty categories are very sizable markets, so would provide the most opportunity for influencer brands in total dollar terms.

- According to Euromonitor, the size of the US apparel market totaled $284 billion in 2017, the apparel accessories market was worth $15 billion and beauty and personal care products formed an $89 billion market.

Apparel and Apparel Accessories: A Fragmented Market

There look to be greater opportunities for influencer brands in categories where consumers look for branded goods. In categories where branding is less important, shoppers may opt for private labels or low-price branded products over premium branded lines.

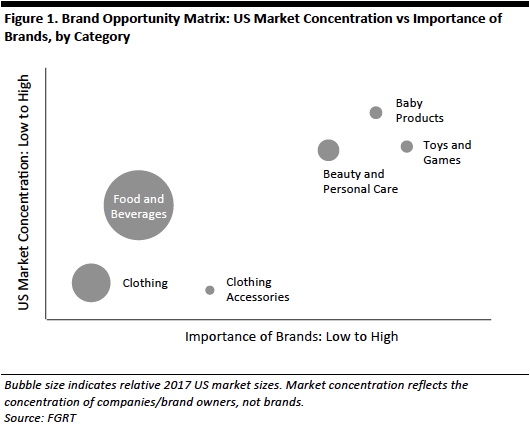

Our matrix below depicts US market concentration and the importance of brands for selected consumer-goods categories.

- The low importance of brands in the clothing category suggests limited scope for launching new branded products in this area.

- The importance of brands is much greater in the beauty category, suggesting greater scope for launching influencer brands.

At the company level, the US clothing and accessories markets are highly fragmented, whereas the beauty and personal care category is moderately to highly concentrated. This suggests that influencer brands would likely need to collaborate with major beauty brand owners to access that market, but that there may be opportunities to “go it alone,” without collaboration, in the clothing category.

Beauty: A Crowded Market

At the same time, the influencer brand space is very crowded, especially in the beauty category. Influencer products are not only competing with other influencer brands, but also with the well-funded brands of large global conglomerates such as Estée Lauder and L’Oréal, as well as the countless cosmetic brands being launched by independent entrepreneurs, dermatologists and beauticians.

- Given the cutthroat level of competition and market saturation, we believe it will be very difficult for the majority of influencer brands to gain meaningful scale in the beauty category. Only the most high-profile social media stars will likely be able to build viable and sustainable businesses. The same could be said for other categories such as fashion apparel, given the plethora of brands and retailers in the market.

Apparel: A Competitive Market

The apparel market in the US is also competitive, and apart from branded goods, we are also seeing more and more private-label apparel introductions that offer attractive merchandise at value price points. Major US retailers including Amazon, Walmart, Target and even supermarket chain Kroger, are launching or expanding their private-label apparel offering.

The Future

Influencer marketing will likely only increase in the coming years, as social media becomes more closely integrated with e-commerce. More and more companies dedicated to optimizing strategies to work with social media influencers are being established.

- Chute: One such company, which works with brands and publishers including Benefit Cosmetics, Adidas and Condé Na st, is Chute, which, in September 2017, launched Chute Influence, a combination of software and services focused on assisting brands in identifying and working with social influencers.

Despite a very competitive market, we believe social media influencers will try to continue to leverage their relationships with followers and increasingly launch their own product lines and grow their own brands.

Key Takeaways

- Influencers generate mass engagement and are a source that consumers trust. Statistics support the power of influencers.

- Influencers have become instrumental to shoppers, and recommendations from favorite bloggers can drive greater product purchases than traditional marketing e-mails.

- Social media influencers have now become celebrities, and many are evolving into designers and product developers.

- Given the cutthroat level of competition and market saturation, we believe it will be very difficult for the majority of influencer brands to gain meaningful scale in either the apparel or beauty categories.