What Retail Apocalypse? Reviewing Trends in US Brick-and-Mortar Retail

KEY POINTS

- Total US store numbers fell in 2017 for the first time since 2009. The decline was driven by apparel retailers and regional malls, which are more skewed toward apparel.

- Open-air shopping centers are benefiting from the growth of off-price, dollar and grocery stores. These shopping centers showed resilient occupancy rates in 2017.

- Superregional malls, which are leisure destinations as well as retail destinations, registered solid occupancy rates across 2017 despite the impact of retail bankruptcies.

- A number of major shopping center owners are pivoting away from apparel specialist stores. Some are focusing on bringing in grocery and other everyday-goods retailers, while others are moving toward mixed-use spaces that incorporate leisure and entertainment venues.

Executive Summary

The “retail apocalypse” narrative in the US has been driven by closures of apparel specialty stores and apparel-focused department stores. These closures have heavily impacted regional malls, which tend to skew toward apparel and, so, have been where many closures have been concentrated. But to see the fuller picture of brick-and-mortar performance, we must look beyond apparel and regional malls, as it reveals that the retail landscape is more resilient than recent coverage has suggested.

In terms of occupancy rates, open-air shopping centers and superregional malls far outperformed regional malls in the US in 2017. Many of the retailers that are actively opening stores—from Aldi to T.J.Maxx—are opening in off-mall locations such as strip malls. Open-air centers also tend to benefit from having a strong presence of everyday-goods retailers, such as grocery stores, which support shopper traffic. Larger, well-invested, destination malls have tended to outperform unremarkable regional malls by mixing traffic-drawing leisure venues with retail.

Shopping-center owners such as GGP have been reducing their exposure to apparel specialist stores and a number of retail real estate owners have sought to bring in more grocery tenants or create more mixed-use spaces at their properties.

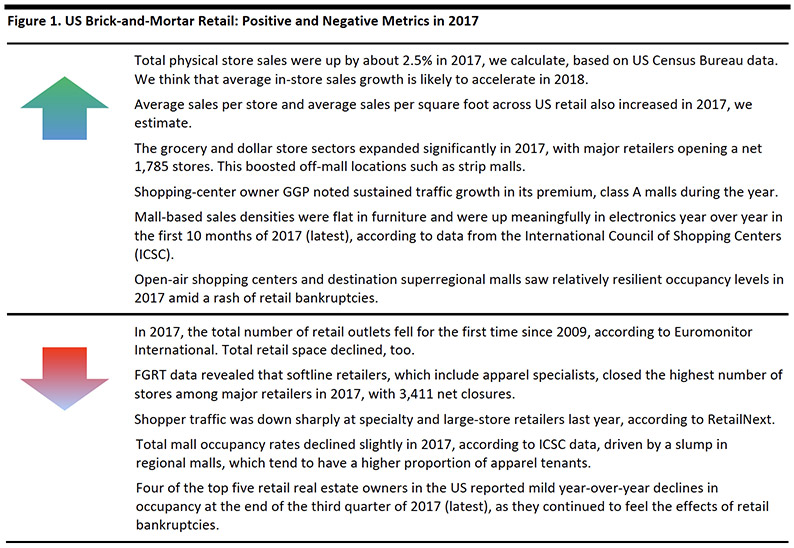

Below, we summarize key metrics that reflect the diversity of US brick-and-mortar performance.

Introduction

As more and more retailers entered bankruptcy or shuttered stores in 2017, the narrative that US retail was undergoing an apocalypse took hold. In this report, we bring together a number of data points on brick-and-mortar retail and retail real estate to analyze what actually happened last year. Our focus is on the physical store landscape rather than on individual retailers.

Store closures by apparel and department store retailers fueled the negative headlines in 2017 and early 2018, although there were casualties in other sectors, too, such as RadioShack in electronics. These closures impacted regional shopping malls most heavily. In this report, we argue that we must look beyond apparel and regional malls to see the fuller picture of brick-and-mortar performance. This wider view reveals a brick-and-mortar landscape that is more resilient than recent coverage has suggested.

- Readers may also be interested in our Mall Is Not Dead reports.

The Bad News

First, we round up some of the bad news regarding store closures and traffic, much of which is likely familiar to readers. We examine more positive indicators later in the report.

Total Store Numbers Declined in 2017 for the First Time Since 2009

Store closures grabbed the headlines and drove the retail apocalypse narrative in 2017 and into 2018. According to our own research, major US chains announced a total of 6,955 store closures in 2017. According to Euromonitor International, whose store closure figures include small and independent retailers, total US store numbers fell in 2017 for the first time since 2009. However, in the context of all retail stores, the declines were slight:

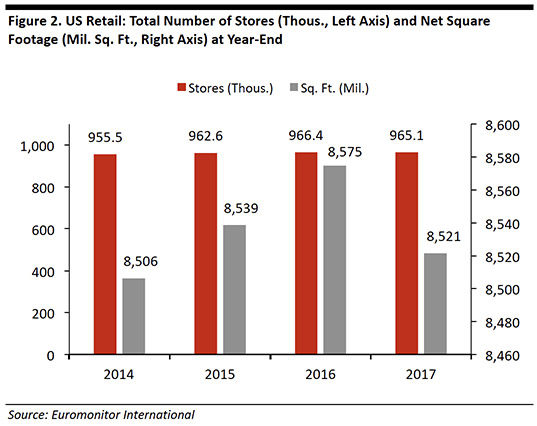

- The total number of US stores fell by just 0.1% year over year in 2017, to 965,148, according to Euromonitor International.

- Because many of the locations that were closed in 2017 were large-format stores, such as department stores, the year-over-year decline in total retail net selling space equated to a more sizeable 0.6%. As of year-end, the US had 8.52 billion square feet of retail selling space, according to Euromonitor.

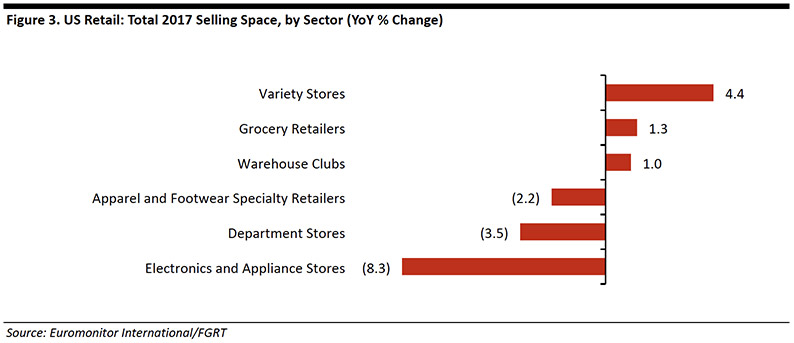

Our analysis of Euromonitor selling-space data and our own tally of store closure and opening announcements revealed the following sector trends:

- Apparel and footwear specialist stores’ total selling space declined by 2.2% year over year in 2017. Payless ShoeSource, Rue21, Ascena Retail, Gymboree and The Limited announced a combined 2,080 store closures in 2017. However, apparel retail is fragmented, so these closures resulted in only a low-single-digit decline in total sector space.

- Department stores’ total selling space fell by 3.5% in 2017. Sears, Kmart, JCPenney and Macy’s announced a combined 566 store closures during the year.

- Selling space in electronics and appliance stores fell sharply in 2017. RadioShack alone closed almost 1,500 stores, while HHGregg closed 220 stores.

- Variety store and grocery retailers grew total selling space in 2017. Dollar General, Dollar Tree, Aldi, Five Below and Lidl announced a combined total of 2,535 store openings in the year.

- Warehouse clubs grew selling space, too.

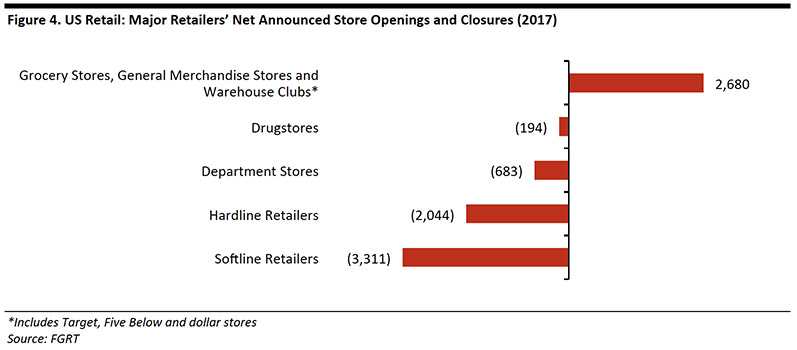

Our Weekly Store Openings and Closures Tracker found that store number trends were broadly similar to selling-space trends over 2017. Softline retailers—which largely consist of apparel specialty stores—were the group that announced the most store closures in 2017, while grocery retailers, dollar stores and warehouse clubs announced a significant net increase in store numbers. For softline and department store retailers, the net figures below include the offsetting effect of openings by chains such as T.J.Maxx, Ross Stores, Macy’s Backstage and Nordstrom.

As we discuss in more detail later, store closures and openings have not been distributed evenly across different types of shopping centers. Many of 2017’s closure announcements were focused on mall locations, and many opening announcements were not. The retailers that announced the most store openings in 2017 were Dollar General, Dollar Tree, Aldi, TJX Companies, Five Below, Ulta, Lidl and Ross Stores. These retailers all opted to open either some or all of their new stores in off-mall locations.

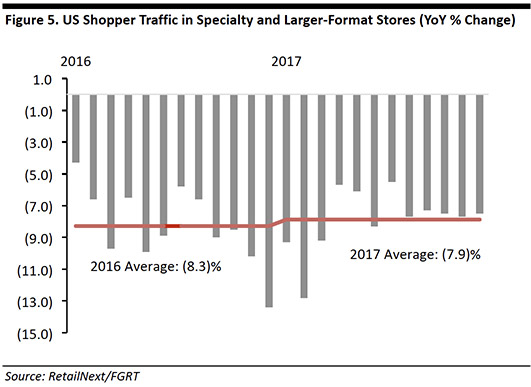

Shopper Traffic Fell by Nearly 8% in 2017

Shopper traffic declined sharply across specialty and larger-format stores in 2017, according to data from RetailNext. These types of stores saw traffic fall by an average of 7.9% over the year, slightly below the 8.3% average decline seen across 2016.

Meanwhile, traffic trends at certain premium malls in the US were strong in 2017. On its midyear conference call, shopping-center owner GGP pointed to a 1.4% year-over-year increase in traffic at its top-tier, class A malls. The firm also noted that its B+ malls had seen positive traffic trends and that its B malls had seen flat traffic trends.

The Good News

Despite the challenges retailers faced in 2017, total in-store sales continued to grow, yielding an uplift in sales densities across US retail. Moreover, occupancy rates in open-air shopping centers and superregional malls proved resilient.

In-Store Retail Sales Continue to Grow

The rapid growth of e-commerce is well documented, but total store-based retail sales have continued to grow, too. Our analysis of US Census Bureau data found that, in 2017:

- Total offline retail sales grew by approximately 2.5%.

- Total offline nonfood sales grew more strongly, by about 2.8%.

- Total offline food and beverage sales grew by about 1.8%.

Meanwhile, total US retail sales grew by 4.0% over the year.

We think that store-based sales growth is likely to strengthen in 2018 amid accelerating total retail sales growth. Offline sales are made largely through physical stores, but they also include more minor channels, such as direct selling.

Across US retail, nearly 88% of sales were made offline in 2017, we estimate from Census Bureau data. The very low e-commerce penetration rate in grocery depresses this total, and when we look only at nonfood categories, about 84% of all sales were made offline last year.

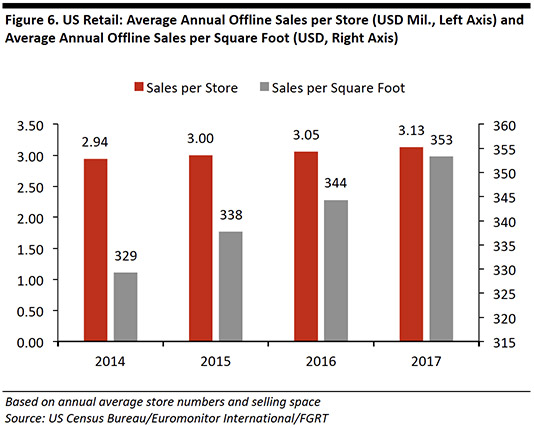

Sales per Store and Sales Densities Are Growing, Too

As total in-store sales climbed across US retail in 2017, so, too, did sales per store and sales per square foot. We estimate that:

- Once online retail sales are stripped out, average sales per store across US retail rose by 2.4% in 2017, to $3.13 million.

- Average sales per square foot of selling space increased even more sharply, by 2.6%, to $353.

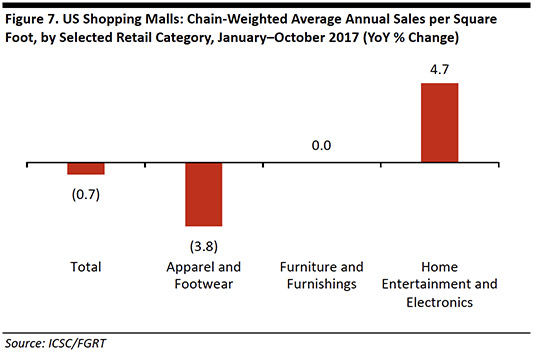

The total growth figures conceal mixed results among different types of retailers and locations. According to our analysis of ICSC mall data:

- Sales per square foot in US malls declined by 0.7% year over year over the January–October 2017 period (latest).

- The apparel and footwear category saw a more severe contraction in mall-based sales densities.

- Home entertaintment and electronics sales densities grew strongly in mall stores. This metric likely benefited from the shakeout of players with lower sales densities.

The ICSC data are chain weighted, to adjust for changes in the sample size. The data are based on non-anchor-store figures and exclude department stores.

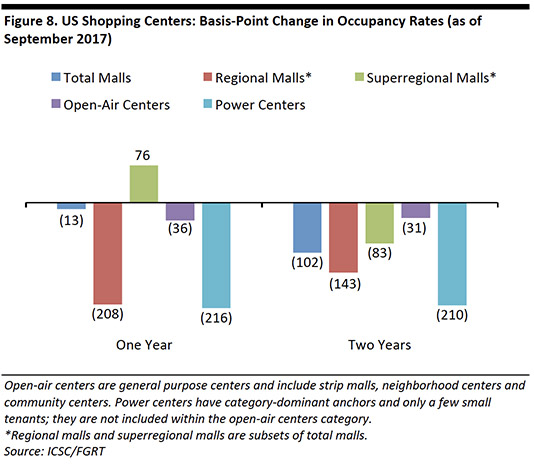

Open-Air Centers and Superregional Malls See Solid Occupancy Rates

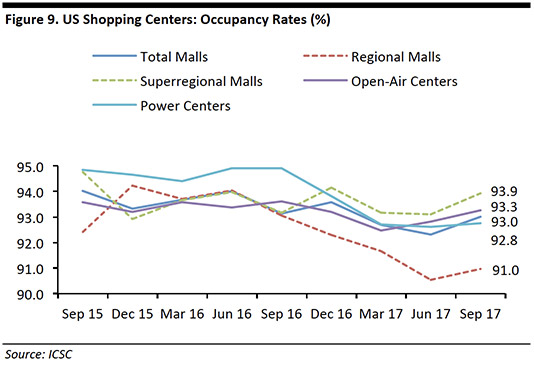

Bankruptcy filings from retailers such as Sports Authority, Payless ShoeSource and Rue21 impacted occupancy rates at shopping centers in 2017. However, the impacts of these closures were not evenly distributed, as occupancy rates at open-air centers and superregional malls outperformed those of regional malls over the year.

In 2017, superregional malls were the only major shopping-center segment to grow occupancy rates. On a two-year stack, open-air centers performed best in terms of occupancy rates. Power centers, which are focused on a few anchor tenants, saw a second year of deep declines in occupancy in 2017.

Open-air centers are one of the most resilient retail real estate segments. There are a number of reasons for the strength of these properties:

- Many of the retailers that are actively opening stores—from Aldi to Dollar General to T.J.Maxx to Ulta—are opening them in off-mall locations such as strip malls.

- Open-air centers tend to have less exposure to apparel specialty retailers, where retail bankruptcies have been most concentrated.

- The centers tend to have a strong presence of everyday retailers such as grocery stores. Grocery, in particular, continues to see a very large majority of sales transacted in physical stores rather than online, which supports shopper traffic at open-air centers.

Superregional malls, which the ICSC defines as those of 800,000 square feet or more, were resilient in 2017. These malls grew occupancy rates by 76 basis points over the year and outperformed total malls on a two-year stack. Some mall owners have chosen to cater to consumer demand for quality experiences by investing in superregional malls to ensure they provide shoppers with wider choice and leisure facilities.

Regional malls, which are typically enclosed malls of 400,000–800,000 square feet, have been the hardest hit of the larger shopping-center formats. These malls include a long tail of shopping centers that focus on apparel retailers, and some of them have suffered from a negative cycle of poor traffic trends and store closures.

In 2017, management at retail real estate firm DDR noted an average window of 12–18 months between the time an anchor store in a shopping center closes and the time the space reopens.

As charted below, occupancy rates have tended to hold up well at superregional malls and open-air centers. Power centers have seen steep declines in occupancy, but from a very strong position. Regional malls have experienced severe attrition in occupancy rates since mid-2016 as a result of bankruptcies and store closure programs.

As a result of these trends, a number of mall owners have been diversifying their portfolios to incorporate more premium, class A malls, where sales densities are higher and where tenants may include destination stores such as Apple or Tesla stores. These A malls account for only 20% of all US malls, but they generate 72% of total mall sales, according to Green Street Advisors. The struggling malls tend to be regional class C and D malls as well as some B malls. Combined, these make up the 300 or so malls that dominate the negative commentary on the state of physical retail in the US.

These same regional malls are likely to be the ones impacted when anchor department stores close, and such closures are driving mall owners to rethink how they are using their spaces. Today, a number of mall owners are using these closures as opportunities to reshape their retail offering and are filling their malls with traffic drivers that include grocery stores, discount stores (such as T.J.Maxx) and higher-growth fashion retailers (such as H&M and Zara). In some cases, mall owners are dividing their spaces into smaller sections to house boutiques that offer a curated selection of goods.

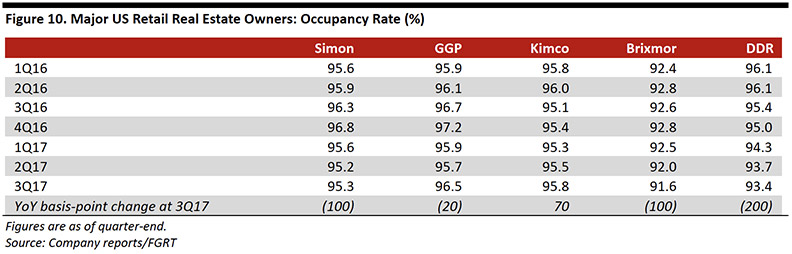

Top Retail Real Estate Owners Maintain 95% Occupancy Rates

According to National Real Estate Investor, the top five owners of US retail real estate (as measured by gross leasable area) in 2016 were, in descending order, Simon Property Group, GGP, Kimco Realty, Brixmor Property Group and DDR.

At the end of the third quarter of 2017 (latest), four of these five companies had seen a year-over-year decline in occupancy rate, as we show in the table below. However, the declines were marginal, especially in the context of retail bankruptcies. The nonweighted average occupancy rates across these companies was 94.5% at the end of the third quarter of 2017, versus 95.2% one year earlier.

- Simon Property Group operates regional malls, premium outlet centers and malls under the Mills banner, the latter of which blend conventional retail, outlet stores and entertainment.

- GGP operates premium retail properties across open-air centers and covered malls.

- Kimco, Brixmor and DDR concentrate on open-air centers. Many of these include everyday retailers such as grocery stores and value retailers: Brixmor shopping centers tend to have grocery anchors while DDR characterizes its centers as “value-oriented.”

GGP and others have been dialing down their exposure to apparel specialty stores, and a number of these companies have focused on grocery-anchored centers or sought to bring in more grocery tenants to their existing centers. Some have also been adding leisure services such as fitness centers and entertainment venues to their properties.

In addition, Simon Property Group and GGP are embarking on mixed-use concepts that include residences, hotels, restaurants, grocery stores, bowling alleys and food halls.

- We feature commentary from management at these five firms in an appendix to this report.

Key Takeaways

- 2017 saw a jump in store closure announcements by major retailers, which prompted a decline in total US store numbers for the first time since 2009. Negative headlines were driven by apparel retail and the regional malls that are more reliant on that sector.

- Open-air centers are benefiting from the growth of off-price, dollar and grocery retailers. The open-air segment saw resilient occupancy rates in 2017 despite the impact of retail bankruptices.

- Similarly, superregional malls, which are leisure as well as retail destinations, registered solid occupancy rates across 2017. Reflecting the strength of premium centers, GGP recorded positive traffic trends in its A malls over the year.

- A number of major shopping-center owners are pivoting away from apparel specialist stores. Some are focusing on bringing in grocery and everyday-goods retailers, which are less vulnerable to e-commerce migration than apparel retailers are. Others are moving toward mixed-use spaces that incorporate leisure and entertainment venues as well as office and residential units.

Appendix: Real Estate Management Commentary

Finally, to add color and detail, we wrap up key commentary from the management of Simon Property Group, GGP, Kimco Realty, Brixmor Property Group and DDR, as stated on conference calls across the first three quarters of 2017 (latest at time of writing).

Simon Property Group

Simon Property Group is diversifying the mix of space at its properties to include lesiure, office and residential space.

3Q17

David E. Simon, Chairman and CEO:

We have a significant opportunity to continue to improve our portfolio through the densification of our centers with the addition of mixed-use components: hotels, multifamily, office and others. … We recently opened The Shops at Clearfork, a great new center. This open-air center is an excellent example of the type of vibrant mixed-use, community-centric environment we create, along with our partners. We have carefully curated a mix of shopping, dining, entertainment [and] office [space].

2Q17

David E. Simon:

Tenant bankruptcies processed during the second quarter for retailers, including, but not limited to, Rue21, Payless, BCBG and Bebe, impacted our occupancy by approximately 100 basis points.

1Q17

Richard S. Sokolov, President and COO:

[Y]ou’ll see new retailers, both the e-tailers and the international retailers, and our existing brands and new designer brands that all want to take advantage of the space that is becoming available, either because we created it, because we took back space from underproductive retailers, or we consolidated those unproductive retailers into more productive space to free up space.

GGP

GGP is seeking to reduce the apparel sector’s share of space on its properties and is bringing in grocery tenants, including Lidl, and leisure tenants such as fitness centers. Like at Simon Property Group, management at GGP has pointed to Internet retailers opening stores as an opportunity.

3Q17

Sandeep Lakhmi Mathrani, CEO:

The second quarter of this year was the trough [in occupancy], following the store closures earlier this year. … [I]n the [A malls], again, which are the top sort of 80 malls…apparel is already down to like 41% of total square footage. … So, effectively, it accounts—in total sales—[for] about 35% of total sales. So, we’re saying that basically we’ll get to the 35% to 40% marker on apparel.

2Q17

Sandeep Lakhmi Mathrani:

In July, we acquired an additional interest in 13 Sears boxes located in our portfolio from Seritage Growth Properties. … These locations are substantially leased to new tenants such as restaurants, fitness centers, entertainment venues, supermarkets and other large-format stores. Sears will continue to occupy 600,000 square feet of the 1.5 million square feet.

[T]here was 1.8 million square feet of bankruptcies [impacting GGP] this year; 80% has been re-leased, i.e., 1.4 million square feet. … There are numerous e-commerce retailers planning to open stores. These are companies that have been operating for five to seven years on the Internet and have sales of $25 million to $100 million.

The overall exposure [to apparel] is still 50%. The new leasing for the year is 25%. So, it’s trending down to 41%. In the A assets, it’s already down into the low 40s.

1Q17

Sandeep Lakhmi Mathrani:

In March, Primark opened at Staten Island Mall. Traffic increased over 10% from the prior weekend, and this increased level has been maintained. Also, Lidl, a German supermarket operator, will open soon in the recaptured Sears space. Lidl operates over 10,000 stores throughout Europe and is bringing their concept to the US, beginning with eight states. … [At Staten Island Mall], entertainment will be 54% and will include an AMC theater and Dave & Buster’s. Apparel will be 17% and include Zara. Food and dining will be about 20% and will include Shake Shack. The remaining space will be taken by a variety of personal care, home furnishing and other tenants, such as Apple Bank, Ulta [and] Z Gallerie.

The portfolio was 95.9% leased at quarter-end compared to 96.1% a year ago. The decrease [was] primarily due to tenant bankruptcies during the quarter. The related store closures affected 1.2 million square feet within our portfolio. To date, we have re-leased nearly 80% of the space.

Kimco Realty

In early 2017, Kimco was impacted by the Sports Authority bankruptcy. It has noted that there are opportunities with nascent US chains such as Lidl and HomeSense from TJX.

3Q17

Conor C. Flynn, CEO:

These results validate our ongoing thesis that open-air centers that focus on grocers, off-price, fitness, everyday goods and services continue to be solid investments and remain the backbone of our strategy to create the optimal portfolio and drive shareholder value.

2Q17

Conor C. Flynn:

[W]hen you look at the names that are still reorganizing and coming out, our store closure list is very, very small…and they’re typically small shops, so they have a very modest impact, if any at all, in terms of our next year’s numbers. So we continue to look at the growing retailers that we’re doing business with. I think that will far outweigh the exposure we have to some of the watch list tenants that are closing stores.

1Q17

Conor C. Flynn:

Kimco is adapting to [the] evolving landscape by working hard to deliver both the product and an experience to tenants and shoppers commensurate with this new world order. And that is why at many of [our] sites, you’ll see more health and wellness, more service providers, more food and restaurants, more entertainment and more experiential retailing. … Of our top 20 tenants, seven have recently hit all-time highs in their stock price, and many have large new store opening plans. For example, TJX, Ross and Burlington in aggregate have announced expansion plans in excess of 300 stores. While we are not immune [to] store closures, we continue to believe we are in the sweet spot of retail and will continue to generate interest from high-quality tenants that will drive more traffic and more sales to the surrounding retail stores.

Glenn Gary Cohen, CFO, EVP and Treasurer:

First-quarter occupancy was impacted by approximately 70 basis points relating to the remaining Sports Authority vacancies.

Brixmor Property Group

Brixmor has pointed to the relative resilience of open-air centers that are focused on everyday categories such as grocery and that incorporate services such as fitness centers and restaurants.

3Q17

James M. Taylor, CEO and President:

These deals highlight…our previously stated commitment to extending our tenancy with uses such as restaurants, fitness, home, value and specialty grocery.

[W]e experienced a 50 basis [-point] impact [to the occupancy rate] from bankruptcies that we highlighted last quarter, primarily Payless and Rue21. I’m pleased to report that we continue to make strong progress on leasing the recaptured space.

2Q17

James M. Taylor:

We tip our hats to the recently reported strong results of our good friends at Kimco, Weingarten and Kite, which underscore the broader truth that demand to be in well-located open-air centers remained strong. In fact, this quarter’s analysis by our national accounts team of over 150 tenants across open-air segments such as grocery, off-price, fitness, entertainment, home goods, restaurant, health and beauty, and others indicated plans to open up over 12,500 new stores in the next 12 months. And, importantly, that count does not include the thousands of new openings planned for regional and local tenants.

[W]e do expect [the occupancy rate] to trough in the third quarter. When you think about the total impact of bankruptcies from [2016] on the year, it’s about 60 basis points. … And we expect a reacceleration actually in the fourth quarter, given the progress that we’ve made re-leasing not only that space, but…the 2016 bankruptcies.

1Q17

Brian T. Finnegan, EVP of Leasing:

[T]he demand we’re seeing for Payless into [the] 3,000-square-foot range, as well as for Rue21 in 5,000 to 10,000 square feet, with pet stores, with home accessories, operators like Five Below, we feel the demand is overall pretty good. … [W]e already addressed roughly 80% of the bankruptcies last year, our Sports Authority rents at close to 70% spread, and we feel pretty good about the demand that we’re seeing in HHGregg so far…and also those that we’re starting to really have more progress with, like entertainment, with our first Dave & Buster’s that we did at the end of the year.

James M. Taylor:

[L]ook again at what the team did with those 16 bankruptcies, most of which were controlled in the latter half of 2016. We were able to proactively get after it and re-tenant—more than the rent that was there, 80% of the [gross leasable area] and, again, bring in…much more relevant concepts across a variety of uses. … And we see far more new concepts and many more segments being interested in moving into the open-air format, so we like how we’re positioned.

DDR

DDR was impacted by bankruptcies such as Sports Authority, HHGregg and Golfsmith but has pointed to demand from retailers such as Aldi, Lidl, T.J.Maxx/HomeSense and Ulta.

3Q17

Michael Makinen, EVP and COO:

We’re particularly pleased to have the country’s first two HomeSense stores, TJX’s new home furnishings concept, opened at Shoppers World in Framingham, Massachusetts, and in East Hanover, New Jersey. … [T]he leasing environment continues to be characterized by steady demand for space. To that end, we continue to expect that it will be a 12-month to 18-month process to achieve rent commencements for new tenants filling anchor spaces made vacant from recent bankruptcies. We now have 24 of the 28 former Sports Authority, HHGregg and Golfsmith spaces re-leased or in…negotiations.

2Q17

Michael Makinen:

[Bankruptcies] caused our quarter-end leased rate to decline 60 basis points sequentially, to 93.7, primarily as a result of HHGregg closures this quarter. We continue to expect the lease rate to trough in the third quarter. Our leasing pipeline remains robust.

1Q17

Michael Makinen:

DDR’s results this quarter and for the remainder of the year are being weighed down by significant anchor vacancies resulting from recent tenant bankruptcies from The Sports Authority, HHGregg and Golfsmith. … The Internet and changing consumer patterns will undoubtedly cause some weak retailers to fall into distress, but there is still a healthy list of high-quality replacement anchors, including the TJX brands, Ulta Beauty, Dick’s, Aldi, Ross, Five Below and Burlington.