Shoptalk 2018: Day 1 Takeaways—Startup Pitch Competition

KEY POINTS

The Coresight Research team is in Las Vegas this week, attending and participating in the Shoptalk 2018 conference held March 18–21.

- On Sunday, to kick off this year’s conference, Coresight Research’s Founder and CEO, Deborah Weinswig, emceed Shoptalk’s Startup Pitch competition.

- The competition featured 15 innovative companies, which Weinswig classified into one of four categories: engaging customer experiences, physical retail solutions, inventory management and assortment optimization, and personalization.

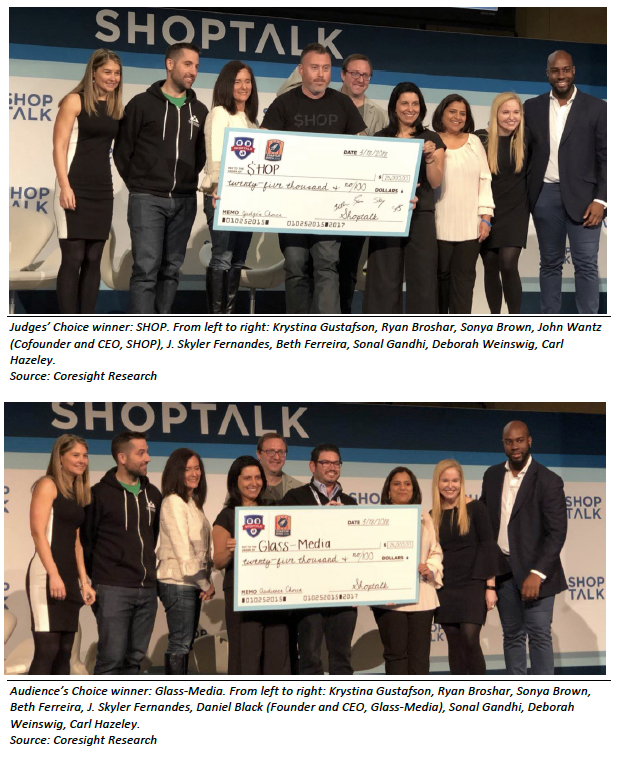

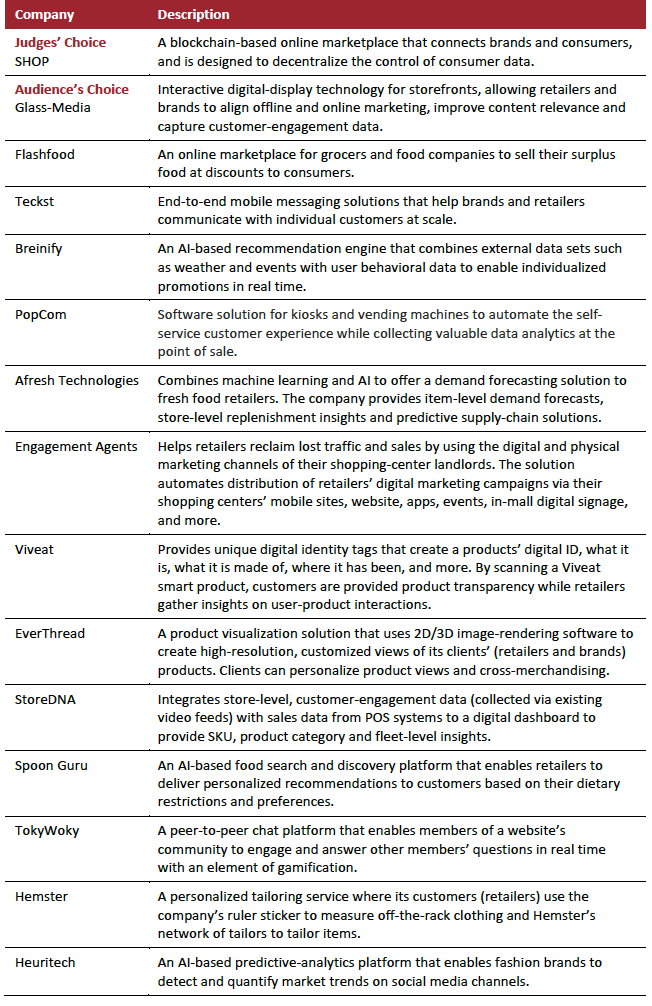

- Two winners were chosen, one by the panel of judges and one through audience voting. The winner of the judge’s choice was blockchain-based shopping platform, SHOP, and the audience’s vote went to digital-display storefront marketing solution, Glass-Media.

- Weinswig concluded the pitch competition with a presentation on the current and future state of the retail environment, emphasizing “New Retail” trends in China.

Shoptalk 2018

The Coresight Research team is attending and participating in Shoptalk 2018 in Las Vegas this week. Described as the world’s largest conference devoted to retail and e-commerce innovation, more than 7,500 attendees are expected at this year’s event—up close to 40% from last year’s Las Vegas event.

The conference, which runs March 18–21, is expected to draw executives from established retailers and brands, startups and technology companies, as well as investors, media professionals and analysts. From new technologies and business models, to changes in consumer preferences and expectations, attendees are exploring disruption in the retail industry, particularly how consumers discover, shop and buy.

The event focuses on topics such as the shopping experience of the future, the evolution of the retail store, on-demand delivery and logistics, shifting e-commerce trends, the next generation of direct-to-consumer (D2C) startups, engaging customer experience, the impact of artificial intelligence (AI) in retail, and more.

The event features more than 300 speakers, representing a broad cross-section of countries and companies, including Allbirds, Ascena Retail Group, BJ’s Wholesale Club, DoorDash, Google, Houzz, Instacart, Macy’s and Rent the Runway.

Below, we summarize our key takeaways from the first day of Shoptalk 2018.

Startup Pitch Competition

On Sunday, to kick off this year’s conference, Coresight Founder and CEO Deborah Weinswig emceed Shoptalk’s startup pitch competition for the third consecutive year. The event saw 15 innovative companies vying for two cash prizes of $25,000 each.

Leaders from the startups pitched their businesses to a panel of four judges. Two winners were chosen, one by the panel of judges and one through audience voting. The judges were:

- Ryan Broshar, Managing Director, Techstars: Broshar is also the Founder and Managing Director of Techstars Retail Accelerator, in partnership with Target, and Founder and Managing Director of Matchstick Ventures, an early-stage venture capital firm.

- Sonya Brown, General Partner, Norwest Venture Partners: Brown coleads the multistage VC and growth equity investment firm’s private equity practice and focuses her investments on consumer products, retail and other consumer-facing businesses.

- J. Skyler Fernandes, Managing Director of Investments, Cleveland Avenue: Cleveland Avenue is a private equity and VC fund focused on restaurants, food and beverage brands, and related technology.

- Beth Ferreira, Managing Director, FirstMark Capital: Ferreira focuses on next-generation commerce, consumer technology and enterprise companies for the New York City-based early-stage VC firm.

15 Companies from Five Countries Competed for Cash Prizes

Shoptalk curated the participating startups based on their solutions to some of the most pressing challenges facing retailers today. The 15 participating startups were selected from among hundreds of applicants through a rigorous vetting process.

- Countries of origin: The 15 startups represented the five countries of the US, Canada, France, Italy and the UK.

- B2B focus: The pitch competition focused on startups that are creating business-to-business (B2B) solutions.

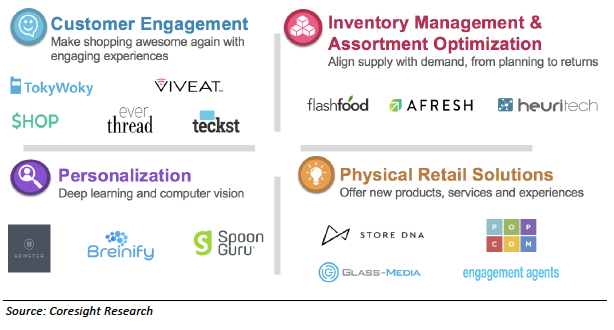

- Areas of disruption: The participating startups all focus on one of four areas of retail disruption: customer engagement, physical retail solutions, inventory management and assortment optimization, and personalization.

- Funding: Of the the 15 competing startups (47%), seven have raised their seed round of funding, while seven (47%) are in the post-seed/series A funding stage and one has chosen not to disclose their level of funding.

The 15 participating companies were: SHOP, Glass-Media, Flashfood, Teckst, Breinify, PopCom, Afresh Technologies, Engagement Agents, Viveat, EverThread, StoreDNA, Spoon Guru, TokyWoky, Hemster and Heuritech.

Each startup focuses on one of the four areas of retail disruption, as depicted below.

Two $25,000 prizes were awarded, one based on votes from the judges and the other on audience votes registered via the Shoptalk app. Each startup was assessed on whether the company addresses a big problem or area of opportunity, the feasibility and scalability of the business model, confidence in the team/presenter to executive and whether the judge/audience member would invest.

The Winners

- Judges’ Choice: SHOP

- Audience’s Choice: Glass-Media

Below, we include pictures of the Shoptalk 2018 startup pitch winners and key event participants. Shop Talk’s Sonal Gandhi, VP Strategy, and instrumental in the startup selection process, along with Krystina Gustafson, Content Director, and Carl Hazeley, Head of Content, joined the winners on stage to present the prizes.

Startup Profiles

SHOP—Judges’ Choice

Company Description

SHOP is a blockchain-based e-commerce operating system that connects brands and consumers and is designed to decentralize control of consumer data. The platform enables brands to reward consumers with discounts and personalized experiences for sharing their personal data.

Consumers purchase the SHOP Token to transact on the platform, which lets them control who sees their data and how much of it is shared. The more users share, the greater the savings rewards. SHOP Tokens are stored in users’ SHOP Wallets, which manage payment and track users’ profiles and what permissions they have given for their data use in the broader ecosystem. The tokens are built and distributed via the Ethereum blockchain platform.

SHOP provides an open-source API to connect existing platforms (such as Shopify, Stripe and UPS) to the Ethereum blockchain. The company has provided a new framework for shopping and selling digitally by creating a tokenized value exchange across decentralized networks.

SHOP seeks to enable a global shopping network that respects data ownership and rewards participants for providing companies with access to their personal data.

Market Overview

Blockchain creates a secure ledger that records and stores every transaction that occurs in a decentralized network and enables the real-time exchange of information. In 2017, the global blockchain technology market was estimated to reach $339.5 million and research firm Statista forecasts that it will grow to $2.3 billion by 2021.

What Problem Is the Company Solving?

Leading global retail marketplaces such as Amazon and Alibaba have built retail empires around hoarding consumer data and blocking its exchange within the brand-shopper relationship. When consumers join an online marketplace, they have to provide personal information to meet the requirements of the site. That information can be used to track what consumers do online, and it has commercial value that consumers are forced to give the company for free.

SHOP competes with third-party marketplaces by giving shoppers control of their data, thereby reconnecting brands with their customers. The company seeks to create a fair, global system for commerce.

Headquarters

Seattle, Washington

Funding Stage

Seed ($3 million)

Business Model

The company maintains a treasury of SHOP Tokens and charges access fees to ecosystem participants.

Competitive Landscape

The company’s competitors include transactional marketplaces such as CommerceHub, PayPal and Amazon.

Management Team

John Wantz, Cofounder and CEO, is an experienced entrepreneur who previously founded three startups and served on the retail innovation team at Target. Jeff Mataya, CTO, specializes in e-commerce and enterprise software-as-a-service solutions. He previously cofounded FoxCommerce. Cheryl Briere, Head of Strategy and Business Development, has industry experience at major retailers including Amazon, JCPenney, Pacific Worldwide and Target.

Company Outlook

The company is focusing on direct-to-consumer retail during its initial launch phase. The SHOP initial coin offering will take place on May 14, 2018.

Product releases and launches in 2018 include the SHOP Wallet, SHOP Protocol, SHOP Token, KangaShop.com (relaunch) and FoxCommerce.com (relaunch).

Glass-Media—Audience’s Choice

Company Description

Glass-Media provides brick-and-mortar retailers and brands a projection-based digital display technology coupled with a proprietary, cloud-enabled software and analytics platform. The solution transforms storefront, street-facing glass and indoor surfaces into vivid, interactive displays. With the display technology, information is provided in a digitized format that includes motion and pictures in order to attract customers with more impact than traditional modes provide.

Unlike legacy digital storefront signage—which tends to focus on a qualitative approach—Glass-Media’s solution is largely focused on a quantitative approach to digital transformation. The interactive display can capture engagement data that can be used in real-time marketing campaigns at the point of sale.

By integrating Glass-Media’s solutions with brand-specific key performance indicators, retailers can:

- Boost foot traffic.

- Enhance the customer experience.

- Build brand awareness.

- Increase customer engagement.

- Drive online/offline conversion

The company’s targets include mall-based retailers, pop-up retail formats, hospitality services, convenience stores and fast-casual retailers.

Market Overview

Market research and consulting firm Grand View Research estimated that the global digital signage market was worth $16.04 million in 2016 and that it will grow to $31.71 million by 2025.

What Problem Is the Company Solving?

Of the estimated 100 million paper posters shipped each year in the US, approximately 40% make it to the physical retail floor, and only 20% make it there on time, according to Glass-Media. The company says that it takes an average of four to nine weeks, from ideation to execution, to refresh a storefront window, whereas online marketing campaigns are dynamic and personalized, and change often. Omnichannel retailing can be enhanced with a dynamic storefront. Through digital storefronts, retailers and brands can align their offline and online marketing campaigns, improve content relevance and engage with consumers in a more experiential way.

Headquarters

Dallas, Texas

Funding Stage

Growth seed (<$3 million raised)

Business Model

Glass-Media customers pay an implementation fee up front, followed by an ongoing software/service subscription fee that can be billed monthly, quarterly or annually. The company offers hardware-enabled software-as-a-service.

Competitive Landscape

Glass-Media competes with interactive digital display companies such as Outernets, Nexnovo and Lumotune.

Management Team

Daniel Black, CEO and Founder, is a serial entrepreneur with a background in digital marketing and analytics. Nic Logan, COO and Cofounder, previously worked at the Ferrari brand’s Ferrari Store concept on the financial and operations management team.

Company Outlook

With more than 85 brands in the pipeline, Glass-Media will continue to focus on customer expansion and pilot programs. From a product development standpoint, system reliability, stability and scalability remain top priorities in addition to designing, developing and delivering improved analytics tools for customers.

Flashfood

Company Description

Flashfood is an online marketplace where grocery stores and food manufacturers can resell their surplus food directly to consumers at discounted prices. Grocers add a picture and description of the available food to the marketplace site, set a price and include a pickup time window. Shoppers browse deals and pay through the Flashfood app and then pick up their food from dedicated Flashfood refrigerators in stores the same day.

The startup seeks to make food more affordable for consumers and help grocers and manufacturers reduce their carbon footprint by reducing food waste, while also creating a new revenue stream for these companies.

Market Overview

Global sales of food and alcohol through e-commerce platforms grew by 30% in the 12 months ended March 2017, accounting for 4.6% of all fast-moving consumer good (FMCG) sales, according to a recent report from Kantar Worldpanel. The firm predicts that online FMCG sales will reach $170 billion by 2025 and hold a 10% market share.

While estimates of e-commerce’s share of total grocery sales vary, grocery is likely to be the next major retail sector to be disrupted by e-commerce.

What Problem Is the Company Solving?

One-third of the world’s food—equivalent to nearly 1.3 billion tons—ends up in a landfill every year, according to the Food and Agriculture Organization of the United Nations. Meanwhile, an estimated one in eight Americans struggled with food insecurity (lack of consistent access to enough food) in 2016, according to the US Department of Agriculture.

Headquarters

Toronto, Ontario, Canada

Funding Stage

Seed ($0.5–$4 million)

Business Model

Grocers pay a transaction fee based on what items are sold through the Flashfood platform. Manufacturers sell their surplus food to Flashfood at a discount.

Competitive Landscape

Flashfood defines its two main competitors as Imperfect Produce and FoodMaven.

Management Team

Josh Domingues, Founder and CEO, was formerly an investment advisor and management consultant. CTO Kris Ryken has experience working on corporate innovation strategy and previously cofounded and served as VP of Digital Innovation for digital marketing company Salt & Pepper, which was acquired in 2014.

Company Outlook

Flashfood is working with big food manufacturers and grocers to help all parties reduce their food waste while making food more affordable for consumers.

Teckst

Company Description

Teckst is an e-commerce customer experience and personalization solution that provides end-to-end mobile messaging engagement, helping brands communicate with individual customers at scale. Through Teckst, consumers are able to directly message marketing and customer service teams. These teams can respond directly to individuals or send relevant responses to many consumers at once by using the Teckst tagging and tracking system, allowing for efficient customer service responses. Additionally, the solution provides multimedia messaging, including emojis, video and images. Teckst’s solution integrates into customer relationship management systems and provides reporting and analytics.

Market Overview

Messaging is becoming the go-to channel for consumers seeking answers to their questions. Over the second half of 2017, this trend advanced with the launch of Facebook Messenger Customer Chat. Technology consulting firm Activate predicted that at least 3.6 billion people will have at least one messaging app on their smartphone in 2018.

What Problem Is the Company Solving?

Teckst is helping brands and retailers communicate with consumers via smartphone. Consumers are more mobile friendly than ever, but customer service has traditionally been offered by phone, email and web chat. According to Teckst, more than 6 billion smartphone owners can use traditional texting and mobile messaging, but brands have not previously had access to a solution that uses those channels.

Headquarters

New York, New York

Funding Stage

Seed round

Business Model

Teckst’s clients are charged a monthly fee per log-in.

Competitive Landscape

The company’s competitors include Quiq, a business messaging application, and Avochato, a text messaging software platform. Companies that provide customer service through live representatives also represent competition for Teckst.

Management Team

Founder Matt Tumbleson previously served as Seamless/GrubHub’s first creative and marketing director. He has also worked to create better mobile experiences for customers at Adidas, LVMH, Red Bull, Disney, CVS and Visa. CEO Josh Rochlin was previously the CEO of Xtify, a mobile alerts company purchased by IBM in 2013. VP of Engineering Alson Kemp built a tech team at Vium in San Francisco that raised more than $200 million to solve complex medical research questions. He has also worked on technologies for Angie’s List, Stitch Fix and Visa.

Company Outlook

Teckst plans to expand into voice command experiences and to continue to build out its artificial intelligence solutions for more automated experiences for customers and agents.

Breinify

Company Description

Breinify is an e-commerce recommendation engine that combines external data sets on factors such as weather, events and holidays with user behavior and location data to enable brands to deliver hyper-relevant customer engagement in real time. The company’s AI engine combines machine learning with time-interval algorithms to predict an individual’s time-sensitive interests and drive spur-of-the-moment purchases.

The company blends machine learning with more than 100,000 distinct temporal models to predict an individual’s upcoming time-sensitive interests. In terms of user behavior, the company tracks online-shopping data such as products consumers view, which links they click on a retailer’s website and location. The company’s targets include B2C retailers, consumer packaged goods brands, quick-service restaurants and e-commerce brands.

Breinify is working with customers such as BevMo!, Round Table Pizza and others to enable them to act on time-sensitive insights through SMS and existing marketing channels. Breinify customers have seen an average increase of 34% in individual spending with a 17% reaction rate, according to the company.

Market Overview

Research firm Research and Markets estimates that the AI marketing market will reach $6.48 billion in 2018 and that it will grow at a 29.79% CAGR, to $40.09 billion, by 2025. Market intelligence firm IDC forecasts that worldwide spending on AI software, hardware and services will jump from $12 billion in 2017 to $58 billion by 2021.

What Problem Is the Company Solving?

Consumers now expect personalization that goes beyond a “Hello, Joe” greeting sent at a predetermined time. But brands’ marketing promotions are often static, and setting up individual marketing rules such as “Send SMS and push notification whenever the temperature is over 70” can require countless hours of labor. This often leads to rules that are too general to be effective, resulting in low response rates and shoppers receiving nonrelevant alerts.

Headquarters

San Francisco, California

Funding Stage

VC-backed seed

Business Model

Breinify’s clients pay a yearly licensing fee to use the company’s platform-as-a-service, which enables them to access the predictive capabilities of the time-driven AI engine.

Breinify charges integration fees if customized implementation is needed and offers onetime purchases of impact reports that analyze user behavior data in a temporal context (seasonality, day of week, etc.) in relation to weather, events and holidays.

Competitive Landscape

The company competes with predictive intelligence companies such as Amplero, Blueshift and IBM Predictive Customer Intelligence and with personalization companies such as Monetate.

Management Team

Breinify CEO and Cofounder Diane Keng is a technology entrepreneur who previously sold a company to AOL and worked at Apple and Symantec. CTO and Cofounder Philipp Meisen holds a PhD in data science and is the author of the book Analyzing Time Interval Data as well as more than 20 research publications.

Company Outlook

Retailers and brands are under pressure to meet customer expectations with exceptional experiences and meaningful engagement. In order to differentiate themselves from competitors, companies will look to AI technologies that activate micromoments for individuals rather than analysis on demographic segments.

PopCom

Company Description

PopCom provides automated software platforms for kiosks and vending machines. The company has developed a software solution to make self-service retail smarter through the use of data and analytics. The software-as-a-service (SaaS) platform uses facial recognition, artificial intelligence (AI) and blockchain technology to collect customer data at the point of sale. The solution can be integrated into new vending machines, and existing machines can be retrofitted to enhance their capabilities.

The company’s solutions can be combined with point-of-sale data to generate customer demographic information, while also helping vendors monitor inventory, capture sales data, and leverage insights for lead generation and retarget advertising. The company’s target markets include beauty, fast fashion, e-commerce and consumer product brands.

Market Overview

According to Research and Markets, the interactive kiosk market is estimated to grow at a 9.2% CAGR from 2016, to reach $73.4 billion in 2020.

What Problem Is the Company Solving?

Traditional self-service machines (vending machines and kiosks) lack seamless technology and the ability to collect data. According to PopCom, 60% of shoppers say they prefer self-service tools such as digital kiosks, but only 7% of vending machines are “intelligent,” meaning that they can offer Wi-Fi connectivity, accept credit card payments and allow for the remote monitoring of inventory. Moreover, traditional machines often do not monitor machine traffic or conversion rates. PopCom is solving two problems at once: it is further enabling the self-service customer experience and it is enabling retailers to collect data from self-service machines.

Headquarters

Columbus, Ohio

Funding Stage

Seed

Business Model

PopCom provides three models for payment: clients can pay a monthly subscription fee for the SaaS platform, a fee per transaction on the platform or a percentage of all advertising on the platform.

Competitive Landscape

Competitors include companies that provide software solutions for vending machines and kiosks, such as Meridian, which makes Mzero Software. Companies that manufacture and sell smart kiosks are potential customers for PopCom.

Management Team

Dawn Dickson, Founder and CEO, is a serial entrepreneur with experience in the self-service retail and consumer product spaces. Mary McMartin, Chief Strategy Officer, has worked with several startups, including, in the 1990s, AOL, where she managed strategy and growth.

Company Outlook

The company is launching its first machine with PopCom software in May 2018 and it has secured its first major strategic partnership, with kiosk manufacturer Kiosk Information Systems. PopCom’s first customers are consumer retail brands seeking a new direct-to-customer retail strategy through vending. Subsequent target customers are major manufacturers that may integrate PopCom’s software before delivering hardware to their own customers.

In 2018, PopCom is adding new features such as facial recognition. The technology will allow customers to create “pay with face” accounts and enable retailers to verify customers’ facial features with government-issued ID in order to facilitate the dispensing of regulated retail products such as alcohol, cannabis and pharmaceuticals.

Afresh Technologies

![]()

Company Description

Afresh Technologies seeks to bring the cutting edge of machine learning and AI to demand forecasting for fresh food. The company uses demand forecasts to provide item-level predictions of future demand and its technology powers a suite of predictive supply chain solutions. Afresh Technologies provides a store-level replenishment tool for fresh categories including meat, produce, deli, dairy and bakery. The company’s technology is currently being piloted by a 300-store grocery chain.

Market Overview

According to the Food and Agriculture Organization of the United Nations, roughly one-third of the food produced in the world for human consumption every year (approximately 1.3 billion tons) gets lost or wasted. Food losses and waste amount to roughly $680 billion in industrialized countries and $310 billion in developing countries. According to the Afresh Technologies website, US grocery stores throw away an estimated $40 billion worth of food each year.

What Problem Is the Company Solving?

Afresh Technologies seeks to solve problems associated with food waste and food freshness and to improve the in-store grocery experience for consumers.

Headquarters

San Francisco, California

Funding Stage

Seed

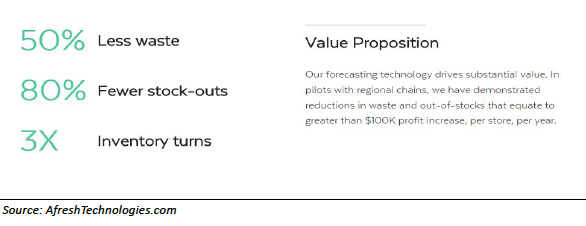

Afresh Technologies’ Value Proposition

Business Model

Afresh Technologies’ clients pay a monthly subscription fee for the software-as-a-service platform.

Competitive Landscape

Itasca Retail and Invatron also provide demand-planning solutions for fresh food retail.

Management Team

The company’s founding team consists of three Stanford University graduates. Matt Schwartz, CEO, holds an MBA from the Stanford Graduate School of Business and formerly worked in the consumer packaged goods industry and as a consultant at Bain & Company. Volodymyr Kuleshov, CTO, holds a PhD in computer science/machine learning from Stanford and was the lead engineer at Moleculo, which was acquired by Illumina. Nathan Fenner, COO, was formerly a robotics engineer at Liquid Robotics and a lecturer in Stanford’s Engineering Department. He holds an MBA from the Stanford Graduate School of Business.

Company Outlook

The company is expanding its offering into omnichannel inventory optimization and online order fulfillment optimization.

Engagement Agents

Company Description

Engagement Agents is a marketing solution targeted to retailers with locations in multiple shopping centers. The solution automates the distribution of retailers’ marketing campaigns to consumers via shopping centers’ mobile sites, websites, social media accounts, email lists, apps, events and in-mall digital signage. The company aims to simplify the distribution process and track the success of campaigns within the shopping centers’ marketing channels, ensuring that they are current, consistent, correct and compliant with retailers’ campaigns and brands.

Market Overview

Market research firm MarketsandMarkets estimates that the global mobile marketing market will grow from $28.6 billion in 2016 to $98.8 billion by 2021, at a CAGR of 28.1%.

What Problem Is the Company Solving?

Shopping centers promote their retail tenants’ marketing campaigns to millions of consumers via mobile sites, websites, social media accounts, email lists, apps, events and in-mall digital signage in order to drive impressions, traffic and sales for both the shopping centers and their retail tenants. Retailers pay for these opportunities within their lease agreements, yet nearly 90% of retailers do not engage their shopping centers’ digital and physical marketing channels—which they have already paid for. That means those retailers are missing opportunities to drive traffic and sales to stores, e-commerce sites and social media accounts.

Headquarters

Hamilton, Ontario, Canada

Funding Stage

Not disclosed

Business Model

Engagement Agents charges a monthly subscription fee for its software-as-a-service platform.

Competitive Landscape

Engagement Agents competes with traditional retail promotional content distribution methods used by shopping centers, some of which are executed by individual store managers.

Management Team

Engagement Agents President Sean Snyder has more than 15 years of experience in high-growth B2B, B2C and C2C industries. Prior to founding Engagement Agents, he was Director of Sales and Marketing for Stitch It, a clothing alterations company. Rick Hudakoc, Managing Director, is a senior retail executive and independent business advisor with more than 25 years of experience in retail and wholesale management.

Company Outlook

The company sees consumer mobile engagement as driving traffic and sales. According to Engagement Agents, 96% of consumers say that they plan to use mobile devices to find promotions through a shopping center’s marketing channels before they visit. The company’s solution will help retailers facilitate consumer engagement on all marketing channels, while also saving resources.

Viveat

Company Description

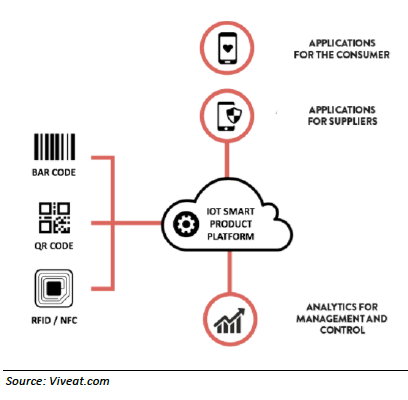

Viveat provides a personalized shopping experience by assigning products a digital identity. The company works with consumer goods brands that aspire to connect consumers with their physical products. Viveat’s Product Passport platform enables brands to engage consumers via their mobile devices with storytelling, authentication and product registration.

The company provides unique identities for physical products, turning them into an engagement and interaction channel. Viveat then uses products’ digital identities to help brands gather insights on user-product interactions in real time. The company can provide an analysis of product lifecycles, supply chain traceability and user profiles to provide brands with market and behavioral insights.

Market Overview

According to market research firm Research and Markets, the IoT market is expected to grow at a CAGR of 26.9% from 2017 to 2022, from $170.57 billion to $561.04 billion.

What Problem Is the Company Solving?

Viveat is addressing two problems. First, the company aims to increase in-store conversion rates by providing consumers with access to product-specific information such as origin, sustainability, product reviews and tutorials while they interact with a physical product in a store. This enables stores to better compete with the online shopping experience.

Second, the company seeks to change the product registration process from a cost center to a profit center by helping brands systematically collect, understand and monetize user and behavioral data for each product. This creates opportunities for personalized interaction and upselling after each purchase.

Headquarters

Milan, Italy and New York, New York

Funding Stage

Seed round ($350,000)

Business Model

Clients pay a monthly subscription fee to access Viveat’s software-as-a-service (SaaS) platform, plus a fee for each digital identity that is created. The subscription fees depend on which functionalities clients choose.

Competitive Landscape

The company’s competitors include ScanLife, Evrythng and Kezzler, which provide IoT smart platform solutions.

Management Team

CEO and Founder Marcello Gamberale Paoletti is a serial entrepreneur who sold his first e-commerce company in 2014 at age 27 before founding Viveat. Marco Gaiani, Executive Chairman, is a former C-level sales and marketing executive who has worked for consumer goods companies such as Procter & Gamble, Ferrero and Levi’s. Strategist Marco Cioffrese was formerly a consultant at The Boston Consulting Group, and Enrico Corradi, Business Development, US, is a SaaS entrepreneur with more than 15 years of international business development experience in the US, Canada, the UK and the EU.

Company Outlook

The company’s platform will be fully integrated with blockchain technology to secure immutable product passports by the end of April 2018. Development of integration with blockchain-based proof of production for Product Passports is also scheduled to be completed by April. Viveat will introduce new NFC features for brand protection by the end of March. The company has successfully addressed the European market and has begun to expand into the US market.

EverThread

Company Description

EverThread is a product visualization solution for retailers and brands. The company uses patent-pending, proprietary 2D/3D image-rendering software to create high-resolution, customized views of its clients’ products. Once a product image is created, the retailer or brand can make thousands of finishes, colors and textures available for the image, allowing shoppers to personalize the product shown and enabling the retailer to cross-merchandise it with other products.

Shoppers can purchase items directly from inventory or personalize and customize them. EverThread links to retailers’ supply chains so custom production-ready orders can be shared directly with vendors.

The company’s cloud-based content management platform streamlines the image production process for retailers and gives them the ability to mix and match product views. EverThread also provides customer behavior analytics to help retailers track trends and merchandising decisions.

The company’s initial target market is the home décor and furnishings space.

Market Overview

Research firm Research and Markets estimated that the global visualization and 3D-rendering software market was worth $431 million in 2015, and the firm expects the market to grow at a CAGR of approximately 30%, to $1.6 billion, by 2020.

What Problem Is the Company Solving?

According to new research from artificial intelligence firm ViSenze, more than 75% of consumers are inspired to make purchases based on image and video content, and the statistic highlights the growing importance of high-quality images. Retailers often struggle to provide high-quality and customizable images via Photoshop, photo shoots and other time-consuming tools and techniques.

In addition, product returns are a costly part of doing business, particularly for e-commerce operators, and managing the increasingly expensive reverse supply chain has become a priority for retailers. According to digital marketing and advertising firm Invesp, at least 30% of all products ordered online are returned.

Moreover, 22% of retail returns are due to a product appearing different in person than it does in a picture, according to ReadyCloud, which makes customer relationship management software for e-commerce firms. Presenting shoppers with high-quality product images can not only boost sales, but also help retailers avoid returns from customers who are disappointed when they discover that a product looks different in real life than it does in an image on a website.

Headquarters

Dallas, Texas

Funding Stage

Seed ($920,000)

Business Model

EverThread clients pay to onboard to the EverThread platform and then pay approximately $120,000 per program (group of 50 products) per year for the company’s software-as-a-service (SaaS) subscription.

Competitive Landscape

EverThread defines its main competitors as Adobe, Scene7, LiquidPixels and Fluid.

Management Team

Nicole Mossman, CEO and Founder, has over 20 years of experience in home décor, apparel and beauty, and holds an MS in Innovation and Entrepreneurship from the University of Texas at Dallas. Technology advisor Scott Levy previously founded ResultMaps.com, a design partner at venture capital firm Growth X (an EverThread investor), and serves as President of W3MG, a firm offering end-to-end product management and marketing for SaaS businesses.

Company Outlook

EverThread has a phased product enhancement and development plan. In its second phase, the company will add virtual reality for dynamic products and room building. In its third phase, it will add 3D for high-resolution and 360-degree views. In its fourth phase, it will add machine learning and product curation and in its fifth phase, it will add augmented reality to product viewing.

StoreDNA

Company Description

StoreDNA integrates brick-and-mortar store data from various sources—including the point of sale, staff schedules and video feeds from store cameras—into its decision-making digital dashboard. The SaaS platform then provides retailers with recommendations on optimizing assortment, staff levels and store layout via its proprietary, AI-based algorithm.

The company provides retail executives with a tool that integrates data silos in order to provide actionable insights, with the goal of increasing shopper spending and traffic through the delivery of a relevant shopping experience. For example, StoreDNA can combine computer vision data from existing in-store cameras with point-of-sale data to help retailers understand customer behavior and optimize assortments and staff levels accordingly.

Market Overview

Market research firm MarketsandMarkets estimated that the global retail analytics market was worth $3.52 billion in 2017 and that it will grow at a 19.7% CAGR, to $8.64 billion, by 2022.

What Problem Is the Company Solving?

Increased adoption of data-intensive platforms and advances in technologies such as machine learning and AI have resulted in retailers collecting enormous amounts of real-time and historical data. However, these piles of data often sit in silos, and many retailers find that processing them is overwhelming and time consuming.

Headquarters

New York, New York

Funding Stage

Seed ($0.5–$4 million)

Business Model

StoreDNA operates as a SaaS platform.

Competitive Landscape

The company competes with retail analytics and business intelligence providers such as RetailNext and Prism Skylabs.

Management Team

StoreDNA CEO Martin Birac previously founded companies in online contextual and behavioral advertising in the Central and Eastern Europe region. Uroš Lekić, COO, holds a PhD in engineering and spent 15 years working with consulting firms. Igor Poznic, CTO, majored in machine learning and is the youngest national chess champion in Croatia.

Spoon Guru

Company Description

Spoon Guru is an AI-based food search and discovery platform that enables food retailers to deliver personalized recommendations to customers based on their dietary restrictions and preferences. Spoon Guru analyzes ingredients for packaged foods and recipes and assigns tags for an array of well-being, lifestyle and medical diet profiles.

Spoon Guru’s technology allows retailers to refine their product offering based on individuals’ dietary profiles, with the goal of increasing basket size, average revenue per user and customer satisfaction. By creating personalized customer profiles that contain information on preferences and restrictions (e.g., a nut allergy or adherence to a vegan diet), Spoon Guru provides grocery retailers with a way to deliver relevant products and recipes to each customer, across channels.

Market Overview

More and more consumers are purchasing groceries online. According to a Prosper Insights & Analytics survey conducted in August 2017, approximately 30% of US shoppers are now purchasing at least some of their groceries online, up from 25% one year earlier.

What Problem Is the Company Solving?

While consumers still purchase the majority of their groceries in stores, the number of consumers shopping for food online is rising sharply. Spoon Guru helps grocery retailers enhance and personalize the online experience, thereby differentiating themselves from competitors and meeting customers’ expectations of an exceptional shopping experience and meaningful engagement. For consumers, Spoon Guru seeks to solve a problem that many shoppers have: finding products that fit their individual dietary needs.

Headquarters

London, UK

Funding Stage

Not disclosed

Business Model

Spoon Guru operates under a B2B model, charging clients a recurring license fee and layering additional professional services on top.

Competitive Landscape

Spoon Guru defines its two main competitors as Nielsen Brandbank and Label Insight.

Management Team

Markus Stripf, Cofounder and Co-CEO, has 15 years of experience in the music industry, where he focused on the digital transformation of the business. He formerly served as managing director at Warner Music Group. Tim Allen, Cofounder and Co-CEO, is a lawyer and commercial leader. Cofounder and CTO Simon O’Regan is a solutions architect and technical director with experience at digital and mobile agencies. Chairman Andy Clarke, formerly CEO of Asda and President at IGD, has more than 25 years’ experience working in multibrand international businesses.

Company Outlook

Spoon Guru is in advanced negotiations with global retailers to provide personalized shopping experiences both online and in stores. The company is also developing additional functionality such as voice-activated search for home shopping and cooking.

Company Outlook

StoreDNA will continue to focus on customer expansion and expand its target market to food retail.

TokyWoky

Company Description

TokyWoky is a peer-to-peer chat platform that enables members of a website’s community to answer other members’ questions in real time, 24/7. The platform is the first e-commerce solution that allows shoppers to advise each other in online shops. The platform empowers engaged community members, known as “ambassadors,” to answer questions from other shoppers, helping them make purchase decisions while shopping online. These interactions provide retailers with insights and analytics that they can use to improve their websites. For example, retailers can learn what kinds of information shoppers need more of, and where they need it within a site. TokyWoky is currently live on more than 150 international e-commerce websites covering the fashion, cosmetics, sports, technology, DIY, petcare, books and specialty retail sectors.

Market Overview

According to a survey by market researcher Ipsos, a majority of consumers across major European countries are turning to online reviews before making a purchase. In the UK, that proportion is 74%, and it is 71% in Germany, 66% in Italy, 63% in Spain and 60% in France. These figures suggest that there is high demand for peer review and consultation prepurchase.

What Problem Is the Company Solving?

TokyWoky is solving two problems: it is helping retailers establish a community-based support network to engage with consumers and it is enabling consumers to get real-time, authentic advice from their online peers when shopping on a website. The platform helps e-commerce retailers respond to and engage with website visitors 24 hours a day, 7 days a week. This helps ensure that online shoppers who have questions do not leave the retailer’s website frustrated, which can result in lost sales and, in some cases, a missed opportunity for the retailer to gain consumer insights.

The platform helps online shoppers by enabling them to ask peers on a website for advice while shopping. Many consumers perceive that their fellow shoppers provide more authentic and valuable advice than brands do, as other shoppers presumably have no hidden agenda.

Headquarters

Paris, France

Funding Stage

Seed round ($700,000)

Business Model

TokyWoky clients pay a monthly subscription fee for the software-as-a-service platform.

Competitive Landscape

The company’s competitors include Needle and Lithium, which also provide chat advocates and support for retailers. TokyWoky’s competition also includes traditional live chat platforms.

Management Team

CEO and Cofounder Quentin Lebeau holds degrees in law and political science. He learned to code while working as a business developer for Universal Music International and then began working in startups. Tim Deschamps, COO and Cofounder, worked in private equity after business school. He then joined a European venture capital firm specializing in the digital sector and later started his own digital business. CTO Raphaël Prat also has a history of starting digital businesses.

Company Outlook

TokyWoky is adding new features to its platform. In March 2018, the company is launching a new version of its community content analysis tool and chatbot. The new community platform’s features include content generation functionality, website community surveys and website community selling tools.

TokyWoky is planning to accelerate its offerings in North and South America. The company also plans to enter the public sector market and the internal corporate software and intranet market.

Hemster

Company Description

Hemster is a tailoring personalization service. Customers can use the company’s patent-pending ruler sticker to measure off-the-rack clothing and then tap its network of tailors to get the perfect fit. Through a pilot at a Westfield mall, Hemster processed more than 1,700 garments from more than 900 customers and helped drive $200,000 in additional revenue to retailer tenants. The company is expanding to 11 additional locations by the end of June 2018.

Market Overview

According to business intelligence firm IBISWorld, clothing alterations are a $2 billion market that encompasses 70,000 businesses. The market grew by 2.7% annually from 2012 to 2017, according to the firm.

What Problem Is the Company Solving?

Hemster is helping apparel consumers who are seeking the perfect size. The company enables retailers to offer a tailoring solution for off-the-rack inventory.

Headquarters

San Francisco, California

Funding Stage

Self-funded

Business Model

Hemster customers pay per item for customization/tailoring.

Competitive Landscape

The company’s competitors include Air Tailor and Worksmith, which also provide tailoring services for retailers, as well as traditional tailors.

Management Team

Allison Lee, Founder and CEO, is an experienced business leader who previously worked in the consumer tech product space and helped grow sales from $20,000 to $15 million within 8 months at her last company. Angela Hung, Head of Retail, gained retail expertise while working for companies ranging from global retailers such as Sears to high-end boutiques.

Company Outlook

Hemster is expanding to more than 20 locations through a mall partnership in 2018 and is also establishing a distribution channel. The company is experimenting with in-home services to gather customer data for creating the perfect fit and is seeking to launch a software product to introduce alterations services for e-commerce.

Heuritech

Company Description

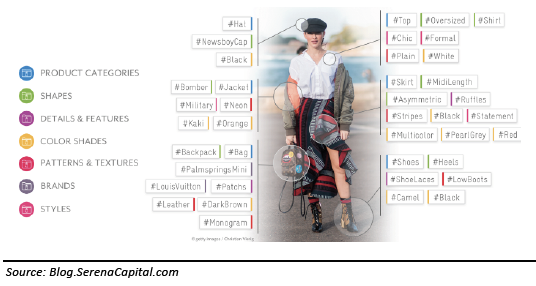

Heuritech is an AI-based predictive analytics platform that enables fashion brands to detect and quantify market trends on social media. The company leverages a proprietary image recognition technology to analyze millions of untagged images shared on social media daily.

The software-as-a-service platform gathers quantitative and qualitative insights on product performance and emerging trends to tailor ad campaigns, measure return on investment on campaigns, and identify clients and influencers to target and engage with. The data collected can also help brands with merchandise planning and product development.

The company has collaborated on projects with Louis Vuitton and Dior.

Market Overview

Predictive analytics helps retailers and brands optimize marketing campaigns and understand customer behavior, with the goal of boosting end-user response. According to a report published by Zion Market Research, the global predictive analytics market was valued at $3.49 billion in 2016 and is expected to grow at a CAGR of about 21% to 2022, to reach $10.95 billion.

What Problem Is the Company Solving?

Today’s fashion world is characterized by uncertainty, with trends and fierce competition often seeming to emerge out of the blue. To pilot their offerings with more confidence, fashion leaders need to be empowered with technology that helps them measure what is happening in the market and anticipate what will happen next.

Headquarters

Paris, France

Funding Stage

Seed (€1.1 million/~$1.35 million)

Business Model

Heuritech clients pay a monthly subscription fee for the software-as-a-service platform.

Competitive Landscape

The company’s competitors include trend-forecasting agencies such as WGSN and NellyRodi, social listening tools such as Linkfluence and Brandwatch, and technology companies that provide visual recognition APIs, such as Fashwell, Wide Eyes and Syte.ai.

Management Team

Tony Pinville, Cofounder and CEO, has 10 years of experience managing technical teams in the advertising and financial industries. Charles Ollion, Cofounder and Chief Science Officer, was previously a lecturer at the Université Paris-Saclay, where he specialized in deep learning. Pinville and Ollion both hold PhDs in machine learning.

Company Outlook

On the technology side, Heuritech plans to add approximately 5,000 new fashion products and attributes to its visual recognition technology in the next six months. The company plans to expand its data coverage to Asia and release several new products that enable higher-level analysis in order to provide more actionable insights to clients. Based in France, the company plans to open an office in the US by next year.