DEEP DIVE: One Belt One Road - Impact On Western Multinational Companies

KEY POINTS

- The China-led One Belt One Road (OBOR) initiative will fund a network of infrastructure such as roads, railroads, ports, electricity and energy, and trade and finance ties between China and the countries along two routes: an overland route that links China with South and Southeast Asia, Central Asia, Russia and Europe, and a sea route that goes through the South China Sea and the Indian Ocean, and eventually reaches the Mediterranean Sea.

- We think that the following are key benefits for Western multinational companies:

- Infrastructure improvements will probably result in lower transit costs.

- Enhanced infrastructure will make it easier for Western firms to tap into the lower-wage economies along the OBOR.

- The OBOR initiative is likely to result in improvements in the business climate and in disposable income, which should bolster demand for consumer goods.

- Multinational brands will gain from enlarged catchment areas as a result of infrastructure upgrades.

- Additionally, infrastructure improvements are set to have direct positive impacts on companies in sectors such as logistics and tourism.

- We foresee challenges in the short-to-medium term as US and Western multinational companies grapple with the environment in some of the emerging markets along the OBOR. In the long run, we expect these challenges to be mitigated by gradual improvement in domestic regulatory environments and believe the rewards are more than justified by the risks.

EXECUTIVE SUMMARY

The One Belt One Road (OBOR) initiative involves 65 countries and encompasses massive infrastructure investment in Eurasia and Africa. Even though OBOR is led by China, the initiative will benefit not only Chinese companies but also Western multinational companies in terms of the numerous emerging trade opportunities that will result from the lower transit costs and the improvements in infrastructure, business climate and disposable income in the region.

We believe the key sectors that stand to benefit from the initiative are trade, tourism, logistics, energy and infrastructure in the countries along OBOR.

For Western multinational companies that are looking to capitalize on the opportunity, they will enjoy the advantages of their IP and brand equity that they have established in their country of domicile and internationally. However, they will likely face challenges in the region such as competition from local players, regulatory risks, credit risk, and supply chain risk.

We highlight that partnering with carefully selected local players is a means to mitigate the risks upon entry into the OBOR regions.

INTRODUCTION

Led by China, the One Belt One Road (OBOR) initiative involves massive infrastructure investment in Eurasia and Africa. This is expected to improve connectivity and the business climate in those regions. The US is not one of the 65 countries included in the OBOR. However, we believe US companies will also benefit from better connectivity in the long-term because emerging markets will be further developed.

This report looks at how Western multinational companies can capitalize on these emerging opportunities, with a focus on consumer-goods companies. First, we outline the details of OBOR, including its funding and its position in the landscape of global cooperation and integration.

THE OBOR AS A FACILITATOR OF GLOBAL TRADE

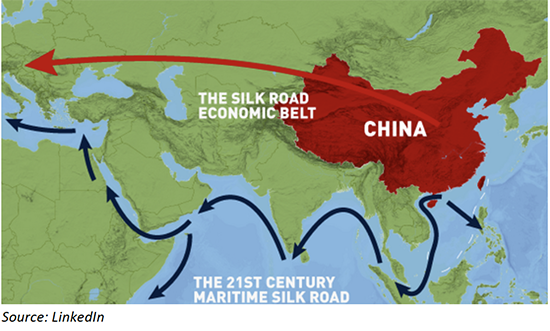

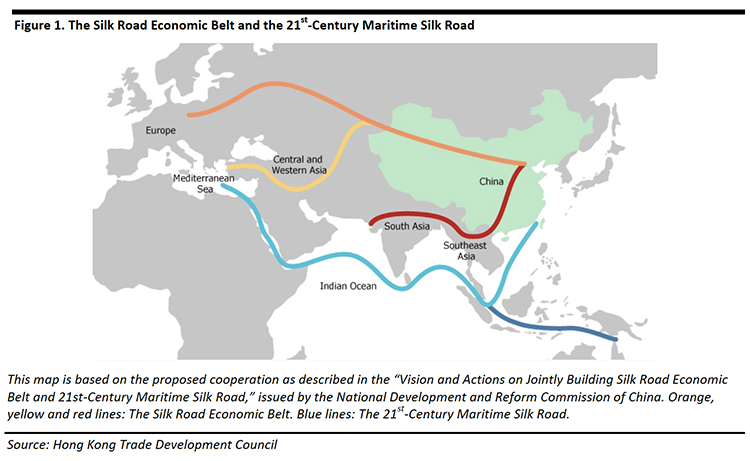

The OBOR initiative refers to the Silk Road Economic Belt and the 21st-Century Maritime Silk Road; two routes that connect China with 64 countries in Asia, Europe and Africa. One route is by land and the other by sea.

- The Silk Road Economic Belt is the land route that links China with South and Southeast Asia, Central Asia, Russia and Europe.

- The 21st-Century Maritime Silk Road is the sea route that goes through the South China Sea and the Indian Ocean, and eventually reaches the Mediterranean Sea.

This China-led development strategy will create a network of infrastructure such as roads, railroads, ports, electricity and energy, and trade and finance ties between China and the countries along the two routes. It will also provide opportunities for China to export overcapacity and to make investments overseas. The initiative focuses on numerous infrastructure investments in countries along the routes, and is expected to increase regional connectivity and facilitate trade, and will likely set the stage for the next round of global economic growth. The development will benefit not only China: in our view, Western multinational companies also stand to benefit from the numerous emerging trade opportunities.

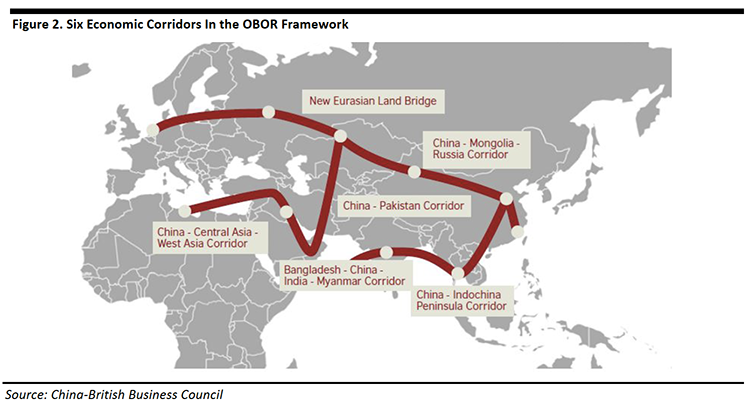

As illustrated in Figure 2, the Silk Road Economic Belt and the 21st-Century Maritime Silk Road will form six economic corridors.

The OBOR initiative focuses mainly on infrastructure development in developing countries in the regions and on removing non-tariff barriers to trade.

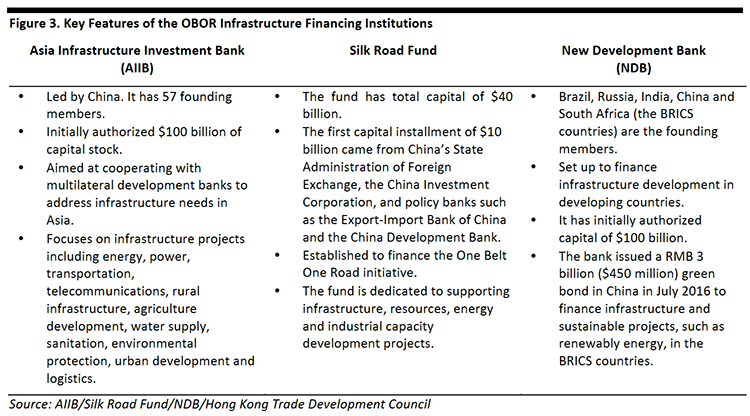

Below, in Figure 3, we provide a summary of the key financing mechanisms that have been established to fund infrastructure projects as part of the OBOR.

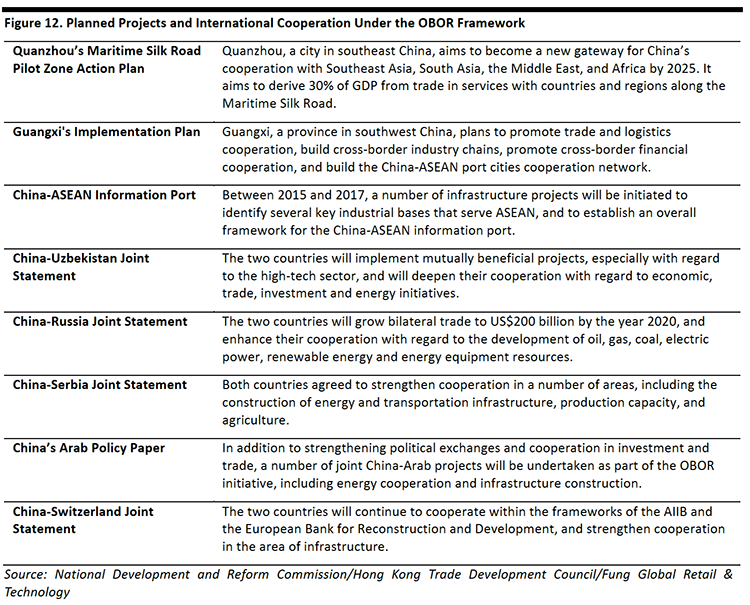

The first four loans approved by AIIB were for power, transportation and urban investments in Bangladesh, Indonesia, Pakistan and Tajikstan. They totaled $509 million and were made in June 2016. Refer to Appendix 1 for selected examples of projects planned under the OBOR framework, including action plans of Chinese local and provincial governments and agreements between China and countries along the OBOR.

OBOR and Other Multilateral Agreements

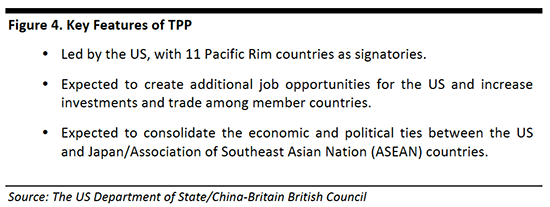

In a global context, the OBOR is one of many efforts underway that promote regional cooperation and integration. There are other multilateral trade agreements aiming at building closer regional ties, and a noteworthy one involving the US is Trans Pacific Partnership (TPP), which is led by the US and signed by 11 other Pacific Rim countries (Australia, Canada, Japan, Malaysia, Mexico, Peru, Vietnam, Chile, Brunei, Singapore and New Zealand.

The US is also forging closer economic ties with ASEAN countries via the US-ASEAN Connect, a US government initiative launched in February 2016 intended to promote trade and economic integration. The four pillars under the umbrella of the US-ASEAN Connect are:

- Business Connect, which supports more commercial engagement between the US and ASEAN businesses in sectors including information and communication technology and infrastructure.

- Energy Connect, which assists in the development of energy sectors in ASEAN, with an emphasis on sustainable and clean energy.

- Innovation Connect, which supports the emerging entrepreneurial ecosystem in Southeast Asia and provides policy support and technical assistance.

- Policy Connect, which supports the ASEAN countries in creating a policy environment that is conducive to trade and investment.

OBOR IMPLICATIONS

Improved Connectivity Translates to More Business Opportunities for Western Multinational Companies

We believe there is much scope for multinationals to capitalize on increased connectivity in the OBOR regions. Improved infrastructure investments and connectivity may open new markets for US and multinational companies and ultimately drive US economic growth. The US currently has close trade ties with countries along the OBOR and we believe they stand to benefit from improved connectivity and business climate in the region.

The US economy is, in part, dependent on the ability of US firms to compete successfully in overseas markets. More than 95% of the world’s consumers live outside the US, and approximately 18% of US manufactured exports are sent by American parent companies to their foreign affiliates, according to the US Bureau of Economic and Business Affairs.

For Western companies, the OBOR initiative means new business opportunities in the ASEAN, Central Asia and African countries. In particular, ASEAN—a $2.5 trillion economy that is the world’s seventh-largest and Asia’s third-largest, just behind China and Japan—is poised for strong growth on the back of a young workforce, improving infrastructure and rising incomes.

Any economic impact from the OBOR initiative, however, will likely be felt in the longer-term because infrastructure projects in the underdeveloped regions along the OBOR will take years to complete.

- We see the following benefits to businesses, including Western companies, from the OBOR initiative: Improved infrastructure conditions along the OBOR countries will likely be positive for Western multinational companies in their continuous drive to optimize manufacturing costs: not only will it probably result in lower transit costs, but the infrastructure will enable companies to tap into the lower wages of emerging economies along the OBOR. Although Western multinational companies already have manufacturing bases in many of these countries, higher connectivity will likely reinforce this trend going forward. As a result, Western consumers stand to benefit from lower prices when lower costs are passed through to end users.

- Improvements in the business climate and in disposable income along the OBOR will also likely drive demand for consumer goods and food and beverage (F&B) categories, in turn benefitting multinational companies. Multinational companies and brands will further gain from enlarged catchment areas for their products due to improvements in infrastructure and the removal of non-tariff barriers that will make it easier for them to carry out business.

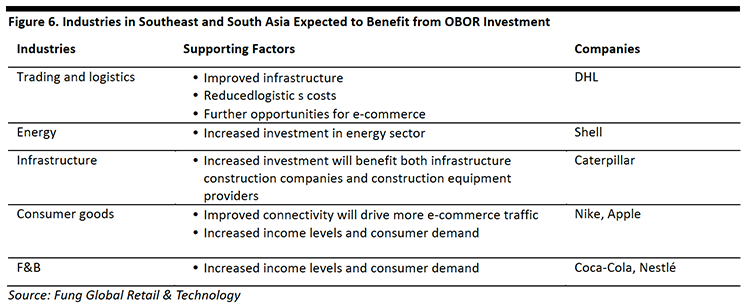

- Finally, sectors as diverse as trading, tourism, logistics, energy and infrastructure in countries along the OBOR are poised to benefit from upgrades in infrastructure, utilities, energy and related industries. We discuss the possible impacts on a logistics firm, DHL Express, and the tourism industry later in this report, and we provide a case study of Kerry Logistics directly below.

CASE STUDY: Structural Shift In Manufacturing And Trade Sets A New Paradigm For Sourcing

Shift in Low-end Manufacturing from China to Other Emerging Economies

China’s low-end manufacturing is shifting to Southeast and South Asia, due to the country’s relatively higher labor costs. Labor costs in China have been growing faster than consumer inflation for years, and are currently nearly four times those in Bangladesh, Laos, Cambodia and Myanmar. As a result, these countries’ share of US light manufactured imports has increased significantly.

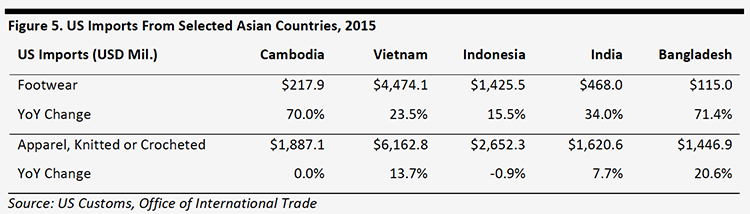

Footwear imported to the US from Bangladesh jumped 71% in 2015 over the previous year. Apparel imported to the US from Bangladesh also increased 20.6% year over year.

China Moved Up the Manufacturing Value Chain to Command a Larger Share of High-end Manufacturing Trade

China’s share of domestic value added in exports, which measures the value added by an economy in producing goods and services, increased to 70% in 2007 from 65% in 2000, according to the World Bank, amid a global trend of declining domestic content in exports. As China moves up the manufacturing value chain, the country will become an increasingly important supplier of high-end products, such as electronic equipment, to the US.

The Made in China 2025 strategy (MiC2025) will further accelerate the upgrade of manufacturing value chain in China. It has identified key sectors and products that China hopes to produce domestically by 2025 and spans a variety of industries that range from information technology (IT) and new energy vehicles to advanced biomedical engineering. There is room for collaboration between China and other countries in high end manufacturing:

- UK: In 2015, the UK Department for International Trade signed an infrastructure and energy project memorandum with the China Development Bank for investments to support British companies’ involvement in “Made in China 2025.”

- Germany: In July 2015, Germany and China signed a memorandum of understanding to step up cooperation in the development of smart manufacturing technology.

In summary, although the OBOR infrastructure projects will be led by China’s state-owned enterprises and financial institutions, multinationals are likely to benefit from urbanization and the growing consumer goods markets in these regions due to their already established strong brands.

In the following sections, we discuss in more detail the types of consumer industries and companies that stand to gain from the OBOR initiative. We discuss two multinationals with a presence in Southeast and South Asia: Nestlé and DHL Express. First, we look at the substantial and fast-growing Chinese outbound tourism sector.

The Tourism Industry Will Benefit

The OBOR initiative presents opportunities to promote integrated tourism development between China and the countries along the OBOR and hence drive up Chinese outbound tourism. According to the World Tourism Organization, the number of Chinese outbound tourists reached 120 million and they spent $200 billion overseas in 2015. This made China the largest source of outbound tourists in the world.

Using Thailand as an illustration, tourism is a major income source for its economy and accounts for nearly 16% of its gross domestic product (GDP). Thailand received about eight million Chinese visits which generated $10.7 billion income in 2015, higher than any other country’s contribution.

The OBOR development has also brought opportunities for the Chinese airlines to open new routes to cover cities along the OBOR. For example, Air China is planning new routes connecting cities in Western China with Central Asia and Africa, which will open up new tourist destinations for the Chinese outbound travelers.

Some US airlines have already formed strategic partnership with Chinese airlines – for example, United Airlines is cooperating with Air China, and Delta with China Eastern. While their cooperation focuses primarily on US-China routes, the airlines may their strategic cooperation to cover the OBOR regions.

Consumer Goods and F&B: Set To Benefit From Growing Consumer Demand

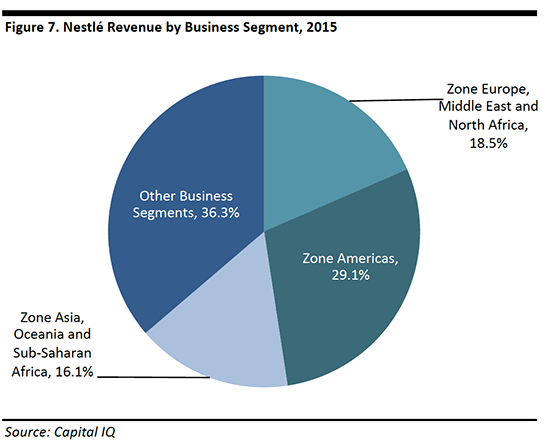

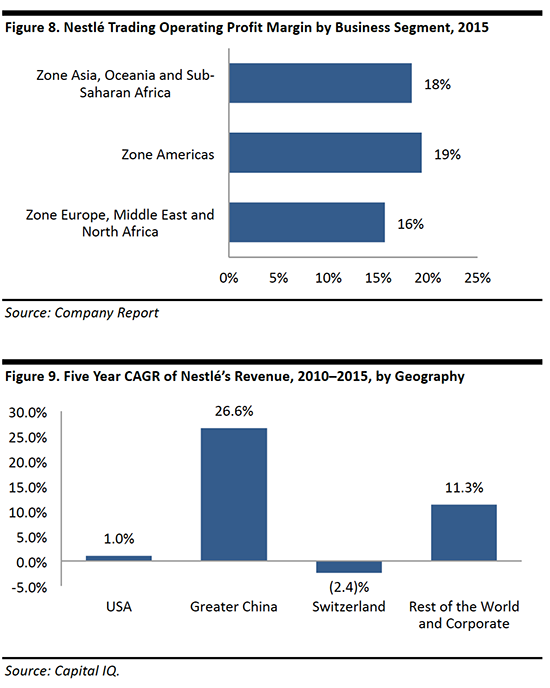

Nestlé, a global food and beverage company, has positioned itself as a beneficiary of emerging market growth, with more than one-third of its sales contributed by Europe, the Middle East and Asia (it does not split out the regions in more detail). For the past five years, sales from China grew the fastest at a 27% Compound Annual Growth Rate (CAGR), followed by rest of the world at +11%, the US at +1% and Switzerland +2%.

Nestlé Indochina, a division of Nestlé, currently has 4.5% of the company’s total workforce in ASEAN.

The Asia, Oceania and sub-Saharan Africa region collectively contributed 16.1% of total revenue in 2015, and Vietnam and Indonesia were the bright spots. We expect companies such as Nestlé to benefit from the support the OBOR initiative provides to income levels and demand for consumer goods in the region.

The 18% operating profit margin for Nestlé’s Asia, Oceania and Africa region in 2015 was second behind the Americas and better than EMENA region.

Logistics Industry: Multinational Company Cooperating With Local Players

DHL Express is a German rapid freight company that stands to benefit from the improved infrastructure along the OBOR.

DHL Express has 27% of its global work force in the Asia Pacific region. In order to benefit from improving connectivity, DHL Express is cooperating with local logistic players so they can penetrate the more remote areas where the company does not have extensive presence. For example, DHL Express works with local postal agencies to make deliveries in outlying locations.

The e-commerce development in ASEAN countries has been hindered by poor transport infrastructure in the region and inefficiency in last mile delivery, according to CIMB ASEAN Research Institute. The upgrade of transportation networks and improvements in connectivity could help solve the last mile problem and drive e-commerce in the region, and as a result benefit logistic and delivery companies.

ADVANTAGES AND CHALLENGES FOR WESTERN MULTINATIONAL COMPANIES

In the following section, we discuss the challenges Western multinational companies could face when they expand and tap into the growing markets in the OBOR regions, as well as the advantages Western they will likely enjoy.

Key Advantages: IP and Brands

We see IP and brand equity as major advantages for Western companies:

- IP: Advanced and innovative technology is one of the biggest advantages held by Western multinational companies when they expand into emerging markets. However, IP protection in these markets is still relatively weak and regulatory systems need further improvement. India ranked the second lowest in IP protection regulations, according to the US Chamber of Commerce International Intellectual Property Index of 2016. The gradual improvement of the regulatory environment will raise awareness and offer more IP protection for multinationals.

- Established brands: Multinational companies can harness the power of their brands to capture the loyalty of emerging market customers. Tapping into emerging markets that are characterized by structural increases in disposable income and a rising middle class will be an important part of the global strategies of multinational companies.

Key Challenge: Competition from Local and Regional Players

Multinational companies, with their established franchises, have enjoyed competitive advantages as they expand into emerging markets. The gap may close in the future, however, as Chinese companies intensify their overseas expansion. We outline some of the key challenges for international retailers below:

- Local competition: We see local competition as the main challenge for global brands. Local players are better attuned to the tastes of local customers than their international counterparts. They are likely to have low cost structures, better access to regulators and are also positioned to benefit from OBOR.For example, Carrefour, a French hypermarket experienced difficulty keeping up with the shopping habits of the Chinese customers after it entered China in the 1990s. The habit of Chinese customers is to shop daily for fresh food and they treated hypermarkets as convenience stores instead of buying in bulk as many Western shoppers do.

- Regulatory risk: In addition, the regulations of many markets along OBOR may have opaque decision-making process and incentives, which may prove challenging for international companies to adapt to.

- Credit risk: International companies have developed credit and payment systems that protect them against counterparty and default risk.In overseas markets, international companies will face customers that may operate on different credit, payment and enforcement principles.

- Supply chain risk: Supply chain risks stems from firms operating in emerging markets which may have limited visibility of suppliers and distributors and may lead to delivery delays and quality control issues.

In some cases, we expect multinationals will cooperate with local or regional players as a means of mitigating local risk, especially in areas that prove too costly for the multinational companies’ expansion. DHL’s cooperation with local postal agencies in remote areas in ASEAN is a good example.

CONCLUSION

In summary, Western multinational companies stand to benefit from the outsized opportunities in the markets along the OBOR in the longer run, because improving infrastructure leads to an enlarged catchment area for their products and increased international sales.

More specifically, the OBOR will likely deliver benefits for Western multinational companies over the medium to long term:

- All parties will benefit from lower transit costs as a result of the build-out and improvement in land and sea infrastructure along the OBOR. Additionally, multinational companies will benefit from lower manufacturing costs as improved infrastructure conditions will better enable them to tap into the lower wages of emerging economies along the OBOR. As a result, Western consumers will subsequently benefit as cost reductions are passed through to them in the form of lower prices. Western brands will likely benefit from an enlarged catchment area for their products as the OBOR unlocks key markets in Southeast and Central Asia and Africa. The opening of markets would likely lead to lower non-trade tariffs, such as reduced complexity and regulatory costs and would potentially open the market to competition with domestic players. Moreover, improvements in the business climate and in disposable income along the OBOR will also likely support demand for consumer goods.

Appendix 1