Weekly Insights June 23, 2017

KEY POINTS

- This week’s note “From the Desk of Deborah Weinswig” discusses Amazon’s options and opportunities for Whole Foods Market once the acquisition of the grocery chain closes in the second half of this year.

- UPS plans to charge retailers extra fees to deliver packages during the busiest weeks before Christmas, creating a new challenge for an industry already coping with a shift away from traditional stores.

- eBay said it would match top competitors’ prices for a number of popular products in an effort to lure customers. The news follows a string of initiatives by the marketplace to catch up to e-commerce rivals and, ultimately, set itself apart as a haven for finding treasures online rather than commodity products.

- German retailer Zalando has rolled out a new supply chain service called Zalando Fulfillment Solutions for retailers that sell through its website. The new service will allow retailers to store products in Zalando’s warehouses and deliver products from them.

FROM THE DESK OF DEBORAH WEINSWIG

Amazon Takes a Bite Out of the Grocery Market

Amazon’s planned purchase of Whole Foods Market is one of the most startling retail news stories of this decade, for several reasons:

- It is Amazon’s largest acquisition by far. The company is buying Whole Foods Market for $13.7 billion in cash, which includes the assumption of roughly $1 billion in Whole Foods’ net debt.

- It is a major step into brick-and-mortar retailing for Amazon, which has already dipped its toes into physical retail with its bookstores and the Amazon Go grocery format. Whole Foods has more than 460 stores in the US, Canada and the UK.

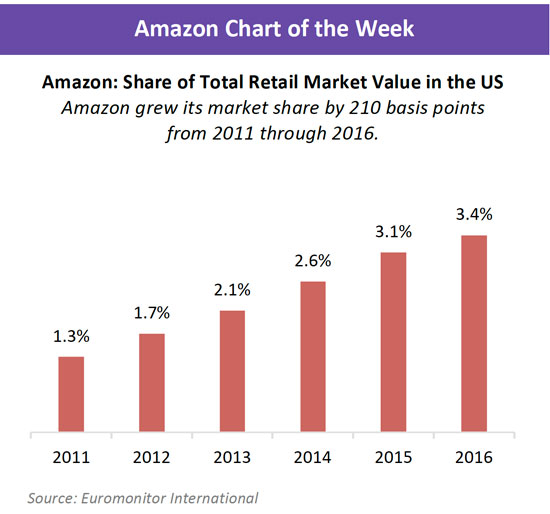

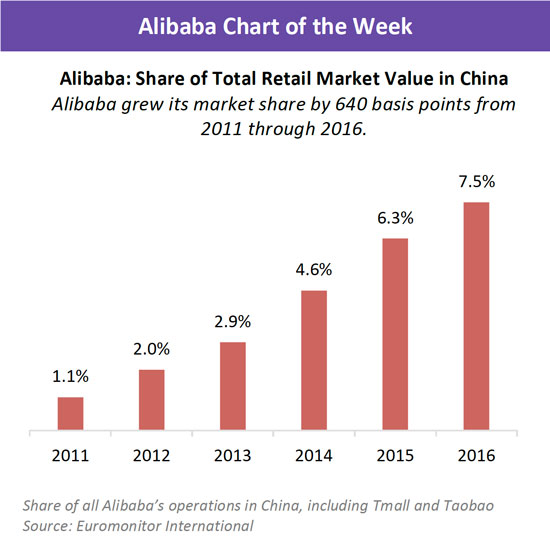

- It confirms that Amazon is serious about grocery—so serious that it is abandoning its status as an Internet pure-play retailer. Whole Foods was America’s eighth-largest grocery retailer in 2016, according to Euromonitor International.

- The acquisition is further confirmation that Amazon plans to be a company that can provide nearly everything consumers might need. (With its ever-expanding offerings in the services field, it looks as if Amazon aims to provide nearly everything enterprises might need, too.)

What Will Amazon Do with Whole Foods?

What Amazon will do with the Whole Foods chain is the key question—and it is one we can only answer with informed speculation.

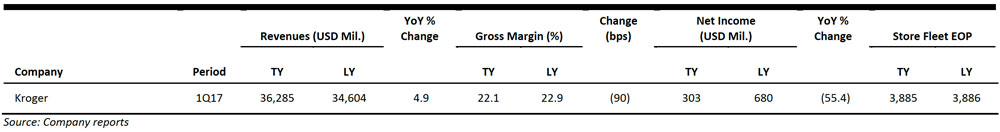

Amazon has typically prioritized investments in order to grow businesses ahead of generating profits, and it could do that with Whole Foods, too, although the grocery retailer is comfortably profitable, generating 5.5% operating margins in 2016 versus Amazon’s 3.1% and grocery rival Kroger’s 3.0%.

Amazon’s options include:

Growing Whole Foods: There are likely some opportunities to grow the Whole Foods chain in the US, where the grocery sector remains unusually fragmented and regionalized. But we think Whole Foods’ premium positioning puts a natural cap on how much Amazon can actually grow the business in the US market. So, if Amazon is interested in growth, it might focus on international markets such as selected European countries.

Reviving Whole Foods: We think Amazon will seek to revive the proposition at Whole Foods, where comparable sales have fallen for seven consecutive quarters as rival grocery chains have improved their organic and natural product offerings. We see the following as possibilities for Whole Foods: lower prices; click-and-collect for online grocery orders made through either the Whole Foods website or Amazon.com; in-store collection of Amazon nonfood orders, such as media and apparel purchases, which would help drive store traffic; and the inclusion of the technology currently being trialed in the high-tech Amazon Go store in Seattle.

Bolstering Amazon Grocery: Amazon could strengthen its own grocery operation through Whole Foods’ established supplier relationships and in-house expertise in grocery retailing as well as through synergies such as click-and-collect and using stores as delivery hubs for Prime Now orders. Amazon’s grocery sales were estimated to be $350 million in the first quarter of 2017, according to OneClickRetail.com; that equates to $1.4 billion in annual sales.

Whatever Amazon does with Whole Foods, this acquisition confirms that the company is serious about dominating virtually every retail category—so serious that it has abandoned its status as an e-commerce company in favor of becoming a multichannel retailer.

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

![]() eBay to Match Some Rivals’ Prices in Bid to Attract Shoppers

eBay to Match Some Rivals’ Prices in Bid to Attract Shoppers

(June 21) CNBC.com

- eBay said it would match top competitors’ prices for a number of popular products in an effort to lure customers. The news follows a string of initiatives by the marketplace to catch up to e-commerce rivals and, ultimately, set itself apart as a haven for finding treasures online rather than commodity products.

- In the fall, eBay will guarantee three-day delivery for tens of millions of items for the first time, a logistical feat that Amazon has already mastered. eBay has also shifted away from its former core—online auctions—toward fixed-price sales, in line with big retailers.

![]() Big Prize in Amazon-Whole Foods Deal: Data

Big Prize in Amazon-Whole Foods Deal: Data

(June 20) The Wall Street Journal

- Amazon spent two decades hastening the demise of the traditional brick-and-mortar retail industry. So why would the tech giant spend $13.7 billion to acquire an organic-grocery chain with more than 460 stores? The deal for Whole Foods Market, which people familiar with the matter said came together quickly, presents Amazon with several potential gains.

- Amazon could use the stores as distribution hubs to build out its online grocery-delivery business. It also could stock gadgets such as its Kindle e-readers and Echo speakers in the stores, as well as goods from its burgeoning private label offering. The bigger opportunity, though, is data.

![]() Amazon Launches New “Try Before You Buy” Prime Wardrobe Service

Amazon Launches New “Try Before You Buy” Prime Wardrobe Service

(June 20) Fortune.com

- In a new threat to the likes of Macy’s and Gap, Amazon announced on Tuesday that it has begun testing a new subscription service, called Prime Wardrobe, that lets customers try on clothes before they buy them and return them for free.

- Amazon’s Prime Wardrobe will be available to Prime members at no extra charge and gives customers one week to decide whether they like what they ordered. They pay only for what they choose to keep, a service similar to those offered by Trunk Club (owned by Nordstrom) and Stitch Fix.

UPS to Add Delivery Surcharges for Black Friday, Christmas Orders

UPS to Add Delivery Surcharges for Black Friday, Christmas Orders

(June 19) The Wall Street Journal

- UPS plans to charge retailers extra fees to deliver packages during the busiest weeks before Christmas, creating a new challenge for an industry already coping with a shift away from traditional stores.

- The surcharges, announced Monday, are a shot across the bow for retailers, including giants such as Walmart and Macy’s, which have been ramping up their e-commerce businesses as they seek to offset declining foot traffic at shopping centers. The extra fees also add to the costs of Amazon and other online players, which rely on UPS and rival FedEx to handle a surge in holiday shipments.

![]() Walmart to Buy Bonobos, Men’s Wear Company, for $310 Million

Walmart to Buy Bonobos, Men’s Wear Company, for $310 Million

(June 16) The New York Times

- Walmart has agreed to acquire men’s clothing company Bonobos for $310 million. The purchase is part of a sweeping effort by the world’s largest retailer to revamp its business model as it tries to better compete with Amazon, which announced last Friday that it would buy upscale grocer Whole Foods Market for $13.7 billion.

- Bonobos, founded 10 years ago in New York, began by selling simple chino pants on the Internet. In recent years, it has expanded to offer shirts, suits and other men’s clothing, and has opened dozens of brick-and-mortar locations as well as boutiques in Nordstrom department stores.

EUROPEAN RETAIL HEADLINES

UK Retail Sales Grow in May as Prices Rise

UK Retail Sales Grow in May as Prices Rise

(June 15) Press release

- In May, total retail sales in the UK grew by 3.3%, below the 4.2% rolling average for the preceding 12 months, according to the Office for National Statistics. The sales growth was supported by shop-price inflation increasing to 2.8% in May from 2.1% in April.

- Sales at grocery stores grew by 2.8% in May. Retail sales at clothing specialists grew by a strong 8.0% year over year, despite some unseasonably wet weather during the month.

![]() Sainsbury’s in Talks to Buy Nisa

Sainsbury’s in Talks to Buy Nisa

(June 19) Retail-Week.com

- British supermarket Sainsbury’s is set to buy convenience retailer Nisa and sign an exclusivity deal with the company that would temporarily ban it from pursuing other bidders.

- Sainsbury’s is understood to be offering £2,500 (US$3,174) a share, which would value Nisa at £130 million (US$165 million). The deal is currently under review by the Competition and Markets Authority.

![]() Zalando Launches Fulfillment Service

Zalando Launches Fulfillment Service

(June 16) Retail-Week.com

- German retailer Zalando has rolled out a new supply chain service, called Zalando Fulfillment Solutions, for retailers that sell through its website.

- The new service will allow retailers to store products in Zalando’s warehouses and deliver products from them. The service also includes a fast replenishment model that uses an algorithm to predict which items need to be replenished regularly in order to fulfill customer orders quickly.

Quiz Clothing Confirms Its Intention to Float

Quiz Clothing Confirms Its Intention to Float

(June 15) ProactiveInvestors.co.uk

- British womenswear brand Quiz has reportedly enlisted corporate broker Panmure Gordon to advise on funding options, including a £200 million (US$254 million) floatation on the London Stock Exchange.

- “We are delighted to announce the group’s intention to float on AIM and we are confident that this will help enable the brand to achieve its exciting global potential,” said Quiz founder and chief executive Tarak Ramzan.

N Brown Group Revenues Advance by 5.6% in Fiscal 1Q18

N Brown Group Revenues Advance by 5.6% in Fiscal 1Q18

(June 20) Company press release

- British fashion retailer N Brown Group announced total revenue growth of 5.6% in its fiscal first quarter, ended June 3, 2017. The company reported that retail sales advanced by 10.2%, while financial services sales declined by 4.9%.

- The group also announced plans to close up to five loss-making Simply Be and Jacamo dual-fascia stores by the end of August. For the full fiscal year, the company expects a retail gross margin decline of 20–120 basis points due to exchange rate impact.

ASIA TECH HEADLINES

![]() China’s Mobike Plans Move into Services and Aggressive International Expansion

China’s Mobike Plans Move into Services and Aggressive International Expansion

(June 21) TechCrunch.com

- Chinese bike-sharing company Mobike announced last week that it plans to expand to 200 cities, many of which are expected to be outside China, before the end of the year. The company is also working to introduce a range of services to take it beyond transportation.

- Data is another area Mobike may look to monetize. Currently, the company works selectively with government bodies to aid with city planning, maintenance and operations. It formed an alliance with 12 institutions for the purpose of sharing data that can be packaged to provide insights and analysis.

![]() Sony Soft-Launches an Educational Robotics Coding Kit on Indiegogo

Sony Soft-Launches an Educational Robotics Coding Kit on Indiegogo

(June 21) TechCrunch.com

- Sony is ready to bring its educational coding kit, Koov, to the US. The company will essentially be using Indiegogo to gauge consumer interest in the kit and, hopefully, gain some insight into the US market as it works to shape the product for a new region.

- There are plenty of different kits available that aim to teach kids to code and build robots. Apple recently partnered with a handful of hardware makers to help teach its Swift programming language to kids, and LEGO’s new Boost line joins a number of others already produced by the company.

Chinese Bike-Sharing Company Shuts Down After 90% of Cycles Go Missing

Chinese Bike-Sharing Company Shuts Down After 90% of Cycles Go Missing

(June 20) TechinAsia.com

- Chinese bike-sharing startup Wukong Bike has shut down just five months after launching, with $147,000 in losses. The Chongqing-based company claims that it was forced to wrap up, as it could locate only 10% of its bikes, with the remainder presumed lost or stolen.

- Wukong, which operated bike-share programs in the center of Chongqing and on Chongqing University’s campus, said in a statement that it would refund its customers any outstanding value in their accounts.

![]() Jack Ma Considering Joining $1.5 Billion Investment in Grab

Jack Ma Considering Joining $1.5 Billion Investment in Grab

(June 15) TechinAsia.com

- Alibaba’s Jack Ma may team up with Masayoshi Son’s SoftBank in a $1.5 billion investment in Southeast Asian ride-hailing startup Grab. Didi Chuxing, China’s ride-hailing giant and already a Grab investor, could also participate in the round.

- The investment may come from either Alibaba itself or its payments affiliate, Ant Financial, which has struck a series of deals in Southeast Asia. If the deal closes, it would make Grab a key player in Alibaba’s proxy war with Tencent, maker of popular messaging app WeChat.

LATAM RETAIL HEADLINES

JDE Bets on Brazil as It Chases Nestlé in Global Coffee Retail

JDE Bets on Brazil as It Chases Nestlé in Global Coffee Retail

(June 20) Reuters.com

- Global coffee retailer Jacobs Douwe Egberts (JDE) said that it is eyeing new acquisitions in Brazil, where it is seeking double-digit growth as it chases Nestlé in the international coffee retail business.

- JDE was created in 2015, when its controlling holding company, JAB Holdings, bought Mondelez International’s coffee operations in a cash and stock deal. The company has since acquired some of the best-known brands in Brazil, such as Café do Ponto, Pilão and Café Pelé.

Motorola Parties in Brazil, India with Android 7.1.1 and Moto C Plus Releases

Motorola Parties in Brazil, India with Android 7.1.1 and Moto C Plus Releases

(June 17) TechnoChops.com

- Motorola has officially released the latest Google Android 7.1.1 Nougat to Moto G4 Play devices in Brazil. The company has also reportedly conducted an Android 7.1.1 soak test for Moto Z devices in Brazil and in India.

- The Nougat update for the Moto G4 Play is expected to bring in several features, bug fixes and improvements, including Google Assistant, app shortcuts, a security patch and the Duo Video calling app.

UPS Opens New Shipping Centers in Mexico

UPS Opens New Shipping Centers in Mexico

(June 21) StatTimes.com

- UPS plans to double its number of shipping centers across Mexico. The centers have trained personnel to help owners of small and medium-sized businesses with their domestic and international shipping.

- UPS expects to have more than 110 customer shipping centers in Mexico by the end of 2017. The company already has a network of more than 600 retail locations in the country that offer convenient package pickup and drop-off at local businesses such as neighborhood grocery stores, dry cleaners and cafés, many of which offer extended evening and weekend hours.

![]() Roku Device Sales Blocked in Mexico on Piracy Concerns

Roku Device Sales Blocked in Mexico on Piracy Concerns

(June 21) Bloomberg.com

- Roku set-top boxes were pulled from the shelves of major department store chains in Mexico after a court blocked sales of the devices, saying they could be hacked to let users view pirated movies and TV shows.

- Cablevision, a cable provider controlled by Grupo Televisa, obtained a court order temporarily blocking the sale of the devices. The court order also required some banking institutions and convenience stores to stop accepting monthly payments to hackers.

MACRO UPDATE

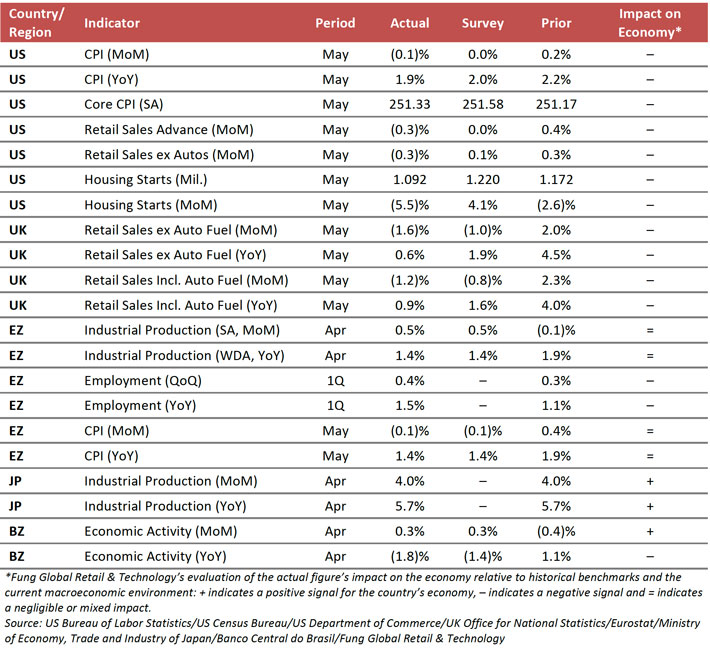

Key points from global macro indicators released June 14–21, 2017:

- US: The US Consumer Price Index (CPI) dropped slightly month over month in May, declining by 0.1%. Year over year, the CPI was up 1.9%. The retail sales advance figure decreased by 0.3% in May from the previous month. Housing starts also fell in May, to 1.092 million a 5.5% decrease from the April.

- Europe: UK retail sales excluding auto fuel increased by 0.6% year over year in May. The eurozone CPI decreased by 0.1% in May month over month.

- Asia-Pacific: In Japan, industrial production maintained its growth momentum in April, increasing by 4.0% month over month and by 5.7% year over year.

- Latin America: In Brazil, economic activity increased by 0.3% month over month in April, but fell by 1.8% year over year.

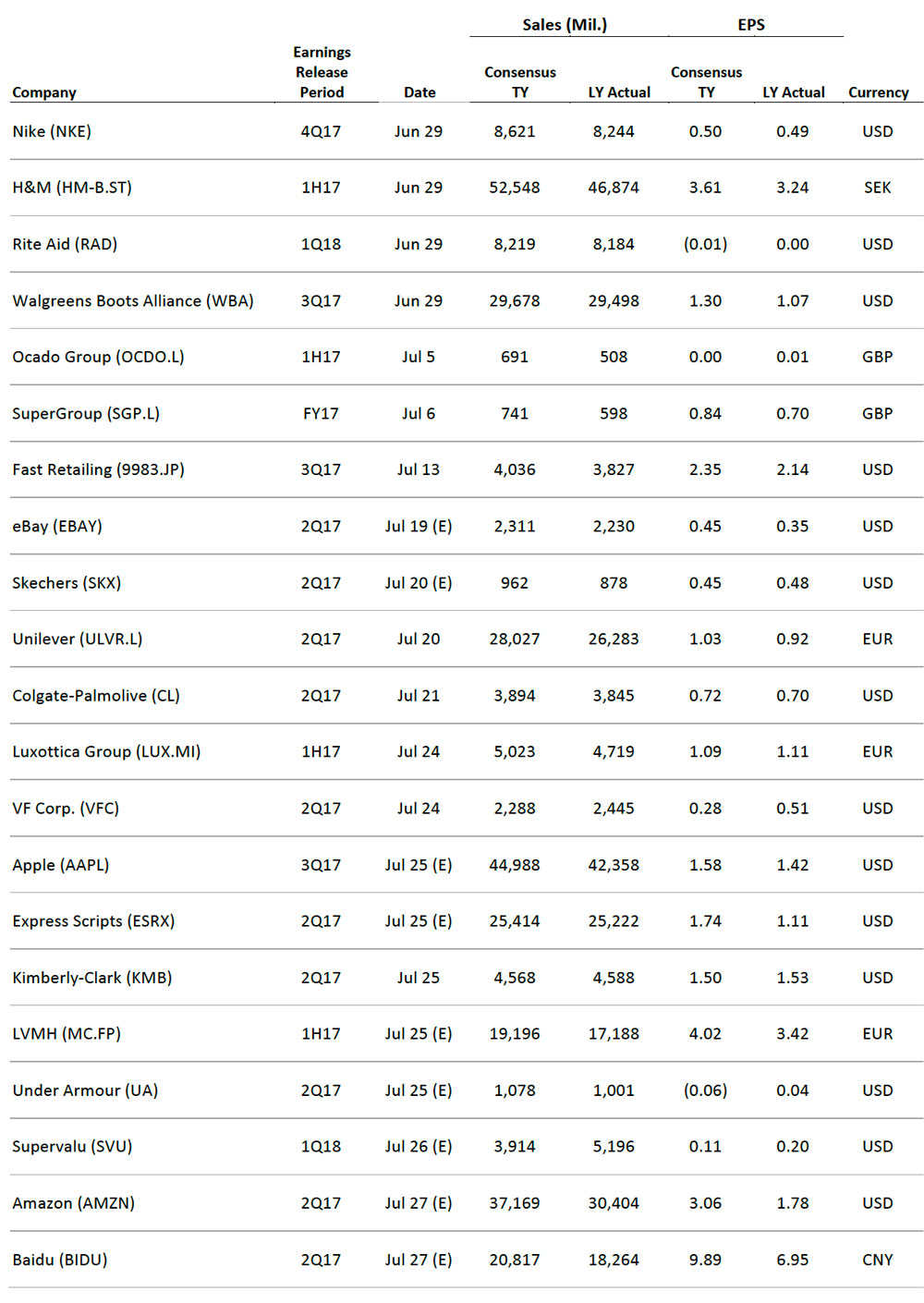

EARNINGS CALENDAR

EVENT CALENDAR