17 Retail Trends for 2017

The rise of e-commerce over the last 10 years or so has forced retailers to adapt to the changes demanded by consumers. E-commerce growth continues to accelerate and outpace growth in the brick-and-mortar channel, and online sales accounted for almost 20% of total US sales this holiday season, based on preliminary estimates.

In addition, department stores have offered discounts and promotions as a key tool to drive demand and bring consumers into stores. Over time, this strategy can dilute a store’s brand and leave stores looking picked through. Also, it trains consumers to wait for discounts instead of buying products at full price.

There has been a significant number of store closures in the last few years, and we expect that to accelerate in 2017 and in the following few years. As the department store channel shrinks, and more brands fight for less space, we think brands will need to be more creative, flexible and diversified in their approaches.

One way brands can disrupt the more traditional wholesale channel without taking on the significant real estate risk that comes with opening their own stores is to open pop-up stores. With pop-ups, brands have complete creative control of the brand experience and how their messaging is communicated to consumers. They can tell the story they want to tell and explain in their own voice what the brand stands for.

In some cases, brands use pop-ups more as an advertising tool than as a place to transact commerce. These kinds of pop-ups usually offer some kind of special experience to draw consumers into the store. Pop-ups can also be set up in locations other than malls, allowing brands to reach their target customers where they are.

Retailers and brands can also use pop-ups to test the waters in the most expensive shopping areas, often at discounted rents, while landlords can use the temporary stores to show off the space to prospective long-term tenants. Mall operators are receptive to pop-ups, as they bring something new and unique to consumers. Real estate firm Related Companies has used pop-up shops at the Time Warner Center in New York City to provide a fresh feel and add variety for consumers.

We have seen just the tip of the iceberg in 2016 in terms of what brands can do to reach consumers in more creative ways. Food trucks have become highly popular, and they now compete with restaurants in a number of markets. We think a similar opportunity exists in the retail space: retailers and brands can operate retail trucks, temporary spaces and pop-up shops in traditional and nontraditional locations in order to drive sales and traffic.

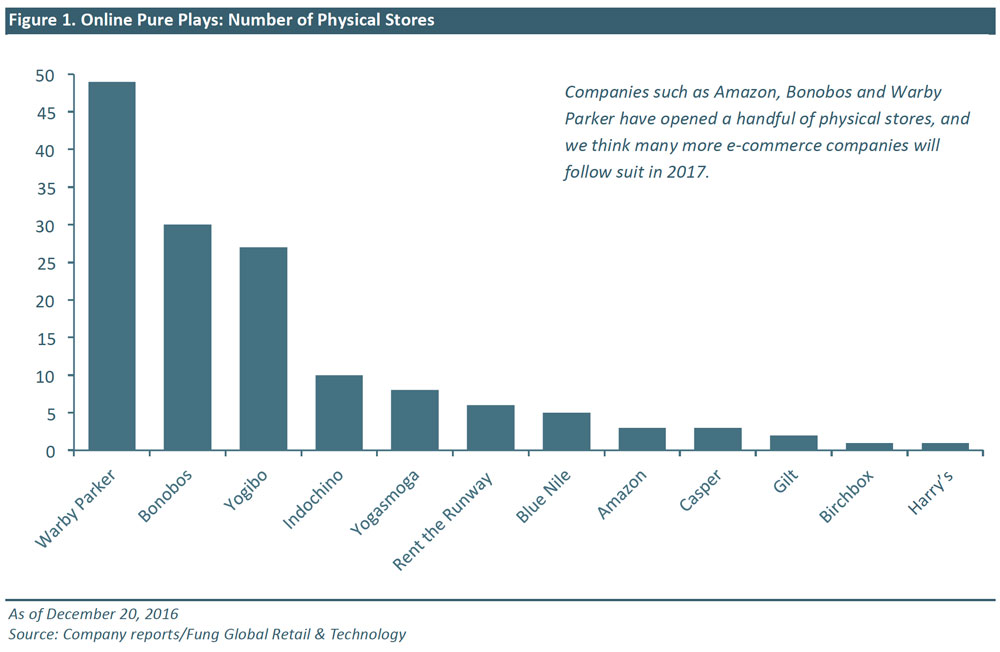

Online pure plays are also increasingly seeking a physical presence. Companies such as Amazon, Bonobos and Warby Parker have opened a handful of physical stores, and we think many more e-commerce companies will follow suit in 2017. A brick-and-mortar presence will be a necessary part of the business model for online pure plays, and pop-up stores are a good way to test the market. We think more companies will use pop-up stores to enhance profitability, increase brand awareness and enhance the overall shopping experience.

Another way for brands to directly reach consumers is through social media. Instagram and Pinterest, for example, both now offer a commerce tool. In addition to allowing users to shop via its platform, Instagram allows brands to directly share their brand story and messaging with users. We think this way of shopping will become more mainstream in 2017.

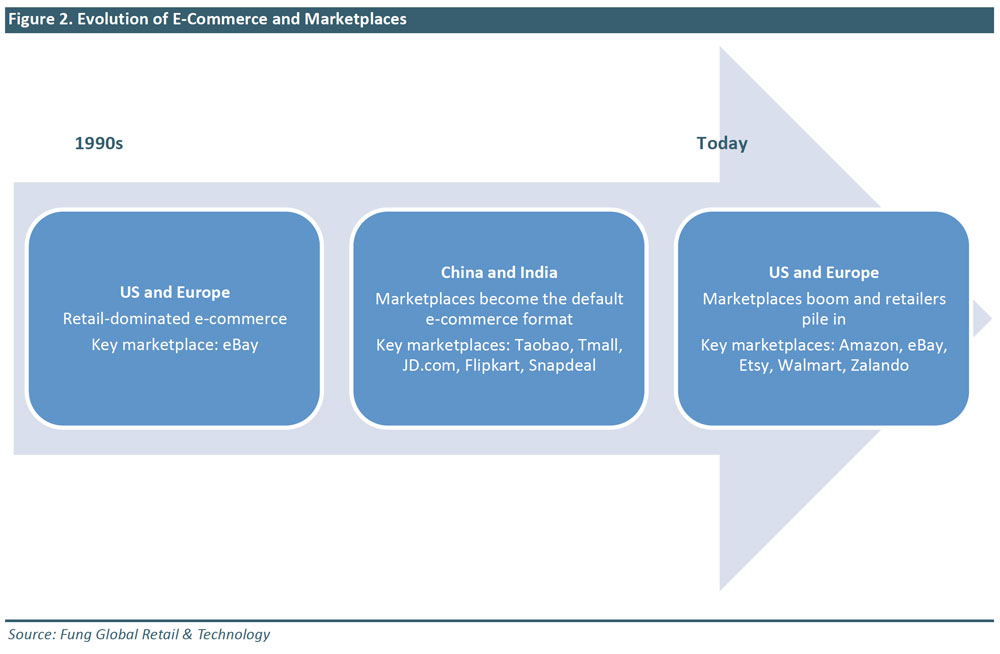

Online marketplaces from names such as Amazon and Walmart are carving greater share of e-commerce sales in Western markets, including the US and Europe. These regions are following in the footsteps of China and India, where marketplace sites such as Tmall, JD.com and Flipkart have long dominated online retailing.

Marketplaces are purely platform providers. They enable other companies to sell goods or services, but do not provide anything tangible themselves. In 2017, we expect competition among marketplaces to intensify further as the major ones gain share of consumers’ online spending.

Internet shopping in the US and Europe traditionally meant buying from a retailer’s or brand’s website—with the obvious exception of eBay. Now, consumers in these markets are following trends seen in China and India, migrating to marketplace sites. Below, we identify three phases in the development of online marketplaces.

Amazon has led the charge to marketplace formats in the West. In the third quarter of fiscal 2016, third-party sellers were responsible for half of all units sold on Amazon.com—this was the first time this threshold had been reached. We estimate that, in 2016, Amazon’s annual marketplace sales exceeded those of eBay for the first time.

Walmart moved into the marketplace format in 2009, but it did not grow its seller numbers substantially until 2016. As a result, Walmart added approximately 1 million SKUs per month to its website in 2016. Walmart’s acquisition of Jet.com in August 2016 brought the latter’s 14.8 million product listings, 210 million unique visitors and $1.2 billion gross merchandise value run rate to Walmart. Walmart has also made investments in JD.com in China, taking its stake to around 10.8%. These moves are further bolstering its exposure to the marketplace segment.

In Europe, Zalando has been among the retailers to launch a marketplace. Zalando’s is targeted at big fashion brands and, like Amazon, it offers fulfillment on behalf of third-party sellers.

There are four benefits to the marketplace model that make it attractive to companies that have previously operated in the direct-retail sector:

- It is highly profitable. Marketplace sites can charge double-digit commissions for simply acting as portals. Fulfilling orders on behalf of sellers provides an additional revenue stream.

- Marketplaces are protected from the risks associated with owning stock.

- Shoppers are less likely to walk away unsatisfied, as the long tail of product demand can be satisfied with little effort by the retailer, in turn building loyalty and repeat visits.

- A marketplace model offers an asset-light way of entering new regional markets.

Due to these benefits, we expect major retail names to continue their push into the marketplace format in 2017. Amazon will become a majority marketplace by number of units sold and will pull further ahead of eBay in terms of marketplace sales. We also expect to see marketplace providers enhancing their services, such as in fulfillment, in order to make themselves attractive to both buyers and sellers. Marketplace growth will pressure more brands and retailers to establish a presence on these sites.

However, over the medium term, we also foresee marketplaces’ share of e-commerce plateauing, as some consumers will continue to seek the reassurance that dealing directly with a retailer gives them in areas such as product authenticity, return policies and collection options. So, it is far from certain that e-commerce landscapes in the US and Europe will end up imitating their marketplace-dominated counterparts in Asia.

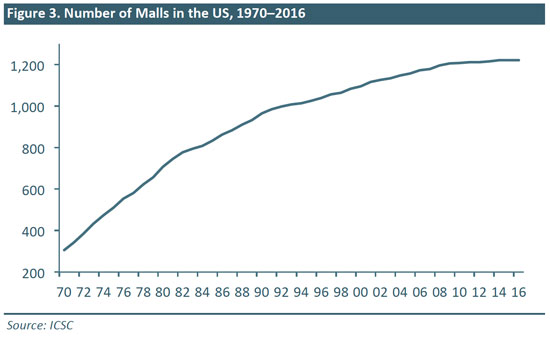

The US is overmalled and overstored. There are currently 1,221 malls in the US, according to the International Council of Shopping Centers (ICSC), and the number of malls grew by more than 300% from 1970 to 2016. Mall operators are repurposing B malls as A malls, and closing many C and D malls altogether. Combined, B and C malls total almost 550, but represent only 28% of all mall sales.

As the number of malls has grown, there has been corresponding growth in the number of retail stores.

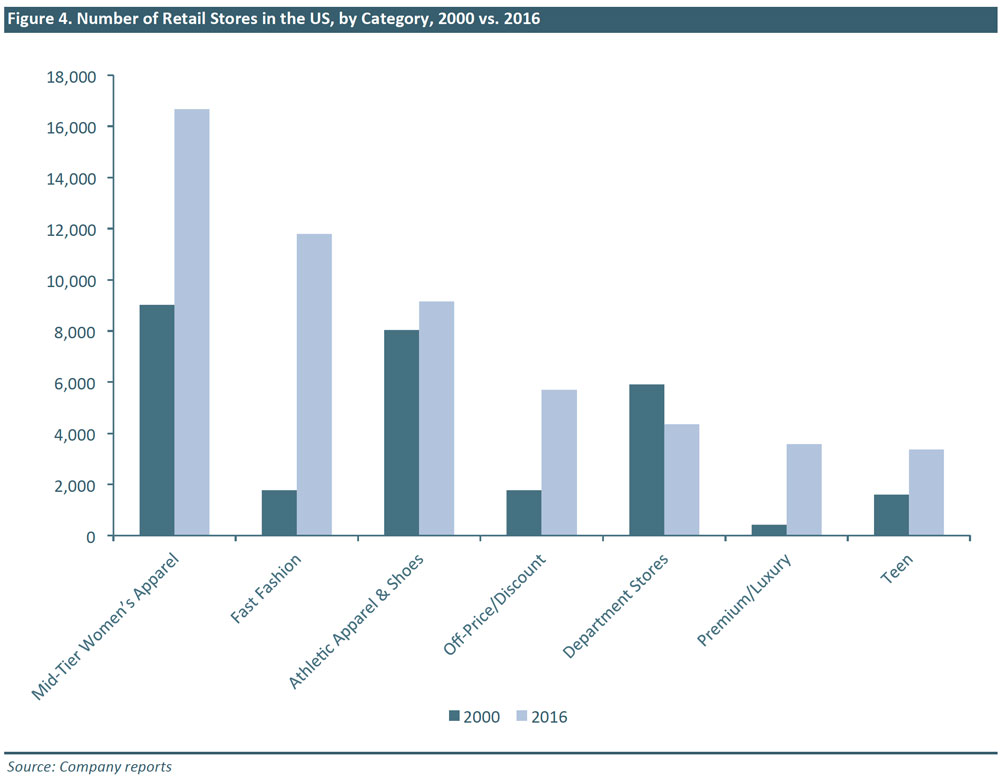

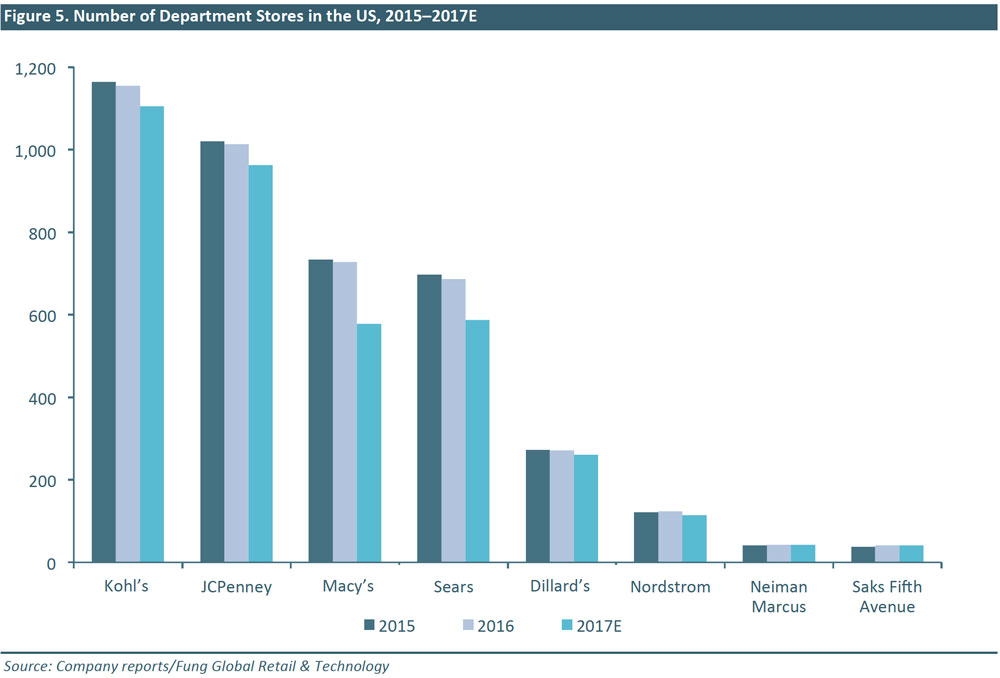

Many department store chains are consolidating and closing stores. Department stores have traditionally served as mall anchors, but they have been challenged on a number of fronts: mall operators have closed some malls and changed others into A malls, e-commerce has seen rapid growth, fast-fashion retailers and outlet stores have provided much competition, and smaller store formats have lured shoppers away from bigger stores. In 2016, Macy’s announced that it would close 100 stores, or 15% of its fleet. Sears announced that it would close 50, or 7%, of its stores, and JCPenney said it would close seven stores.

Some specialty retailers have also announced store closures over the past year. The women’s apparel and teen categories have been hit hard. The mid-tier women’s apparel category is struggling with a lack of differentiation in a saturated market. Additionally, fast-fashion and off-price retail are proving to be tough competition as consumers are finding on-trend pieces at affordable prices at these stores. Specialty retailers such as The Limited, Banana Republic, and Gap—where women traditionally shopped for wardrobe staples—have all announced store closures. The teen category has also struggled, with five retailers declaring bankruptcy in 2015 and 2016. Express reduced its store count by 21% and American Eagle Outfitters reduced its store count by 10% from 2015 to 2016.

We think that retailers, particularly department store and specialty store operators, are likely to close more stores in 2017 than they have in the past, and that the bulk of the closures will be mall locations. We predict that there could be several hundred announced department store closures in 2017, and that a number of retailers could file for bankruptcy, which would result in even more store closures. We believe most of the department stores as well as Banana Republic and Gap will continue to close less profitable locations. Gap Inc. could reduce its store footprint by another 5%, closing approximately 170 Gap and Banana Republic stores. Macy’s will also likely continue to close stores, reducing their fleet by approximately 10%. High-end malls are doing well, and we expect the A malls to survive. However, we believe that at least 30% of US malls, or more than 350 of them, mostly within the C and D classifications, need to be closed.

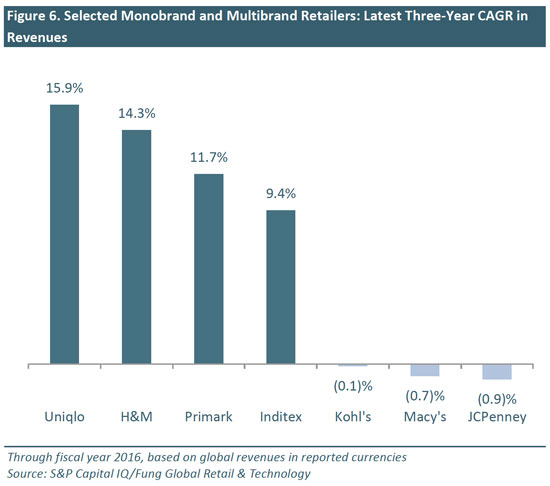

We expect H&M, Primark and Zara to remain among the fastest-growing names in mass-market apparel retail in 2017. High-growth online names such as Boohoo.com will be among this group, too.

Innumerable articles and reports have pored over these retailers’ fast-fashion credentials to explain their success. But their fast-fashion credibility is enabled by a more fundamental characteristic: they are monobrand retailers. In other words, they sell only their own labels, which enables them to establish themselves as brands rather than just as retailers.

Uniqlo provides further evidence of the popularity of monobrand apparel retailers. The company is not a fast-fashion retailer, but a single-brand retailer that has seen very strong growth in recent years.

At the same time, a number of large multibrand retailers have reported disappointing top-line performance. We chart the diverging trend below.

This trend is not black-and-white. Monobrand retailing does not guarantee success—as Gap can attest to—and some multibrand pure plays, such as Amazon and ASOS, are seeing much success online. But the trend is evident nonetheless.

Monobrand fashion retailers’ outperformance is not a surprise, given the advantages the format bestows. These include:

- Product differentiation that is enabled by offering exclusivity.

- Hindrance of direct price comparison, which means monobrand retailers are not forced to race to the bottom on price. The advent of e-commerce and the ease of comparing prices of identical branded goods online make this more of an advantage than ever.

- Greater fashion authority, as ranges are curated and sold under the retailer’s own name. This makes names such as H&M and Zara fashion brands in their own right rather than simply curators of other companies’ products.

Additionally, looking beyond the consumer proposition, own-brand sales typically have higher margins than sales of branded merchandise.

US multibrand retailers ranging from hard-hit department stores to other established general retailers to Amazon are racing to build or strengthen their own apparel offerings in order to take advantage of these benefits:

- In 2016, JCPenney announced plans to ramp up its private-label offerings such as St. John’s Bay, Liz Claiborne and Boutique+. The company’s aim is for its private and exclusive brands to account for 65%–70% of total sales by 2019, up from 52% in fiscal 2016.

- Meanwhile, Kohl’s relaunched its Sonoma Goods for Life apparel and home-goods brand, in a bid to make itself a “destination” for womenswear, and Target launched new private-label ranges such as Cat & Jack in childrenswear.

- Amazon rolled out a number of private-label apparel ranges in 2016 and we expect it to build out its ranges in 2017 and thereafter, as we discuss in further detail elsewhere in this report.

Yet even when they are selling their own products, these types of retailers adopt a multibrand proposition—they use a variety of third-party names, such as Liz Claiborne (JCPenney) and Franklin & Freeman (Amazon). We think this limits the gains they yield from private labels, especially in terms of strengthened fashion credibility.

Multibrand apparel retailing is far from dead. However, future growth appears to lie in the off-price and e-commerce channels, and both exert a depressing force on price and, so, on margins. In 2017, we expect monobrand retailers to further grow their share in store-based, mass-market fashion. This will spur additional efforts among multibrand competitors to adjust their offerings and thereby narrow the performance gap.

The level of competition in the US grocery and apparel segments will likely intensify in 2017 due to new entrants and greater competition from existing players. In grocery, a wave of European retailers is set to enter or expand in the US, and emerging grocery concepts enhanced services and convenience are bringing increased competition. US grocery sales are estimated to have reached $1.13 trillion in 2016, representing a 5-year CAGR of 1.1%. In apparel, Amazon’s push into fashion—specifically, its expansion of its private-label offerings—and consumers’ increasing comfort with purchasing apparel online will likely pose a greater threat to those apparel retailers that are primarily value oriented. Euromonitor estimated US apparel and footwear sales were $384.94 billion in 2016, representing a 5-year CAGR of 2.1%.

Competition in the grocery segment is intensifying due to the aggressive expansion of German discount supermarket Aldi and its fellow German competitor Lidl, which has announced plans to enter the US market in 2017. In addition, emerging concepts with enhanced service offerings, such as Amazon’s smart grocery store concept, Amazon Go, will fight for share in the market. Amazon Go is in test phase and is expected to open in Seattle in early 2017.

Aldi announced plans to accelerate its US expansion and operate 2,000 stores by 2018, which would represent a 29% increase from its 1,300 US stores in 2015. Lidl is expected to enter the US toward the end of 2017, and the company plans to open 150 US stores by 2018. Both of these low-overhead, no-frills concepts have had significant impact on the UK grocery market already. They have taken share from the “big four” grocers in the UK—Sainsbury’s, Tesco, Asda and Morrisons—and put downward pressure on these retailers’ margins. In the US, Aldi’s prices are estimated to be 10%–25% lower across both like-for-like items and private-label SKUs that are similar to those sold by Walmart.

These discount chains keep prices low by limiting inventory to a lean selection of private-label items, whereas traditional supermarkets tend to carry a variety of different brands of a single product. In addition, Aldi and Lidl operate much smaller store formats and limit their store investment more than traditional supermarkets do, which allows the discounters to deliver convenience and affordability to shoppers.

Adding further pressure will be emerging concepts with enhanced service offerings, such as Amazon’s smart grocery store concept, Amazon Go, will fight for share in the market. Amazon Go is in test phase and its first store is expected to open in Seattle in early 2017. Other retailers such as Target and Kroger are looking to offer its shoppers greater convenience with new store formats. Target plans to open 27 flexible format stores in the next three years. The stores are one-third the size of a typical Target and offer a more curated product assortment and improved back-end capabilities that provide additional online pickup options.

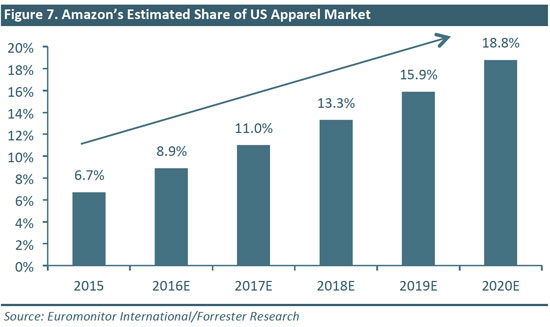

And Amazon will be heaping pressure on apparel retailers, too, after it ramped up activity in 2016. The company began selling apparel in 2002, but intensified its efforts in February 2016, when it launched seven private-label apparel brands. Amazon’s push in the category is being driven by increased private-label offerings, Amazon Prime benefits, new brand relationships and Amazon’s superior fulfillment infrastructure. For Prime members, all of Amazon’s private-label items are available with free two-day shipping and free returns.

Although many brands previously refrained from selling their goods on Amazon, the e-commerce giant has recently improved its fashion profile. Now, brands such as Kate Spade, French Connection, 7 for All Mankind and Vince sell their goods on Amazon’s website. According to Internet Retailer, Amazon increased the number of apparel and accessory products on its site by 87% from 2015 to 2016.

We expect these kinds of competitive pressures in grocery and apparel to continue in 2017. Expansion by Aldi and Lidl is likely to increase competition within the value-oriented grocery segment. This competition may lead to downward pressure on the sales and margins of US retailers that skew toward a more price-sensitive customer, as they have in the UK. To combat margin pressures, we expect grocers to increasingly invest in private-label brands, which typically offer high product margins and cheaper prices for consumers. We also expect traditional grocers and big-box retailers to work to combat this increasing competition by offering enhanced online solutions, such as buy online/pick up in-store, that provide shoppers with ease and convenience.

Meanwhile, in apparel, we expect brands and department stores will feel intensified competition due to Amazon’s increased focus on the category. Department stores have clearly seen negative momentum in 2016 and we expect that to continue in 2017. We believe Amazon will continue to increase its apparel market share thanks to consumers’ increasing comfort with purchasing online, the convenience Amazon offers, and the value of its private-label offerings. As the graph below shows, Euromonitor International and Forrester Research expect Amazon to triple its share of the US apparel market over the next five years.

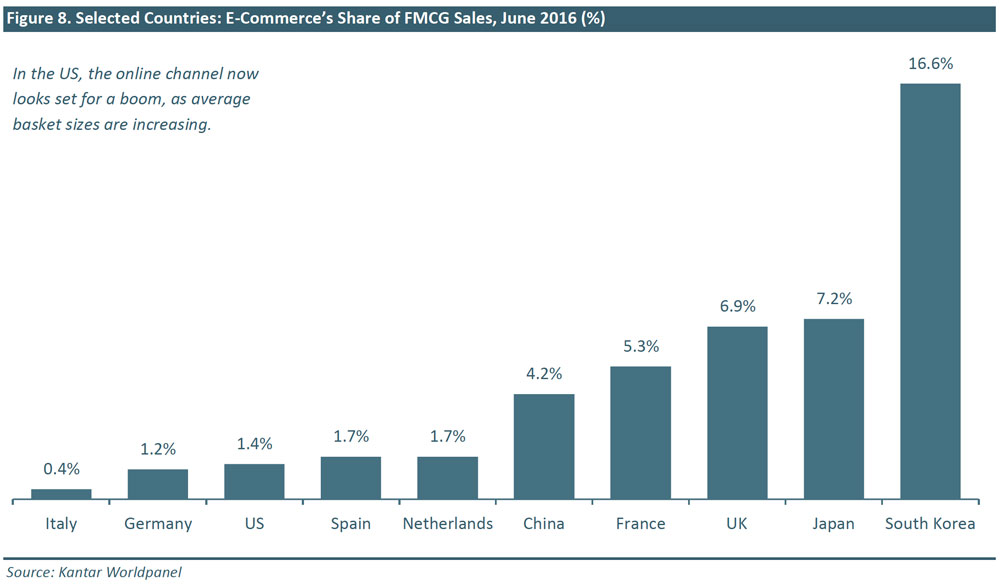

Online grocery is set to grow rapidly in the US and China in 2017 as the battle between major players becomes even more fierce. The US is a particular laggard in grocery e-commerce, but we are now seeing major online activity from the biggest American grocery retailers. At the same time, the Chinese online grocery segment is likely to be boosted by moves from online giants JD.com and Alibaba Group, as well as by the growing involvement of Walmart.

E-commerce’s share of fast-moving consumer goods (FMCG) sales varies greatly among countries. In many countries, the online channel is a nascent, but fast-growing, one. As the graph below shows, South Korea is comfortably in the lead in terms of share of FMCGs sold online, while Italy, Germany and the US trail.

Given its heritage of large grocery stores serving as convenient, one-stop destinations, the US is notably late to grocery e-commerce. But the online channel now looks set for a boom, as average basket sizes are increasing. Survey data show that, so far, American consumers have been overwhelmingly using online grocery services to buy only specific items, not to undertake regular, big shops: just 15% of online grocery “trips” were for major shops in the fourth quarter of 2015, according to research firm Brick Meets Click. But we expect new moves by mass-market retailers to change that, and make online shopping more about conventional, big-basket shopping.

America’s offline market leaders, Walmart and Kroger, continue to expand their pickup service to new locations. AmazonFresh is fighting back by lowering the cost of its service and is set to launch drive-through pickup stores in 2017. FreshDirect is growing the coverage area for its one-hour delivery service while Ahold Delhaize has identified scope to grow the coverage area of its Peapod operation. And retailers such as Whole Foods Market, Target and Publix are using or trialing Instacart’s delivery service.

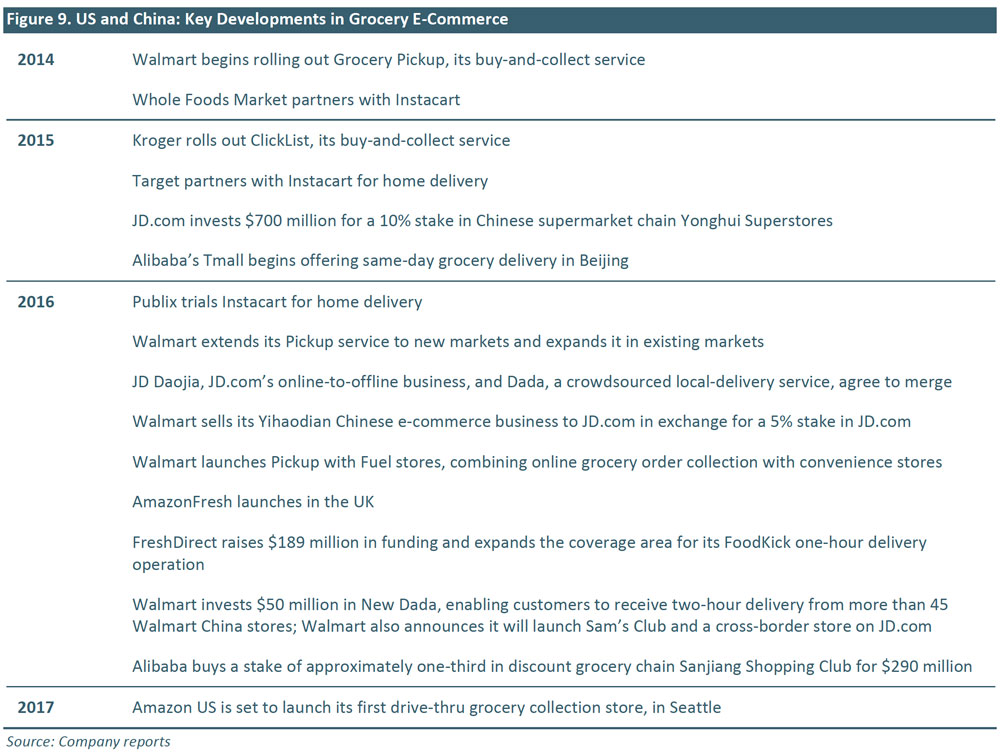

In China, meanwhile, Alibaba and JD.com are fighting it out. JD.com is extending its New Dada rapid-delivery grocery operation in partnership with Walmart. Alibaba’s Tmall began offering same-day grocery delivery in 2015. And both JD.com and Alibaba have invested in brick-and-mortar grocery stores, providing further indication of their interest in this sector. The table below lists the key recent developments in grocery e-commerce in the US and China.

For online marketplaces and pure plays such as JD.com and Amazon, grocery is the culmination of an e-commerce product pathway that began with easily shippable goods bought on specification, such as media products, and progressed through more tangible product such as apparel and beauty. Grocery offers these players a market whose scale is highly attractive even if its margins are slim. For 2017, we expect that:

- E-commerce will become even more important for store-based retailers in China and the US as they face stronger competition. In China, we would not be surprised to see further acquisitions and investments as JD.com and Alibaba seek to build scale in grocery e-commerce. In the US, we expect the pace of growth in grocery e-commerce to accelerate, and for the online channel to capture 2% or more of FMCG sales, up from 1.4% in 2016.

- In all markets, e-commerce will capture the large basket sizes that are the lifeblood of hypermarkets and other big stores. In 2017 and beyond, this migration of big-basket shops will pose a threat to big-store retailers.

Rising labor costs are incentivizing retailers to decrease costs and boost productivity through greater investment in innovative technologies such as robotics, automation and artificial intelligence. In 2017, we expect to see more self-checkouts, self-scanning, chatbots, and robotic customer service assistants and warehouse systems. Amazon will continue to lead the pack in terms of technological innovation.

Retailers in the US and UK are grappling with higher labor costs due to higher minimum wage legislation, pension contributions and warehouse worker labor strikes during critical periods such as the weeks leading up to Christmas. US retailers also face the burden of health insurance costs, which have been rising. At the same time, some big retailers, such as Walmart, are actively hiking wages for their lowest-paid workers in order to retain and incentivize staff. Retailers are being forced to seek new ways to leverage technology in order to lower costs and progressively decrease their dependence on human employees.

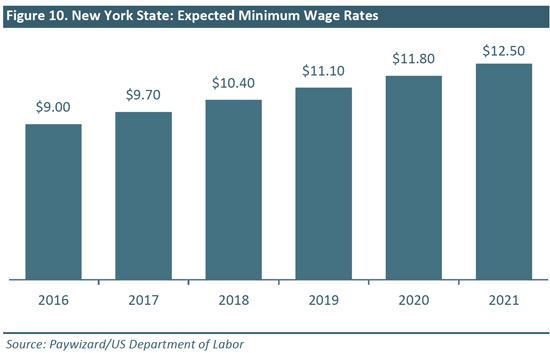

The current US federal minimum wage is $7.25. President-elect Donald Trump supports the White House’s proposal to raise the rate to $10.10. New York is one of the US states that is increasing its minimum wage over the next few years.

Later 2016 saw a flurry of retail technology developments, which included:

- Robots: In November 2016, French supermarket chain Auchan announced that it will trial robots that follow customers in stores, and carry and check out groceries. Walmart has patented a system of self-driving shopping carts that scan, retrieve and deliver products, as well as check inventory.

- Chatbots: A growing number of retailers are using these automated customer-service agents help online shoppers resolve standard queries about product recommendations, prices, promotions and availability. Ahead of Christmas 2016, Nordstrom launched a chatbot on Facebook Messenger to help shoppers select gifts. The company joined a suite of fashion and beauty retailers that are using chatbots; this includes ASOS, Nordstrom, Sephora, H&M, Macy’s, Tommy Hilfiger, Burberry and even Swiss luxury watchmaker Jaeger-LeCoultre.

- Self-scan and self-checkout: As we note elsewhere in this report, Amazon Go a new convenience store concept that has no staff, checkouts or cash registers, and uses technology to detect what products customers take off shelves. In the UK, an increasing number of mass-market retailers are adopting self-service checkouts and handsets that allow shoppers to scan their own purchases.

- Warehouse automation: More and more companies are using robotic systems to improve e-commerce fulfillment. In November 2016, Canadian retailer Hudson’s Bay Company introduced a new robotic distribution-center fulfillment system that is 12 to 15 times faster than manual handling. The system can locate and ship an item in 15 minutes, whereas it might take a human 2.5 hours to complete the same tasks. In September 2016, Walmart announced it was testing Symbotic’s warehouse system, which uses robots to drop off and retrieve product cases five times faster than a human can. The system allows food retailers to decrease labor costs by 80% and operate warehouses that are 25%–40% smaller, saving on real estate costs.

- Electronic shelf labels: In December 2016, German wholesaler and retailer Metro Group announced that it had invested €200 million (US$209 million) in electronic shelf labels. In later 2016, Whole Foods 365 stores also introduced digital price tags. These allow the retailers to change prices almost instantly instead of having to assign store staff to replace each ticket by hand.

The US and the UK will continue to experience further minimum wage increases, pressuring retailers’ margins. In the UK, the national living wage will increase from £7.20 to £7.50 an hour and an apprenticeship levy will be introduced in April 2017. The result of higher labor costs will be more automation, and we expect retailers to continue to boost investments in productivity and efficiency in 2017:

- We will see greater adoption of self-scanning options within aisles, especially at grocery and mass-merchandise stores, as well as machines that bag items. Sam’s Club in the US and Sainsbury’s in the UK are already testing scan-as-you-shop solutions. Self-checkout will also spread to more retailers.

- Chatbots will become more sophisticated and easy to use.

- More service robots will be used to locate inventory. As artificial intelligence evolves, the need for human shop assistants will decline.

- Warehouses will become more automated as online sales continue to grow, and distribution centers will become smaller. Automation could include more Internet-connected forklifts, drones, voice-activated order-picking solutions and sensors on trucks.

Mobile technology has changed the way consumers interact with brands and consequently, retailers and retail companies have had to invest in digital and omnichannel capabilities to react to the changing consumer behavior. However, one area that has lagged behind this digital transformation is the management of store associates, who, in many cases, are still bound to using outdated legacy systems and infrastructure. We are seeing more retailers moving in the direction of empowering their store associates with mobile solutions, and believe the trend will pick up significantly in 2017.

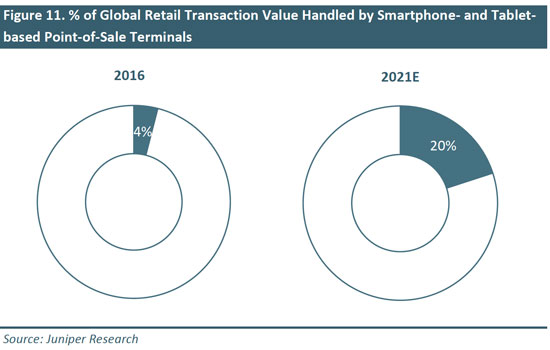

Integrated mobile platforms in the hands of store associates are essential for a true omnichannel customer experience. Beyond personalized services, these mobile technologies integrate hassle-free, on-the-spot payments, eliminating long checkout and waiting times from the shopping experience. In a 2016 study, Juniper Research, a mobile, online and digital market research specialist, found that smartphone- and tablet-based mobile point-of-sale terminals will handle 20% of all retail transaction value worldwide by 2021, up from a 4% forecast in 2016.

In 2016, we saw major international retailers announce moves to empower their store associates with mobile technology. We have also identified several new solutions for store associates that are gaining traction in the market.

- Mad Mobile’s Concierge platform: In December 2016, Ashley Furniture HomeStore, the largest US furniture retailer by sales in 2015, announced plans to roll out Mad Mobile’s Concierge retail platform to store associates nationwide and internationally in 2017. The Concierge platform is a mobile solution that connects store associates with customer, product and delivery information from the retailer’s enterprise systems to enable informed customer service, clienteling and mobile checkout.

- Tulip Retail’s mobile solution: A similar mobile solution developed by Tulip Retail, a Canadian startup founded in 2013, has already been adopted by Coach, Kate Spade, Saks Fifth Avenue, Toys “R” Us and Bonobos, among others.

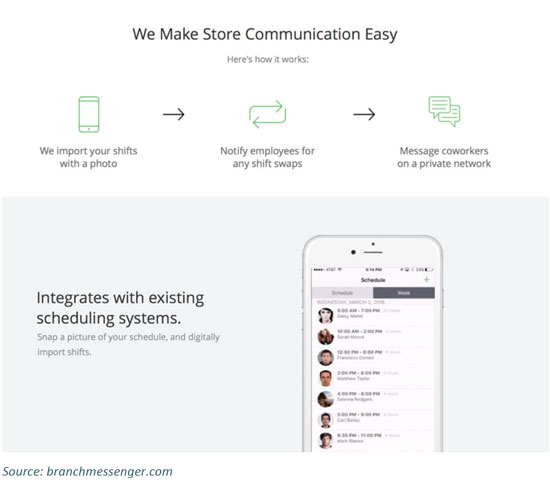

- Branch Messenger’s communication tool: Lastly, 2016 saw the emergence of another startup, Branch Messenger, which was part of the Techstars accelerator program in collaboration with Target. The company has developed a communication tool for hourly workers, among which store associates represent a large segment. Branch Messenger digitalizes the shift-scheduling process, allowing workers to coordinate and exchange shifts. According to the company, its solution reduces employee absenteeism by 43% and saves managers four hours per week. Employees from Zara, J. Crew, Sephora, Walgreens and Gap are already using the application.

As digital-native companies such as Bonobos, Warby Parker and Amazon move forward with their brick-and-mortar push in 2017, traditionally-offline retailers will be necessitated to gain more leverage from their customer service resources as well as their omnichannel investments. Because store associates are the key touch point with customers in physical retail, technologies that enable staff to provide better service more efficiently will likely become the focal point of omnichannel strategies going forward.

We expect more retailers to deploy solutions from technology providers such as Tulip Retail and Mad Mobile in 2017, while enterprise messaging tools such as Brand Messenger will also gain traction.

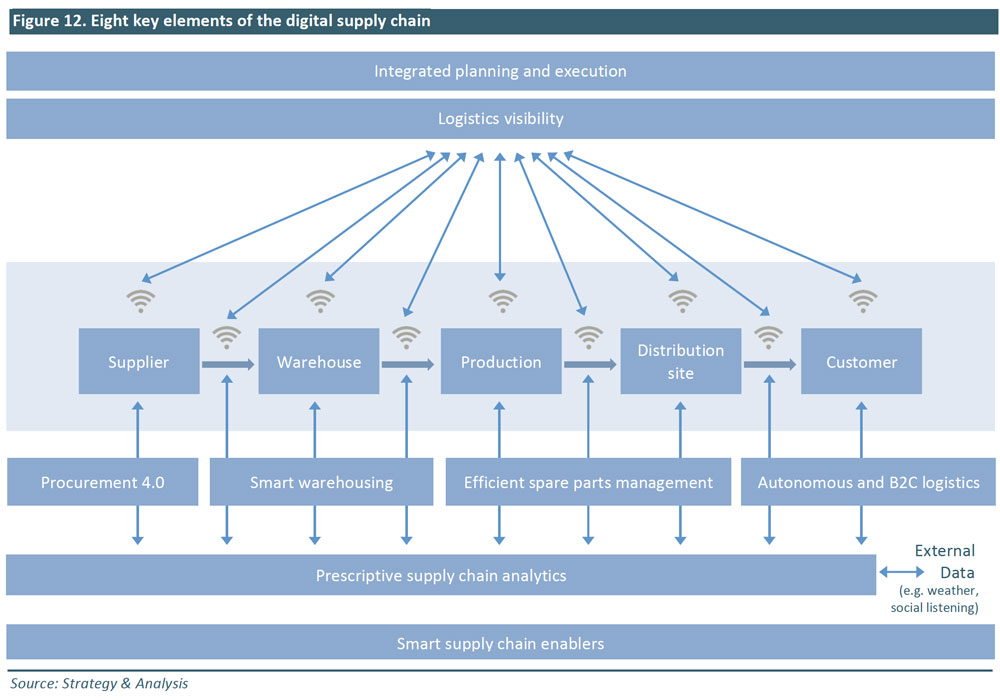

Digitalization, a term that has been around for more than 20 years, is still gradually transforming the structure of supply-chain management. As of today, there are still companies using hybrid supply-chain management, i.e. half digital and half analog, and most people believe such companies will either fully adopt digital or go the way of the dinosaurs when it comes to supply-chain management.

Digitalization comes in different forms, and supply-chain visibility is one of them. Supply-chain visibility is defined as the visibility of specific information and data related to order processes, including shipment, transportation and logistics. There are an increasing number of corporates looking to invest in this particular area—a solution to strengthen visibility on order processing, inventory management, or risk management, by making data readily available to all stakeholders, including clients. This is driven by collaboration across multi-tier, supply-chain partners, and is expected to be the fastest-growing sector in the coming years.

As 2017 is expected to bring a more uncertain global trade environment, we expect retailers to explore ways to create speed and agility in their supply chains, for which supply-chain visibility is key. We expect companies to explore alternative sourcing strategies such as local to local and supply-chain technologies such as RFID and blockchains.

RFID Technology

We expect more companies to adopt radio-frequency identification (RFID) technology in 2017.

- Macy’s: In 2016, Macy’s a long-time user of RFID chips, revealed that the company plans to have 100% of all items in every store tagged by the end of 2017.

- Moncler and Salvatore Ferragamo: Fashion houses such as Moncler and Salvatore Ferragamo have already adopted RFID tags for certain product categories, and other players in the luxury industry are likely to follow suit, to offer visibility and a verification of authenticity to their customers.

- Advanced E-Textiles: 2016 also saw the launch of Advanced E-Textiles, a startup developing RFID technology that can be embedded into yarn and textiles, which, if successful, will further increase the scope and usability of RFID technology in relation to creating supply-chain visibility in industries such as apparel.

Blockchain Technology

Another technology that has the potential to speed up the digitalization of supply chains, which saw interesting developments in 2016, is blockchain technology. Defined as decentralized, shared and distributed ledgers that enable all information to be exchanged securely in almost real-time in a peer-to-peer network, blockchains are an innovative technology that is expected to fundamentally reshape the structure of recording transactions, e.g. inventory management, proving provenance and transaction processing. In 2016, Walmart, IBM and Tsinghua University collaborated on a project to guarantee food safety in China by improving the way food is tracked, transported and sold to consumers using blockchain technology. We anticipate seeing rapid development in the application of blockchain technology in supply chains, especially with the now real potential to combine sensors (RFID) and software (blockchains).

As e-commerce relentlessly gains share, retailers are becoming more creative in tackling the challenges of the last mile of fulfillment—i.e., how they get products to customers. In 2017, we expect retailers to collaborate more, use more technology and adopt new delivery models as they cater to consumers’ near-insatiable demand for immediacy and convenience.

The journey from retailer to customer is getting more complex—and more expensive—for retailers. Sustained e-commerce growth means more purchases are being delivered, yet an increasing share are being picked up from retailers and from third-party collection points such as lockers.

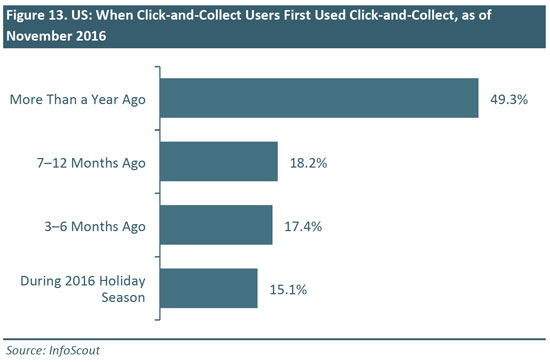

The US, in particular, is seeing rapid growth in click-and-collect as it catches up with more mature markets such as the UK. Some 37% of US shoppers reported using click-and-collect services for holiday 2016 gift purchases, according to a late-November survey by market research firm InfoScout. Of these click-and-collect users, fully 51% had begun using such services only within the past year.

Among recent last-mile developments are the emergence of a new generation of store formats that for the first time “build in” collection services:

- Amazon is set to open three drive-through grocery collection stores, according to technology news site GeekWire.com.

- Walmart recently opened its first two Pickup with Fuel stores, which combine a convenience offering with collection points for online grocery orders at gas stations.

- In Germany, trade newspaper Lebensmittel Zeitung reported that Lidl is preparing to launch an “Express” small-store format that will focus on collection of online orders and offer an edited selection of groceries.

Consumers are enjoying extended collection options, too. For instance, in 2016, Walmart offered Christmas Eve collection for selected nongrocery items ordered on its website before 6 p.m. on December 23.

And new technology is coming into delivery and collection:

- European food-service marketplace Just Eat is using self-driving delivery robots from Starship Technologies to deliver food orders.

- Walmart is trialing an “automated pickup machine”—a kind of giant vending machine for online order collection—in a store near its headquarters in Bentonville, Arkansas.

Finally, retailers are increasingly using third-party providers to offer convenience in delivery and collection:

- The UK, which is ahead of many markets in terms of e-commerce and click-and-collect, has seen a number of third-party collection providers emerge. These include CollectPlus, which offers collection through a network of more than 5,800 local stores, and Doddle, a network of 78 stand-alone collection sites.

- And, as we note elsewhere in this report, AmazonFresh in the UK and New Dada in China are using freelance couriers, while US grocery retailers such as Whole Foods Market are using third-party delivery providers such as Instacart

Consumers in the US and the UK now enjoy a surfeit of delivery and pickup choices, and we expect these to expand further in 2017. We think that consumers will continue to adopt collection services at similar rates, and that retailers will respond to shopper demand for convenience and immediacy with new service offerings. We expect to see:

- Greater use of technologies to fulfill orders, whether by air or land, or in-store.

- Greater collaboration between firms. This could be between retailers, such as brick-and-mortar retailers offering collection points for Internet retailers in their stores, or between retailers and the growing body of third-party service providers such as Instacart and Doddle.

- More capital-light, flexible delivery services using the gig economy business model that companies such as UberEats and Deliveroo use in the food-service world. In other words, we predict that more retailers will use low-cost, third-party couriers for rapid deliveries.

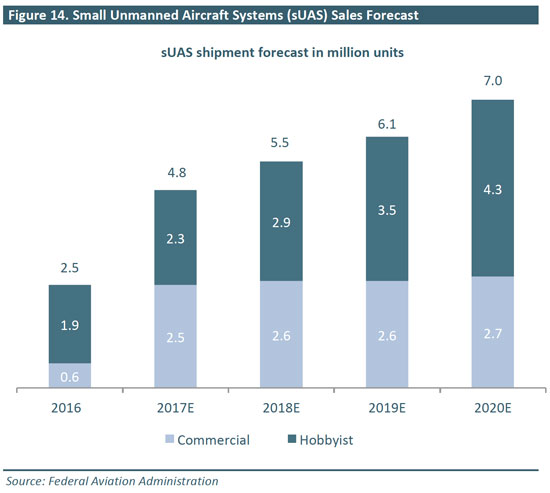

We highlighted drone technology in our 2016 retail technology trend report, noting that the technology is still in its infancy. However, over the course of the year, we have seen increasing evidence for its viable use in last-mile delivery, particularly in rural China. Commercial drones are also become increasingly common in the US – Federal Aviation Administration (FAA) expects that more than 2.5 million drones will be shipped for commercial use in 2017.

Drone technology was once used exclusively for military purposes. However, the consumer drone market took off in early 2016, with the integration of photo and film shooting in drones. Since then, the technology has advanced rapidly to enable much more stable, energy-saving and high-safety solutions. At the same time, companies such as Amazon, Walmart and Google have been investing in their drone-delivery programs in the US and Europe, while drone startups raised over $450 million in funding in 2016. 2016 also saw successful deployment of drone-delivery experiments worldwide:

- JD.com: During Singles’ day 2016, JD.com deployed 1,000 drones on over 10 routes to offer last-mile delivery in rural areas. The total flying time reported was over 10,000 minutes, which was recognized as a success by both the management of the company and mass media. JD’s Chief Technology Officer suggested that the company’s drone delivery fulfillment capabilities will cover 100 routes in 2017. Drone delivery tackles the difficulties of fulfilling orders in rural areas, especially in places with low population density, where it has the potential to offer better fulfillment economics than the last-mile delivery methods available today. According to reports, the drones lower delivery costs by as much as 50%, to under $0.08 per package for JD.

- Amazon: Amazon Prime Air is an exclusive aerial delivery service for Amazon Prime members. The drone-delivery program under Primer Air is designed to deliver packages up to 5 pounds to customers within 30 minutes using a drone. On December 7, Amazon used a drone to deliver an Amazon Fire TV-streaming device and a bag of popcorn to a private customer in Cambridge, England for the first time.

- 7-Eleven: Both drone programs at JD.com and Amazon target countryside and rural area last-mile delivery mainly to reduce the complexity of mitigating safety concerns, which are a lot stricter when drones fly in high-density urban areas. Yet, since the start of its drone delivery experiment in July 2016, 7-Eleven has delivered items to 77 customers in Reno, Nevada, a highly populated urban and suburban area. All 77 drones are capable of delivering goods to customers who live within a 1-mile radius of the shop, similarly to JD.com and Amazon.

Despite these success cases, the main challenge for drone-delivery adoption is regulation. As government and corporates are still finding common ground in finding the balance between safety and economic benefits, new laws and regulations are frequently updated to enforce a better operating environment. In the US, The Federal Aviation Administration relaxed restrictions on the commercial use of drones in the summer of 2016, but it did not go as far as enabling drone-delivery services at large. The rules state that drones used for delivery must weigh less than 55 pounds, fly up to a maximum of 400 feet in altitude, at a speed of no more than 100 miles per hour and can only be operated during daytime within visual line of sight. This means autonomous drone delivery will likely not pick up in the US in 2017. China, on the other hand, offers an environment that is relatively less regulated, and the government has given explicit permission to JD to deploy drone delivery. This is why we believe 2017 will mark the beginning of drone-delivery adoption, with China leading the way.

For retailers operating in the region, the advance of drone delivery will provide better unit economics for fulfilment in rural areas. It will also bring more consumers to the market and allow companies to tap more effectively the large spending potential of the rural population in China.

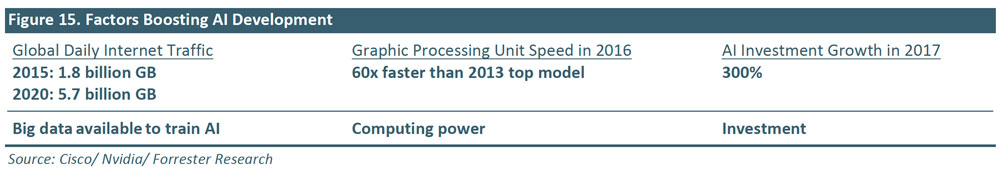

Artificial Intelligence (AI) has undergone a period of rapid development over the past decade, and we expect applications using AI to become more popular in commercial interfaces in 2017.

AI is a branch of computer science that existed long before the invention of personal computers and cell phones. However, commercial application of AI had been limited until the development of machine learning since the 1990s, and in the past decade with its sub-set deep learning.

Deep learning is behind key technologies, including natural language processing (NLP) and image recognition. NLP deals with analyzing, understanding and generating languages that humans use naturally. Image recognition helps to identify elements in pictures, and it is also the core technology for facial recognition software and devices.

In October 2016, Sundar Pichai, CEO of Google, stated that “the last 10 years have been about building a world that is mobile-first. In the next 10 years, we will shift to a world that is AI-first.” In fact, AI, and, in particular, deep learning, has become more capable due to the following developments:

Retailers and brands have experimented and implemented AI-driven solutions in the past few years, such as automated customer service, social-media analysis, optimized product search and recommendation. For instance, Target and Best Buy have been working with AddStructure, a startup that offers a white-labeled, natural language understanding (NLU) platform.

In December 2016, Amazon took this to the next level with the introduction of the Amazon Go experiment, an automated, checkout-free, physical convenience store powered by deep learning algorithms and other technologies such as computer vision and sensor fusion. It is described as running the “world’s most advanced shopping technology”, and this innovative concept has the potential to revolutionize brick-and-mortar retail.

In 2016, we saw tech giants and startups introducing or enhancing applications using AI in commercial interfaces. We expect this to become more popular in 2017, and Amazon Echo together with Alexa, Amazon’s digital personal assistant, will be one of the key drivers. Since its introduction in late 2014, 5.1 million Amazon Echo devices have been sold, according to industry reports. Prior to the 2016 Christmas holiday, Amazon Echo was sold out on the Amazon US website, an indication of the enormous interest in the device. With millions of Amazon customers now using Echo, purchases made via the device will help to train and enhance the AI, whereas their positive experience might help to drive adoption of Echo and similar devices powered by AI. Already in 2017, we have started to see Alexa moving on from the Echo to be integrated in smart home appliances and cars, with recent news that the personal assistant will be available in some Ford and Volkswagen models.

Although 2017 may not be the year that AI-powered applications become sustainably-used, widely-adopted consumer products, the shift from a text interface to a voice-one will present a big challenge for retailers and brands operating digital shopping channels. Shopping via voice commands decreases the influence of product image and web interface in the buying decision and increases the weight of factors such as prior purchase history, price and availability which are used to filter searches. In addition, as Alexa becomes the preferred AI platform, products available and distributed via Amazon’s platform will likely hold an advantage when it comes to Alexa users. This, in turn, will likely bring more retailers to Amazon’s platform. We expect to see this shift develop in 2017.

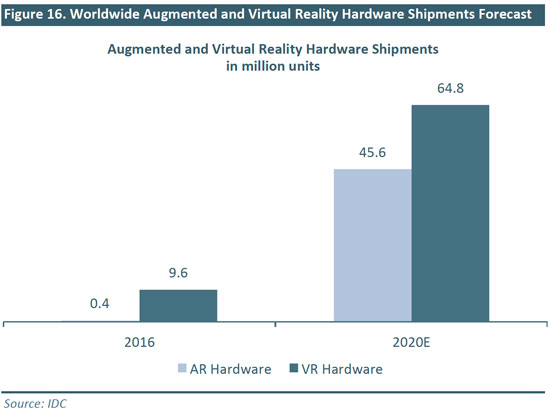

A number of Virtual Reality (VR) devices hit the market in 2016, HTC’s Vive, Samsung’s Gear VR, Facebook’s Oculus Rift and Sony’s PSVR, and VR applications generated hype across industries—from gaming, to entertainment, to retail—throughout 2016. IDC forecasts VR hardware shipments will reach 9.6 million units in 2016, and 64.8 million units in 2020, which represents a 5-year CAGR of 184%.

However, there are still several technical issues that limit the user experience and are likely to hinder consumer adoption:

- Sub-optimal resolution and framerate: Theoretically, 120 frames per second (FPS) and 8K resolution are required for users to have a smooth experience without feeling dizzy. However, currently, set-ups can only support up to 60 FPS and 4K resolution.

- Insufficient bandwidth: In order to transmit 4K ultra-high definition (UHD) content for VR, 25 megabits per second, or 7GB per hour, is required. Without a high-speed internet connection, VR displays result in framerate drop that worsens the user experience.

- Limited duration of VR immersion: Most VR companies suggest taking at least a 10-15 minute break for every 30 minutes of use in order to avoid any health issues.

On the surface, it still looks like the technology has a ways to go before VR devices and applications become commonplace. However, 2016 gave start to the first VR applications in shopping, which we believe will become more prevalent in 2017.

- Alibaba: In 2016, Alibaba developed “Buy+”, a VR shopping platform. The software enables a VR user to visit and shop at virtual retail locations. Customers walk through the virtual environment, and if they want to purchase any of the products they see, they are connected to T-mall, Alibaba’s e-commerce platform. Payments are done directly in the VR environment. On the first day of Buy+’s debut in July 2016, 30,000 people had tried the platform within an hour of its launch, according to Alibaba. As of November 10, more than 8 million people had tried Buy+. Retailers such as Costco, Target, Macy’s, Freedom Foods, Chemist Warehouse, Tokyo Otaku Mode and Matsumoto Kiyoshi had made virtual shops available to consumers.

Subsequent to the launch of Buy+, Alibaba’s finance arm, Ant Financial, demonstrated “VR Pay”, which enables payments in virtual reality. The technology, showcased at Shenzhen Innovation Week in October 2016, works with VR headsets that are powered by smartphones and is linked to Ant Financial’s payments platform, Alipay

- Amazon: We infer, based on the job listings on the company’s website, that Amazon is also on its way to develop a VR platform. One job description for a new opening indicates that the company is trying to launch a “physical and digital Virtual Reality shopping experience anchored by Oculus Rift HTC Vive, and PlayStation VR gaming headsets.”

- Wieden+Kennedy London: Wieden+Kennedy London also created its first VR shopping experience named Shopageddon, aimed to enrich the shopping experience for its customers ahead of Black Friday. Shopageddon’s site predicted what future retail might look like—numerous goods appear around the user and a simple movement of the eye will help to add the product to a shopping list.

VR will likely remain as the “icing on the cake” for most applications, and in shopping it will most likely be constrained to an in-store experience for the foreseeable future. Yet, as consumers are looking for more experiential shopping experiences and gamification has proven to be an effective tool to attract and retain customers, we expect more retailers to experiment and deploy VR shopping solutions in 2017.

Augmented reality (AR) is a technology that augments or enhances the appearance of the outside world with computer-generated graphics. The technology has passed an inflection point, and is now seeing increasing application in fashion, beauty, household products and computer gaming.

AR stands in contrast to virtual reality (VR), which consists of purely computer-generated worlds, and mixed reality (MR), which combines real and completely virtual worlds. We expect AR to be more widely adopted than VR and MR because AR can be implemented using existing hardware such as PCs, tablets and smartphones, whereas VR and MR require a headset and external optics.

AR has already found several successful retail applications in the fashion, beauty and home categories. These include smart mirrors and apps that enable users to virtually try on makeup and virtually arrange home furnishings in their homes.

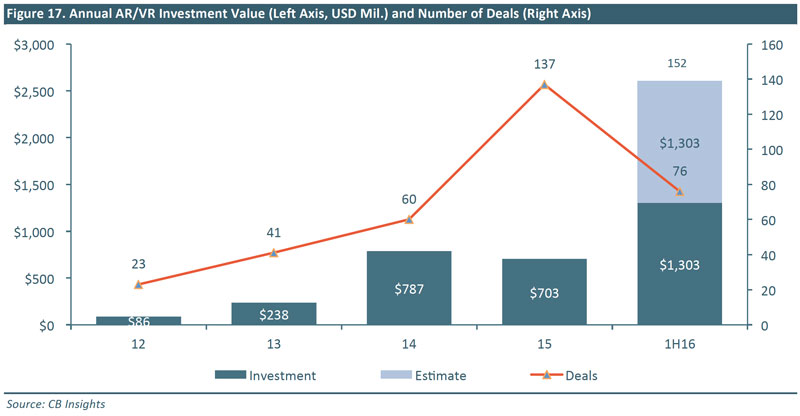

The adoption of AR is likely to accelerate, fueled by healthy venture capital financing, high smartphone penetration and the mainstream acceptance of AR apps such as the Pokémon Go game. CB Insights estimates that global venture capital funding for VR and AR is on track to reach $2.6 billion in 2016, up from $703 million in 2015.

The introduction of the mobile AR game Pokémon Go was a watershed event for AR technology, bringing AR entertainment to the mainstream. The game had more than 26 million active users at its peak, and it brought swarms of monster-seeking players into malls and retail stores.

The technology has also gained traction in the home furnishings category. AR-powered apps have helped customers reimagine their living spaces using augmented virtual furniture arrangements. Consumers can now use such apps to visualize how a piece of furniture would fit in their living space before purchasing, which has resulted in reduced return rates. IKEA created an AR catalog app in 2013 to help customers visualize how its products would fit in their homes. Home retailers Lowe’s and Wayfair have also created their own AR apps.

Smart mirrors and virtual try-on beauty apps have offered novelty for shoppers, but we have yet to see a breakthrough technology that can replicate a realistic try-on experience. Neiman Marcus debuted magic mirrors in its fashion department in 2014, and has expanded their use to the sunglasses and beauty departments at 20 of its store locations. Retailer Rebecca Minkoff and others have piloted smart fitting rooms where customers can virtually try on outfits, and Sephora and Vogue have both released apps that allow customers to apply makeup virtually using facial-mapping technology.

We expect the stream of new AR applications to turn into a flood across industries in 2017, driven by healthy venture capital funding. AR technology will become essential for furniture and household goods makers as they follow the lead of major home retailers IKEA, Lowe’s and Wayfair and roll out their own AR apps. We are also likely to see more accurate fitting and visualization technology in next-generation virtual try-on apps in apparel. We expect magic mirrors to become more commonplace, too. These are likely to be installed at more non-flagship locations and expanded into use for accessories categories. Mass-market brands are likely to experiment with magic mirrors, and their applications in the beauty category will continue to improve, allowing them to more realistically represent the color and texture of beauty items, thereby creating better user experiences in-store and on smartphones.

The accelerated development of AR applications in retail will drive continued e-commerce penetration and reduced return rates for retailers. The prevalence of AR apps among home e-tailers will better accommodate customers’ growing preference to shop on their mobile devices and drive incremental online sales. The accurate representation of furniture dimensions in customers’ living spaces will help them make better purchase decisions and reduce home furnishing return rates.

There will be future versions and imitators of Pokémon Go in 2017, following Alibaba’s introduction of a mobile “catch the Tmall Cat” game. Other potential applications include mobile AR games that drive traffic to stores and AR-powered mobile marketing campaigns that combine retailers’ digital and physical offerings.

Smartphones have empowered users to consume digital content on the go. Consequently, over the past two years, livestream content on mobile has begun to occupy a larger of share of viewing time.

After the initial foray by Periscope and Meerkat, technology companies discovered the potential of personal livestreaming, but also saw the challenges of user-generated live content. In Meerkat’s case, the platform was unable to sustain user interest, as users did not go to the app to generate and consume content on a regular basis. In 2016, we started seeing companies making adjustments to the model in the US, and a brand-new monetization model emerge in China. Companies are looking to specialize in the various use-cases of the technology, which, we believe, will bring significant growth to the use of livestreaming globally in 2017.

US

Twitter: Twitter is following a two-pronged approach when it comes to live content: on the one hand, the company has brought live major events such as sports games and political conventions to the platform, and on the other, it is bringing “live” into its main mobile app to enable personal streaming (versus the standalone Periscope app). In this way, Twitter is powering video citizen journalism for its many users who utilize the platform to comment on live events.

Instagram: Instagram launched a live video feature that has videos disappear after being livestreamed, unlike Facebook Live which saves the content and allows the user to edit and repost it, making the app look a lot more similar to Snapchat.

China

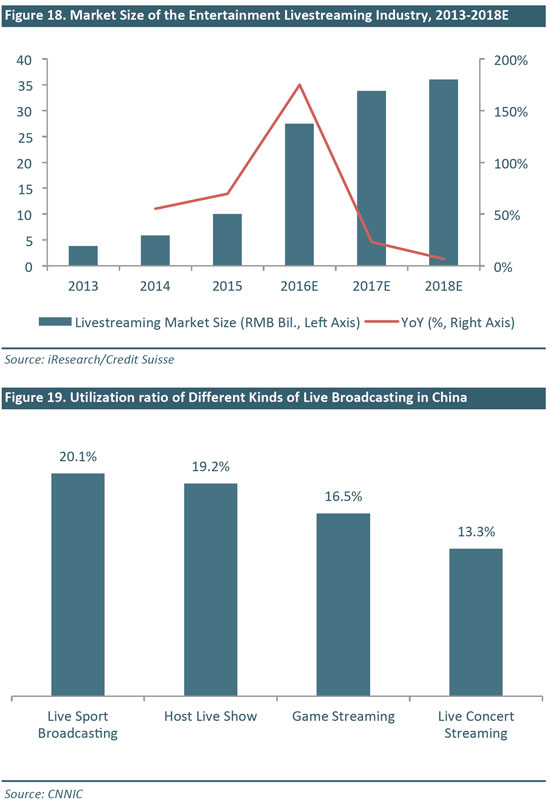

In China, a substantial livestreaming industry was created over the span of two years, powered by an emerging breed of internet celebrities, or “cewebrities.” The apps in China are essentially different from the ones in the US. Viewers and broadcasters interact during livestreaming sessions, with viewers often sending digital gifts to broadcasters; which is how the business model works: the revenue from digital gifts is shared between the livestreaming platform and the broadcaster. Personal livestreaming is seen as a major form of entertainment for a large portion of the population in China that does not necessarily have access to more-traditional forms of content, but at the same time, it has become an effective and powerful sales channel for the young Chinese demographic. Analysis by Credit Suisse, published in September 2016, estimated that the personal livestreaming market in China will be worth $5 billion in 2017 from an estimated $1.8 billion in 2015. The success of the model has seen 150 livestreaming platforms emerge in China, and Chinese-owned services such as live.me and live.ly launch in the US market: just 3 months after its launch, live.ly saw 3.5 million downloads on iOS in the US.

In 2017, we expect to see personal livestreaming gain more traction with users across the board. Apps and platforms will develop into niche use cases for the technology, which will make livestream content an even more powerful marketing tool to reach targeted demographics. Accordingly, we expect brands and retailers to engage more aggressively with consumers through live content. The most successful way to do that so far has been by working with influencers and cewebrities, which we cover in more detail in the following section.

Cewebrities (or “web celebrities”) and influencers are individuals who are not famous by traditional standards, but who have significant clout on social media within a particular market. Many influencers have become cewebrities, with loyal followers and a level of stardom within certain circles. Consumers follow influencers because they feel they are an authentic source of deep product knowledge and that their opinion is of value. Not all of them have a large following, but their followers tend to be exceptionally engaged. Influencers are seen as contrasting voices to brands’ official social media efforts, as many consumers view brands as only trying to sell them something. Influencers’ credibility often comes from their ability to recommend a lifestyle rather than just a product.

Consumers rely on influencers’ authenticity and honesty regarding product recommendations, styling options and fashion choices. However, the Federal Communications Commission (FCC) in the US is cracking down on paid and unpaid advertising, so it is likely that influencers will begin to lose some of their power. Currently, a hypothetical influencer with 500,000 followers and an engagement rate of about 20% could receive a free lipstick from a new lipstick brand and $1,500 per Instagram post that features the lipstick. Under the FCC’s new regulations, though, the influencer would be required to mark each post in order to communicate that she, in fact, received some type of compensation for featuring the product on her Instagram feed.

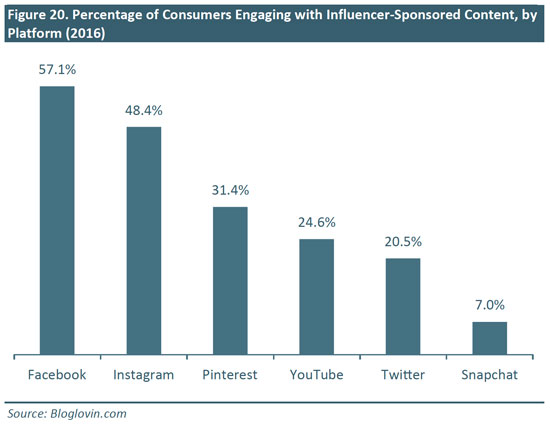

Popular blog platform Bloglovin’ conducted a survey of 20,000 female Bloglovin’ users aged 18–49, and found that 52% of women surveyed felt that inconsistent caption writing on an influencer’s feed made a sponsored post feel fake or inauthentic. Some 38% of the group said that photos that are inconsistent with the influencer’s normal feed make a post feel inauthentic and 31% said that too much brand messaging in a post can make it feel fake.

It may seem as though brands should target those influencers with millions of followers in order to reach their target audiences most effectively. However, those that partner with more niche-oriented influencers who have a smaller following tend to have more successful marketing campaigns. These “microinfluencers” typically have fewer than 100,000 followers and keep in close touch with them, on a more personal level.

According to Experticity, a firm that connects category influencers with brands, microinfluencers have 22.2 times more conversations than typical consumers do regarding recommendations on what to buy. And, according to a study by the Pew Research Center, 82% of consumers are likely to follow a recommendation made by a microinfluencer. This is particularly the case among Gen Zers, 60% of which are more likely to believe what a YouTube star says than what a movie star says, according to Econsultancy. From a brand perspective, microinfluencers allow a company to identify the correct target customer more effectively, while also saving money on marketing costs.

As regulators begin to enforce rules on paid advertising more heavily, we expect that cewebrities and influencers will begin to lose some of their credibility in 2017, and that microinfluencers will have a stronger voice. This shift in advertising comes at a time when consumers are asking that brands connect with them on a personal level. Young consumers, in particular, want a brand connection and to feel like part of a community that surrounds the brand. We expect microinfluencers will serve as a fulcrum between brands and their audience.

A Chinese perspective on cewebrities

Cewebrities’ strong influence in driving consumption can be seen during Singles’ Day 2016, when Alibaba had another record year with a GMV of RMB 120.7 billion (US$ 17.8 billion).

Cewebrity stores comprised 8 out of 10 top-selling stores during Taobao Singles’ Day 2016. The e-shop of cewebrity Zhang Dayi was the No.2 women’s fashion retailer on Taobao, and almost reached top 10 women’s fashion retailer on Tmall, according to ebrun.

Operating within the confines of e-commerce which typically has thin margins and heavy discounting, cewebrities are another tool for brands to advertise and differentiate their product offering. The case for brands to engage cewebrities include: 1) effectiveness in converting browsers to buyers, 2) effectiveness in raising loyalty and driving repeat purchases, 3) a rapid feedback loop as brands gather followers’ comments on social media quickly, and 4) lower marketing costs.

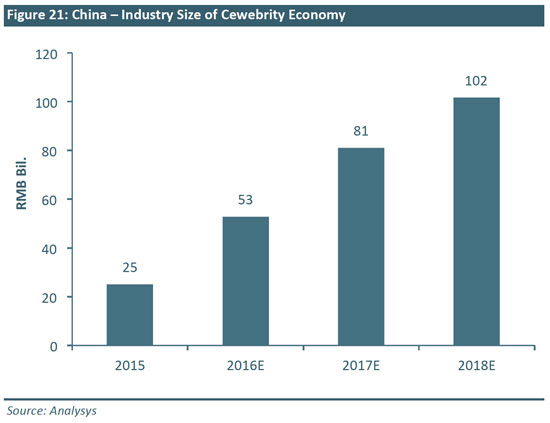

The size of China’s cewebrity economy will increase at a CAGR of 59.4% to RMB102 billion in 2018 from RMB25 billion in 2015, according to Analysys. E-commerce and live broadcasting, which comprise 86% of total cewebrity revenue in 2016, will remain the primary growth drivers of the cewebrity economy.

2017 is set to be another strong year for the cewebrity economy in China, but in our view the industry will enter a period of consolidation. China’s internet regulator has also demanded livestreaming sites to remove offensive content and improve the online environment for viewers, and we expect the recent regulatory changes will pave the way for a more moderate but sustainable growth of the cewebrity economy in 2017. We believe the cewebrities that will stand out in the environment are those who are influential in a particular vertical.

We see wearable cameras jumpstarting a slower wearable device market in 2017, with Snap driving the inspiration behind the consumer adoption of these products with its Spectacles camera glasses.

What this means for retail is that 2017 could finally see a technology eyewear piece become more of a mainstream product. This would, in turn, impact ad content, wearable sales and over a longer-period of time, consumer behavior, as more people become comfortable with technology products beyond watches and fitness trackers. More importantly, the breakthrough will come on the back of a lackluster year for the wearables market, as competition intensified and consumer adoption of wearable devices failed to live up to the initial expectations of companies, marketers and investors.

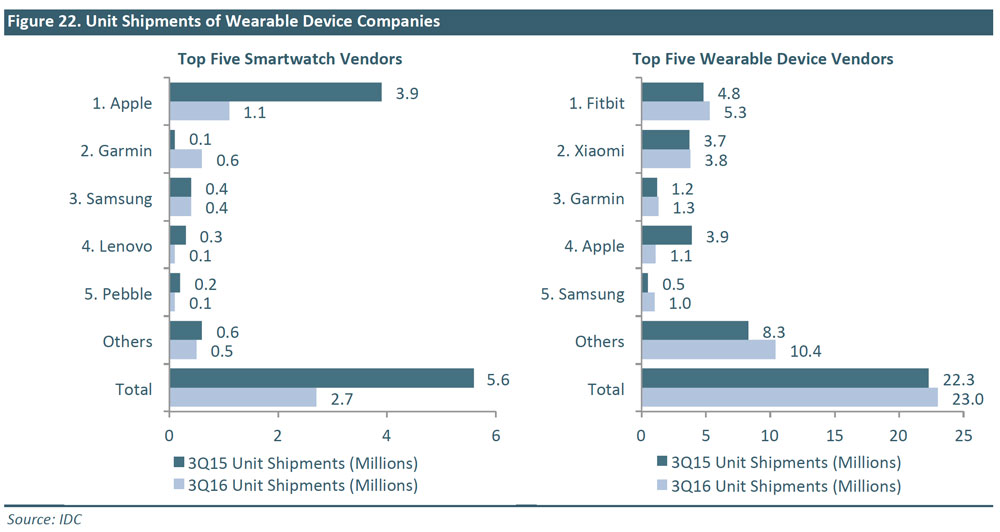

- Apple Watch: Apple claims that the Apple Watch performed extremely well during the holiday season, yet, according to IDC, shipments of the Apple Watch suffered a 71.6% decline in the third quarter of 2016 and shipments of smartwatches in general declined 51.6% in the same period.

- Pebble: The smartwatch pioneer that raised over $20 million in crowdfunding, Pebble, announced that it is shutting down, with its core assets sold to Fitbit for less than $40 million.

- Fitbit: Fitbit, which entered the smartwatch market in 2016, cut its sales forecasts for the 2016 holiday season—its share price tumbled from $29.59 on December 31, 2015 to $7.44 on December 20, 2016. In this core fitness tracker market, the company is facing increasing competition from low-cost disruptors such as Xiaomi.

- GoPro: The company laid off 15% of its staff and recalled its flagship camera drone, Karma, in November.

On the other hand, specialists such as Garmin registered impressive growth: Garmin smartwatch shipments grew 324.2% in the third quarter of 2016 to make up 20.5% of the market, according to data from IDC.

We see a clear trend emerging—consumers are willing to wear technology devices that serve a particular purpose such as fitness trackers or specialized smartwatches, but refuse to wear all-purpose products that blend fashion and technology at scale. This is why we think Snap’s Spectacles have the potential to excel in the market.

Snapchat, the company behind the namesake social media image and video communication platform, was renamed to Snap in 2016, and repositioned as a camera company ahead of its widely-anticipated IPO in 2017. The company’s first hardware product, the Spectacles, was launched in 2016, with a creative campaign that created hype around the product, boosting its price on third-party marketplaces to as much as $900 from a $130 retail price tag. Spectacles are marketed as a fun, fashion-tech product that takes 10-second Snapchat videos. The glasses look a lot less like a technology product than the Google Glass or other AR/VR wearable and, more importantly, they serve a single purpose—to take superior Snapchat videos more conveniently than a smartphone camera.

If successfully adopted, Spectacles and similar wearable cameras from Snap will allow the company to control at least part of the hardware ecosystem that feeds content into the Snapchat platform. With a growing Snapchat user base that numbered 150 million global daily active users in June 2016, this represents a significant market opportunity.

We expect Snap’s Spectacles to be a success among a significant portion of Snapchat users and, as a result, we should see more companies focus on smart glasses/wearable camera products. We expect to see technology companies, camera manufacturers and eyewear brands come up with similar products to the Spectacles to experiment in the category.