Deep Dive: Opportunities from US Department Stores’ Closures

KEY POINTS

Big department-store retailers such as JCPenney, Macy’s and Sears are future-proofing their offerings by closing stores.

- We estimate that approximately $2.5 billion in sales will flow to competing retailers as a result of 380–390 total store closures across the JCPenney, Macy’s, Sears and Kmart chains, and that some $1.5 billion of that will be in the clothing, footwear and accessories categories.

- Within womenswear, Kohl’s is the most popular retailer by shopper numbers, and survey data suggest it is particularly well placed to pick up sales as a result of closures at JCPenney and Macy’s. Amazon could pick up sales from Macy’s, and JCPenney could pick up sales from Macy’s and Sears.

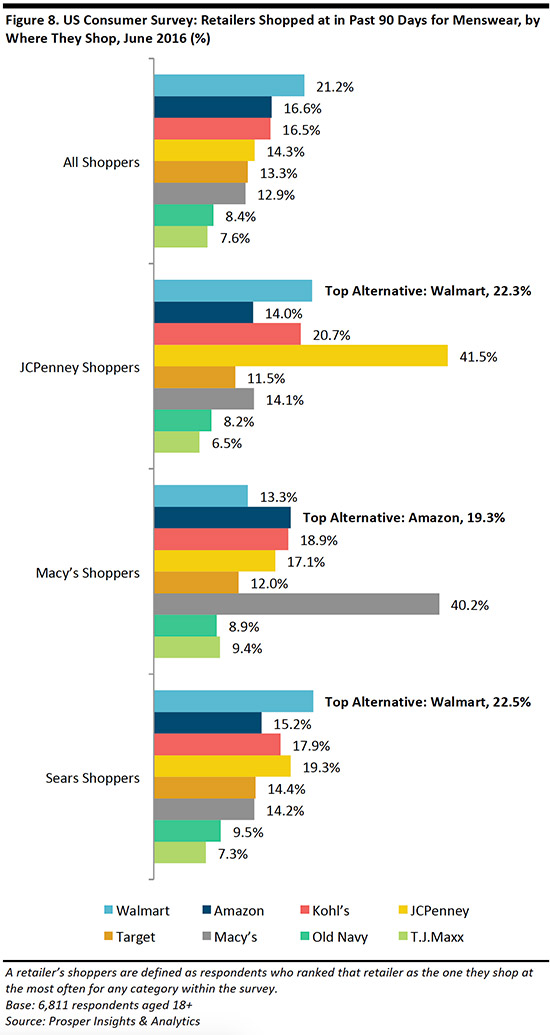

- In menswear, Walmart is the most popular retailer overall. As with the womenswear segment, survey data for menswear suggest that Kohl’s could pick up sales as a result of store closures by JCPenney and Macy’s, and that Amazon could pick up sales from Macy’s.

Executive Summary

The Value of Closures to Rival Retailers

Some 380–390 stores will be closed across the JCPenney, Macy’s, Sears and Kmart chains, according to recent announcements from these companies. We estimate that these closures will result in a total of $2.5 billion in annual sales being freed up for alternative retailers to grab.

Approximately $1 billion of that total will come from Macy’s closures, $1 billion from Sears and Kmart closures, and $500 million from JCPenney closures, we estimate.

Based on shopper preference data, we expect Macy’s to retain the highest share of sales when it closes stores and Sears to see the lowest sales-retention rates.

Where Will Those Dollars Go?

Apparel is the most important category for these retailers. In womenswear, Kohl’s is well placed to pick up share: it is the most popular womenswear retailer overall and is particularly popular among JCPenney and Macy’s shoppers, according to consumer survey data from Prosper Insights & Analytics. Amazon’s popularity among Macy’s womenswear shoppers, and JCPenney’s popularity among Macy’s and Sears womenswear shoppers, suggests that Amazon and JCPenney will benefit by grabbing share in women’s apparel categories.

In menswear, Walmart is the most popular retailer overall. Mirroring the consumer preference trends in womenswear, in menswear, Kohl’s is popular among JCPenney and Macy’s shoppers, and Amazon is the most popular alternative for Macy’s shoppers. Both of these sets of shopper preference data provide indications of where menswear category dollars could flow as a result of store closures.

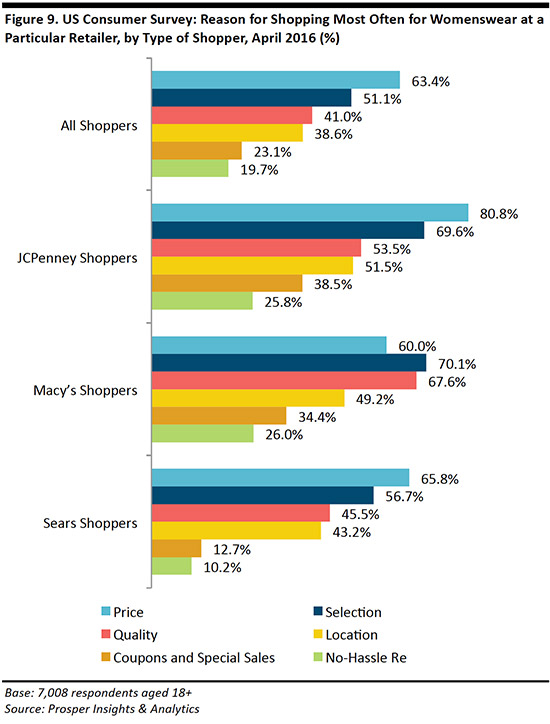

In descending order, the following factors are the most important for womenswear shoppers in general and for those who shop at JCPenney and Sears the most often: price, selection, quality, location, coupons and sales, and returns policies. Macy’s womenswear shoppers have somewhat different priorities, showing greater concern for selection and quality than the average womenswear shopper does.

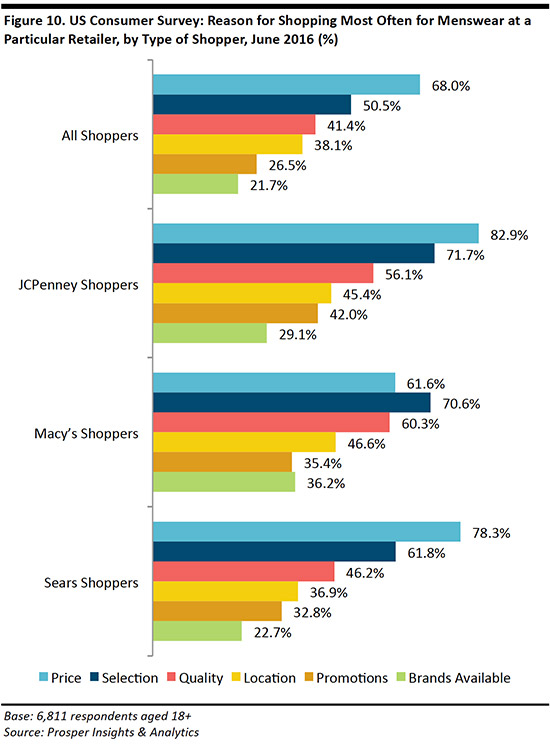

In descending order, the following factors are the most important for menswear shoppers in general and for those who shop at JCPenney and Sears the most often: price, selection, quality, location, promotions and brands available. Macy’s menswear shoppers stand apart: they are less concerned about price and more concerned about quality than the average menswear shopper is.

In short, Kohl’s and JCPenney are likely to pick up some sales resulting from the announced store closures, even while JCPenney closes some of its own stores. Macy’s shoppers are more concerned than the average shopper is about apparel brands and choice, which helps explain the popularity of Amazon among Macy’s customers: we expect that Amazon will gain some of the sales that are freed up by the Macy’s store closures.

Introduction: JCPenney Joins Macy’s and Sears in Closing Stores

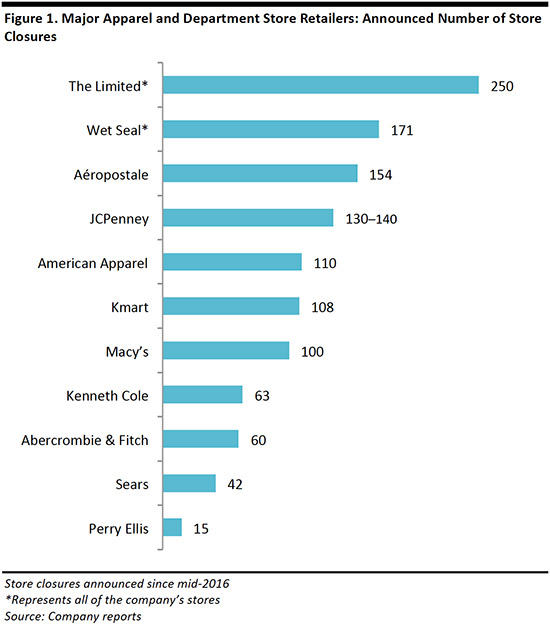

US retail is witnessing a rash of store closures—not only because some retailers are filing for bankruptcy, but because big names such as JCPenney, Macy’s and Sears are reducing capacity to future-proof their offerings and shore up profits.

In late February, JCPenney became the latest big US department-store name to announce a round of store closures. The company said it will close 130–140 stores and two distribution centers over the next few months in a move to “align the company’s brick-and-mortar presence with its omnichannel network.”

Macy’s said in August 2016 that it intended to close 100 stores. Sears and Kmart continue to close stores, too. Sears Holdings announced in January this year that it would close 42 Sears stores and 108 Kmart stores. Kohl’s closed 18 stores in 2016.

In this report, we focus on JCPenney, Macy’s and Sears Holdings, and analyze the following:

The Value of Closures to Rival Retailers

- The dollar value of the sales likely to be distributed to rival retailers as a result of closures at these chains.

- How much of the revenues JCPenney, Macy’s and Sears Holdings will be able to hold on to, through other stores or e-commerce, in the aftermath of these closures.

- The incremental profit benefit of sales transference to remaining stores.

Where Will Those Dollars Go?

- Where shoppers at these chains also shop, across all categories and for womenswear and menswear in particular. Data on shopper crossover between retailers provides a strong indication of which retailers are likely to gain as a result of closures.

- Why shoppers buy from selected retailers. This provides further context on which rivals can steal share, and how.

We begin by charting the store closures announced by major chains since mid-2016, including those not covered in this report.

1. The Value of Closures to Rival Retailers

How many dollars are up for grabs as a result of these announced closures is one big question in the market. In this section, we provide our estimates to help answer that question.

An Estimated $2.5 Billion Up for Grabs

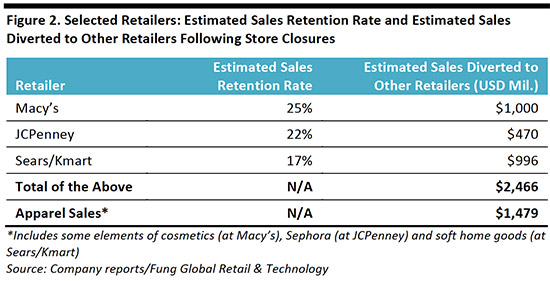

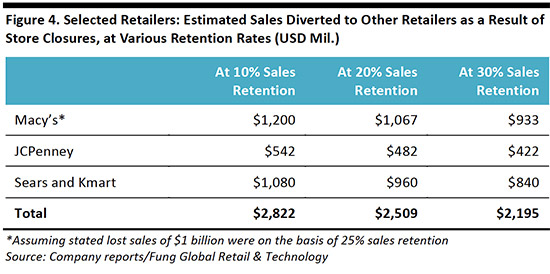

We estimate that the closure of stores by JCPenney, Macy’s and Sears Holdings will divert some $2.5 billion in sales to other retailers. We further estimate that around $1.5 billion, or 60%, of that total will be in the apparel category, which includes footwear and accessories. These figures are based on the latest fiscal-year data for these retailers.

When a retailer closes a store, it does not necessarily lose all of the sales associated with that store: the retailer’s other nearby stores and its transactional website can pick up some sales, especially if the company has established loyalty among its customers. The table below details our estimates of the proportion of sales retained by these retailers following store closures.

Across these chains, the stores being closed turn in lower-than-average sales. The companies have provided some selected metrics regarding the stores to be closed:

![]()

JCPenney

- JCPenney emphasized that the locations it will close are lower-sales stores, specifying that these accounted for less than 5% of total company sales, despite representing 13%–14% of the company’s current store portfolio.

- The stores set to be closed contribute less than 2% of EBITDA and no net income.

![]()

Macy’s

- Macy’s estimates that it will take a $1 billion hit to sales due to its 100 store closures, after adjusting for sales retained at other Macy’s stores and on Macys.com.

- The company did not provide a gross figure excluding retained sales. In January, Macy’s indicated that it has retained as little as 10% of sales from previous closures, but stated that it expected it “could retain roughly 40%–45%” in some areas.

- This billion-dollar total equates to $10 million in sales for each store that will close. However, the average Macy’s store turned over $30 million in the year ended January 2017, indicating that the stores the company has chosen to close are lower-sales stores.

Sears and Kmart

- In January 2017, when Sears Holdings announced its latest round of closures across the Sears and Kmart banners, it stated that the 150 stores set to close had generated around $1.2 billion in total sales in the past 12 months.

- We estimate that this total is approximately one-third less than the total sales that 42 average Sears stores and 108 average Kmart stores generated in the year ended January 2017.

- The stores set to be closed generated an adjusted EBITDA loss of approximately $60 million over the same period.

How Much Revenue Do Retailers Retain When They Close Stores?

The figures above are based in part on our estimates of how much revenue these retailers can retain through their other stores and their websites after closing stores. Two major department-store retailers have put figures on how much revenue from closed stores they have retained so far:

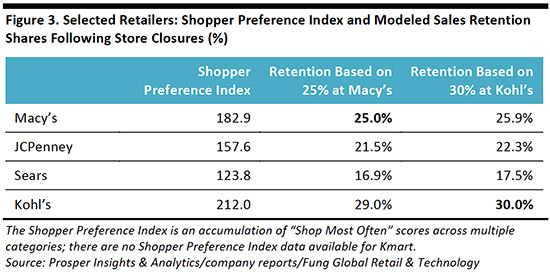

- In February, Kohl’s stated that it had retained roughly one-third of sales from closed stores. As we show in the table below, however, Kohl’s sees higher loyalty rates than the other retailers discussed here. Its store-closure program is also more limited, which may suggest it is concentrating closures on areas where it has other existing stores.

- Macy’s has indicated that it has a sales-retention range of 10%–45%. The midpoint of this range suggests that Macy’s could be retaining about one-quarter of sales, on average, when it closes stores.

The table below shows estimated sales-retention rates across selected retailers based on figures extrapolated from these data points. We modeled these using the Shopper Preference Index recorded by Prosper Insights & Analytics as a proxy for loyalty rates among shoppers at these retailers:

- Using the Shopper Preference Index, we extrapolate to other retailers based on our own estimate of 25% retention at Macy’s.

- Also using the Shopper Preference Index, we then extrapolate to other retailers based on a 30% retention rate at Kohl’s.

Both extrapolations indicate similar retention rates for each retailer: for instance, approximately 22% at JCPenney and 17% at Sears. We do not show Kmart below, as we do not have shopper preference data for the retailer.

Below, we apply various retention scenarios to these retailers’ store sales to offer a range of scenarios for sales lost to other retailers in dollar terms. This suggests a total potential range of diverted sales of $2.2–$2.8 billion.

The Bottom-Line Benefit of Sales Transference

Retailers that close stores can enjoy a disproportionate profit boost at nearby stores that remain open, as the majority of costs in brick-and-mortar retailing are fixed. Store rents, utility bills, taxes and depreciation, for example, stay much the same regardless of much a retailer sells. Even in-store labor is a largely a fixed cost, as a retailer will always need a certain number of staff for the store to function.

In basic terms, this means that any sales a brick-and-mortar store makes after covering its costs are largely profit. And this principle applies to the sales remaining stores could gain as sales are transferred from closing stores. Store

closures therefore promise appealing profit accretion at the store level (not the company level) to retailers that can transfer sales to nearby stores. Although the stores that remain open will probably see some increase in variable costs, such as inventory and in-store labor, the added sales will disproportionately trickle down to the bottom line.

2. Where Will Those Dollars Go?

To help answer the question of where the revenues lost from store closures will end up, we turn to consumer survey data from our research partner, Prosper Insights & Analytics.

Where Department-Store Shoppers Also Shop

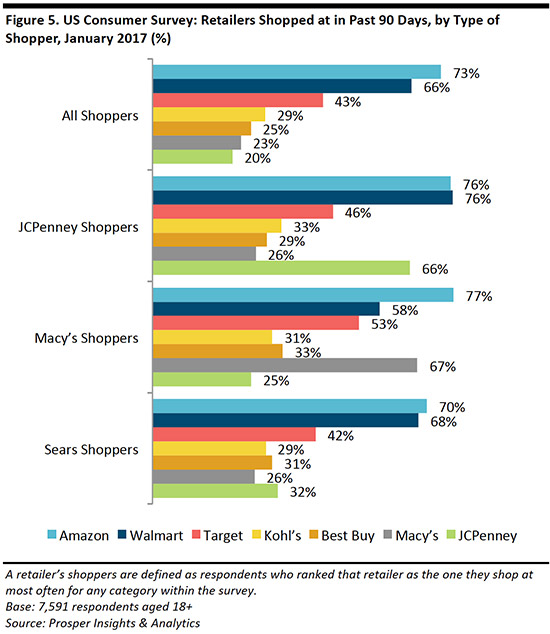

Below, we chart US consumer survey data on where respondents said they had shopped in the past 90 days, for both consumers in total and those identified as existing shoppers at JCPenney, Macy’s and Sears. It is important to note that the question survey respondents answered makes no distinction as to the type of products they bought, so a given respondent may have bought groceries from Walmart and footwear from Macy’s. Later in this report, we provide a category-level analysis of women’s and men’s clothing sales.

Key points from the survey:

- In theory, Amazon, Walmart and Target are most likely to win sales as a result of store closures by other retailers, given their across-the-board popularity. However, the survey does not split out what people were buying. Moreover, Amazon’s lack of brick-and-mortar stores will probably limit its gains.

- JCPenney shoppers show a substantially higher propensity to shop at Walmart than the average consumer does, suggesting that Walmart could gain the most from JCPenney store closures.

- Macy’s shoppers are more likely than the average consumer to shop at Target, Kohl’s, Best Buy and JCPenney, which suggests that these four retailers could gain disproportionately from Macy’s store closures.

- Sears shoppers overindex meaningfully at JCPenney. They are broadly in line with the average consumer on a number of other indicators.

- So, while JCPenney will lose sales from its own store closures, it could pick up share as a result of closures by Macy’s and Sears.

No data are available for what proportion of the consumer segments below shopped at Sears in the 90-day window.

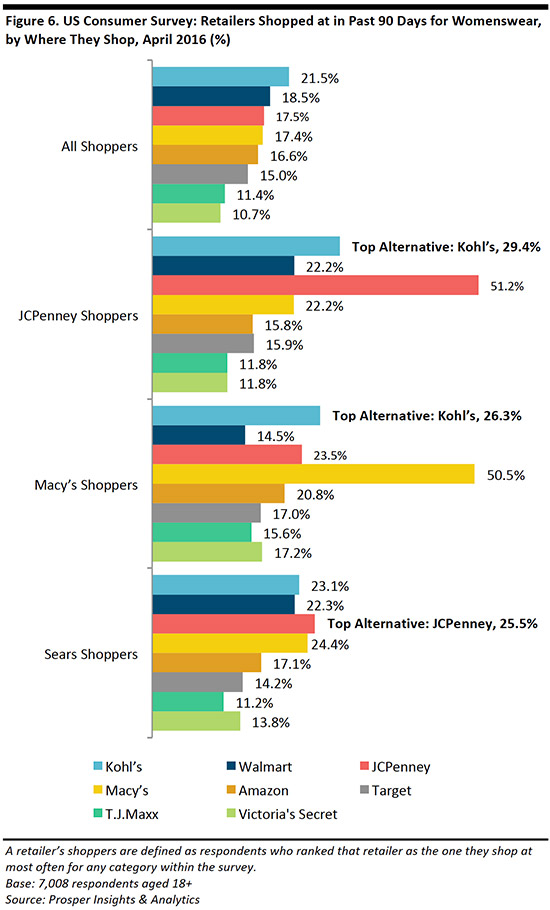

Where Department-Store Shoppers Also Shop for Womenswear

Apparel is the core category for department stores: we expect this category to account for 60%, or $1.5 billion, of all the estimated revenues diverted to other retailers as a result of store closures. Womenswear is the dominant apparel category, accounting for around half of all clothing sales. In womenswear, Kohl’s is well placed to pick up share as a result of store closures by other retailers: it is the most popular womenswear retailer overall and is particularly popular among JCPenney and Macy’s shoppers. Below, we show where consumers (whether male or female) have shopped for womenswear in the past 90 days.

- JCPenney and Macy’s shoppers show a high tendency to also shop at Kohl’s.

- Macy’s shoppers also show an above-average tendency to shop at Amazon, suggesting that the Internet giant could absorb some of Macy’s lost sales.

- Macy’s and Sears shoppers show a high tendency to shop at JCPenney. As a result, JCPenney could gain share in womenswear from closures at Macy’s and Sears, even while it loses some sales from its own store closures.

- JCPenney and Sears shoppers show an above-average tendency to shop at Macy’s, suggesting the latter could pick up share from closures at JCPenney and Sears.

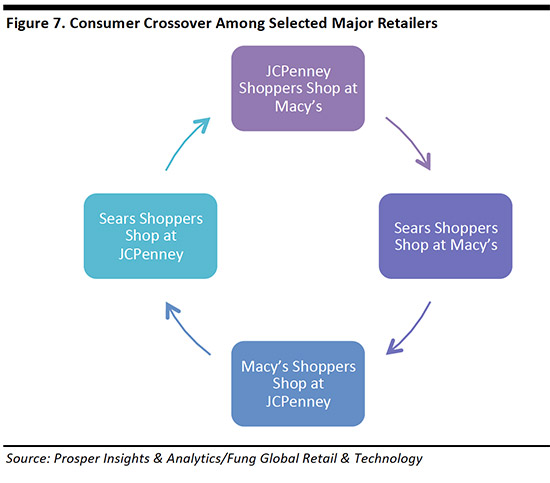

The data above confirm that, when it comes to shopping for womenswear, there is substantial crossover of customers between the biggest names in retail.

Where Department-Store Shoppers Also Shop for Menswear

Menswear accounts for around one-third of the US clothing market. In menswear, Walmart is the most popular retailer overall, and the crossover picture is slightly less uniform than it is in womenswear:

- For JCPenney and Sears shoppers, Walmart is the most popular alternative store for menswear

- JCPenney and Macy’s shoppers show a higher-than-average tendency t

o shop for menswear at Kohl’s, suggesting that Kohl’s is in a strong position to gain share of menswear sales as a result of store closures by other retailers. - Among Macy’s shoppers, the most popular alternative retailer for menswear is Amazon, which is narrowly ahead of Kohl’s.

- Macy’s shoppers are more likely than the average consumer to shop for menswear at T.J.Maxx.

Why Department-Store Shoppers Shop Where They Do

To capture shoppers, retailers must understand what shoppers are looking for and why they choose to shop where they do. For insight, we turn to Prosper’s data on the reasons shoppers choose particular retailers:

- In descending order, the following factors are the most important for womenswear shoppers in general, and for those who shop at JCPenney and Sears the most often: price, selection, quality, location, coupons and sales, and returns policies.

- Macy’s womenswear shoppers have somewhat different priorities, showing greater concern for selection and quality than the average womenswear shopper does.

- Macy’s shoppers also cite the importance of “brands available” (not charted below) more often than average as a reason for buying from a particular womenswear retailer: fully 40% of Macy’s shoppers said this was a reason for them to shop at a retailer.

Below, we chart the top reasons cited by consumers for shopping at particular retailers for menswear.

- In descending order, the following factors are the most important for menswear shoppers in general, and for those who shop at JCPenney and Sears the most often: price, selection, quality, location, promotions and brands available.

- Macy’s menswear shoppers stand apart, showing less concern for price and more concern for quality than the average menswear shopper.

- Macy’s menswear shoppers say their greatest priority is selection, and they show above-average consideration for brands available. The relative importance of these two factors may help explain the popularity of Amazon among Macy’s menswear shoppers, given that Amazon offers a wide range of choice.

Key Takeaways

The estimated $2.5 billion in sales that will be freed up as a result of store closures by JCPenney, Macy’s, Sears and Kmart is the prize for retailers who can capture shoppers from the closed locations.

If we look across all categories, the popularity of Amazon, Walmart and Target suggests they could win sales. Meanwhile, JCPenney is popular among Macy’s and Sears shoppers, which indicates that it stands to pick up sales from their closures even while it loses sales due to its own store closures.

Apparel is the most important category and Kohl’s looks particularly well placed to pick up womenswear sales as a result of other retailers’ store closures. Kohl’s is the most popular womenswear retailer across all consumers and it overindexes among crossover JCPenney and Macy’s shoppers. Amazon is unusually popular among Macy’s womenswear shoppers, and JCPenney is popular among Macy’s and Sears womenswear shoppers, suggesting further potential winners.

Similar trends are seen in menswear, where Kohl’s is popular among JCPenney and Macy’s shoppers, and Amazon is the most popular alternative retailer for Macy’s shoppers—providing indications of where menswear category dollars will flow. Walmart is the most popular menswear retailer overall.

Similar trends are seen in menswear, where Kohl’s is popular among JCPenney and Macy’s shoppers, and Amazon is the most popular alternative retailer for Macy’s shoppers—providing indications of where menswear category dollars will flow. Walmart is the most popular menswear retailer overall.

So, JCPenney could pick up some lost sales, even while it closes some of its own stores. Macy’s shoppers show a greater concern for apparel brands and choice, which helps explain the crossover popularity of Amazon among those who shop primarily at Macy’s. Accordingly, Amazon, which is already grabbing share in the apparel category, stands to make additional gains as a result of Macy’s store closures.